Maximum Sec 179 Deduction 2023 The maximum deduction under Section 179 is 1 160 000 for the 2023 tax year taxes that were due in 2024 If you placed more than 2 890 000 worth of property in service that would be eligible

Limits and Qualifications for 2023 and 2024 For 2023 the Section 179 deduction limit is 1 160 000 However there is a limit to how much eligible equipment a business can purchase and still receive a deduction For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 890 000

Maximum Sec 179 Deduction 2023

Maximum Sec 179 Deduction 2023

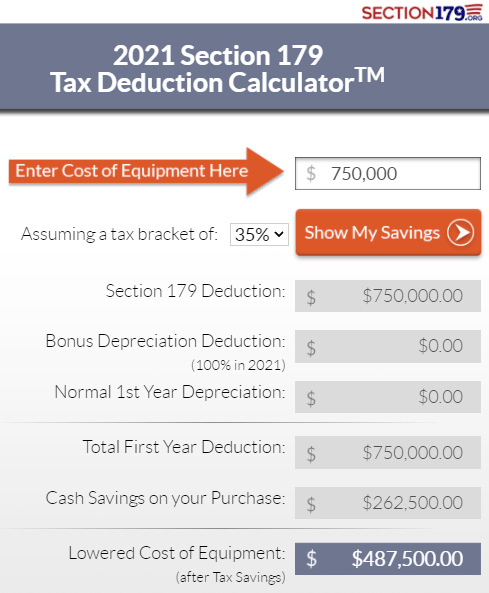

https://info.blockimaging.com/hs-fs/hubfs/section-179-example-2021.png?width=489&name=section-179-example-2021.png

CDS Blog Have An Old Copier Or Printer Here s How Section 179 Can Help

https://assets-global.website-files.com/5c957bc65469cc6d9dbb74df/618c1f2e2090ef3f2e9358ea_Section179Example Lease-01.png

2022 Section 179 deduction example QTE Manufacturing Solutions

https://qtemfg.com/wp-content/uploads/2020/10/2022-Section-179-deduction-example.jpg

For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 890 000 The new Act raised the deduction limit to 1 million and the phase out threshold to 2 5 million including annual adjustments for inflation In 2023 the Section 179 benefits apply to small and mid size businesses that spend less than 4 05 million per year for equipment

The maximum Section 179 deduction of 1 160 000 for 2023 1 220 000 for 2024 is reduced dollar for dollar by the amount of Section 179 property purchased during the year that exceeds 2 890 000 3 050 000 for 2024 What is the maximum Section 179 deduction you can make in one year The maximum Section 179 deduction any one business can claim can change each year as the IRS makes adjustments for inflation As of the 2023

Download Maximum Sec 179 Deduction 2023

More picture related to Maximum Sec 179 Deduction 2023

Section 179 Deductions For 2022 Load King

https://www.loadkingmfg.com/wp-content/uploads/2022/10/Section-179-blog-2048x1152.jpg

Line 15 Employee Benefit Programs Center For Agricultural Law And

https://www.calt.iastate.edu/files/resize/page/images/schedule_f_3_5-1048x602.jpg

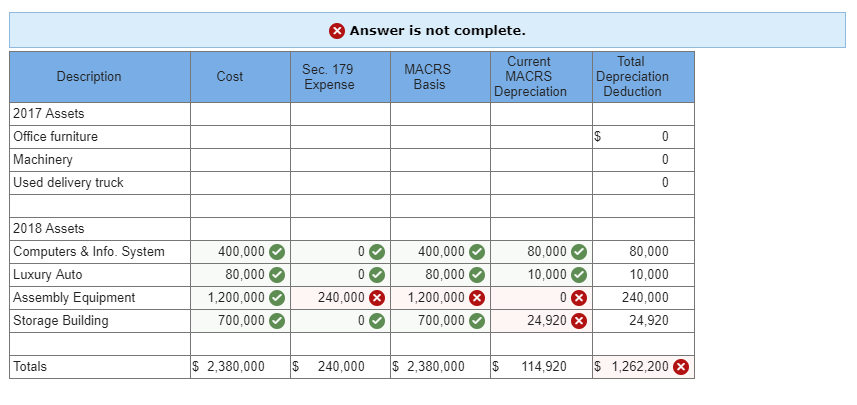

The Following Information Applies To The Chegg

https://media.cheggcdn.com/media/189/1896d7c6-ced2-4ed6-a8e4-1bf68e53ae65/phpgvhPjU.png

Section 179 allows businesses to write off the entire purchase price of a piece of qualifying equipment for the current tax year within certain limits and caps that change from year to year For example in 2022 you can deduct up to 1 080 000 with a 2 700 000 cap on expenditures as well as 100 Bonus Depreciation for new and used machine For the tax year beginning in 2023 there are specific dollar limits associated with the Section 179 Deduction Maximum Deduction The maximum Section 179 expense deduction is 1 160 000 This means that businesses can deduct up to this amount from their taxable income if they meet the criteria

How Much Can You Deduct for Section 179 in 2023 The Tax Cuts and Jobs Act of 2017 doubled the Section 179 Deduction to 1 million and then indexed that amount to inflation For 2023 the maximum deduction is 1 160 000 One alternative to the TCJA deduction is Section 179 which also allows for the full expensing of qualified property However in 2023 it is limited to a certain threshold 1 160 000 in 2023 as well as a service cap of 2 890 000 limiting the

:max_bytes(150000):strip_icc()/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition How It Works And Example

https://www.investopedia.com/thmb/34tWhWpyMVX80UVLHfqmZDIFgCU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png

Section 179 Bonus Depreciation Saving W Business Tax Deductions 2023

https://www.commercialcreditgroup.com/hs-fs/hubfs/2023 Section 179 Flyer Infographic.png?width=413&height=534&name=2023 Section 179 Flyer Infographic.png

https://www.nerdwallet.com/article/taxes/section-179-deduction

The maximum deduction under Section 179 is 1 160 000 for the 2023 tax year taxes that were due in 2024 If you placed more than 2 890 000 worth of property in service that would be eligible

https://www.paulhood.com/understanding-tax...

Limits and Qualifications for 2023 and 2024 For 2023 the Section 179 deduction limit is 1 160 000 However there is a limit to how much eligible equipment a business can purchase and still receive a deduction

Forklift Section 179 Deductions ForkliftSystems

:max_bytes(150000):strip_icc()/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition How It Works And Example

Section 179 Deduction 2020 Guide TopMark Funding

Section 179 Deduction Limit Increased For 2023

Max Out On Section 179 Deduction

Section 179 Year End Tax Savings

Section 179 Year End Tax Savings

Section 179 Deduction 2023 TopMark Funding

Section 179 Deduction Vehicle List 2024 Excel Nedi Vivienne

Section 179 Deduction Limit For 2023 And 2022

Maximum Sec 179 Deduction 2023 - The Section 179 deduction for 2023 is 1 160 000 an 80 000 increase from the previous year This allows businesses to deduct the full purchase price of qualifying equipment from their 2023 taxes up to the limit