Maximum Solar Tax Credit 2023 Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Maximum Solar Tax Credit 2023

Maximum Solar Tax Credit 2023

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Claim Your Solar Tax Credit

https://static.wixstatic.com/media/d685f4_764b64c81c544a9e97e4b2db56045551~mv2.jpg/v1/fill/w_980,h_980,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/d685f4_764b64c81c544a9e97e4b2db56045551~mv2.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The federal solar tax credit or solar investment tax credit ITC currently allows you to claim 30 of the total cost of your solar system on your annual income tax return to reduce the taxes 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

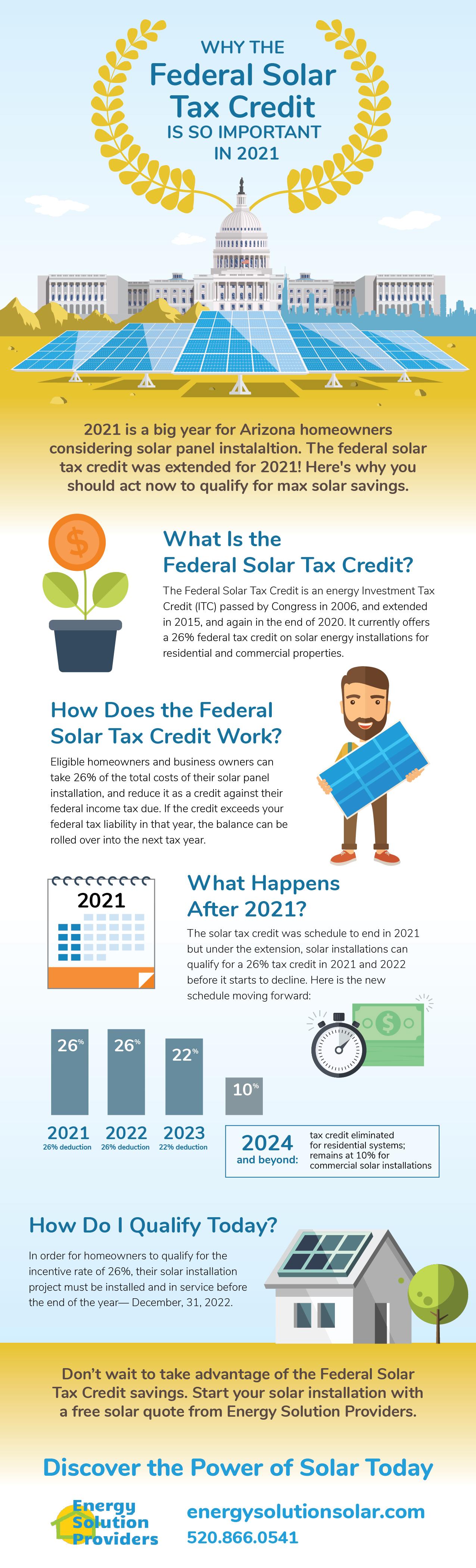

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit expires starting in 2024 unless Congress renews it There is no maximum amount that can be claimed Written by Riley Adams CPA Reviewed by a TurboTax CPA Updated for Tax Year 2023 January 28 2024 3 01 PM OVERVIEW The Residential Clean Energy Credit for solar energy upgrades to your home has been extended through 2034 and expanded in value TABLE OF CONTENTS What is the Residential Clean Energy Credit

Download Maximum Solar Tax Credit 2023

More picture related to Maximum Solar Tax Credit 2023

Is There Still A CT Solar Tax Credit For 2023 Advanced BC

https://advancedbc.org/wp-content/uploads/2022/06/solar.jpg

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2021-01.jpg?itok=SJbBX9lJ

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

[desc-10] [desc-11]

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-750x422.png

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

https://www.energy.gov/sites/default/files/2023-03/...

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

The Solar Investment Tax Credit Extension

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

2023 Vs 2022 EITC Earned Income Tax Credit Changes EXPECT BIGGER

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

California Solar Tax Credit LA Solar Group

California Solar Tax Credit LA Solar Group

Earned Income Tax Credit For Households With One Child 2023 Center

Solar Tax Credit Guide And Calculator

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Maximum Solar Tax Credit 2023 - In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit expires starting in 2024 unless Congress renews it There is no maximum amount that can be claimed