Medical Expenses To Claim On Income Tax Canada Web On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or your spouse or common law partner paid in 2022 for eligible medical expenses Step 2 On the line below line 33099 enter the lesser of the following amounts 3 of your net income line 23600 or 2 479

Web 21 Nov 2019 nbsp 0183 32 Here s the top 3 things you should know about claiming medical expenses 1 The Three Percent Rule Many taxpayers expect to receive a deduction for every cent they ve paid in medical expenses The amount you can claim is actually based upon your income Web 1 Okt 2020 nbsp 0183 32 Identify which medical expenses you can claim when filing taxes Plus learn about common medical expenses if family members can claim and the 12 month rule

Medical Expenses To Claim On Income Tax Canada

Medical Expenses To Claim On Income Tax Canada

https://www.olympiabenefits.com/hubfs/How does the Medical Expense Tax Credit work in Canada.png

Medical Expenses You Can Claim On Your Canadian Income Tax Return The

https://i1.wp.com/canadianbudgetbinder.com/wp-content/uploads/2019/03/medical-expenses-you-can-claim-on-your-Canadian-Income-Tax-Return.png?resize=588%2C882&ssl=1

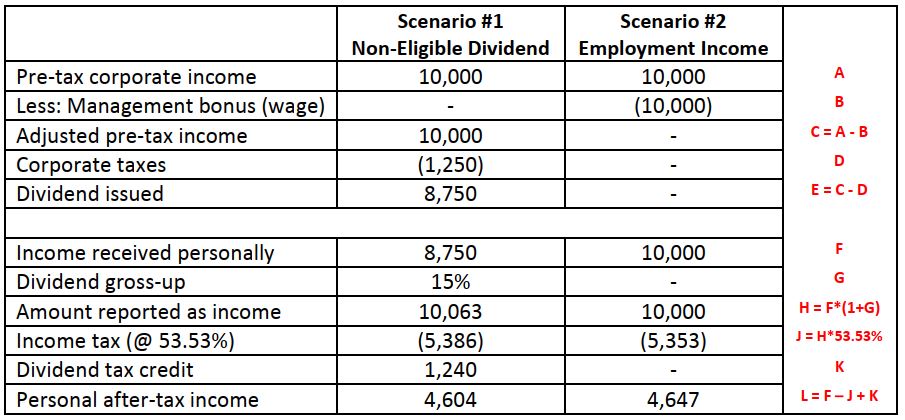

Introduction To Taxable Income In Canada Part II Davis Martindale Blog

https://www.davismartindale.com/app/uploads/2020/03/Example-1.jpg

Web 7 Feb 2022 nbsp 0183 32 You can claim eligible medical expenses on your return if the expenses were Paid by you or your spouse common law partners included Paid in any 12 month period ending in 2021 Not claimed by you or by anyone else in 2020 You can also claim all amounts paid even if they weren t paid in Canada Web 22 Apr 2022 nbsp 0183 32 To qualify your household s eligible medical expenses must add up to the lesser of 3 of your net income or 2 479 For example if your net income is 60 000 all medical expenses beyond 1 800 are a credit against your taxable income

Web 1 Okt 2020 nbsp 0183 32 The medical expense tax credit is one of the most overlooked non refundable tax deductions Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses This tax credit can also be claimed for your spouse common law partner and children under Web 21 M 228 rz 2022 nbsp 0183 32 Your 2021 expenses need to exceed the lesser of your net income on line 23600 of your tax return or 2 241 The tax savings is 15 federally and ranges based on your province or territory

Download Medical Expenses To Claim On Income Tax Canada

More picture related to Medical Expenses To Claim On Income Tax Canada

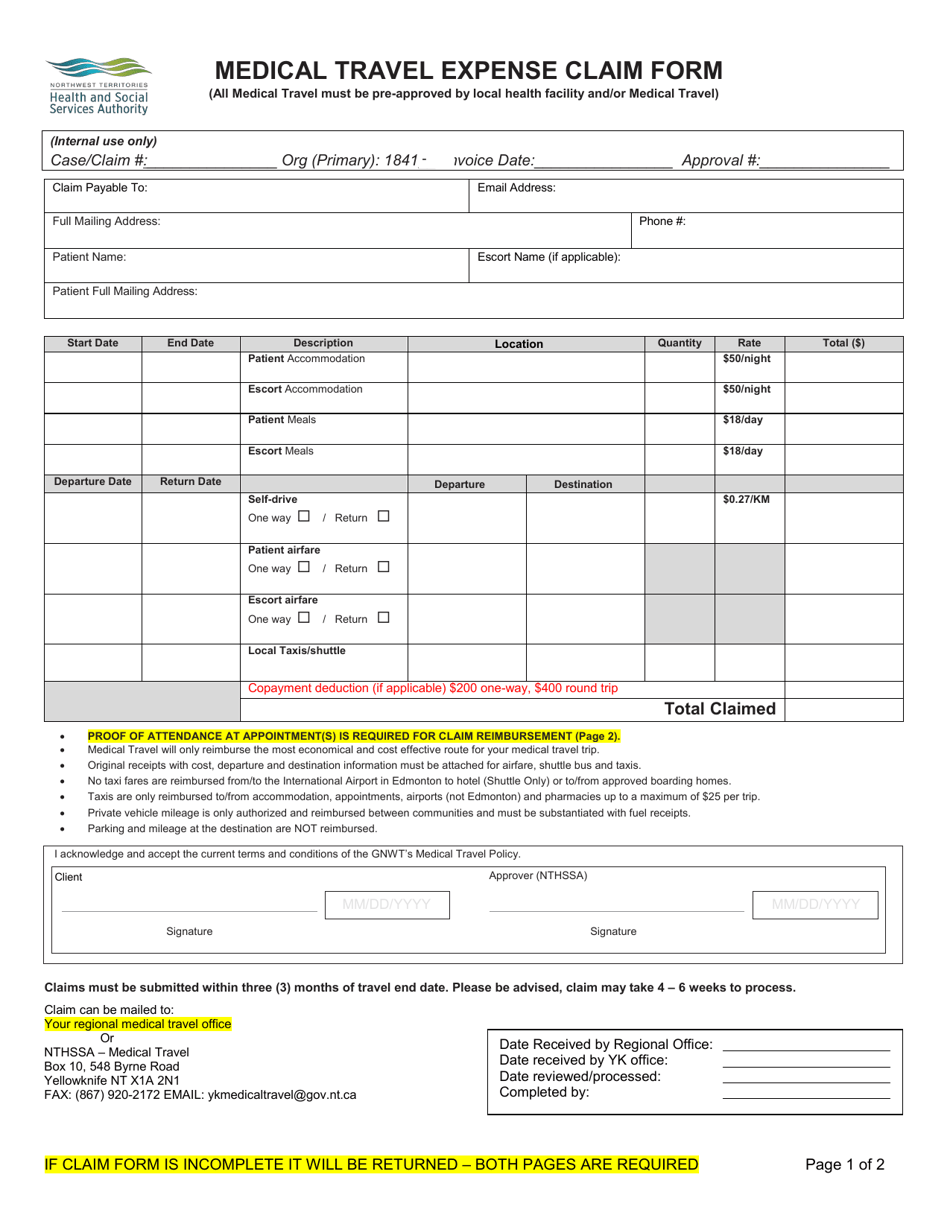

Northwest Territories Canada Medical Travel Expense Claim Form Fill

https://data.templateroller.com/pdf_docs_html/2066/20668/2066829/medical-travel-expense-claim-form-northwest-territories-canada_print_big.png

Can You Claim Prescription Drugs On Income Tax Canada 27F Chilean Way

https://www.27fchileanway.cl/wp-content/uploads/2023/05/can-you-claim-prescription-drugs-on-income-tax-canada-1536x808.jpg

Tax Planning For Medical Expense Deductions Wegner CPAs

https://www.wegnercpas.com/wp-content/uploads/2020/12/medical-expense-deductions-1024x683.jpg

Web The medical expenses tax deduction in Canada is a non refundable tax credit Canadians can claim on their personal tax return This credit is called the Medical Expense Tax Credit METC Because it is a non refundable tax credit you can subtract it from your tax owed as long as it does not bring your balance above 0 It s easy to track and calculate your Web 20 Okt 2023 nbsp 0183 32 An individual taxpayer can only claim medical expenses if the medical expenses exceed the lesser amount of 3 of the individual s net income reported on his or her tax return or 2 635 in 2023 2 479 for 2022 Hair Transplant Costs Cosmetic Surgery Procedure

Web 28 Feb 2022 nbsp 0183 32 You may To get a credit these unreimbursed medical expenses must exceed a set threshold The threshold for the 2021 tax year is 3 of net income or 2 421 whichever is less Threshold levels for the provincial part of the credit may be different In Quebec for provincial income tax purposes the threshold is 3 of both spouses Web 31 Dez 2022 nbsp 0183 32 medical expense deductible expense deductions credits expenses child care child care expenses education education tax credits disability disability tax credits pensions employment related tax credit

In Order To Take Advantage Of This Deduction It Is Important That You

https://i.pinimg.com/originals/cf/7c/a3/cf7ca31760316c1638a534441fe98613.png

Filing Your Personal Income Taxes T1 In Canada RKB Accounting Tax

https://www.rkbaccounting.ca/wp-content/uploads/2020/12/Personal-Income-tax.jpg

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

Web On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or your spouse or common law partner paid in 2022 for eligible medical expenses Step 2 On the line below line 33099 enter the lesser of the following amounts 3 of your net income line 23600 or 2 479

https://turbotax.intuit.ca/tips/three-tips-for-claiming-your-medical...

Web 21 Nov 2019 nbsp 0183 32 Here s the top 3 things you should know about claiming medical expenses 1 The Three Percent Rule Many taxpayers expect to receive a deduction for every cent they ve paid in medical expenses The amount you can claim is actually based upon your income

Can I Claim Medical Expenses Without Receipts

In Order To Take Advantage Of This Deduction It Is Important That You

Turn Your Personal Medical Expenses Into 100 Corporate Expenses

Can I Claim Medical Expenses Without Receipts

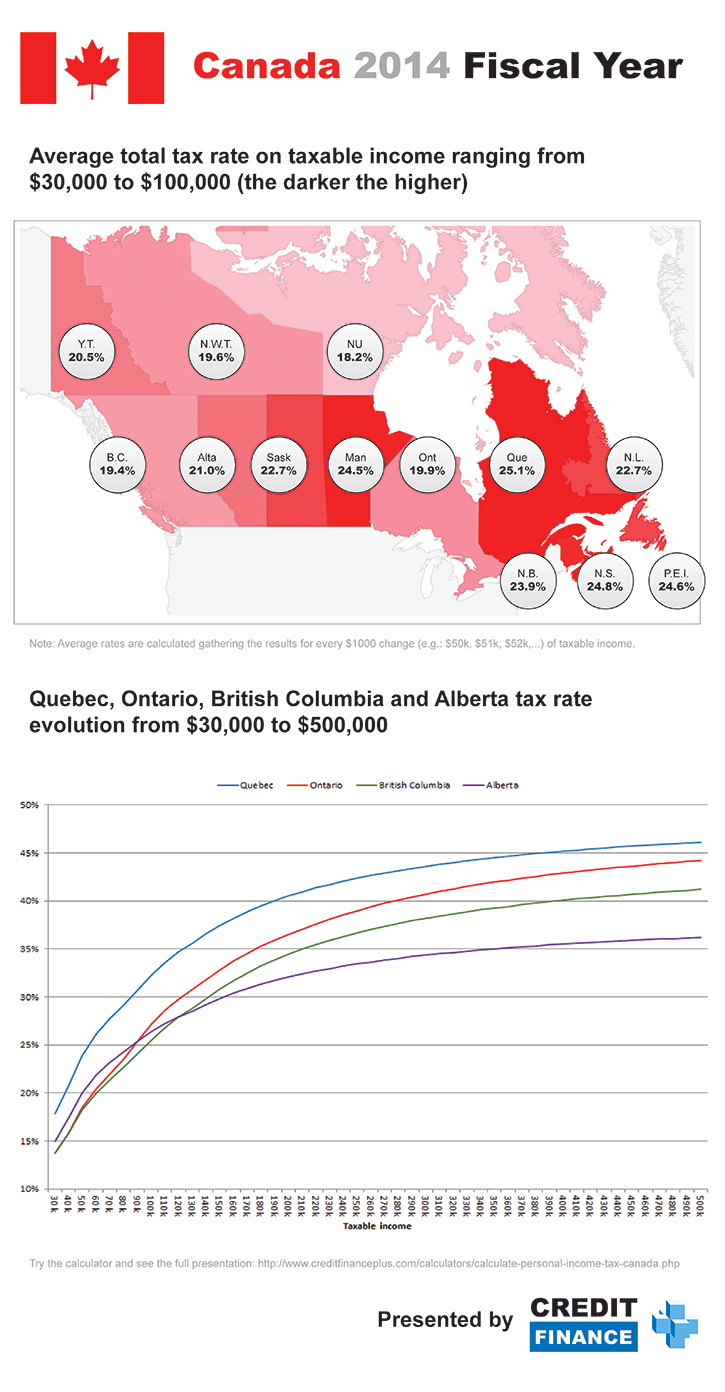

Infographic Canada 2014 Fiscal Year Comparing Personal Income Tax

Vhi Medical Expenses Claim Form ClaimForms

Vhi Medical Expenses Claim Form ClaimForms

Personal Income Tax Brackets Ontario 2022 MD Tax

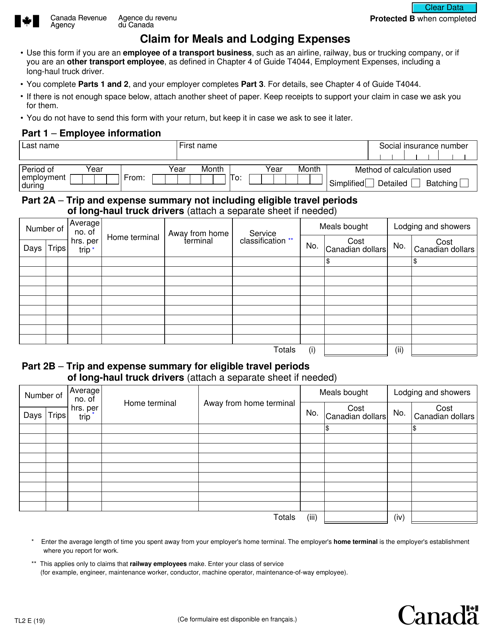

Form TL2 Fill Out Sign Online And Download Fillable PDF Canada

Canada Quebec Tax Brackets Canadaaz

Medical Expenses To Claim On Income Tax Canada - Web 22 Apr 2022 nbsp 0183 32 To qualify your household s eligible medical expenses must add up to the lesser of 3 of your net income or 2 479 For example if your net income is 60 000 all medical expenses beyond 1 800 are a credit against your taxable income