Maximum Tax Free Lump Sum On Redundancy Web 5 Apr 2022 nbsp 0183 32 If you receive a lump sum in compensation for the loss of employment part of it may be tax free The following payments are tax free The statutory redundancy

Web Statutory redundancy pay under 163 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Web 12 Apr 2023 nbsp 0183 32 Your total redundancy pay both statutory and contractual may be tax free up to a maximum amount of 163 30 000 Given statutory redundancy pay is capped at 163 19 290 you won t pay any tax if you just

Maximum Tax Free Lump Sum On Redundancy

Maximum Tax Free Lump Sum On Redundancy

https://nomadcapitalist.com/wp-content/uploads/2020/03/Lump-Sum-Tax-vs.-Tax-Free-scaled.jpg

TAX LUMP SUM

https://s3.studylib.net/store/data/007948853_1-78b0e63c5349a926675054b774da6d26-768x994.png

DB Tax Free Lump Sum T mobile

https://tmipensions.co.uk/wp-content/uploads/2019/08/Img001.jpg

Web Certain lump sum payments by an employer to an employee can be exempt from tax including the following Statutory redundancy lump sums A payment made on account Web Up to 163 30 000 of redundancy pay is tax free Any non cash benefits that form part of your redundancy package such as a company car or computer will be given a cash value

Web For example you may get a redundancy package that includes things that you have a contractual right to receive such as holiday pay for holiday you have built up but not taken or pay in lieu of notice if you are not asked Web Employees are often paid a lump sum after they have left the payroll When this happens a PAYE of 0T should be used on a Month 1 basis The 0T month code gives no tax free

Download Maximum Tax Free Lump Sum On Redundancy

More picture related to Maximum Tax Free Lump Sum On Redundancy

Is My Pension Lump Sum Tax free Nuts About Money

https://global-uploads.webflow.com/5efd08d11ce84361c2679ce1/627bc76e504d3aa0c4b4119e_pension-tax-free-lump-sum.png

Pension Tax free Lump Sum Your Investment Options

https://moneycube.ie/wp-content/uploads/2020/07/dimitry-anikin-zcZEsKiwFyo-unsplash.jpg

Pension Trick That Could Get You A Second Tax free Lump Sum This Is Money

https://i.dailymail.co.uk/i/pix/2012/08/13/article-0-14365002000005DC-219_1024x615_large.jpg

Web Any lump sum compensation payment paid subject to the 163 30 000 tax free limit To be clear the 163 30 000 limit includes both an lump sum ex gratia payment made and any Web You can see how much redundancy pay you d get using the redundancy pay calculator on GOV UK Redundancy pay is based on your earnings before tax called gross pay

Web 13 M 228 rz 2021 nbsp 0183 32 Most payments from employers to employees are taxable but there is a special tax treatment for lump sum payments on a redundancy or retirement Statutory Web The redundancy payment is tax free but Colin s employer will have to deduct tax and National Insurance contributions from the additional 163 1 000 Tax on redundancy pay

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

Lump Sum Tax Quiz Lump Sum Tax The City Government Is Considering

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/32204036a5e9f07b88f423a1d4244b6f/thumb_1200_1553.png

https://www.citizensinformation.ie/.../retirement-lump-sum-taxation

Web 5 Apr 2022 nbsp 0183 32 If you receive a lump sum in compensation for the loss of employment part of it may be tax free The following payments are tax free The statutory redundancy

https://www.gov.uk/redundancy-your-rights/tax-and-national-insur…

Web Statutory redundancy pay under 163 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment

Lump Sum Tax What Is It Formula Calculation Example

Suspension Of Employer s Obligation On Redundancy Payments Lifted

Should You Take A Tax Free Lump Sum From Your Pension Beaufort Financial

Lump Sum Payment Definition Example Tax Implications

How Would You Spend Your 25 Tax free Pension Lump Sum This Is Money

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Is It Worth Taking The Maximum Tax Free Lump Sum Pension Commencement

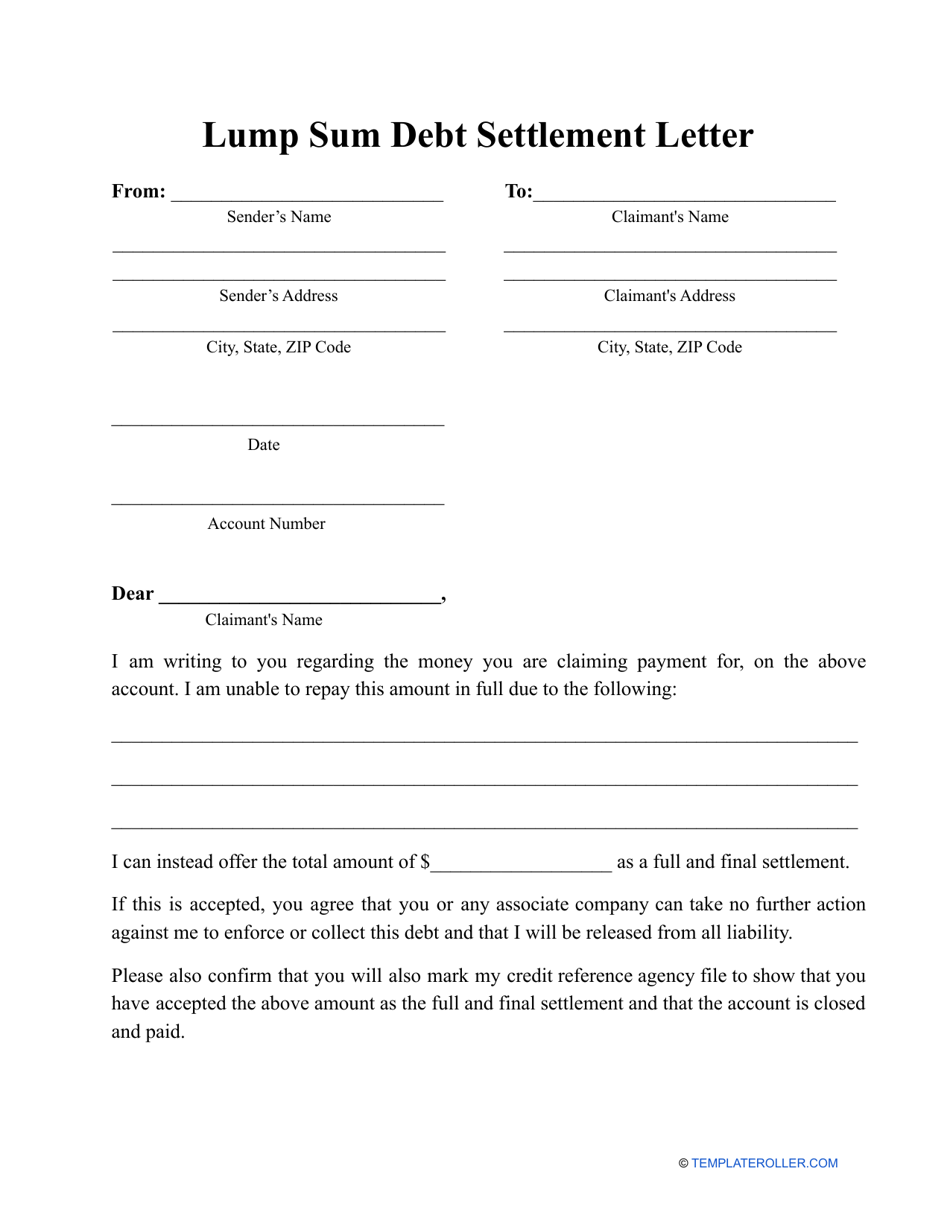

Lump Sum Debt Settlement Letter Template Download Printable PDF

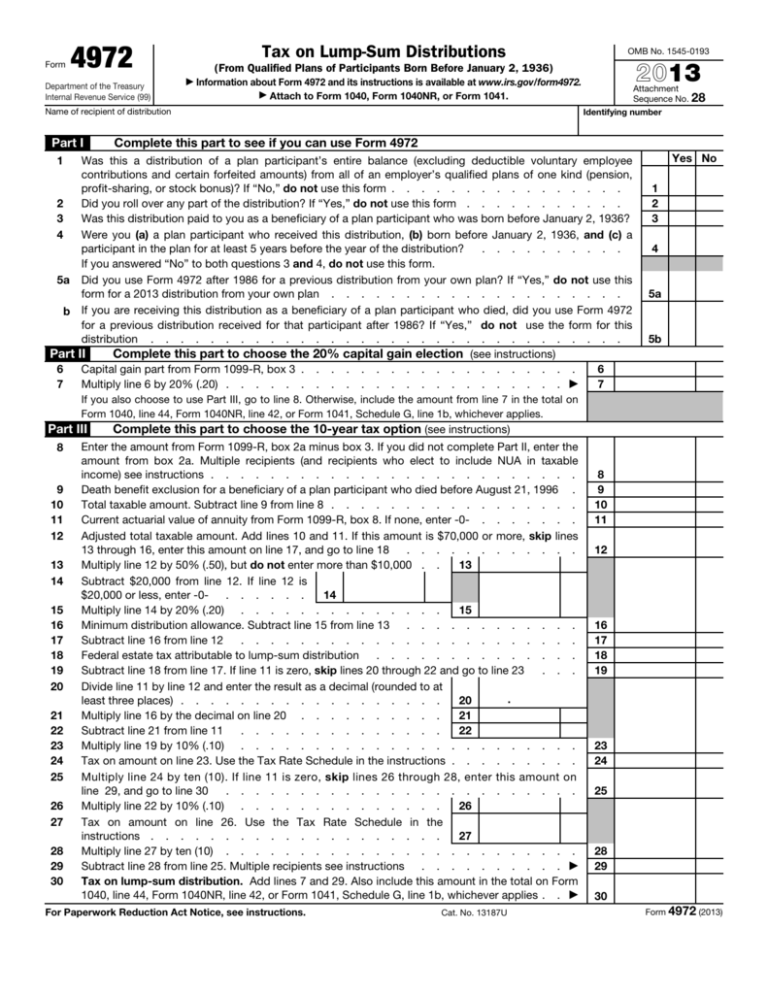

Tax On Lump Sum Distributions

Maximum Tax Free Lump Sum On Redundancy - Web From 6 April 2023 the amount of tax free lump sum you can take is 25 of your pension pot up to a maximum of 25 of the standard lifetime allowance The current lifetime