Medical Expenses For Tax Relief You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home Individual Relief Types Amount RM 1 Individual and dependent relatives 9 000 2 Medical treatment special needs and carer expenses for parents Medical condition

Medical Expenses For Tax Relief

Medical Expenses For Tax Relief

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

How To Get The Most Out Of Your Medical Expenses Elite Tax

http://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

Medical Expense Tax Strategy Bunching Medical Expenses For

http://ramsaycpa.com/blog/wp-content/uploads/2017/10/10_03_17_80407780_ITB_560x292.jpg

Health insurance in India is essential for managing medical expenses Section 80D offers tax benefits for premium payments It applies to individuals and HUFs For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there

Download Medical Expenses For Tax Relief

More picture related to Medical Expenses For Tax Relief

All You Need To Know About Claiming Medical Expenses On Your Personal

https://www.dmtax.ca/wp-content/uploads/2022/12/medical-expenses.jpg

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

TAX RELIEF ON MEDICAL EXPENSES Patrick Keane

http://pkeane.ie/wp-content/uploads/2015/07/Medical-Expenses.jpg

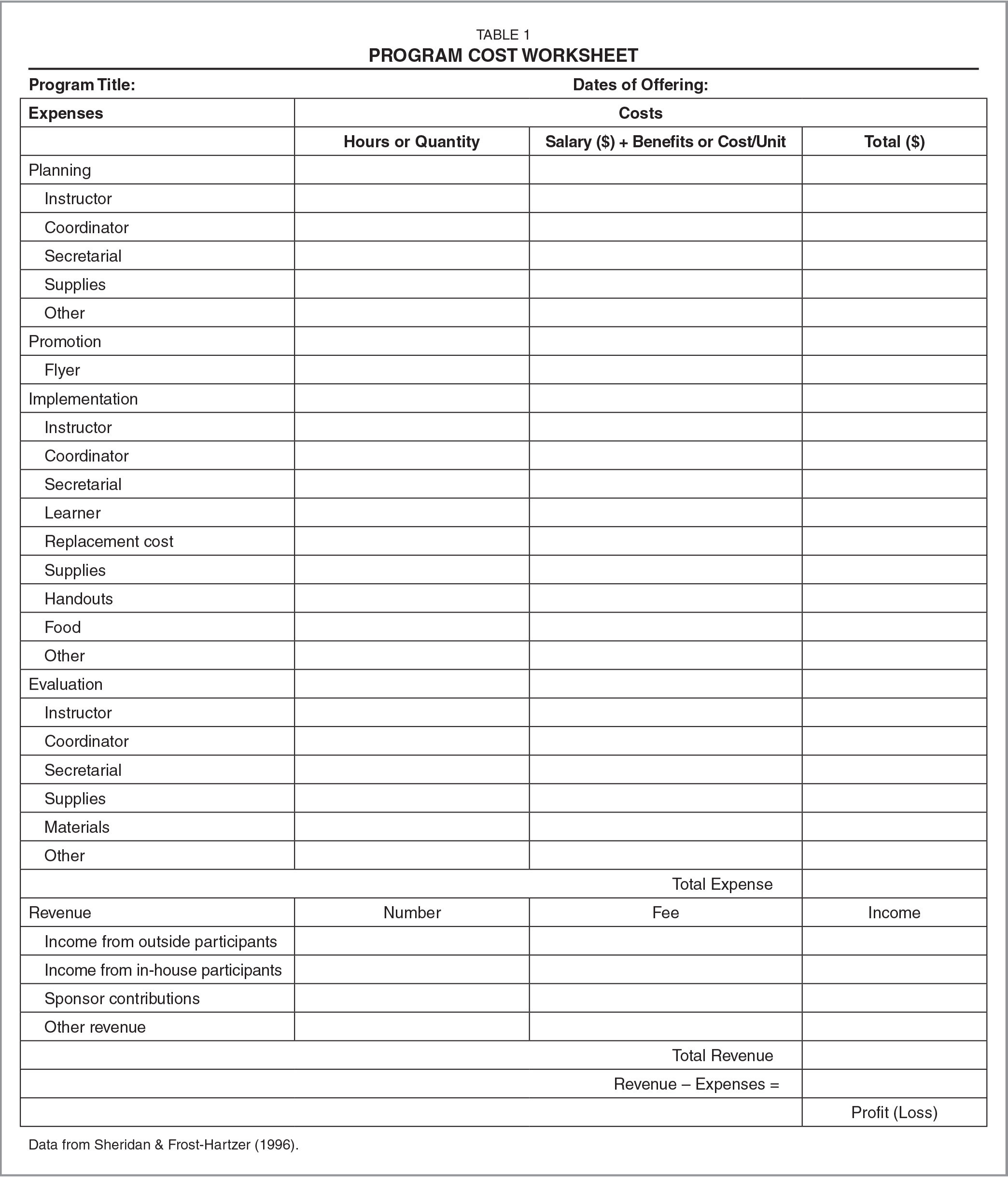

Index Find out if this guide is for you This guide is for persons with medical expenses and their supporting family members The guide gives information on eligible medical Medical Expenses Motor Vehicle Expenses Registration Costs for Patents Trademarks Designs Plant Varieties Reinstatement Costs Renovation Refurbishment Works

Examples of qualifying health expenses are payment for doctor s and consultant s services routine and maternity care for women during pregnancy diagnostic Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you can claim

Personal Tax Relief 2021 L Co Accountants

https://landco.my/wp-content/uploads/2021/11/3-5.png

Medical Expenses Islamicmyte

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-worksheet-home-design-ideas-home.jpg

https://www.revenue.ie/.../health-expenses/index.aspx

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40

https://www.citizensinformation.ie/.../taxation-and-medical-expenses

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home

Malaysia Personal Income Tax Relief 2022

Personal Tax Relief 2021 L Co Accountants

Personal Tax Relief 2021 L Co Accountants

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

What Can You Claim For Tax Relief Under Medical Expenses

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Medical Expense Deduction How To Claim A Tax Deduction For Medical

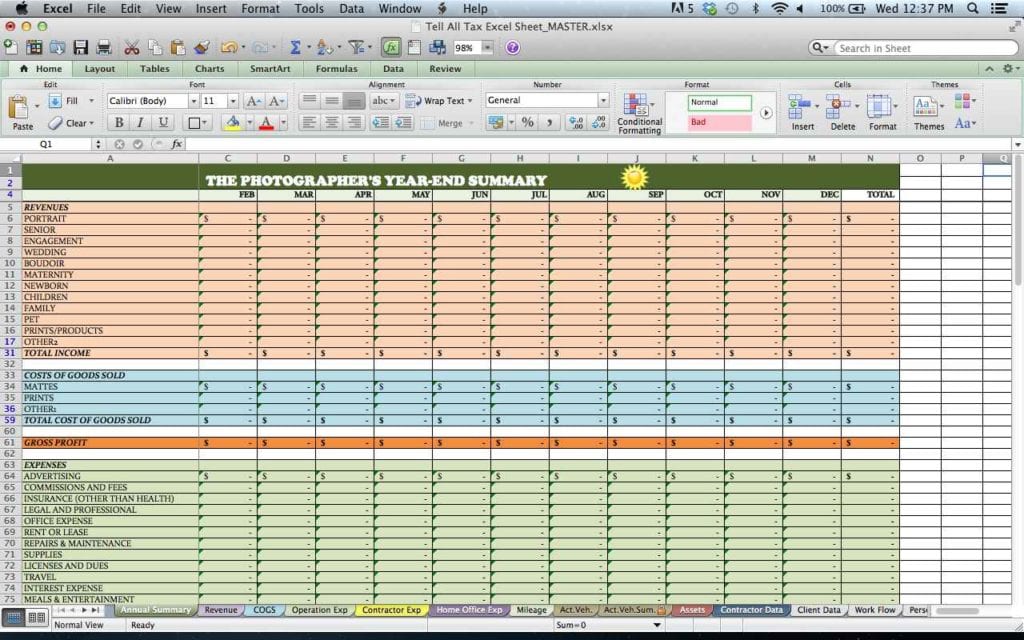

Tax Deduction Template

Template Expenses Sheet Excelxo

Printable Itemized Deductions Worksheet

Medical Expenses For Tax Relief - Health insurance in India is essential for managing medical expenses Section 80D offers tax benefits for premium payments It applies to individuals and HUFs