Franking Rebate Tax Web 22 ao 251 t 2019 nbsp 0183 32 Updated January 6 2023 What is Franking Credit Also known as imputation credit franking credit is a type of tax credit that enables a company to pass

Web 26 oct 2022 nbsp 0183 32 Budget 2022 23 multinationals franking credits to boost tax take and force strategy rethink The first Budget of the new Labor Government has been delivered Web 22 juin 2023 nbsp 0183 32 Get Franking Credit Refunds Franking credits are a refundable tax offset If no tax is payable or if the franking credits are

Franking Rebate Tax

Franking Rebate Tax

https://content.api.news/v3/images/bin/21b2784e0272c77236a76ca379923799

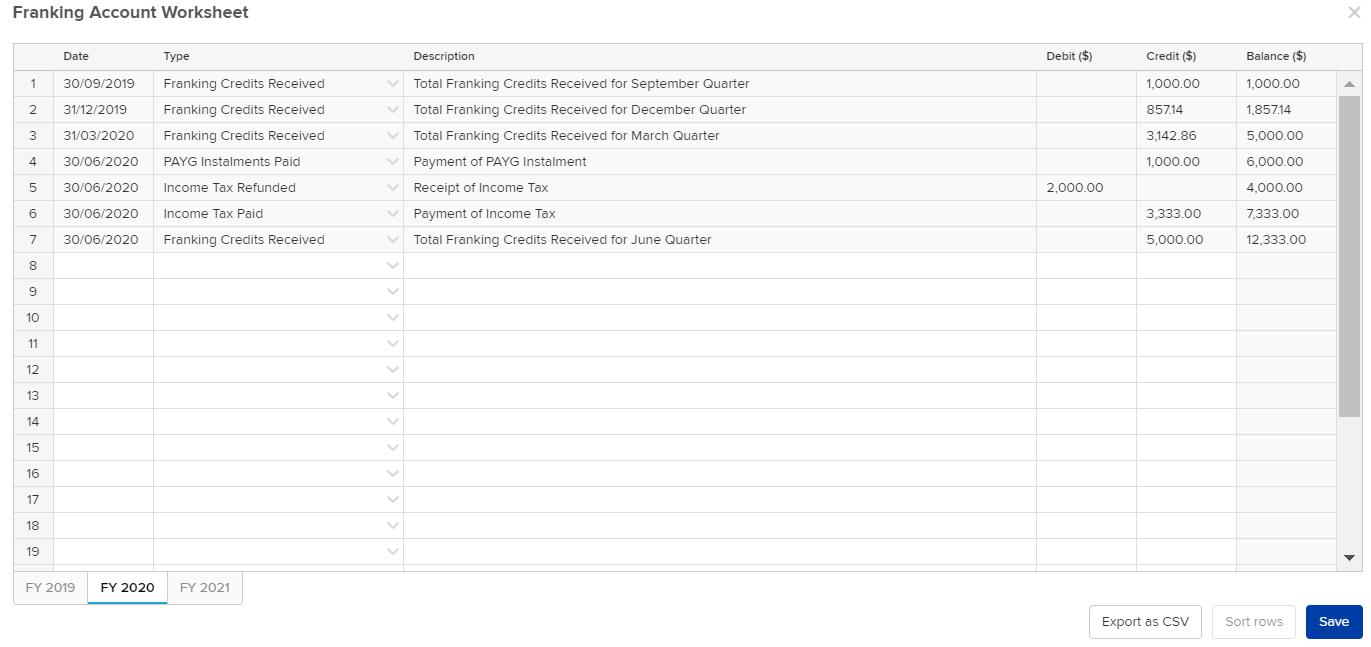

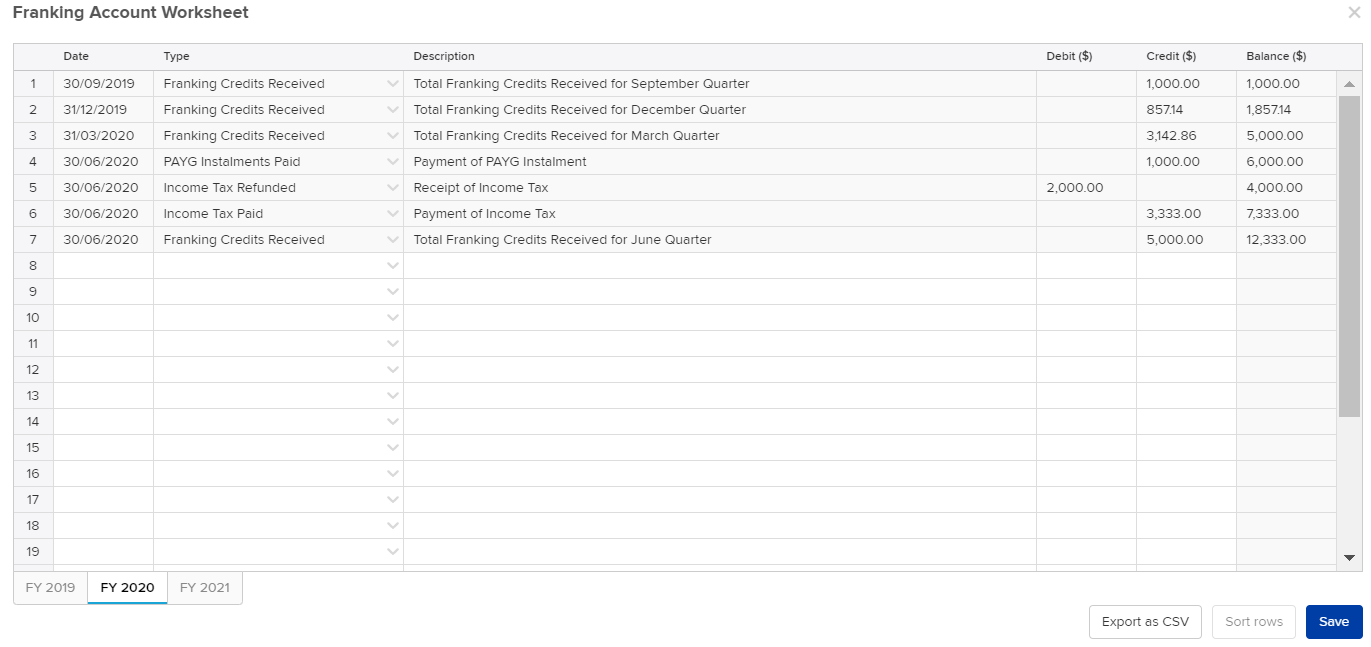

Franking Account Worksheet Simple Invest 360

https://support.simpleinvest360.com/hc/article_attachments/4403600962829/41.png

Franking Account Worksheet 2016 Math Worksheet Activities

https://central.xero.com/sfc/servlet.shepherd/version/renditionDownload?rendition=THUMB720BY480&versionId=0683m00000EydUK&operationContext=CHATTER&contentId=05T3m00000sp5ab

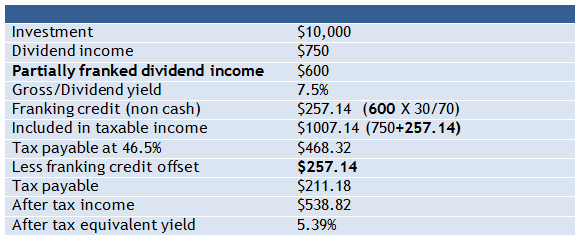

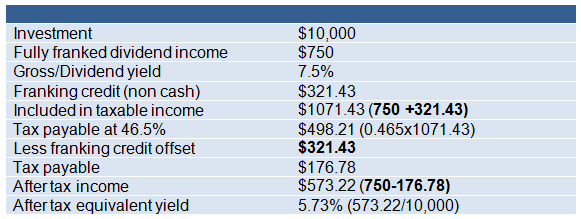

Web There are several options available to you to apply for a refund of franking credits In some circumstances we automatically refund franking credits to eligible individuals If you Web 23 mai 2023 nbsp 0183 32 Franking credits are essentially a tax rebate paid to investors with shares in Australian companies As the company you have invested in has already paid tax on its profits the idea is that

Web You can claim a tax refund if the franking credits you receive exceed the tax you have to pay This is a refund of excess franking credits You may receive a refund of the full Web 30 juin 1999 nbsp 0183 32 List of yields These yields are calculated with the assistance of rating agency S amp P Dow Jones Indices and are generally available by the middle of the following month

Download Franking Rebate Tax

More picture related to Franking Rebate Tax

Franking Account Worksheet 2018 Free Download Goodimg co

https://help.myob.com/wiki/download/attachments/46597242/FAR FDT example Sections A and B.PNG?version=1&modificationDate=1576644225000&api=v2

Franking Credits Refunded By Taxpayer Type Franking Credits

https://www2.com.au/wp-content/uploads/2018/06/FrankingByType.png

Removing Imputation Credit Rebates That s Not Fair Supernova Consulting

https://www.super-nova.com.au/wp-content/uploads/2018/03/Dividend-Franking-Credit-Cash-Flow.jpg

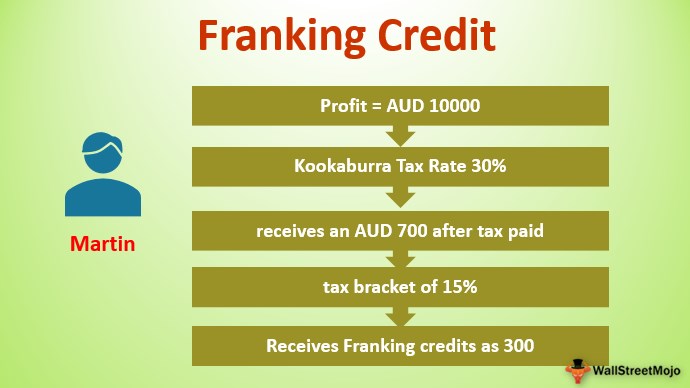

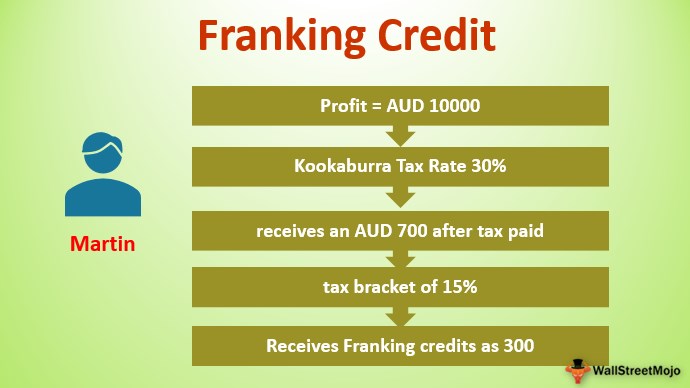

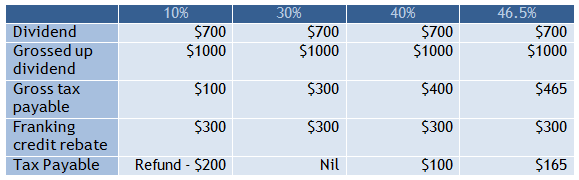

Web 8 f 233 vr 2019 nbsp 0183 32 A franking credit is an entitlement to a reduction in personal income tax payable to the Australian Taxation Office The entitlement is offered to individuals who own shares in a company Web Franking can significantly impact the amount of tax paid by companies and by individuals like you so it s important to make sure you get the right information when making any choices and completing your tax return

Web 1 sept 2014 nbsp 0183 32 The 2001 Simplified Tax System Act allows resident taxpayers with low tax rates such as pension funds not for profit organizations and low income earners to cash Web You receive a tax credit for the value of the franking credit which can be offset against other income Remember the company tax rate is 30 If your personal tax rate is 30

Franking Credit Formula Examples How To Calculate

https://www.wallstreetmojo.com/wp-content/uploads/2020/06/Franking-Credit.jpg

Franking Account Tax Return And Instructions 2022 Reliable Melbourne

https://rmelbourneaccountants.com.au/wp-content/uploads/2022/07/Franking-Account-Tax-Return-and-Instructions-2022-980x572.jpg

https://corporatefinanceinstitute.com/resources/accounting/franking-credit

Web 22 ao 251 t 2019 nbsp 0183 32 Updated January 6 2023 What is Franking Credit Also known as imputation credit franking credit is a type of tax credit that enables a company to pass

https://www.claytonutz.com/knowledge/2022/october/budget-2022-23...

Web 26 oct 2022 nbsp 0183 32 Budget 2022 23 multinationals franking credits to boost tax take and force strategy rethink The first Budget of the new Labor Government has been delivered

Franking Credit Refund 2023 Atotaxrates info

Franking Credit Formula Examples How To Calculate

Franking Tax Offsets Tax Losses For Corporate Tax Entities

Dividend Imputation System Franking Credits Explained Calculations

PROOF Tax Is Withheld From Franked Dividend Payments Franking Credits

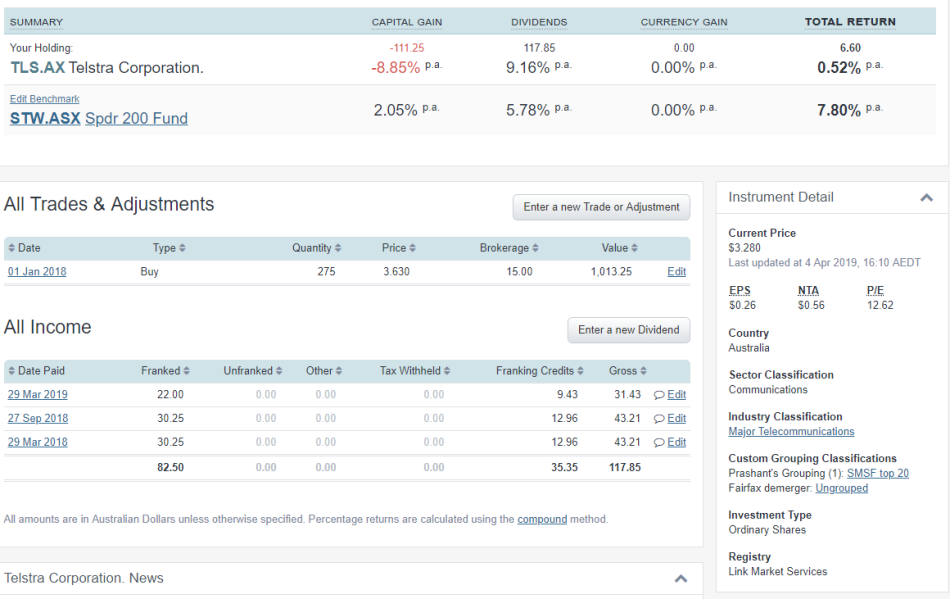

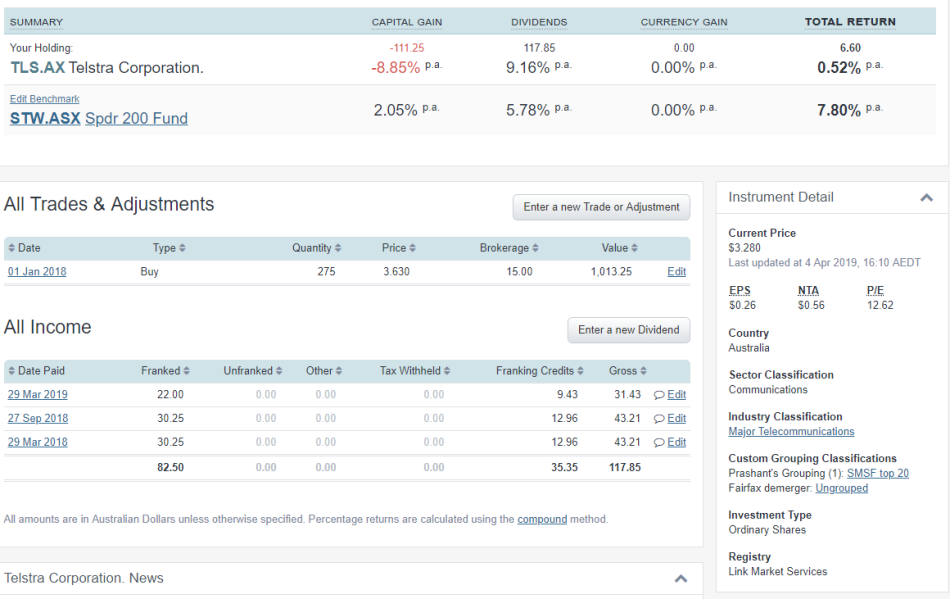

How To Calculate Franking Credits On Your Investment Portfolio Sharesight

How To Calculate Franking Credits On Your Investment Portfolio Sharesight

Dividend Imputation System Franking Credits Explained Calculations

Solved Statement Of Advice 3 Calculate The Franking Account And Tax

Dividend Imputation System Franking Credits Explained Calculations

Franking Rebate Tax - Web There are several options available to you to apply for a refund of franking credits In some circumstances we automatically refund franking credits to eligible individuals If you