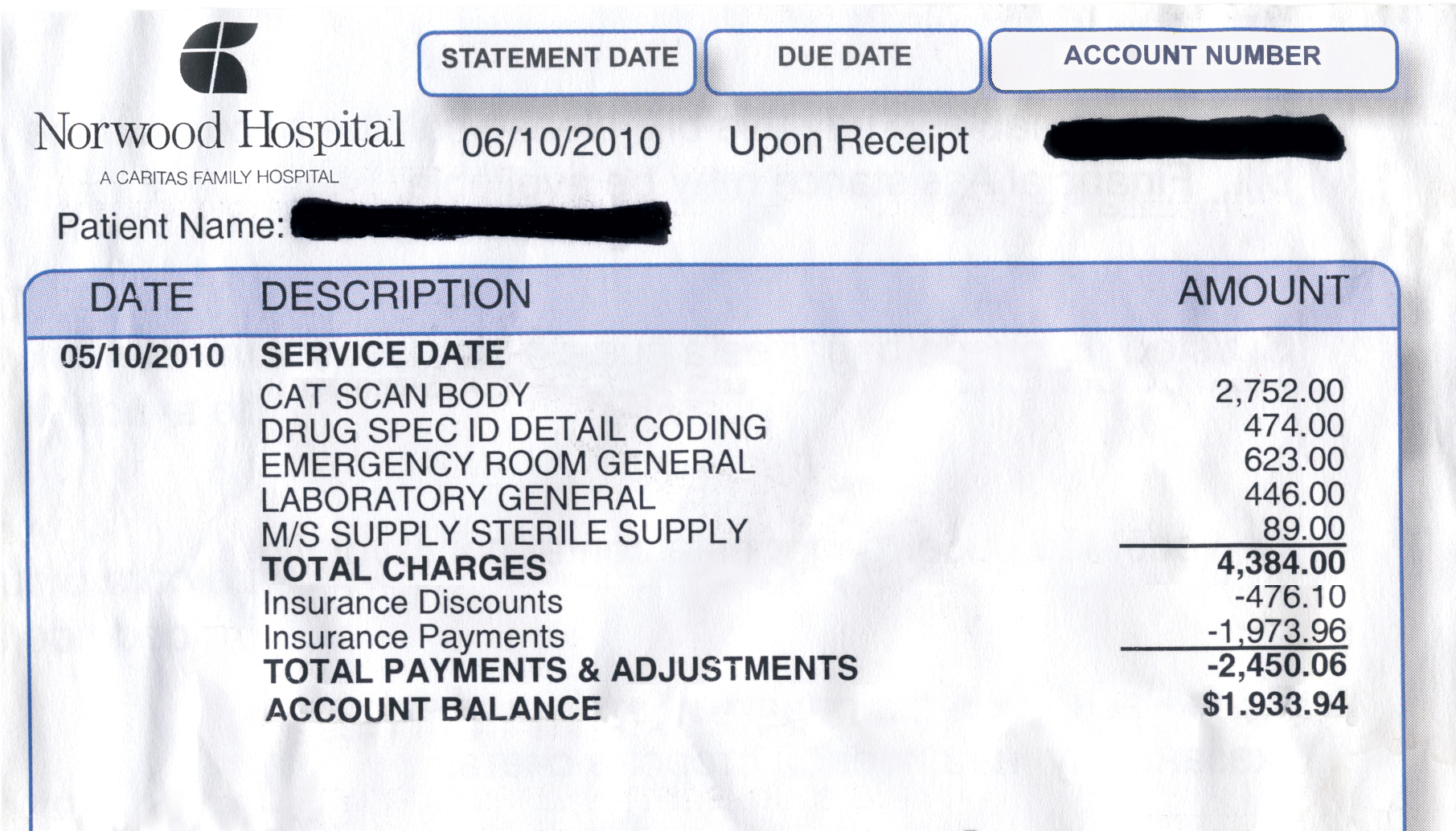

Medical Bills Limit For Tax Exemption Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for

Under medical allowance exemption Section 10 the medical allowance you receive is not included in your taxable income Here are some of the guidelines for While health insurance covers medical expenditure offering Section 80D benefits another tax benefit is available for employees known as the Medical

Medical Bills Limit For Tax Exemption

Medical Bills Limit For Tax Exemption

https://www.signnow.com/preview/497/332/497332566/large.png

Do You Have To Pay Your Medical Bills From A Personal Injury Settlement

https://www.injurylawrights.com/wp-content/uploads/2020/04/medical-bill-from-personal-injury-settlement.jpg

Can My Work related Phone Bills And WiFi Bills Help Me Reduce Taxes

https://life.futuregenerali.in/media/qptadiyc/reduce-taxes-with-phone-and-wifi-bills.jpg

You can save tax up to a maximum of Rs 1 lakh per financial year if you your family members and your parents both are above the age of 60 years by paying health insurance premium Medical bills of salaried employees reimbursed by employers are not taxable You do not have to pay tax on up to Rs 15 000 in a financial year if you submit medical bills for the same amount to the employer The main

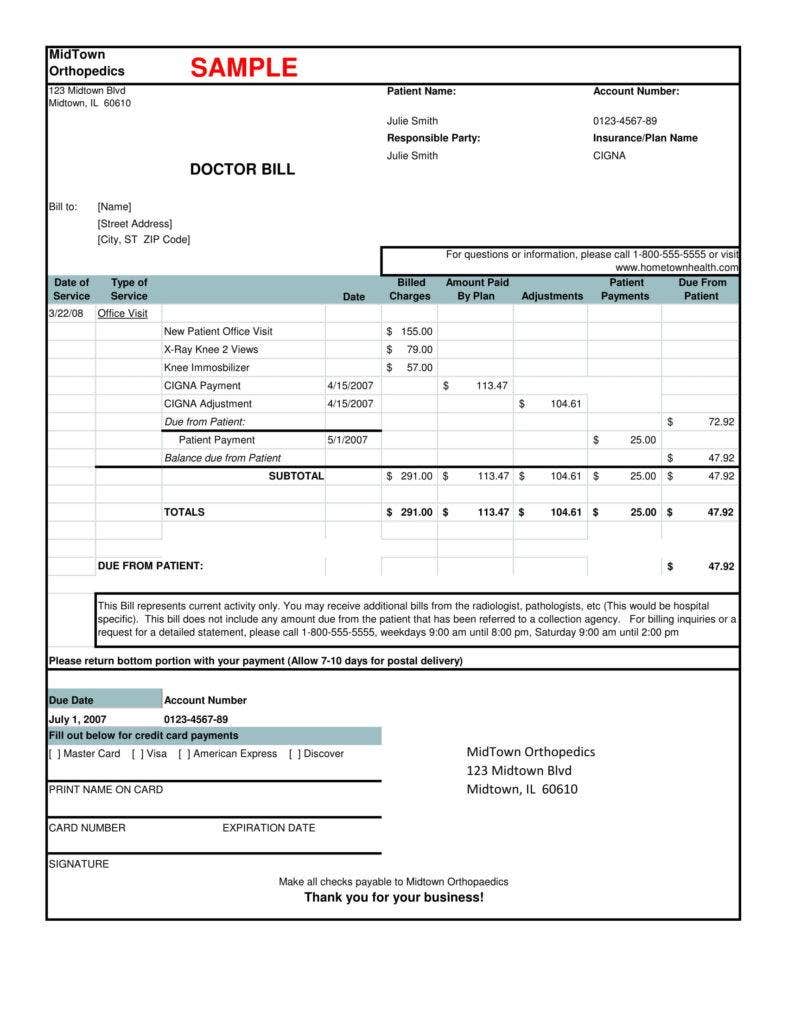

The Income Tax Act 1961 has given tax benefits of Medical insurance as well as regular medical expenditure which are as under Maximum Limit Medical Insurance premium Preventive health checkup sub limit of Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical

Download Medical Bills Limit For Tax Exemption

More picture related to Medical Bills Limit For Tax Exemption

Sample Medical Bill Receipt Invoice Template

https://1.bp.blogspot.com/-MDdgYM0imQY/YH7cixrUfSI/AAAAAAAGqRg/C-kMYr9cjcEAPoeBhia21Vq5puWbhZdWACLcBGAsYHQ/s16000/hospitality-hospitality-hospital-bill-sample.jpg

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

US Lawmakers New Legislation Seeking Tax Exemption On Small Crypto

https://www.thecoinrepublic.com/wp-content/uploads/2022/07/US-Senators-Introduce-Bill-to-Make-Crypto-Purchases-Less-Than-50-Tax-Free-1536x864.jpg

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers and the Any amount exceeding the medical allowance is not exempt from tax and can be taxed at the appropriate rate according to the employee s tax bracket As far as

Learn how to claim medical bills under Section 80D of the Income Tax Act Know the benefits limits and tax savings for health insurance premiums No Income Tax on Medical Reimbursement is levied up to Rs 15000 provided all bills for the same are furnished by the employee to the employer Such exemption of Rs 15000

How New York Can Stop Sky s the limit Out of network Hospital Bills

https://s3-prod.crainsnewyork.com/s3fs-public/MAIN-Health Bill_iStock_i.jpg

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

https://tax2win.in/guide/section-80d-ded…

Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for

https://fi.money/guides/money-matters/guide-to...

Under medical allowance exemption Section 10 the medical allowance you receive is not included in your taxable income Here are some of the guidelines for

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

How New York Can Stop Sky s the limit Out of network Hospital Bills

Anatomy Of A Medical Bill

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Will Unpaid Medical Bills From My Accident Hurt My Credit Score

Bills Would Limit Salaries Spending By N J Boards Commissions Nj

Bills Would Limit Salaries Spending By N J Boards Commissions Nj

Tax Exemption Certificate SACHET Pakistan

U2L Liaison Resources United To Learn

Writing Religious Exemption Letters

Medical Bills Limit For Tax Exemption - The Income Tax Act 1961 has given tax benefits of Medical insurance as well as regular medical expenditure which are as under Maximum Limit Medical Insurance premium Preventive health checkup sub limit of