Maximum Solar Tax Credit 2021 Web 28 Aug 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

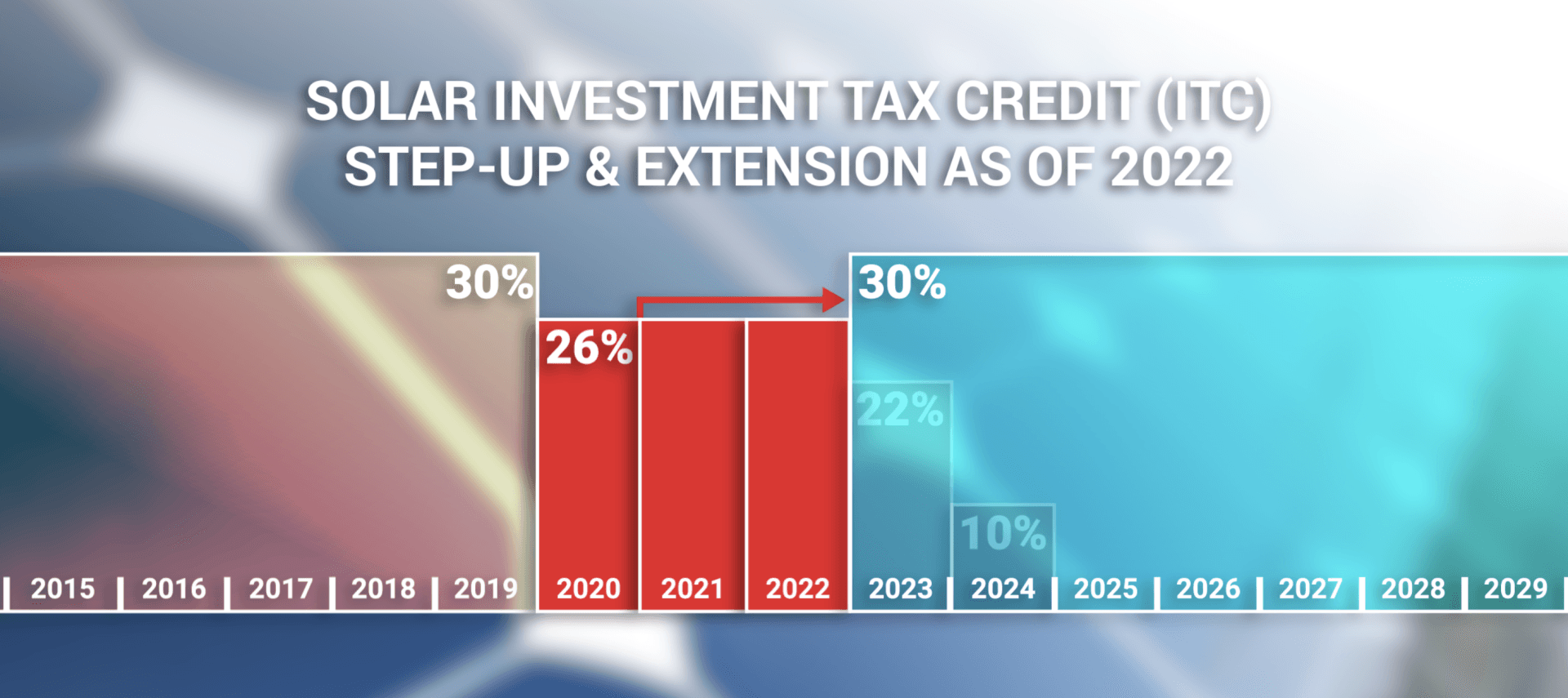

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit Web Deadline for solar energy tax credits extended On June 29 2021 the IRS announced that those developers who began construction on renewable energy projects between 2016 and 2019 have been granted six years to finish work on

Maximum Solar Tax Credit 2021

Maximum Solar Tax Credit 2021

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

IRS Tax Credit For Year 2022 And 2023 DIY Solar Power Forum

https://www.leafscore.com/wp-content/uploads/2022/08/federal-solar-tax-credit-inflation-reduction-act-scaled.jpg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

Web 29 Dez 2023 nbsp 0183 32 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Web In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

Web 8 Sept 2022 nbsp 0183 32 Let s take a look at the biggest changes and what they mean for Americans who install rooftop solar The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit Web 19 Okt 2023 nbsp 0183 32 The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

Download Maximum Solar Tax Credit 2021

More picture related to Maximum Solar Tax Credit 2021

2021 Tax Changes Tewslee

https://static.twentyoverten.com/5d5413591d304774fba39eb3/6kFYVeqmtJC/Adjusted-Gross-Income.jpg

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

https://www.thinkepic.com/wp-content/uploads/2021/06/AdobeStock_165208034-scaled.jpeg

Web 1 Aug 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Get ready for simple tax filing with a 50 Web 2016 2019 Eligible for a 30 credit 2020 2021 Eligible for a 26 credit 2022 2032 Eligible for a 30 credit 2033 Eligible for a 26 credit 2034 Eligible for a 22 credit 2035 The ITC is set to expire and you will no longer be

Web The 2021 Solar Tax Credit is a 22 Federal Tax Credit for solar energy systems installed before December 31 2021 It will decrease to 10 for commercial solar energy systems installed in 2022 After 2022 it expires for home solar energy systems unless Congress renews it There is no maximum amount that can be claimed Web 17 Juni 2022 nbsp 0183 32 In 2021 the ITC will provide a 26 tax credit on your solar panel installation costs provided that your taxable income is greater than the credit itself For most homeowners this effectively translates to a 26 discount on your home solar system So if your system costs 20 000 the ITC would enable you to claim around 5 200 as a

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

https://images.squarespace-cdn.com/content/v1/550788b1e4b0985f434d4037/1608669084346-LX3EC97L9CO6X7YQ8MMF/Photos_Overall_Array_Capture_All_Modules-1.jpg

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

https://southfacesolar.com/wp-content/uploads/2021/01/136682227_5076885039018728_2629942985947998441_n-600x503.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 Aug 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

How To Take Advantage Of The The Solar Tax Credit Extension 2021

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

The Federal Solar Tax Credit Increased Extended Solaria

The Full Guide Solar Investment Tax Credit In 2022 Karla Dennis

Federal Solar Tax Credit 2022 How Does It Work ADT Solar

The Federal Solar Tax Credit What You Need To Know 2022

The Federal Solar Tax Credit What You Need To Know 2022

The Federal Solar Tax Credit Get Updated For 2021

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Federal Solar Tax Credit 2022 How Does It Work ADT Solar

Maximum Solar Tax Credit 2021 - Web In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500