Maximum Deductible Mortgage Interest 2021 Is mortgage interest tax deductible In general yes You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home

The item ized deduction for mortgage insurance premi ums has been extended through 2021 You can claim the deduction on line 8d of Schedule A Form 1040 for amounts that were paid or ac crued in 2021 Home equity loan interest How to deduct mortgage interest on federal tax returns When you file taxes you can take the standard deduction or the itemized deduction In 2022 the standard deduction is 25 900 for

Maximum Deductible Mortgage Interest 2021

Maximum Deductible Mortgage Interest 2021

https://i.ytimg.com/vi/vlLTI8XKn8E/maxresdefault.jpg

Is Mortgage Interest Tax Deductible In 2023 Orchard

https://assets-global.website-files.com/5fcff9094e6ad8e939c7fa3a/639ba11b8923dc39fc2c17c1_Is mortgage interest tax deductible_.png

What Is A Mortgage Interest Adjustment Nesto ca

https://www.nesto.ca/wp-content/uploads/2020/09/what-is-a-mortgage-interest-adjustment.jpg

Is mortgage interest tax deductible In a nutshell yes If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the amount of interest paid on Before the TCJA the mortgage interest deduction limit was on loans up to 1 million Now the loan limit is 750 000 That means for the 2022 tax year married couples filing jointly single filers and heads of households could deduct the interest on mortgages up to 750 000

Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home For tax years prior to 2018 the maximum amount of Using our 12 000 mortgage interest example a married couple in the 24 tax bracket would receive a 27 700 standard deduction for tax year 2023 29 200 in 2024 which is worth 6 648 in

Download Maximum Deductible Mortgage Interest 2021

More picture related to Maximum Deductible Mortgage Interest 2021

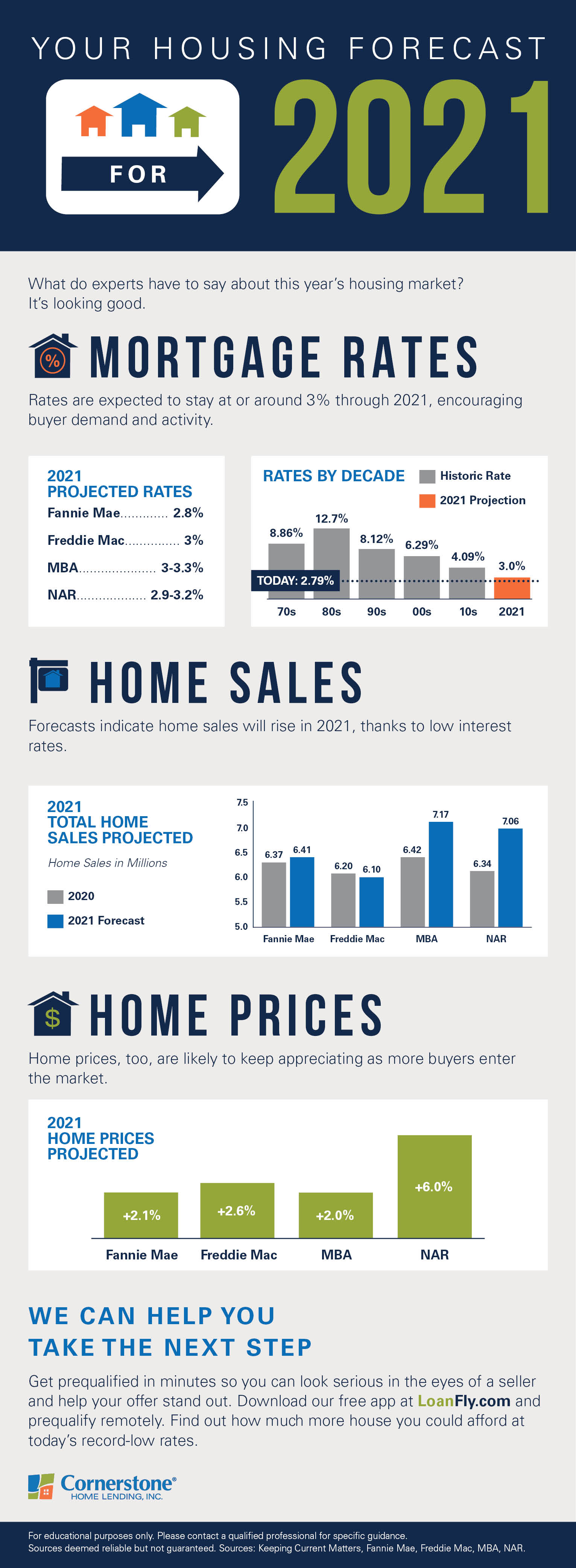

Housing And Mortgage Rates 2021 Here s Your Forecast

https://www.houseloanblog.net/wp-content/uploads/2021/01/210001_SM_INFO_Housing-Forecast-2021-1.jpg

Mortgage Interest Rate Calculator Ireland Moneysherpa

https://mlfxk9f4fh20.i.optimole.com/w:auto/h:auto/q:mauto/ig:avif/f:best/https://moneysherpa.ie/wp-content/uploads/2022/08/Untitled-design-17.png

How To Figure Out The Interest Rate On A Bad Credit Car Loan Mortgage

https://i.pinimg.com/originals/6c/bc/16/6cbc16f304c042a2065d261684402e28.jpg

Important rules and exceptions The maximum amount you can deduct is 750 000 for individuals or 375 000 for married couples filing separately If you took out your home loan before Dec 16 2017 the maximum you can deduct goes up to 1 million for individuals and 500 000 for married couples filing separately Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who file jointly and for qualifying widow er s 25 900 for tax year 2022 Heads of household 19 400 for 2022

Up to 750 000 in interest is deductible for mortgages originating after December 15 2017 The total limit is 375 000 for taxpayers with a married filing separately status For the 2020 tax year the standard deduction is 24 800 for married couples filing jointly and 12 400 for single people or married people filing separately But if you use itemized deductions

Home Awnings Tax Deductible Or Tax Credit Qualified AZ Awnings

https://lirp.cdn-website.com/739d0cb2/dms3rep/multi/opt/are+awnings+tax+deductible-1920w.jpeg

Mortgage Interest Rates Are Still Going Up Should You Wait To Buy

https://i.pinimg.com/originals/db/08/9c/db089cd1832092a7239efc85af18462f.jpg

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

Is mortgage interest tax deductible In general yes You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home

https://www.irs.gov/pub/irs-prior/p936--2021.pdf

The item ized deduction for mortgage insurance premi ums has been extended through 2021 You can claim the deduction on line 8d of Schedule A Form 1040 for amounts that were paid or ac crued in 2021 Home equity loan interest

Mortgage Interest Rates Some Perspective

Home Awnings Tax Deductible Or Tax Credit Qualified AZ Awnings

Current Mortgage Interest Rates November 2022

IS MORTGAGE INTEREST TAX DEDUCTIBLE How Does Mortgage Interest Tax

Mortgage Interest Tax Deductible 2023

Will Low Mortgage Rates Continue Through 2021 Real Estate With

Will Low Mortgage Rates Continue Through 2021 Real Estate With

Fed Decision September 2020 Interest Rates Unchanged

Contrary To Popular Belief Mortgage Interest Is Not Always Tax

What Is Deductible In Health Insurance With Example Insurance Noon

Maximum Deductible Mortgage Interest 2021 - Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home For tax years prior to 2018 the maximum amount of