Franking Credits Tax Consolidated Group Verkko HCo maintains a single franking account for the consolidated group When the group forms ACo s franking account surplus is transferred into HCo s franking account by

Verkko When an entity leaves the consolidated group or MEC group it leaves behind all franking credits or debits resulting from transferred surpluses or excess franking Verkko Eligibility A foreign owned group of Australian entities may be able to consolidate despite not having a single Australian head company The resulting group known as a

Franking Credits Tax Consolidated Group

Franking Credits Tax Consolidated Group

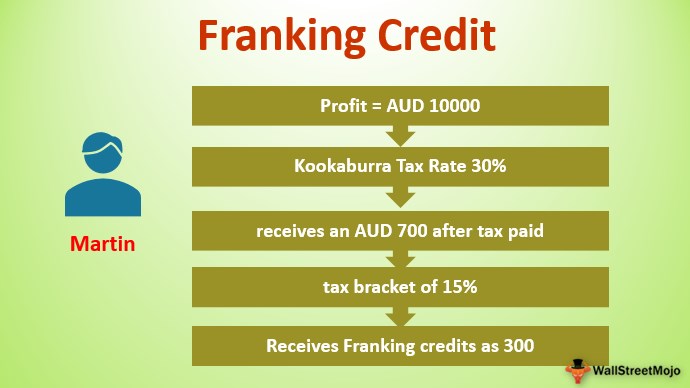

https://www.wallstreetmojo.com/wp-content/uploads/2020/06/Franking-Credit.jpg

Franking Credits Made Easy

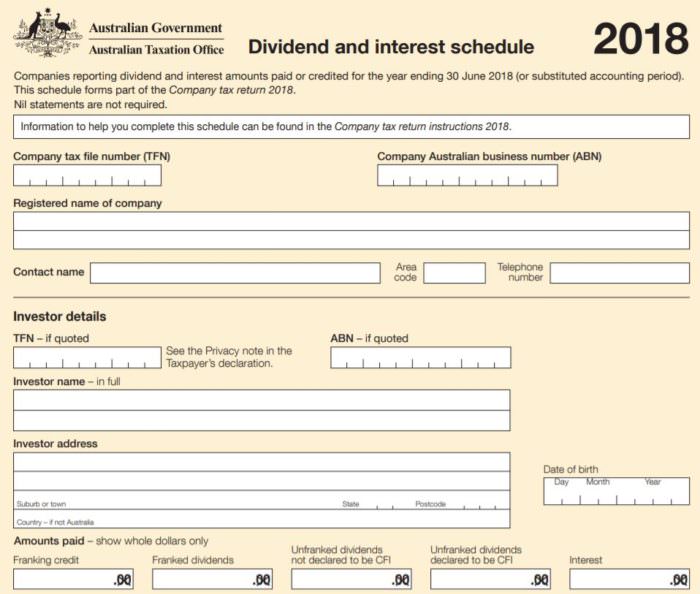

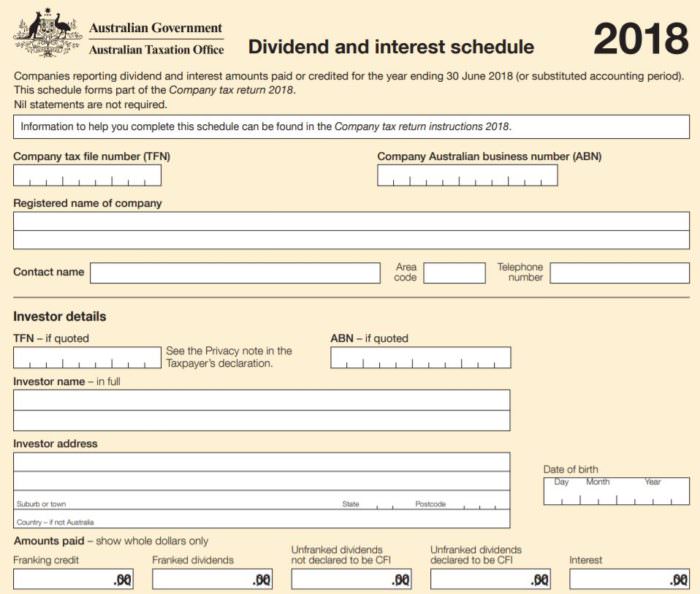

https://www.firstlinks.com.au/uploads/wp/ATO-return-franking-700x594.jpg

Franking Credits Explained Plus 1 Group

https://plus1group.com.au/wp-content/uploads/2021/10/franking-credit.png

Verkko There are a number of advantages to holding companies and their wholly owned subsidiaries becoming a consolidated tax group in particular Intra group Verkko Certain tax attributes such as losses and franking credits of entities that become subsidiary members of a consolidated group are transferred under this Part to the

Verkko 30 marrask 2016 nbsp 0183 32 Franking entity Franking credits and debits A franking account records the amount of tax paid that a franking entity can pass on to its members as a Verkko 12 jouluk 2023 nbsp 0183 32 Dividends paid between companies within a tax consolidated group are ignored for the purposes of determining the taxable income of the group Franked

Download Franking Credits Tax Consolidated Group

More picture related to Franking Credits Tax Consolidated Group

What Are Franked Dividends And How Do Franking Credits Work

https://www.etax.com.au/wp-content/uploads/2019/09/Franked-dividends-and-franking-credits.jpg

What Are Franking Credits And How Do They Work Financial Autonomy

https://financialautonomy.com.au/wp-content/uploads/2022/10/Tax-2.jpg

Explained What Are Franking Credits Rask HD YouTube

https://i.ytimg.com/vi/EDtlf3hgVuc/maxresdefault.jpg

Verkko 11 While a consolidated group is consolidated for tax purposes the head company of a tax consolidated group or a provisional head company PHC of a multiple entry Verkko 30 marrask 2016 nbsp 0183 32 you are part of a consolidated group or multiple entry consolidated group MEC see Special rules for consolidated groups and MECs Imputation on

Verkko 17 toukok 2021 nbsp 0183 32 The maximum amount of the refundable tax offset that can be obtained in a year that the loss carry back offset is claimed is limited to the entity s franking account balance at the end of the year Verkko 24 hein 228 k 2023 nbsp 0183 32 The franking credits pre commencement excess foreign income tax conduit foreign income and attribution account surpluses held by a joining entity at

Franking Credits Guidelines Expat US Tax

https://www.expatustax.com/wp-content/uploads/2023/03/Franking-Credits-in-Australia-explained.jpg

Franking Credits 101

https://assets.website-files.com/5dfab795d6da96ad7da843ed/5e1d089773c54c0feec39431_franking.jpeg

https://www.ato.gov.au/law/view/pdf/conman/c0502110.pdf

Verkko HCo maintains a single franking account for the consolidated group When the group forms ACo s franking account surplus is transferred into HCo s franking account by

https://www.ato.gov.au/.../special-rules-for-consolidated-groups-and-m…

Verkko When an entity leaves the consolidated group or MEC group it leaves behind all franking credits or debits resulting from transferred surpluses or excess franking

Franking Credits In Australia What Are They And How Do They Work

Franking Credits Guidelines Expat US Tax

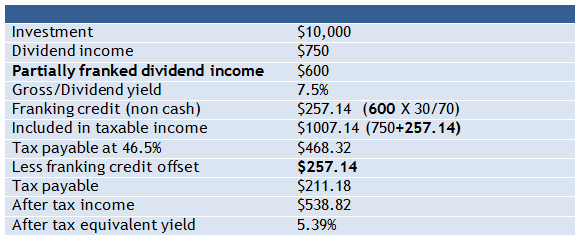

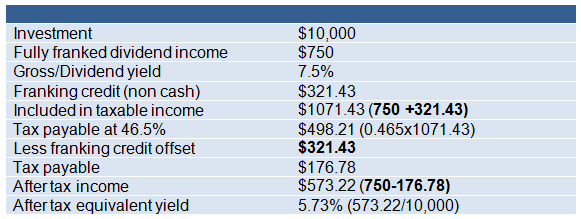

Dividend Imputation System Franking Credits Explained Calculations

Understanding Franking Credits LodgeiT

Dividend Imputation System Franking Credits Explained Calculations

Learn About Franking Credits

Learn About Franking Credits

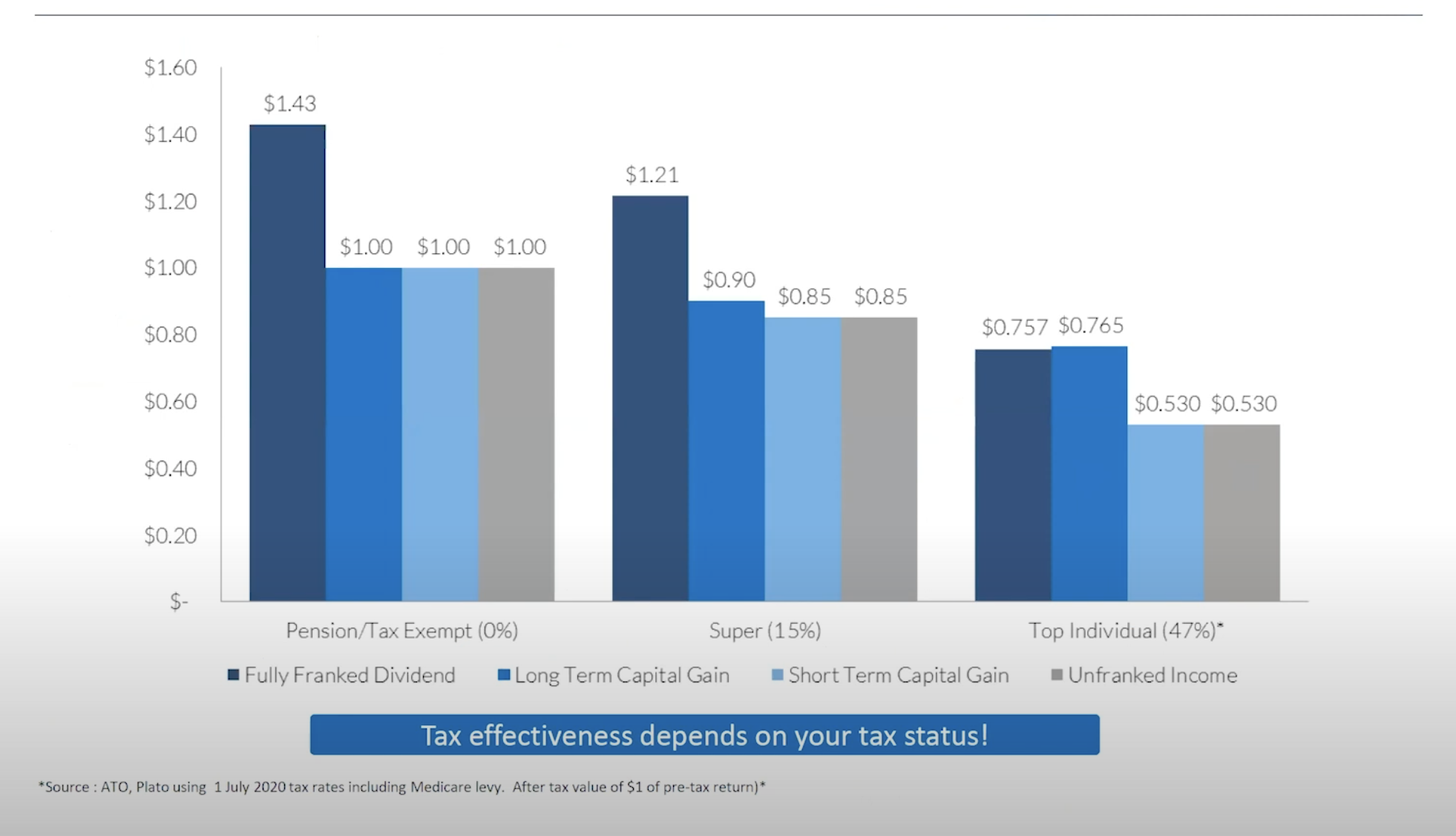

How Retirees Benefit From Franking Credits Plato Investment Management

The Tax Gift Of Franking Credits And How They Can Work For You

Get A Tax REFUND On Franking Credits With Australian Dividends YouTube

Franking Credits Tax Consolidated Group - Verkko Implementation of the tax consolidation system 26 Formation of or subsidiary joins the tax consolidated group 28 Income tax allocation 29 Stand alone taxpayer approach