Maximum Rent Deduction In Income Tax Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Maximum Rent Deduction In Income Tax

Maximum Rent Deduction In Income Tax

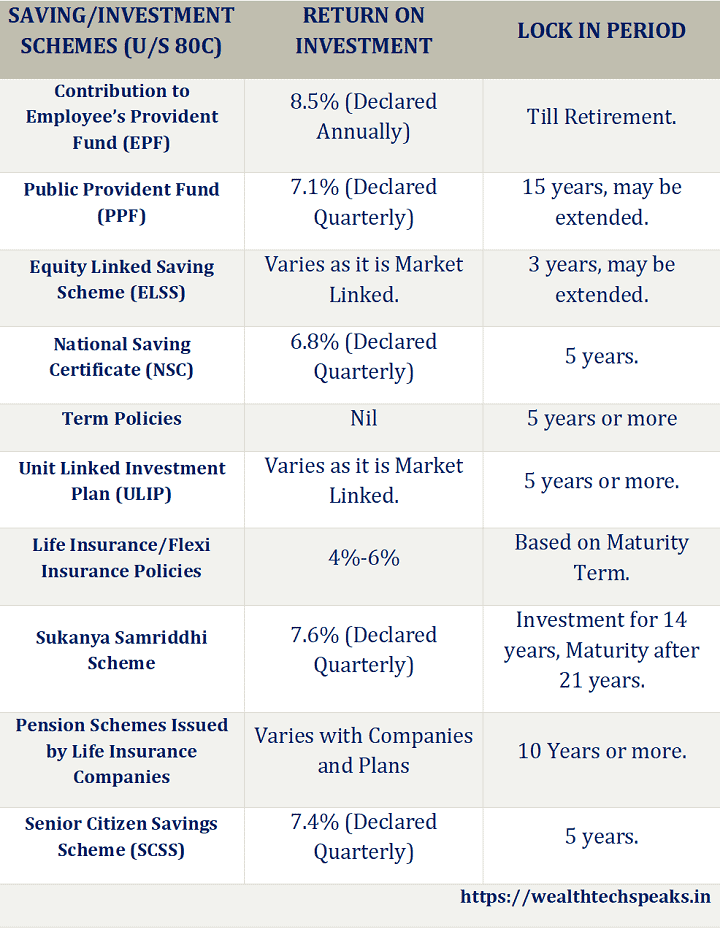

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

House Rent Deduction In Income Tax KMG CO LLP

https://kmgcollp.com/wp-content/uploads/2022/01/Deduction-in-income-tax-where-House-rent-is-paid-and-HRA-not-received.jpg

Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions Standard deduction A flat 30 deduction is allowed on the gross annual value of the let out property regardless of any actual expenses incurred This makes it hassle free and HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

Conveyance allowance is exempt up to a maximum of Rs 1600 per month Tax on employment and entertainment allowance will also be allowed as a deduction from the salary income Employment tax is deducted from your salary by your employer and then it is deposited to the state government HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the city of residence

Download Maximum Rent Deduction In Income Tax

More picture related to Maximum Rent Deduction In Income Tax

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/House-Property/Images/Deductions-U-S-24.jpg

Types Of Standard Deduction In Income Tax Explained

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/11/Types-of-Standard-Deduction-in-Income-Tax-1024x576.png

What Are Standard Deductions In Income Tax ACT Blogs

http://www.actblogs.com/wp-content/uploads/2023/05/what-are-standard-deductions-on-taxes.webp

As a taxpayer you can claim tax benefits on the amount you pay as rent for accommodation each year This is applicable under Section 10 13A of the Income Tax Act Who can avail HRA tax benefit To be eligible for the tax benefit on HRA you need to stay in a rented accommodation Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

If you re a tenant paying more than 50 000 in monthly rent you re required to deduct Tax Deducted at Source TDS at 5 on the total annual rent Key Points House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA under the Income Tax Act if you stay in a rented house and get a HRA from your employer

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

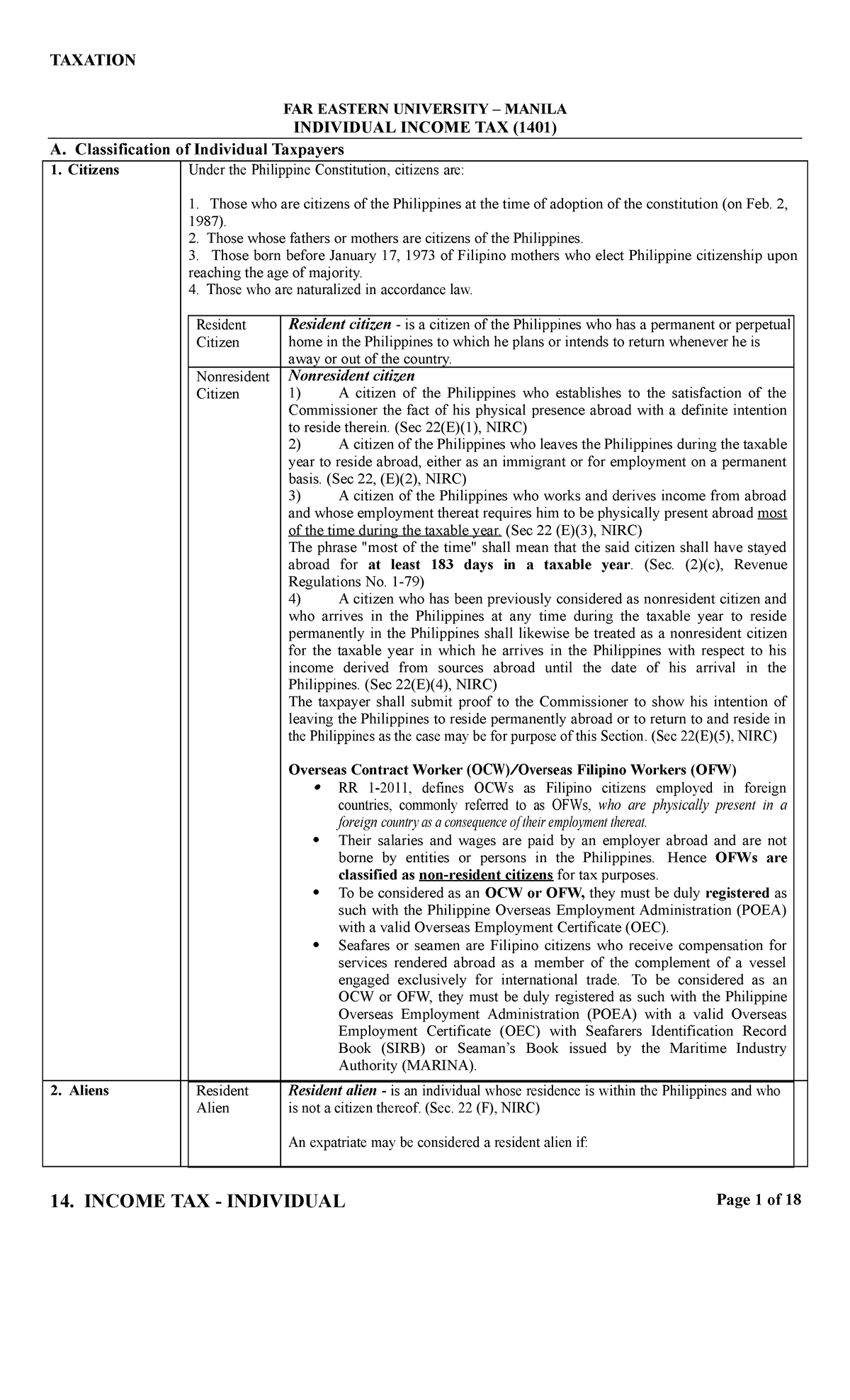

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

https://cleartax.in/s/hra-house-rent-allowance

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section

Section 80C Deductions List To Save Income Tax FinCalC Blog

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Solved Please Note That This Is Based On Philippine Tax System Please

Procedure Of Pre Validating Bank Account In Income Tax

Property Tax Deduction Exemption In Income Tax Paytm Blog

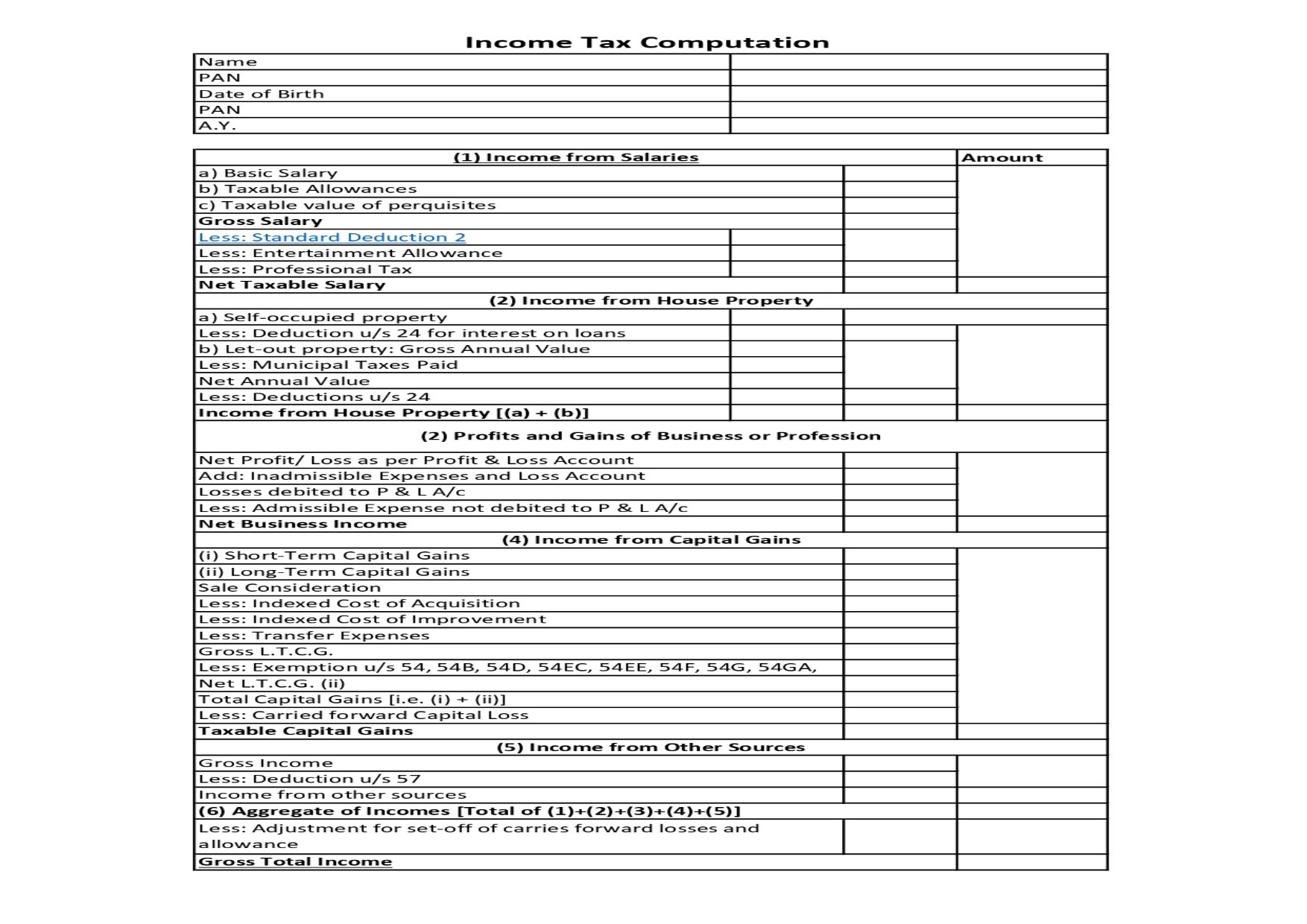

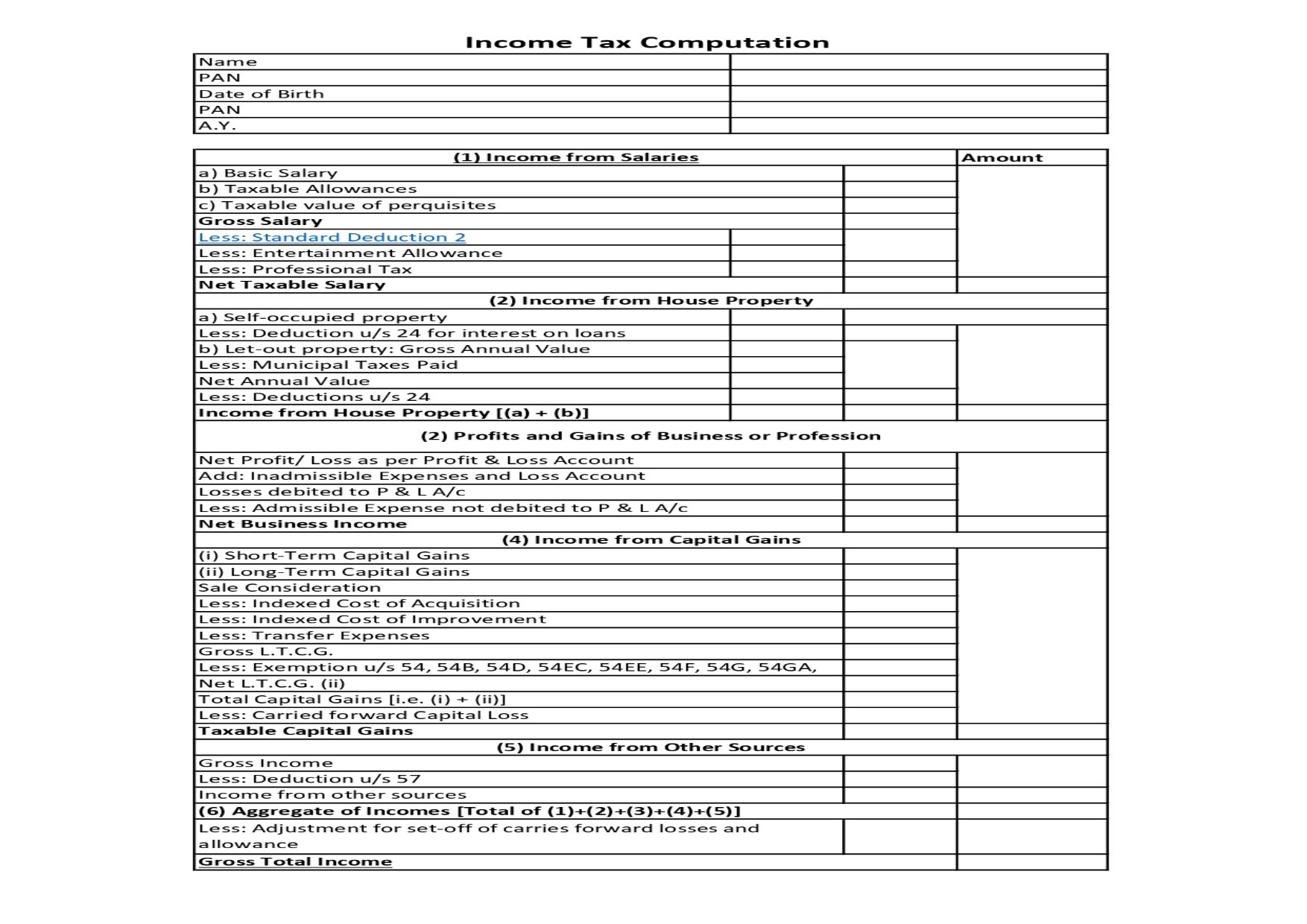

Income Tax Computation Format PDF A Comprehensive Guide

Income Tax Computation Format PDF A Comprehensive Guide

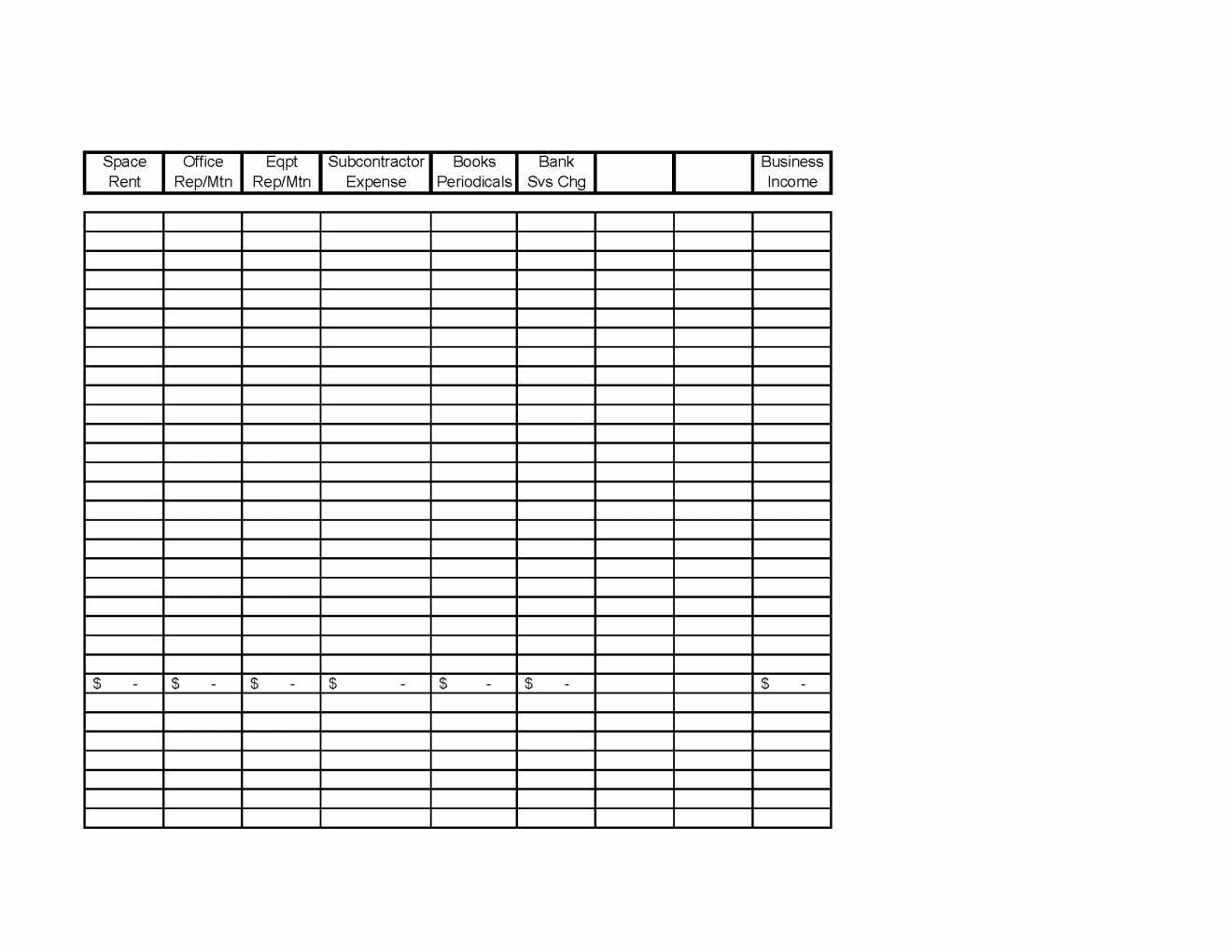

Income Tax Spreadsheet Tax Organizer Worksheet Download New In Income

Standard Deduction In Income Tax 2023 Examples InstaFiling

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Maximum Rent Deduction In Income Tax - HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the city of residence