Meaning Of Tax Exemption Tax exempt refers to income or transactions that are free from tax at the federal state or local level The reporting of tax free items may be on a taxpayer s

A tax exemption enables individuals or organizations to avoid paying some or all taxes in situations that would generally incur a tax liability if the exemption did not exist In many cases receiving a tax exemption requires an individual or organization to apply for that status TAX EXEMPTION definition 1 a situation in which a person or organization does not have to pay tax 2 an amount of money Learn more

Meaning Of Tax Exemption

Meaning Of Tax Exemption

https://i0.wp.com/www.ctpres.org/ctpressblog/wp-content/uploads/2019/12/IRS-Tax-Exemption-Group-Determination-Letter.png?fit=674%2C866&ssl=1

Tax Exempt Meaning Examples Organizations How It Works

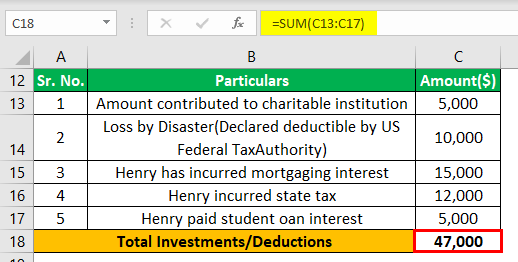

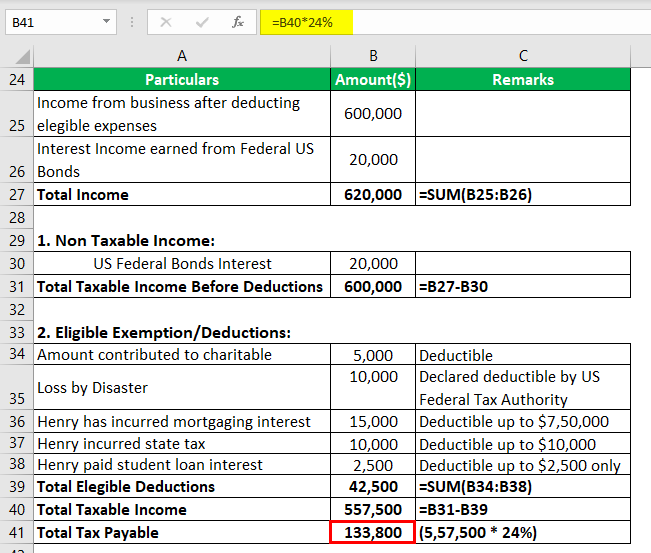

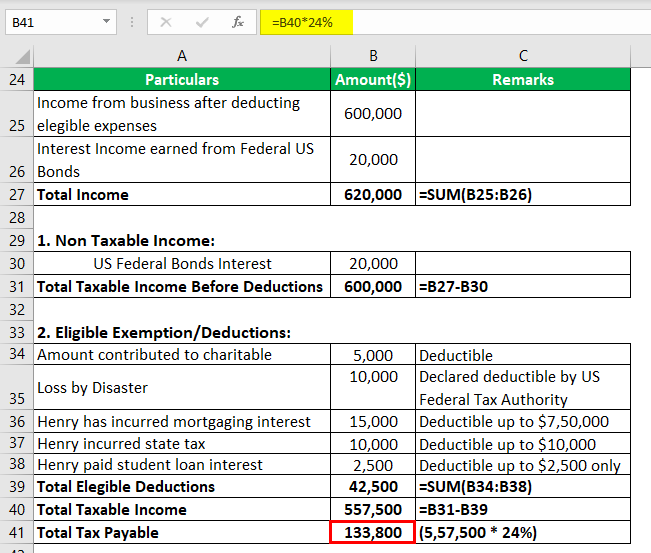

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Tax-Exempt-Example-1-1.png

What Is Meaning Of Tax Exempt Under 26 US Tax Code

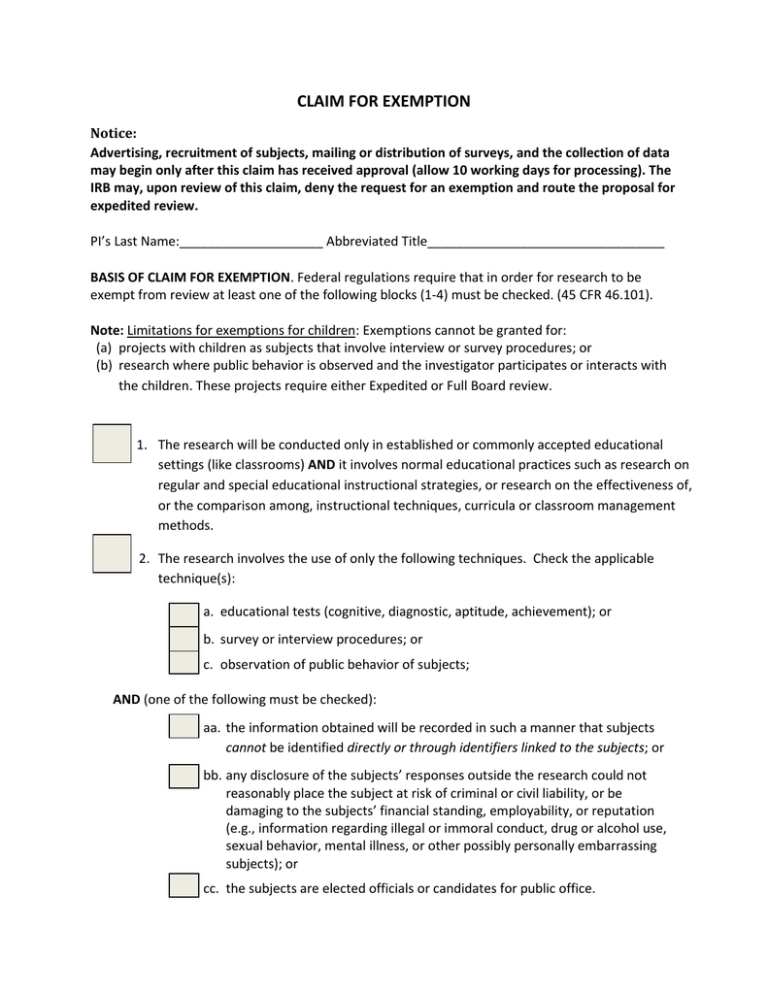

https://www.irstaxapp.com/wp-content/uploads/2017/10/tax-exempt.png

Zero rating and tax exemption are two different ways the government can treat goods and services in value added tax VAT to stimulate economic growth Speaking to Kenyans co ke Economist Brian Wachira explained that zero rating means the government does not charge Value added Tax on selling a good or service Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons property income or transactions Tax exempt status may provide complete relief from taxes reduced rates or

It means that the income or organization is exempt from paying taxes to the government resulting in a lower tax burden for the individual or entity Tax exempt income can include gifts inheritances and certain types of retirement income such as Tax exempt is when an item or income organization etc is not subject to taxation Tax exemptions can apply in many instances such as when a charity is designated tax exempt by the IRS or a purchased item is exempt from state sales tax Tax exemption rules can differ by jurisdiction

Download Meaning Of Tax Exemption

More picture related to Meaning Of Tax Exemption

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

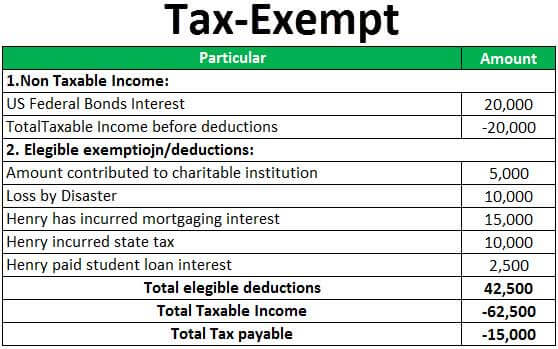

Claim For Exemption

https://s2.studylib.net/store/data/015290925_1-c28b6785682afa346c6300cf0893f532-768x994.png

Tax exempt means some or all income isn t subject to tax at the federal state or local level Here s how it works and who qualifies A tax exemption is an amount subtracted from a taxpayer s taxable income The most common tax exemption is the federal standard deduction

[desc-10] [desc-11]

Exemption Certificate Number ECN

https://igotmyrefund.com/wp-content/uploads/2014/12/IMG_2421-0-815x1024.jpg

Tax Exempt Meaning Examples What Is Tax Exemption

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Tax-Exempt.jpg

https://www.investopedia.com/terms/t/tax_exempt.asp

Tax exempt refers to income or transactions that are free from tax at the federal state or local level The reporting of tax free items may be on a taxpayer s

https://www.thebalancemoney.com/what-is-a-tax-exemption-5218263

A tax exemption enables individuals or organizations to avoid paying some or all taxes in situations that would generally incur a tax liability if the exemption did not exist In many cases receiving a tax exemption requires an individual or organization to apply for that status

CLLA Bankruptcy Blog Debtor Not Allowed To Claim Exemption On Proceeds

Exemption Certificate Number ECN

/single-word-taxes-on-wooden-block-1132754811-f3ef431cc47a4be3a49223b20774845f.jpg)

Net Of Tax Definition

Philosophical Disquisitions Religious Liberty And Tax Exemptions Part 2

Writing Religious Exemption Letters

Tax Exempt Meaning Examples Organizations How It Works

Tax Exempt Meaning Examples Organizations How It Works

Tax Policy And The Family Cornerstone

State Tax Exemption Map National Utility Solutions

Debt Adjustments Such As principal Reduction Or Exemption For Small

Meaning Of Tax Exemption - Tax exempt is when an item or income organization etc is not subject to taxation Tax exemptions can apply in many instances such as when a charity is designated tax exempt by the IRS or a purchased item is exempt from state sales tax Tax exemption rules can differ by jurisdiction