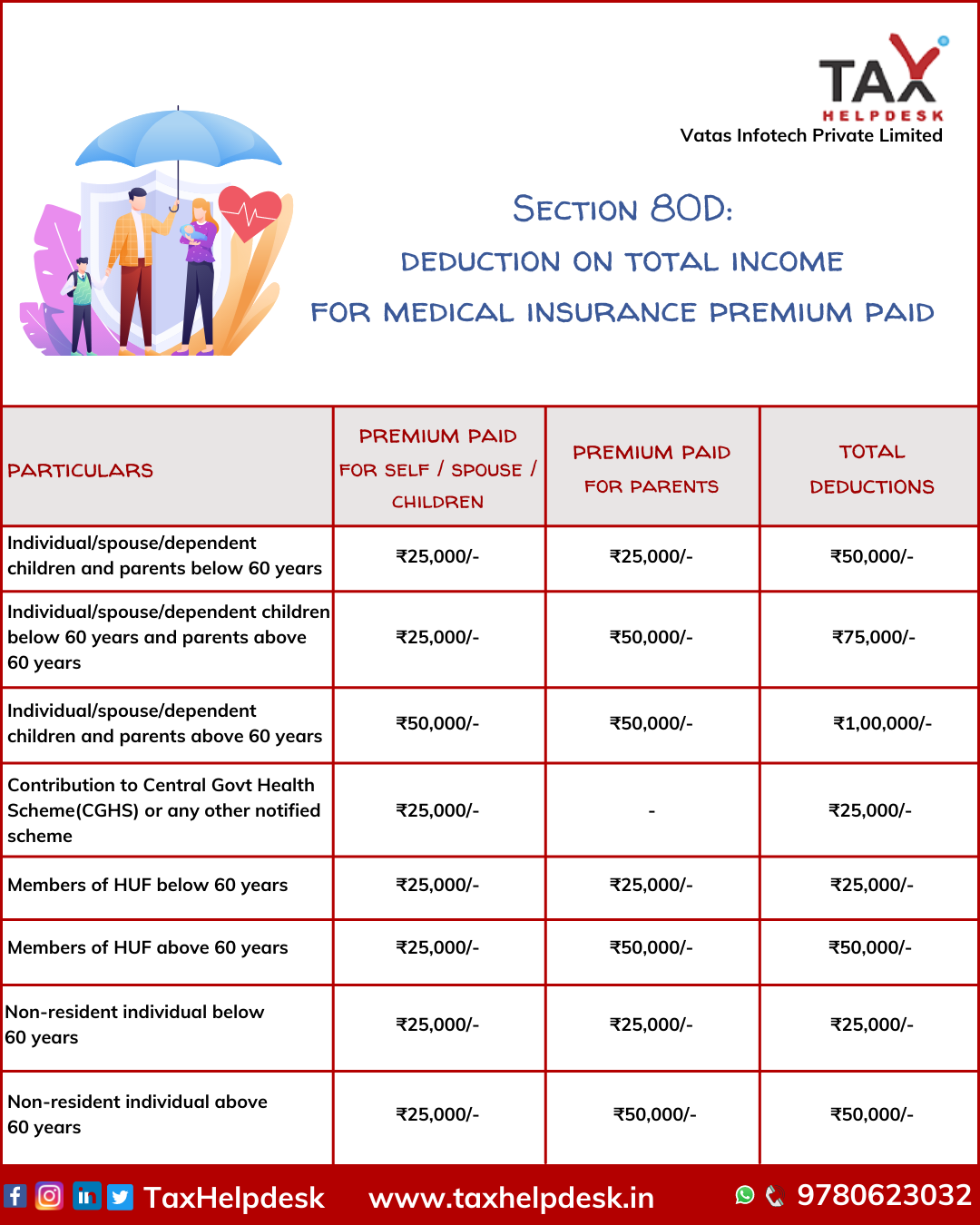

Medical Insurance Income Tax Exemption Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases

Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to 50 000 per fiscal year for senior citizens Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on

Medical Insurance Income Tax Exemption

Medical Insurance Income Tax Exemption

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020-800x2483.png

Medical Insurance Income Tax Benefits By Sue Kneeland Medium

https://miro.medium.com/v2/resize:fit:1000/1*lD5c2M9sQnVSQr7REtvLzA.jpeg

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are Under medical allowance exemption Section 10 the medical allowance you receive is not included in your taxable income Here are some of the guidelines for

Normally tax benefits under Section 80D of the Income Tax Act are offered on health insurance plans However you can also claim tax deductions under this section on the term plan if you have As per the income tax section 80D health insurance premiums paid in cash are excluded from the tax exemption clause All other modes of payment such as demand draft cheque net banking debit and credit cards are

Download Medical Insurance Income Tax Exemption

More picture related to Medical Insurance Income Tax Exemption

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/tax-benefits-on-medical-insurance.png

Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than cash of medical insurance premium paid by an Individual or a Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical

Understand the tax deductions under section 80D of income tax act in medical insurance close Save tax up to 75 000 u s 80D phone in talk Buy New Policy 1800 102 Section 80D of the Income Tax Act of 1961 allows taxpayers to claim deductions for the premiums paid on health or medical insurance policies The section is implemented to

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

https://mahanakornpartners.com/wp-content/uploads/2023/02/Spouse-Income-2048x996.png

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/331/497331433/large.png

https://www.hdfclife.com/insurance-knowledge...

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases

https://www.policybazaar.com/health-in…

Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to 50 000 per fiscal year for senior citizens

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

The Negative Income Tax NIT And The Welfare State An Effective

Income Tax Benefits On National Pension Scheme All You Need To Know

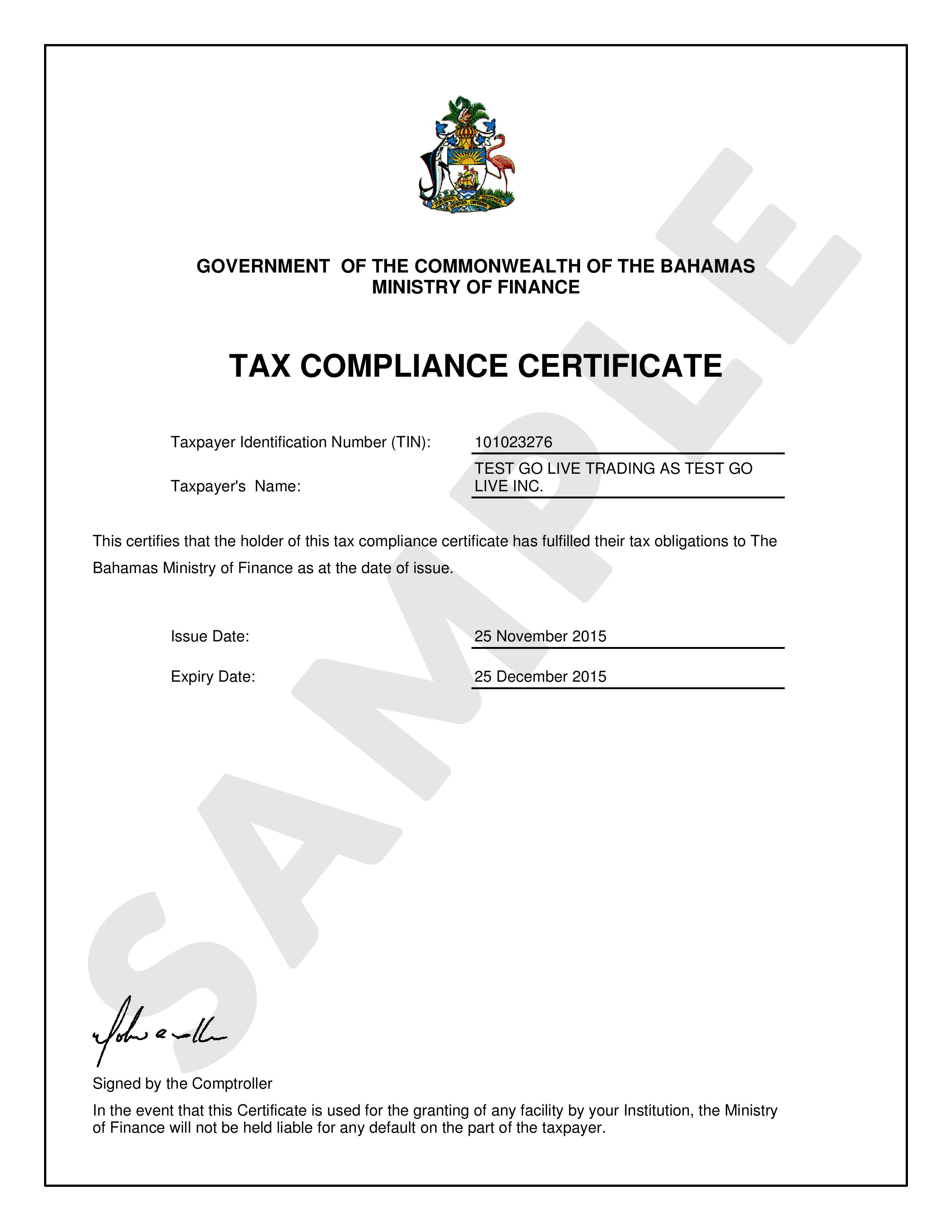

Tax Compliance Certificate Sample Hq Printable Documents CLOUD HOT GIRL

Income Tax Benefits On Medical Insurance How To Claim Tax Benefits On

Income Tax Benefits On Medical Insurance How To Claim Tax Benefits On

You Can Save Tax On Medical Insurance Joblagao

Pin On Retirement

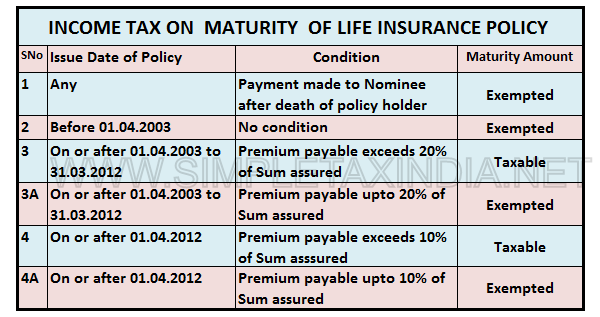

INCOME TAX ON MATURITY RECEIPT OF LIFE INSURANCE POLICY S K And

Medical Insurance Income Tax Exemption - Normally tax benefits under Section 80D of the Income Tax Act are offered on health insurance plans However you can also claim tax deductions under this section on the term plan if you have