Maximum Salary For Cpf Contribution b There will be no change to the CPF annual salary ceiling of 102 000 which sets the maximum amount of CPF contributions payable for all salaries received in the year inclusive of both Ordinary Wages and Additional Wages

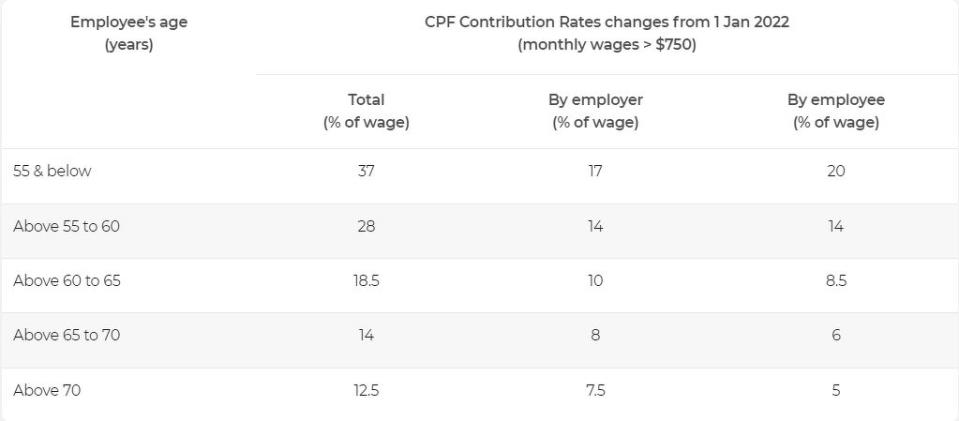

Each month we contribute up to 20 of our salary and our employers have to contribute up to 17 of our salary to our CPF accounts up to a salary cap of 6 800 This percentage may vary depending on our age and our income The annual salary ceiling which limits the total amount of Ordinary Wages and Additional Wages that attract CPF contributions will remain at 102 000 at this juncture It will be reviewed periodically to ensure it

Maximum Salary For Cpf Contribution

Maximum Salary For Cpf Contribution

https://quickhr.co/assets/images/webp/cpf_contribution_rate_n.webp

CPF Contributions Got Limit What Singaporeans Need To Know About

https://cdn-blog.seedly.sg/wp-content/uploads/2020/07/22200520/220720-CPF-Contribution-Guide-768x402.png

CPF BRS To Be Raised By 3 5 Per Year From 2023 To 2027 Older Workers

https://s.yimg.com/ny/api/res/1.2/pIcuUt9xZSJj0ggZiROLew--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTQyMQ--/https://media.zenfs.com/en/the_edge_961/a2c23e7f493e583121c8412fd8bf1a7c

Under the Ordinary Wages component which is typically our monthly salary the CPF contribution ceiling is capped at 6 300 per month This means only the first 6 300 of our monthly salaries require CPF contributions from us and our employers Currently for an employee below 55 years of age earning 8 000 per month the employer s share of CPF monthly salary contribution would amount to 1 020 or 12 240 per year With the new change the total employer s CPF contribution amount will increase by 204 or to 12 444 per worker in 2023

The CPF monthly salary ceiling sets the maximum amount of CPF contributions payable for ordinary wages An example of an ordinary wage would be a monthly salary In short this means employees Employees aged 55 and below are required to contribute 20 percent of their salary while their employer contributes another 17 percent of the same salary Your employers will now have to contribute a higher amount due to

Download Maximum Salary For Cpf Contribution

More picture related to Maximum Salary For Cpf Contribution

Yes CPF Takes 20 Of Your Monthly Salary BUT Investment Stab

https://4.bp.blogspot.com/-AKqiVRYM0g8/WRTNe3O-HcI/AAAAAAAACc4/RWGn8v1SOrYRhanHhY8fAFQ3tNkeH6FvwCLcB/s1600/CPF%2BContribution%2B2.PNG

Increase To CPF Ordinary Wage Ceiling Metropolitan Management

https://metrocorp.com.sg/wp-content/uploads/2023/05/CPF-Article_table-1.png

Calculating Employer CPF Contribution CPF Deduction In Singapore

https://linksinternational.com/wp-content/uploads/2021/12/image-1.png

The Ordinary Wage Ceiling is a CPF contribution cap on your monthly salary and is currently capped at 6 000 As part of Budget 2023 the government announced that this cap will increase progressively to 8 000 by 2026 Starting from 1 September 2023 if your current monthly salary exceeds 6 000 you will receive more CPF contributions because of the increased limit This means that a greater proportion of your salary will be allocated towards your CPF savings

Starting in September 2023 the CPF monthly salary ceiling will rise progressively and reach 8 000 in 2026 It is currently set at 6 000 A young worker earning 8 000 a month will have to contribute 400 more per month to their CPF from January 2026 onwards CPF imposes a contribution cap in what s known as the CPF Wage Ceiling This contribution cap means that no more than S 30 000 is put towards your CPF as a salaried employee This cap can be further broken down into two parts the Ordinary Wage Ceiling and the Additional Wage Ceiling

Increased CPF Salary Ceiling To Cost Businesses About 500 Million A

https://static1.straitstimes.com.sg/s3fs-public/articles/2023/03/02/ONLINE-230214-CPFMonthlySalaryCeiling-budlycpf14_0.jpg?VersionId=utnCpGUWm4b5EPdF7sEU0BSRWMYxG0kJ

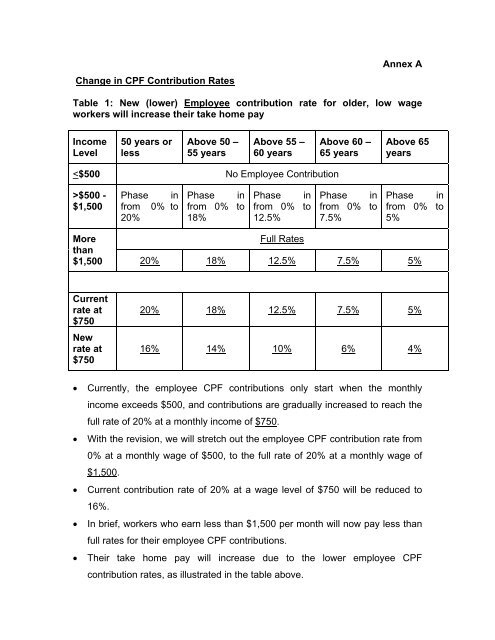

Annex A Change In CPF Contribution Rates Table 1 New lower

https://img.yumpu.com/6012106/1/500x640/annex-a-change-in-cpf-contribution-rates-table-1-new-lower-.jpg

https://www.cpf.gov.sg/.../new-contribution-rates

b There will be no change to the CPF annual salary ceiling of 102 000 which sets the maximum amount of CPF contributions payable for all salaries received in the year inclusive of both Ordinary Wages and Additional Wages

https://www.dollarsandsense.sg/complete-guide-cpf...

Each month we contribute up to 20 of our salary and our employers have to contribute up to 17 of our salary to our CPF accounts up to a salary cap of 6 800 This percentage may vary depending on our age and our income

Pin On Wow Salary

Increased CPF Salary Ceiling To Cost Businesses About 500 Million A

CPF Contribution Of Employees And Employers Rates More

CPF Interest Rate MariskaEibhlin

CPF Interest Rate NelmaNavenka

Max Retirement Contribution 2024 Henka Kyrstin

Max Retirement Contribution 2024 Henka Kyrstin

Increase In Central Provident Fund CPF Rates For Those 55 To 70 Years

How To Count The Singapore Permanent Resident SPR Year For CPF

How Much Deduction For Cpf Contribution Rate In Singapore

Maximum Salary For Cpf Contribution - The CPF monthly salary ceiling sets the maximum amount of CPF contributions payable for ordinary wages An example of an ordinary wage would be a monthly salary In short this means employees