Income Tax Rebate On Donations To Ngo Web 11 mai 2022 nbsp 0183 32 France Individuals in France can claim an income tax reduction tax credit of 66 of the amount donated or a 75 reduction in wealth tax Donations to certain

Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Income Tax Rebate On Donations To Ngo

Income Tax Rebate On Donations To Ngo

https://i.pinimg.com/736x/b9/c1/20/b9c12098fd27992e99156ada839c1d27--needy-people-like-you.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity How this works depends Web 28 mars 2023 nbsp 0183 32 Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax

Web 11 juil 2023 nbsp 0183 32 In general you can deduct up to 60 of your adjusted gross income via charitable donations but you may be limited to 20 30 or 50 depending on the Web You can claim tax deductions on the donations made to an NGO provided the NGO is registered under Section 80G of the Income Tax Act 1961 Not only that helping those

Download Income Tax Rebate On Donations To Ngo

More picture related to Income Tax Rebate On Donations To Ngo

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

https://i.ytimg.com/vi/jZcpVwGx4EE/maxresdefault.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://www.propertyrebate.net/wp-content/uploads/2023/05/income-tax-rebate-under-section-87a-for-income-up-to-5-lakh.jpeg

Web 8 juil 2016 nbsp 0183 32 1 Deduction allowable on cash basis in other words if it is paid in F Y 2015 16 then you can claim the same on the same F Y only 2 Deduction is allowable 50 of Web 2 f 233 vr 2023 nbsp 0183 32 These NGOs receive donations from the public and it is recorded as their income But under certain circumstances the total amount of taxable income for

Web Registration Procedure under section 80G Documents to be furnished Renewal of 80G Registration NGO s in India Web Section 80G of the Income Tax Act of 1961 is a little different as it provides tax exemption to charity donors as well Donations to an NGO under 80G offers deductions while

INCOME TAX REBATE ON INVESTMENT

https://i.ytimg.com/vi/jhvGGPmV5_8/maxresdefault.jpg

Tax Exemption 80G Certificate

https://docs.erpnext.com/files/donor-certificate.png

https://donorbox.org/nonprofit-blog/nonprofit-tax-programs

Web 11 mai 2022 nbsp 0183 32 France Individuals in France can claim an income tax reduction tax credit of 66 of the amount donated or a 75 reduction in wealth tax Donations to certain

https://cleartax.in/s/charitable-trusts-ngo-income-tax-benefits

Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your

Individual Income Tax Rebate

INCOME TAX REBATE ON INVESTMENT

Know The Tax Changes On Donations Dividend Incomes And Esops Before

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

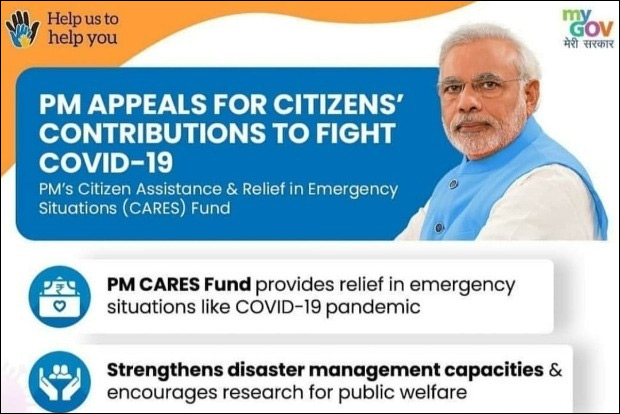

Pm Cares Fund Income Tax Rebate 2022 Carrebate

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Are Donations To Crowdfunding Platforms Eligible For Tax Rebate Here

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate On Donations To Ngo - Web Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity How this works depends