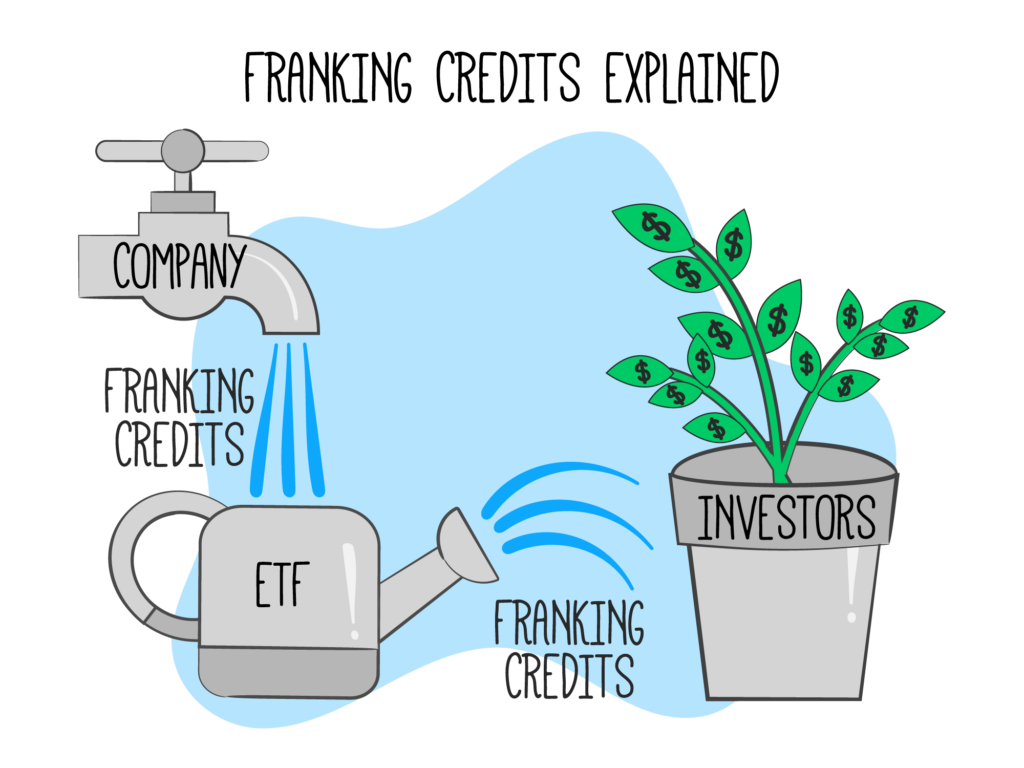

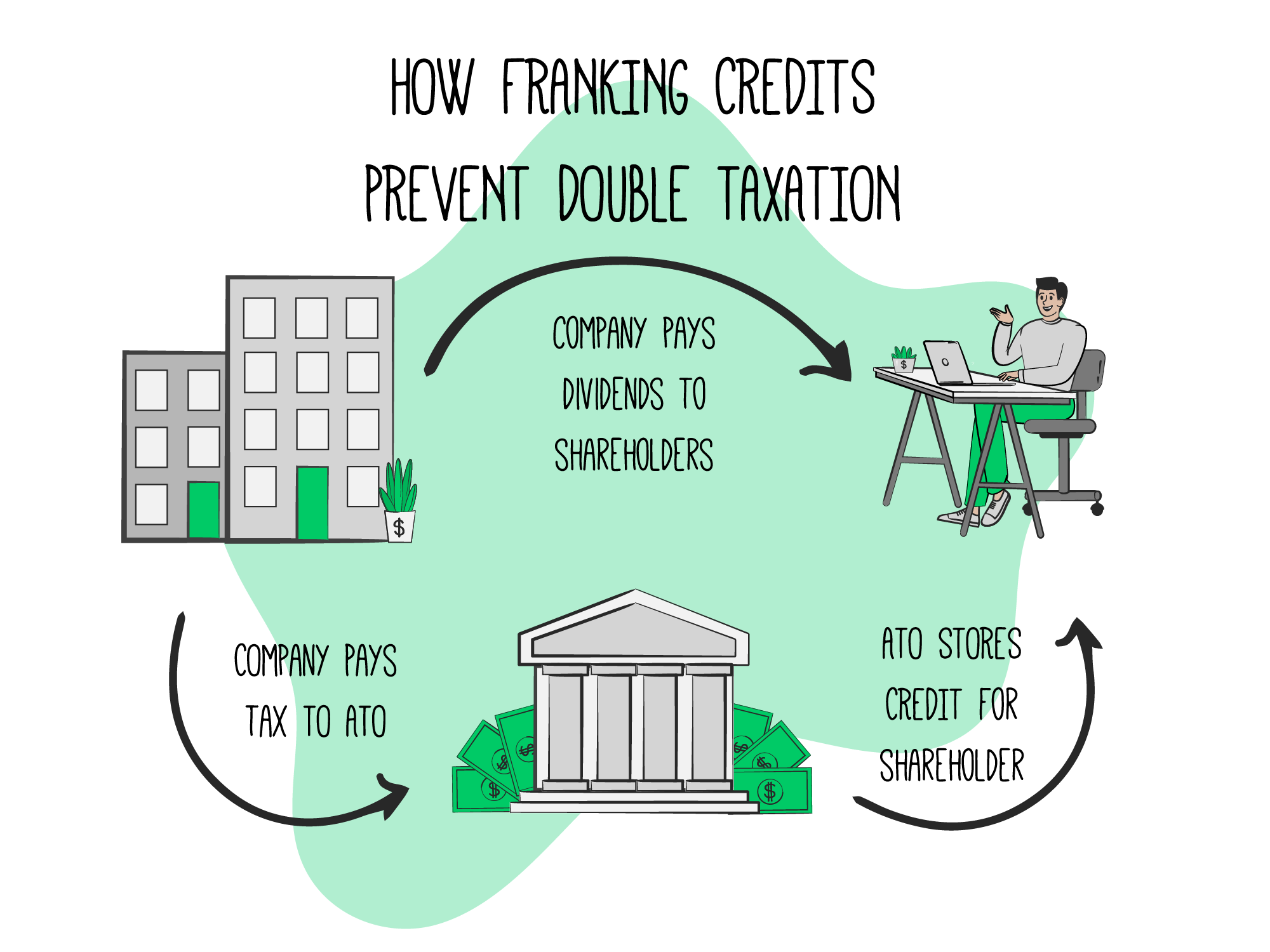

Franking Credits Explained What Is a Franking Credit A franking credit also known as an imputation credit is a type of tax credit paid by corporations to their shareholders along with their dividend

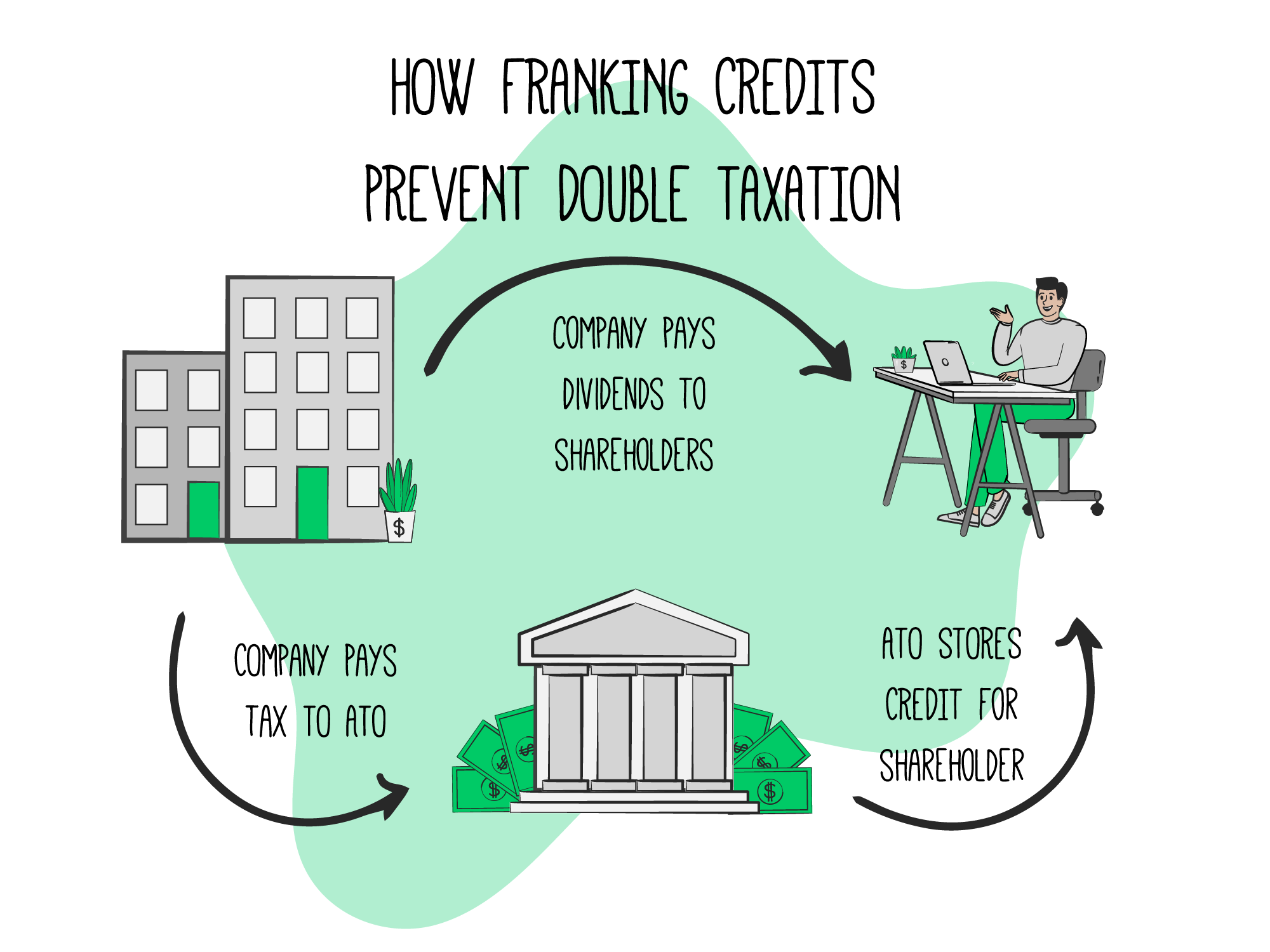

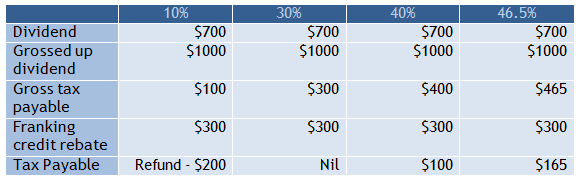

Franking credits are a reflection of tax already paid at the corporate level Attaching franking credits to dividends avoids double taxation of corporate profits distributed Franking credit is a tax credit used in Australia and other nations used to eliminate double taxation Under this system the Australian Tax Office takes into account that companies pay

Franking Credits Explained

Franking Credits Explained

https://i.ytimg.com/vi/EDtlf3hgVuc/maxresdefault.jpg

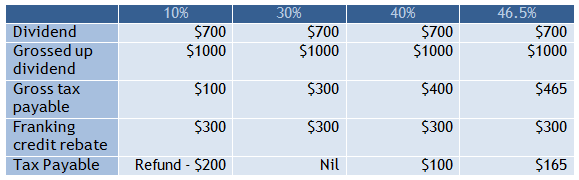

Dividend Imputation System Franking Credits Explained Calculations

http://s.stockwatch.com.au/Assets/Images/franking-credits-fig3.png

Video Franking Credits Explained Adviser Ratings

https://www.adviserratings.com.au/media/51852/michaelradaljfrankingcreditexplained.png

Basically as the shareholder of a company you receive a piece of the company s profit and this is called a dividend When income tax has already been paid on this dividend the company can In this article we explain the mechanics of franking credits in simple terms outlining the key benefits and controversies surrounding this complex system What are

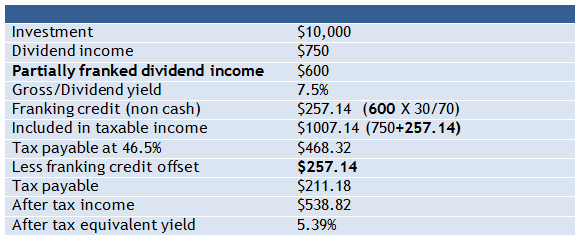

Guide to what is Franking Credit Here we explain the formula examples and how to calculate Franking Credit along with advantages Franking credits effectively boost the return you receive from your Australian shares If you received 1 000 income from your investment property or interest on a term

Download Franking Credits Explained

More picture related to Franking Credits Explained

Franked Dividends Franking Credits And The Dividend Imputation System

http://www.gtp.com.au/dividends/images/franked_dividend_tbl1.jpg

Franking Credits Explained Newcastle Elliot Watson Financial Planning

http://www.elliotwatson.com.au/wp-content/uploads/2019/04/Franking-Credits-Explained-image.jpg

ATO Franking Credits Explained Rask Media

https://www.raskmedia.com.au/wp-content/uploads/2022/02/[email protected]

Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the A franking credit also known as imputation credit is a tax credit paid by corporations to their shareholders along with their dividend payments If a company s income

[desc-10] [desc-11]

ATO Franking Credits Explained Rask Media

https://www.raskmedia.com.au/wp-content/uploads/2022/02/[email protected]

Dividend Imputation System Franking Credits Explained Calculations

http://s.stockwatch.com.au/Assets/Images/franking-credits-fig2.png

https://www.investopedia.com › terms › frankingcredit.asp

What Is a Franking Credit A franking credit also known as an imputation credit is a type of tax credit paid by corporations to their shareholders along with their dividend

https://www.fool.com.au › definitions › franking-credits

Franking credits are a reflection of tax already paid at the corporate level Attaching franking credits to dividends avoids double taxation of corporate profits distributed

Franking Credits Explained Brightday

ATO Franking Credits Explained Rask Media

Learn 84 About Franking Credits Australia Latest NEC

ATO Franking Credits Explained Rask Media

Franking Credits Explained Dividend Investing Australia YouTube

Franking Credits Explained What Are They And How Do They Work

Franking Credits Explained What Are They And How Do They Work

Franking credits formula Rask Education

Franking Credits Explained Plus 1 Group

What Are Franking Credits How Do Franking Credits Work Solve Accounting

Franking Credits Explained - [desc-13]