Medical Loss Ratio Rebate Taxable Web What is the Medical Loss Ratio MLR rebate and how does it affect you Due to the Affordable Care Act enacted in May 2010 insurance companies are required to spend a

Web 27 mai 2012 nbsp 0183 32 On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates Web A Notices regarding the Medical Loss Ratio MLR insurance rebates are being provided under a provision in the Affordable Care Act that requires insurance companies to

Medical Loss Ratio Rebate Taxable

Medical Loss Ratio Rebate Taxable

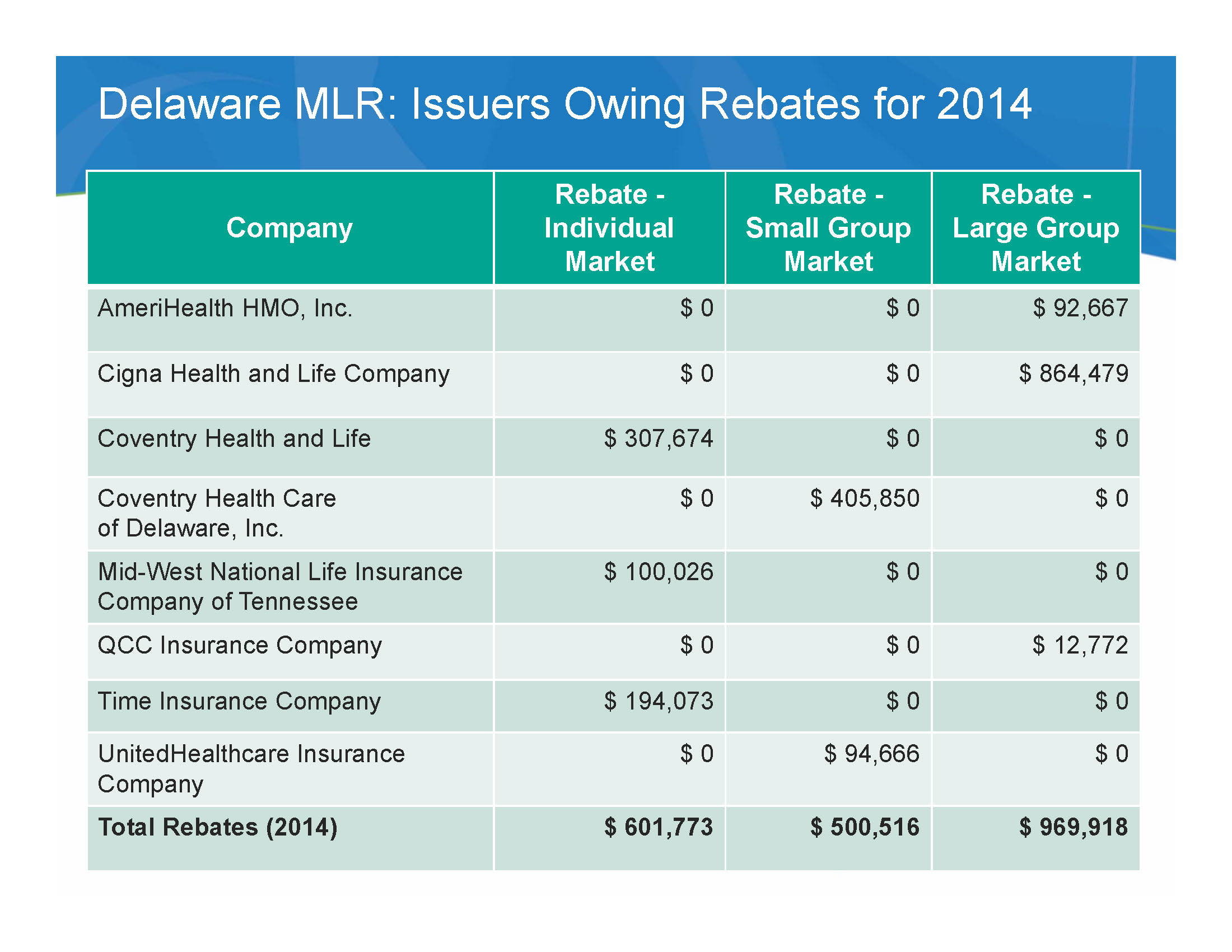

http://news.delaware.gov/files/2015/12/Medical-Loss-Ratio-DHCC-Slides-Dec-3-2015_Page_2.jpg

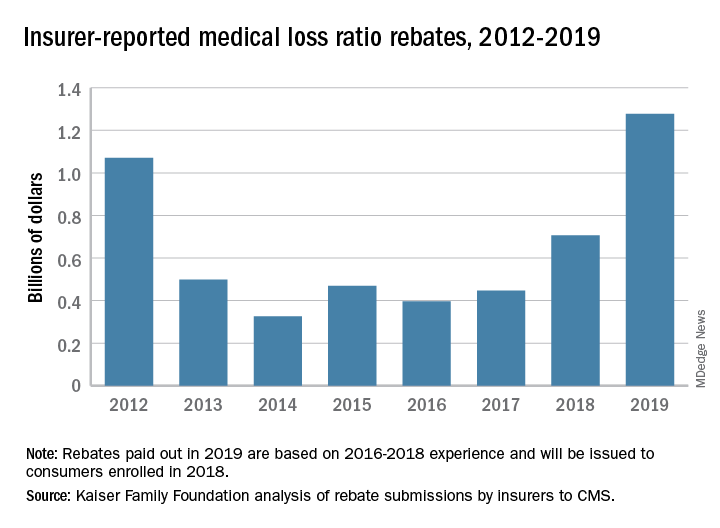

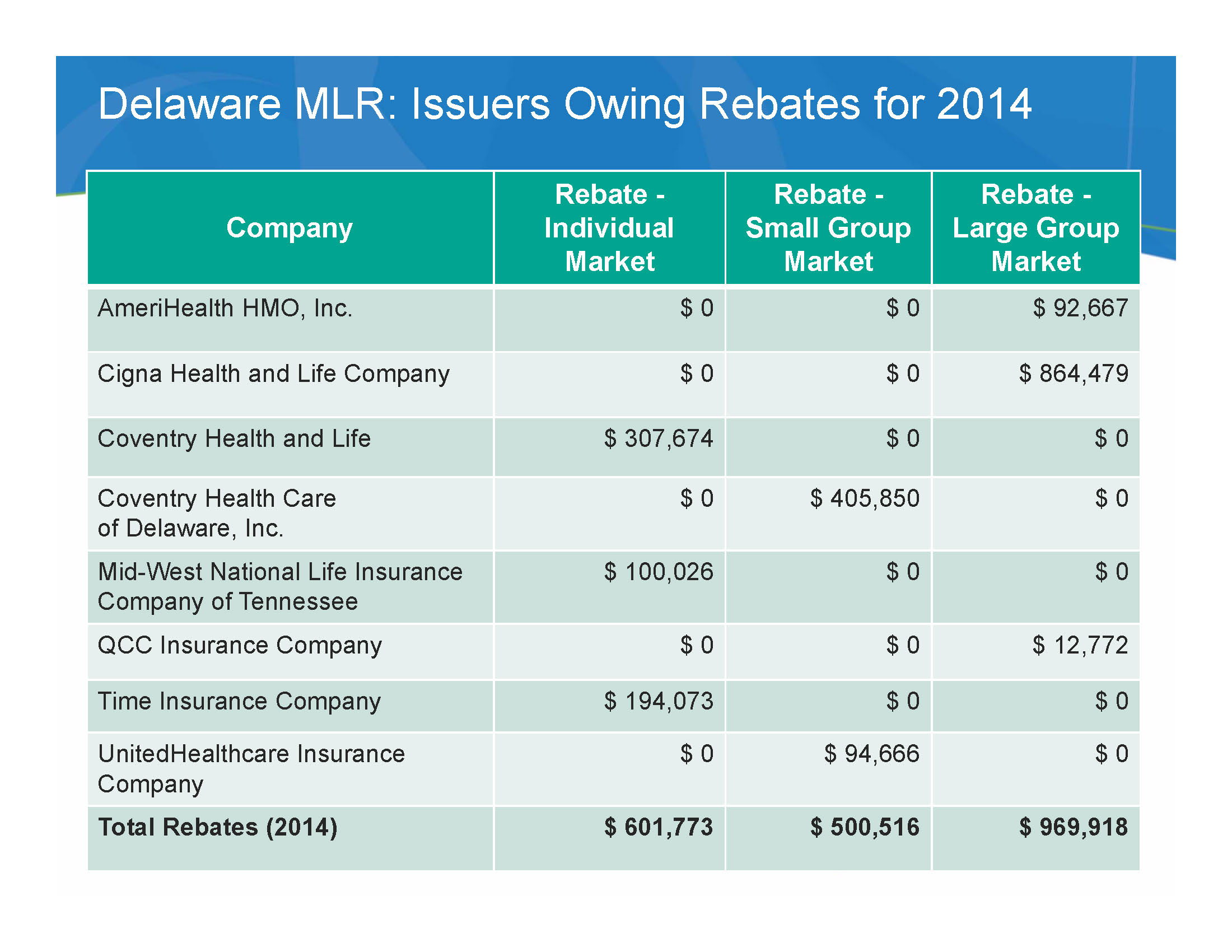

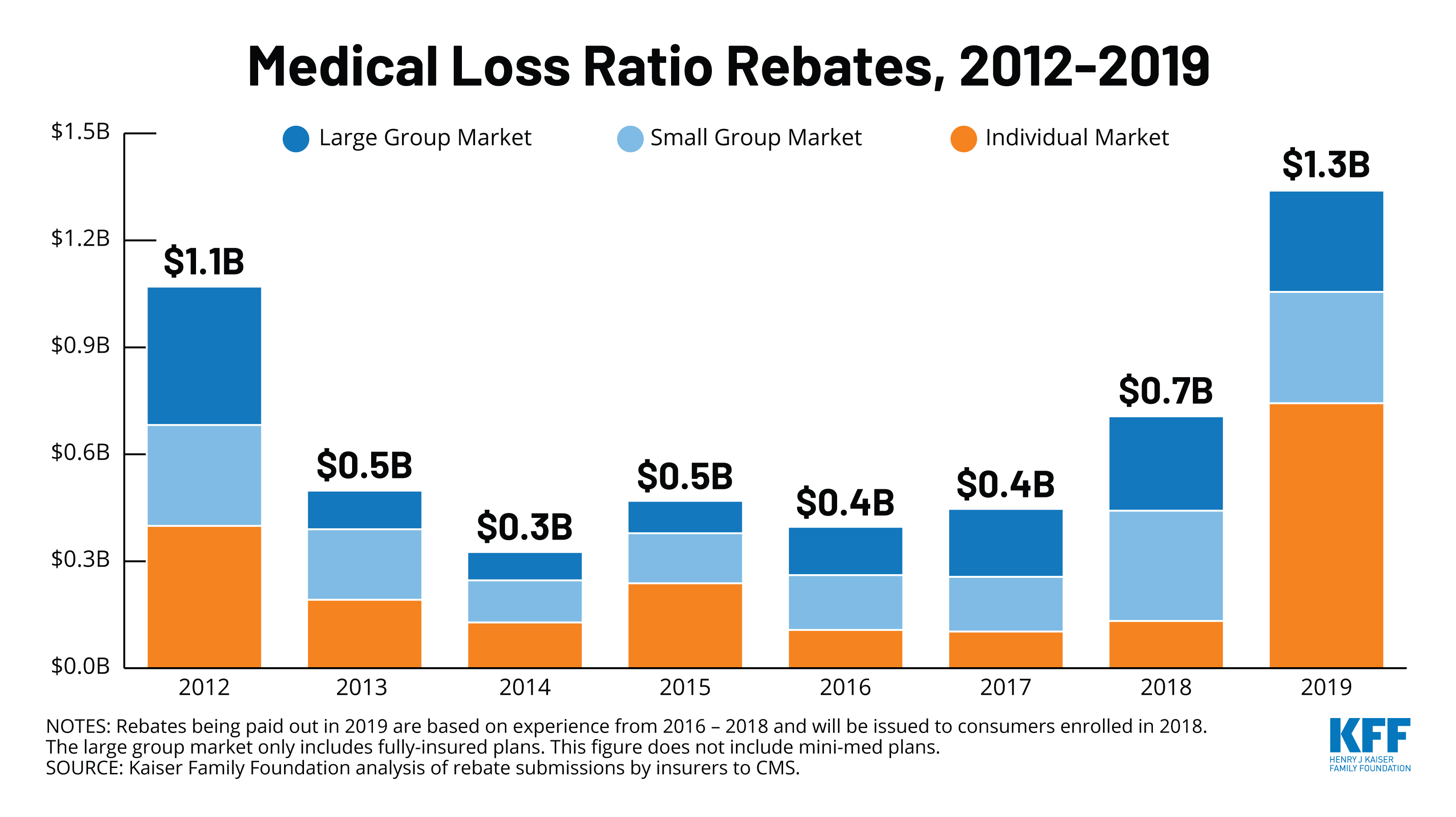

Insurers Paid 447 Million In Medical Loss Ratio Rebates For 2016

https://www.modernhealthcare.com/assets/interactive/20180103_barchart/rebatechart.png

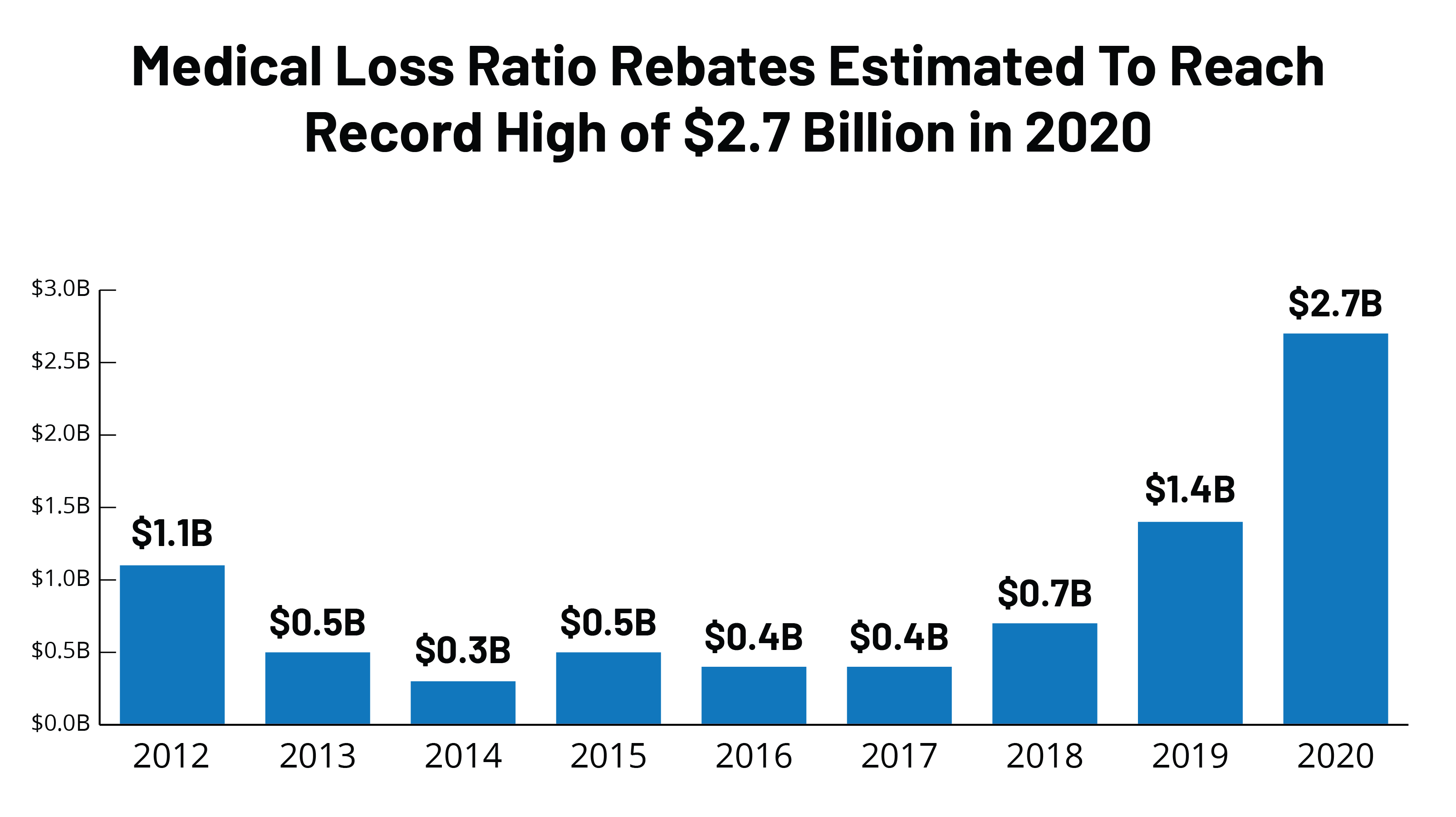

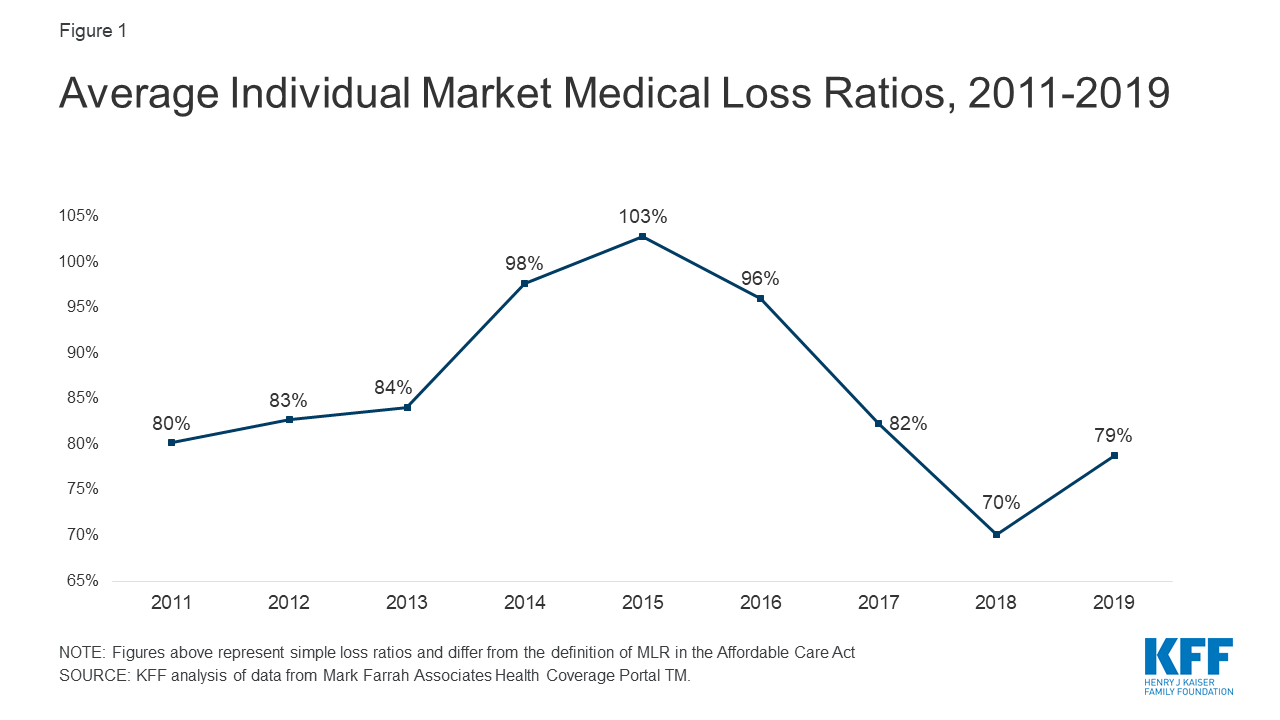

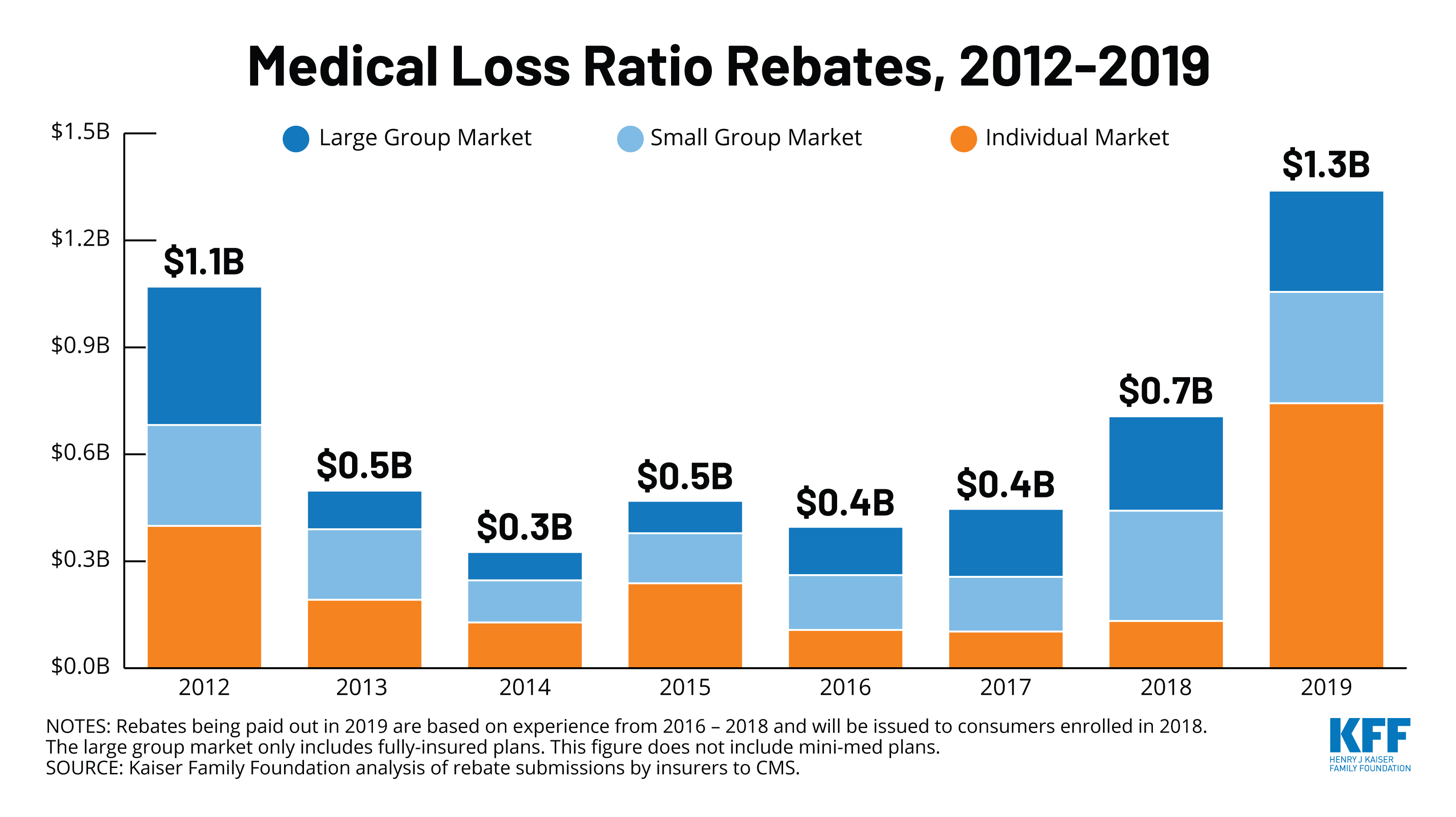

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

https://www.kff.org/wp-content/uploads/2020/04/FEATURE-Medical-Loss-Ratio-Rebates_1.png

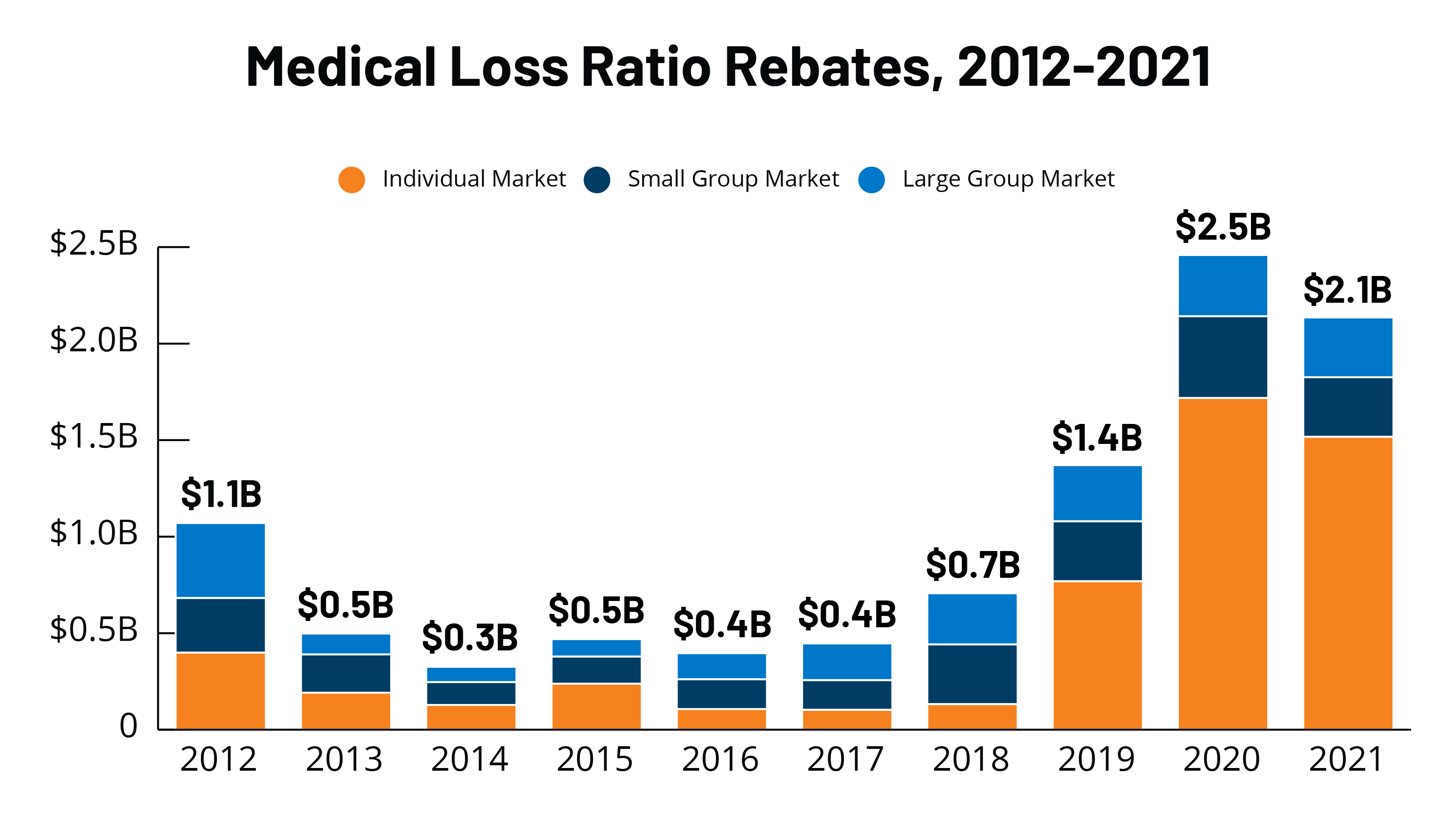

Web 17 mai 2023 nbsp 0183 32 2023 Medical Loss Ratio Rebates Jared Ortaliza Krutika Amin and Cynthia Cox Published May 17 2023 The Medical Loss Ratio MLR provision of the Affordable Care Act ACA limits Web Are rebates taxable In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums

Web 12 nov 2020 nbsp 0183 32 Medical Loss Ratio Rebate I received in 2020 a Medical Loss Ratio Rebate check for premiums paid in 2019 for 2019 health insurance I had deducted Web 12 sept 2012 nbsp 0183 32 The basic rule of thumb in determining whether your MLR rebate is taxable is fairly straightforward if a tax benefit was previously gained on the premiums now

Download Medical Loss Ratio Rebate Taxable

More picture related to Medical Loss Ratio Rebate Taxable

Data Note 2020 Medical Loss Ratio Rebates KFF

https://www.kff.org/wp-content/uploads/2020/04/9346-02-Figure-1.png

Insurers To Pay Record Number Of Rebates To Patients CHEST Physician

https://cdn.mdedge.com/files/s3fs-public/142312_graph.png

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

https://www.caaccess.org/wp-content/uploads/2022/06/Screen-Shot-2022-06-07-at-2.18.42-PM.png

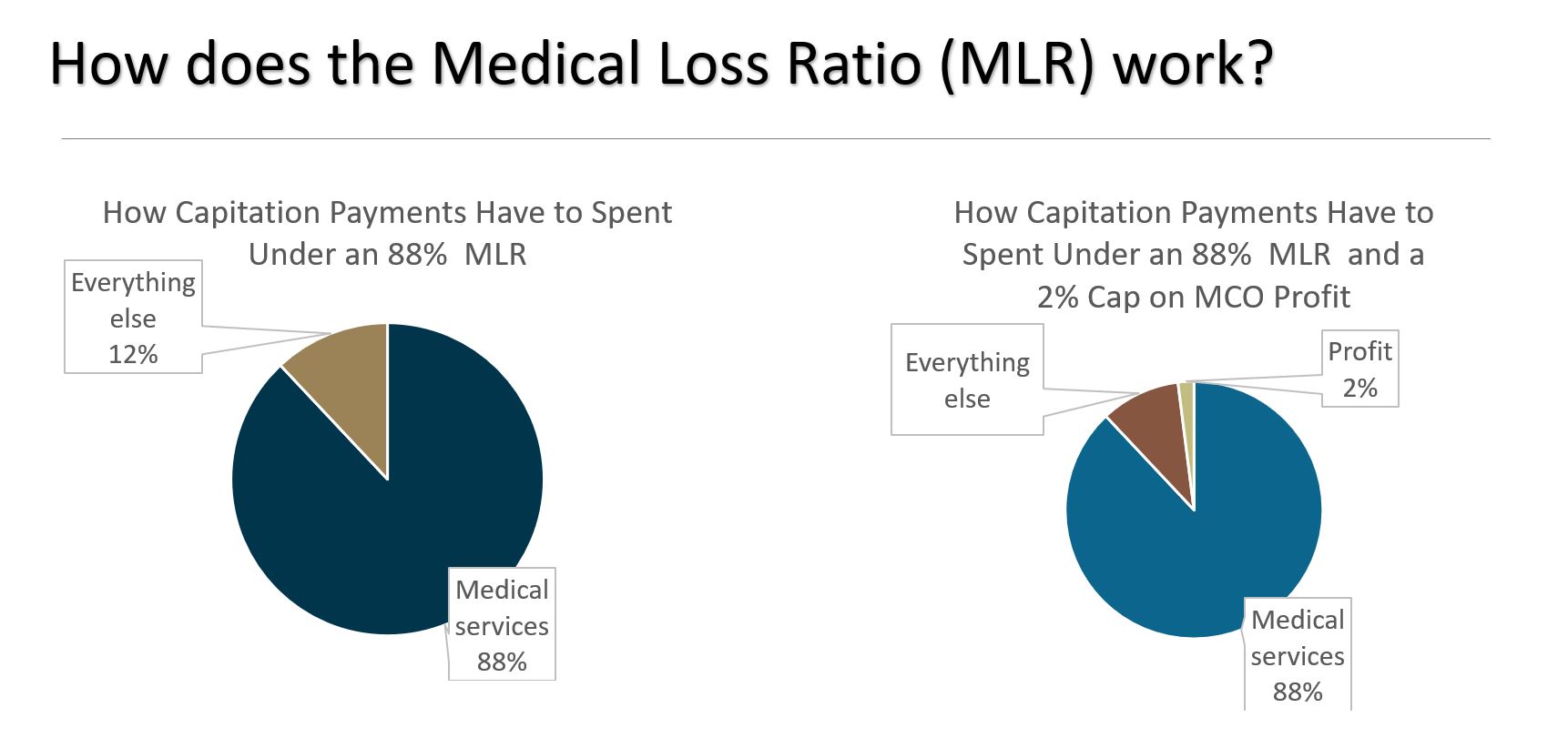

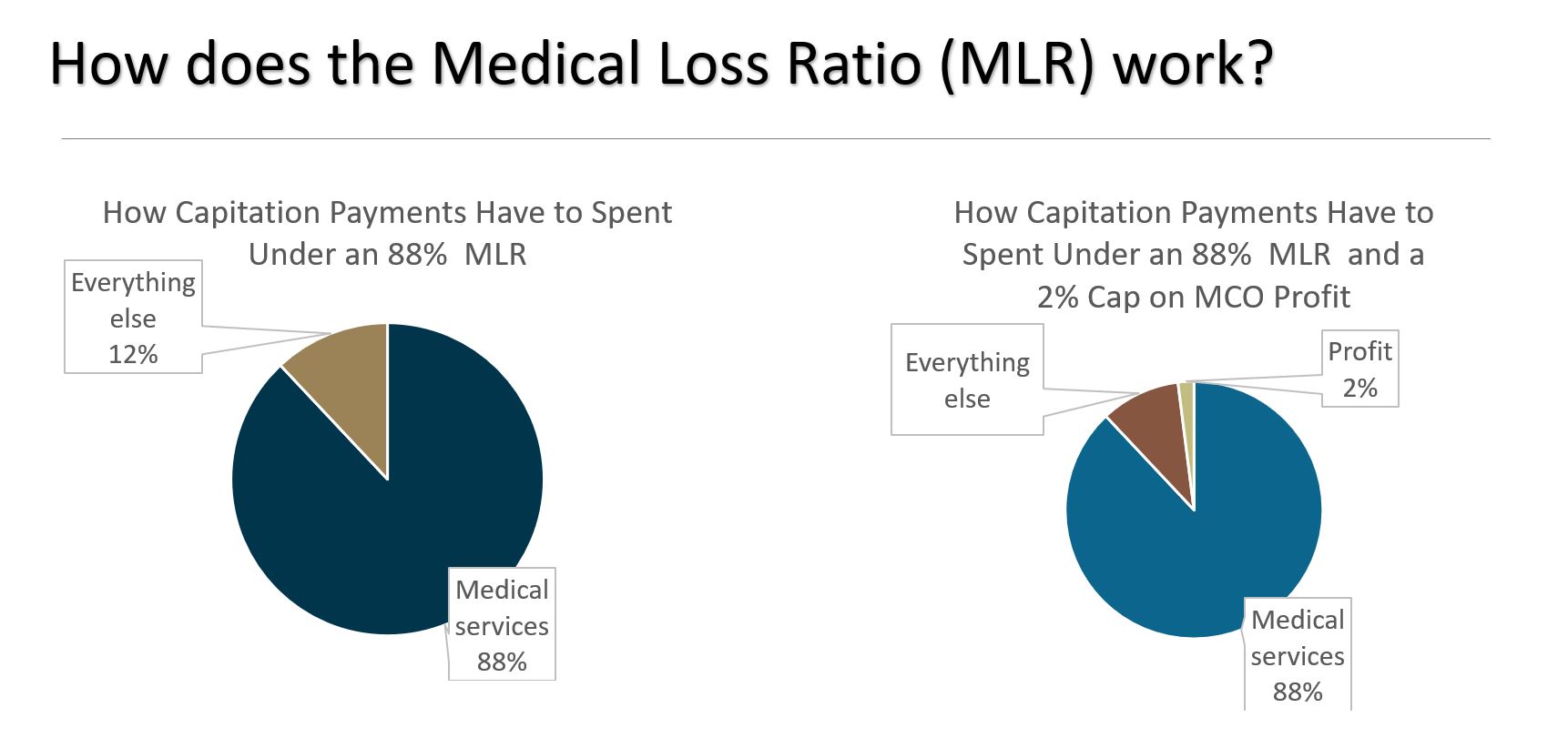

Web percent medical loss ratio for the large group market established by 167 2718 did the organization satisfy the 85 percent 167 833 c 5 MLR for that taxable year Answer 1 Web The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement also known as

Web In most cases rebates are taxable but it all depends on the state you live in and the Medical Loss Ratio provisions of your insurance provider What is a Medical Loss Ratio Under the ACA health insurance providers Web 6 sept 2023 nbsp 0183 32 The MLR rebate checks in the group market are generally small ranging from about 10 00 to 30 00 per participant Forwarding these funds to employees can be a

Medicaid Concepts Medical Loss Ratio Mostly Medicaid

https://www.mostlymedicaid.com/wp-content/uploads/2021/01/MLR.jpg

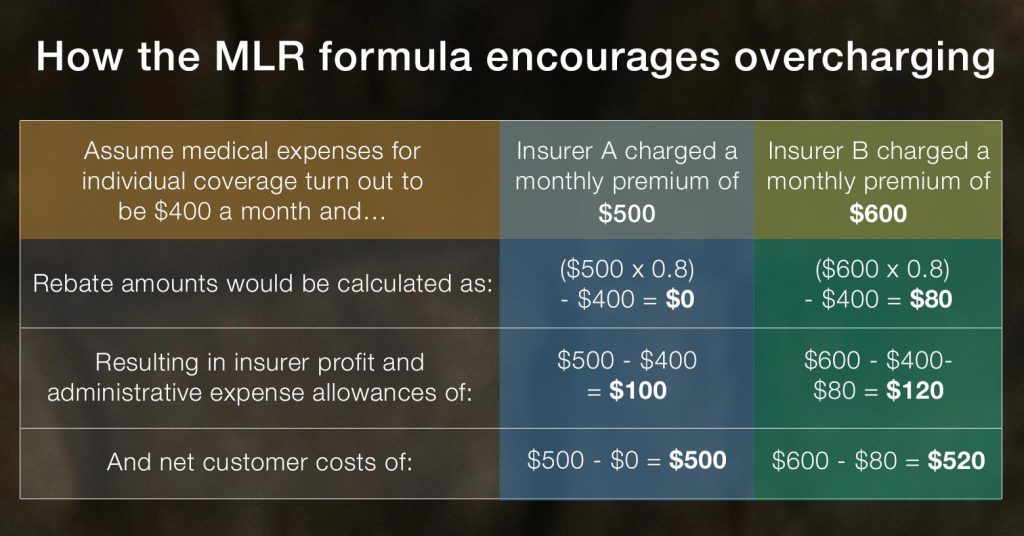

Obamacare Premiums Will Be Way Higher Next Year They Didn t Have To Be

https://img.huffingtonpost.com/asset/5afdfe921e0000a0038e5dc6.png?ops=scalefit_720_noupscale

https://www.irs.gov/pub/irs-utl/Medical Loss Ratio (MLR) R…

Web What is the Medical Loss Ratio MLR rebate and how does it affect you Due to the Affordable Care Act enacted in May 2010 insurance companies are required to spend a

https://www.natlawreview.com/article/irs-issues-faqs-tax-treatment...

Web 27 mai 2012 nbsp 0183 32 On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates

The Latest 2022 Medical Loss Ratio Rebates

Medicaid Concepts Medical Loss Ratio Mostly Medicaid

Medical Loss Ratio Rebates

2019 Medical Loss Ratio Rebates Reminder Leavitt Group

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

TWITTER Medical Loss Ratio Rebates 1 KFF

TWITTER Medical Loss Ratio Rebates 1 KFF

One Way To Ease ACA Rate Hikes Fix The Rebate Formula

Fillable Online Medical Loss Ratio Reporting Form Fax Email Print

FEATURE Medical Loss Ratio Rebates 2012 2021 1 KFF

Medical Loss Ratio Rebate Taxable - Web 23 mai 2023 nbsp 0183 32 Medical loss ratio forced carriers to devote more premium dollars to care and record high rebates have been issued in the last few years The Affordable Care