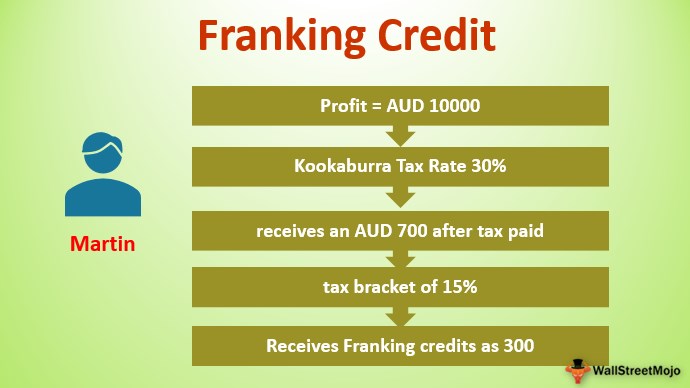

Franking Credits Tax Consolidation The meaning of franking offsets is given in paragraph 707 310 3A c franking offsets is the amount of the entitlement to two tax offsets franking credits and venture capital credits

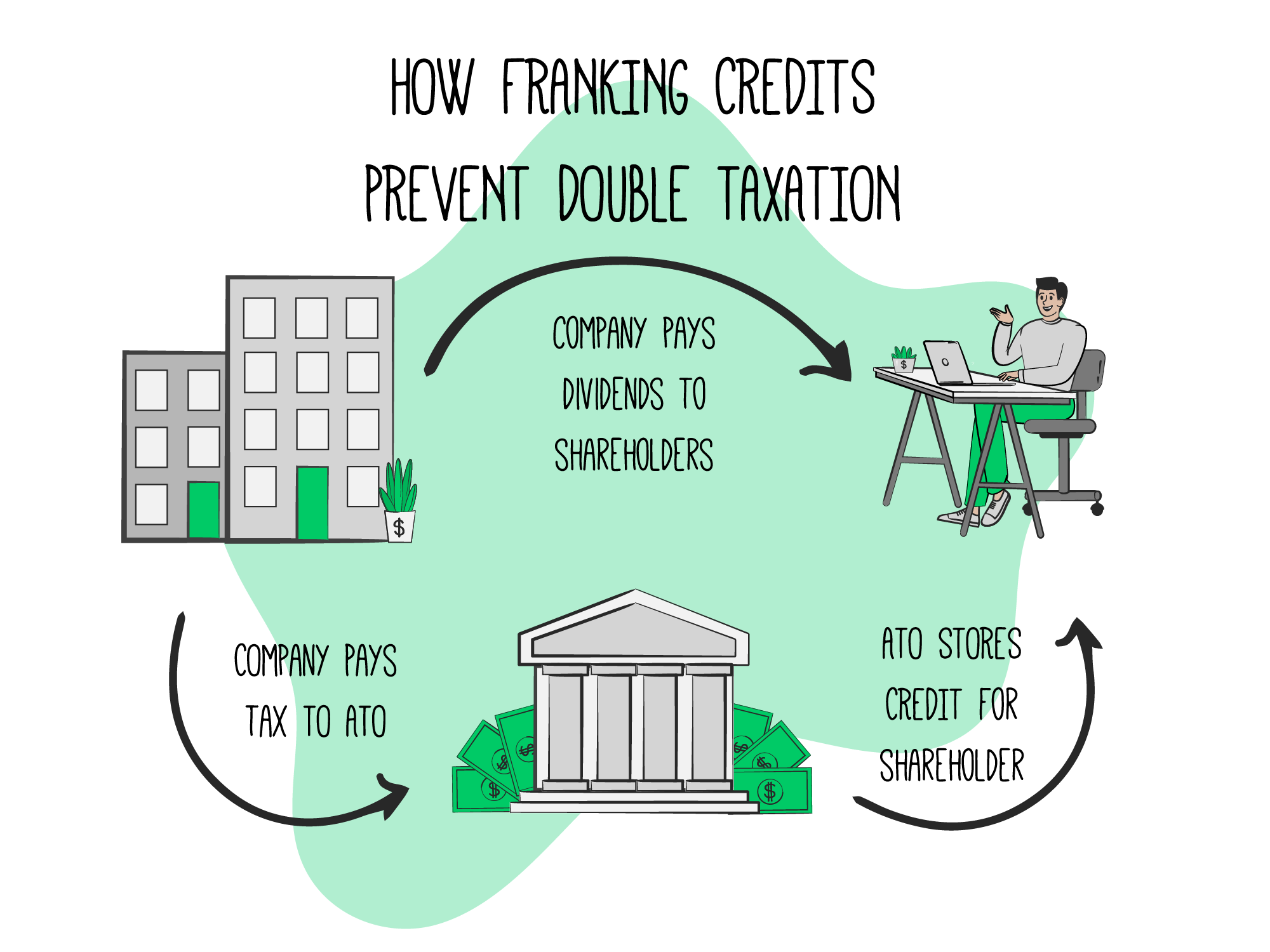

There are a number of advantages to holding companies and their wholly owned subsidiaries becoming a consolidated tax group in particular Intra group transactions are ignored for A franking account records the amount of tax paid that a franking entity can pass on to its members as a franking credit Each entity that is or has ever been a corporate tax

Franking Credits Tax Consolidation

Franking Credits Tax Consolidation

https://lodgeit.s3-ap-southeast-2.amazonaws.com/help/image/ato1.png

ATO Franking Credits Explained Rask Media

https://www.raskmedia.com.au/wp-content/uploads/2022/02/[email protected]

Franking Credits Everything You Need To Know Tax The Guardian

https://i.guim.co.uk/img/media/b96c5c6566a666ee6ce6c79b69f3e66d1c0246d0/17_0_4779_2868/master/4779.jpg?width=1200&height=630&quality=85&auto=format&fit=crop&overlay-align=bottom%2Cleft&overlay-width=100p&overlay-base64=L2ltZy9zdGF0aWMvb3ZlcmxheXMvdGctZGVmYXVsdC5wbmc&enable=upscale&s=93c3ab5512421b2edd43692fced72f99

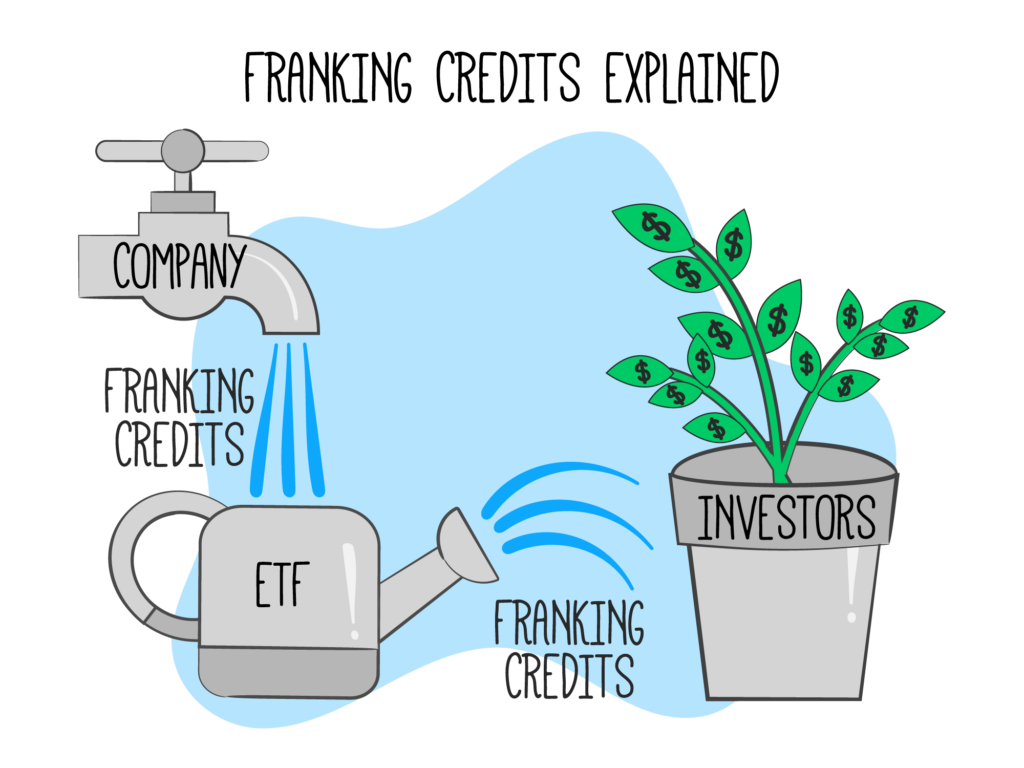

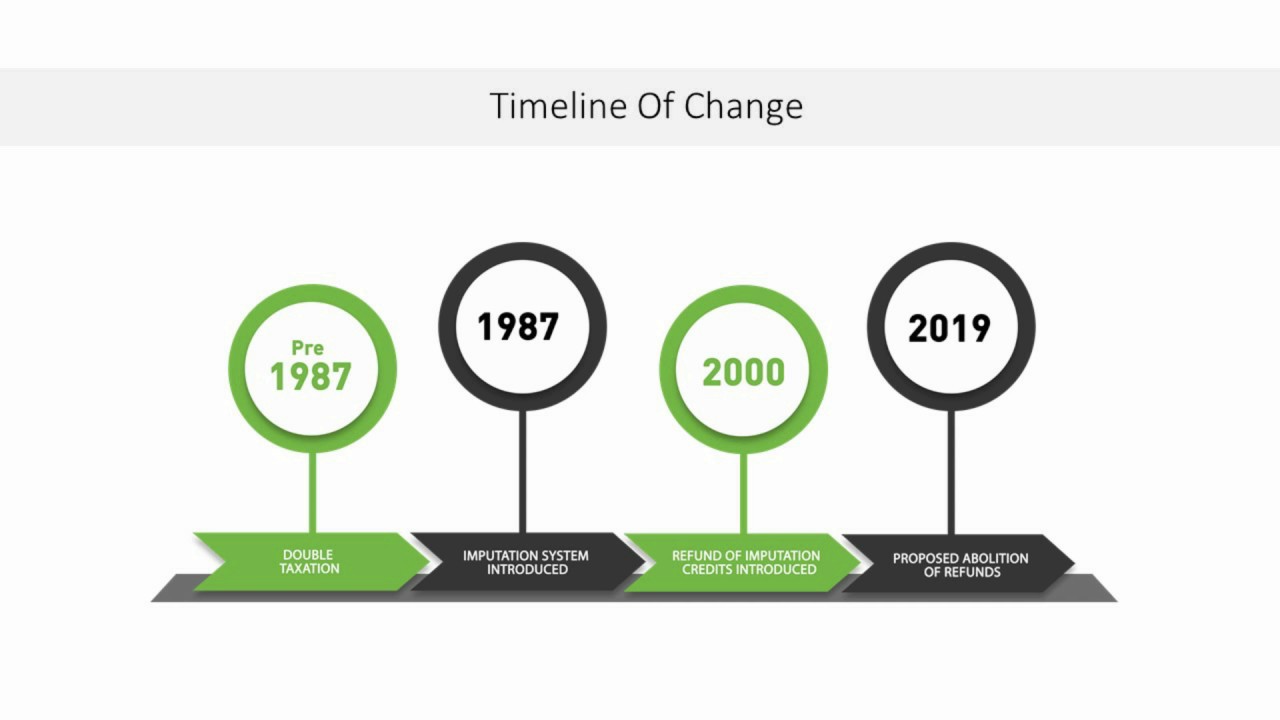

Why should SME s consolidate Franking credits under the tax consolidation regime all franking credits reside with head company of consolidated group the franking account balances of When a subsidiary member joins a consolidated group any surplus in its franking account is transferred to the head company s franking account If on joining a subsidiary member s

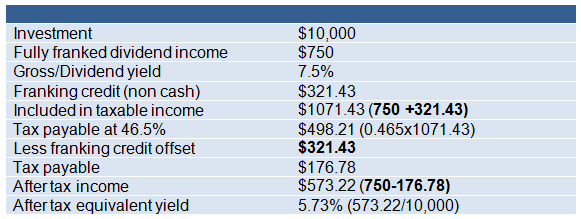

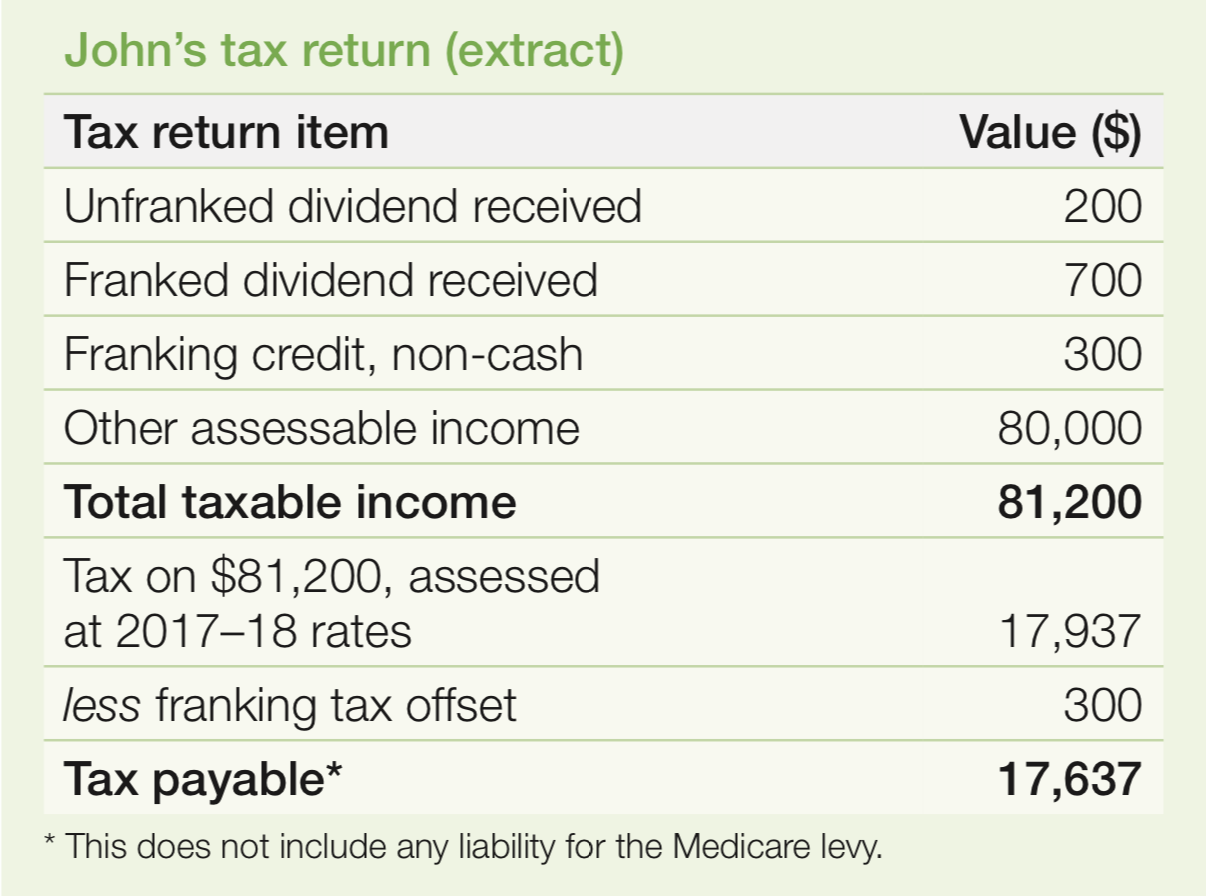

This article delves into the mechanics benefits like simplified reporting and franking credit pooling as well as potential risks such as complex rules and CGT liabilities 1 Each entity that is or has ever been a corporate tax entity has a franking account 2 The payment of a PAYG instalment or income tax will generate a franking credit in that account The amount of the credit is equal to the amount of tax paid

Download Franking Credits Tax Consolidation

More picture related to Franking Credits Tax Consolidation

ATO Franking Credits Explained Rask Media

https://www.raskmedia.com.au/wp-content/uploads/2022/02/[email protected]

Franking Credit Formula Examples How To Calculate

https://www.wallstreetmojo.com/wp-content/uploads/2020/06/Franking-Credit.jpg

What Are Franking Credits And How Do They Work Financial Autonomy

https://financialautonomy.com.au/wp-content/uploads/2022/10/Tax-2.jpg

The tax attributes that the subsidiary member had when it joined the consolidated group such as losses and franking credits remain with the head company of the group 8 These tax attributes Certain tax attributes such as losses and franking credits of entities that become subsidiary members of a consolidated group are transferred under this Part to the head company of the

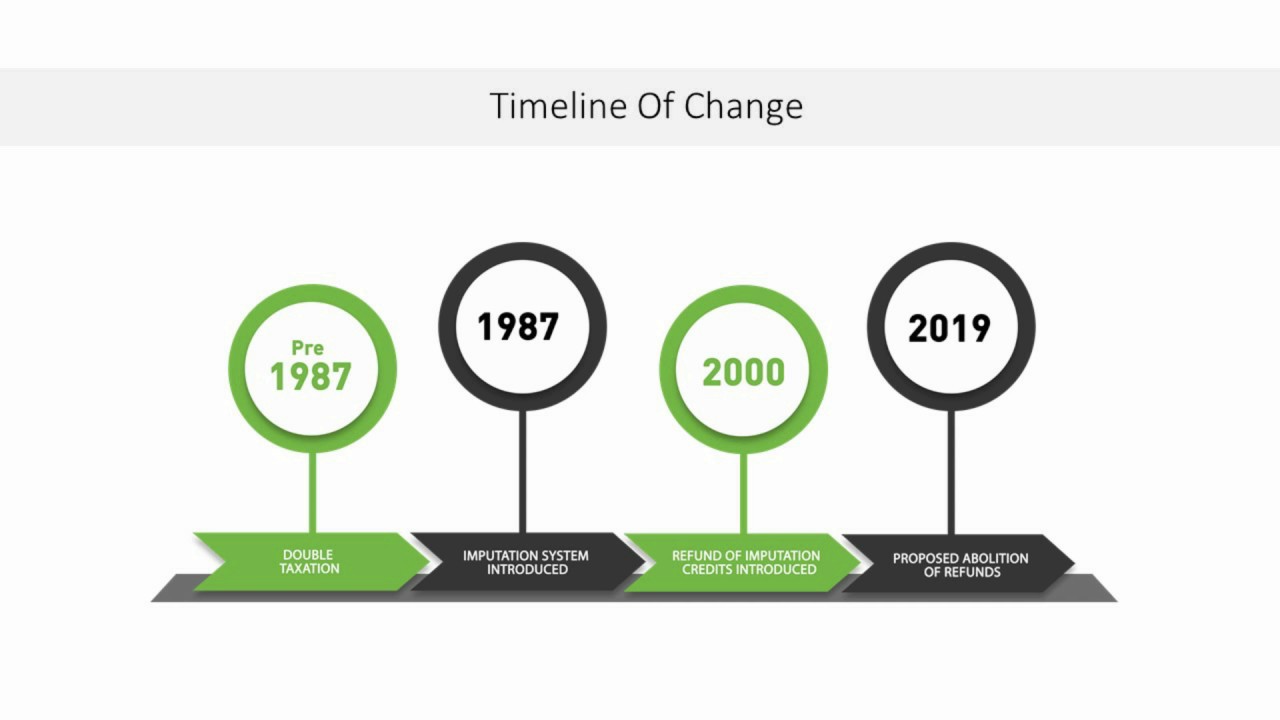

The capital return and accompanying share consolidation were approved by Shareholders at Suncorp s 2024 Annual General meeting held on 22 October 2024 The capital return will be paid on 5 March 2025 and the fully franked special dividend will be paid alongside the interim ordinary dividend on 14 March 2025 allow the transfer of franking credits to a consolidated group determine PAYG instalments for consolidated groups determine tax liability for income tax payments within a consolidated

Labor s Proposed Tax Changes 4 5 Franking Credits YouTube

https://i.ytimg.com/vi/87NoXWOzy2E/maxresdefault.jpg

What Are Franked Dividends And How Do Franking Credits Work

https://www.etax.com.au/wp-content/uploads/2019/09/Franked-dividends-and-franking-credits.jpg

https://www.ato.gov.au › law › view › pdf › conman

The meaning of franking offsets is given in paragraph 707 310 3A c franking offsets is the amount of the entitlement to two tax offsets franking credits and venture capital credits

https://uk.practicallaw.thomsonreuters.com

There are a number of advantages to holding companies and their wholly owned subsidiaries becoming a consolidated tax group in particular Intra group transactions are ignored for

What Are Franking Credits and How They Can Help Australian Investors

Labor s Proposed Tax Changes 4 5 Franking Credits YouTube

Secrets And Lies How Franking Credits Stole The Tax Bonanza Michael West

Dividend Imputation System Franking Credits Explained Calculations

Franking Credits 101

Franking Credits In Australia What Are They And How Do They Work

Franking Credits In Australia What Are They And How Do They Work

Franking Credits

Everything To Know About Dividend Imputation And Franking Credits

Addressing The franking Credit Dilemma Is Bank Subordinated Bank

Franking Credits Tax Consolidation - Why should SME s consolidate Franking credits under the tax consolidation regime all franking credits reside with head company of consolidated group the franking account balances of