Tax Liability Rebate Web 13 avr 2022 nbsp 0183 32 Generally tax refunds are applied to tax you owe on your return or your outstanding federal income tax liability If you are eligible for a 2020 Recovery Rebate

Web A tax rebate is a reimbursement made to a taxpayer for an excess amount paid in taxes during the year It occurs when the taxes paid by an individual or a business through Web 1 juin 2023 nbsp 0183 32 Your tax liability is the amount of taxes you owe to the IRS or your state government Your income tax liability is determined by your

Tax Liability Rebate

Tax Liability Rebate

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

https://i.pinimg.com/564x/b6/70/c4/b670c47f275a63df1ef5550404fec2b1.jpg

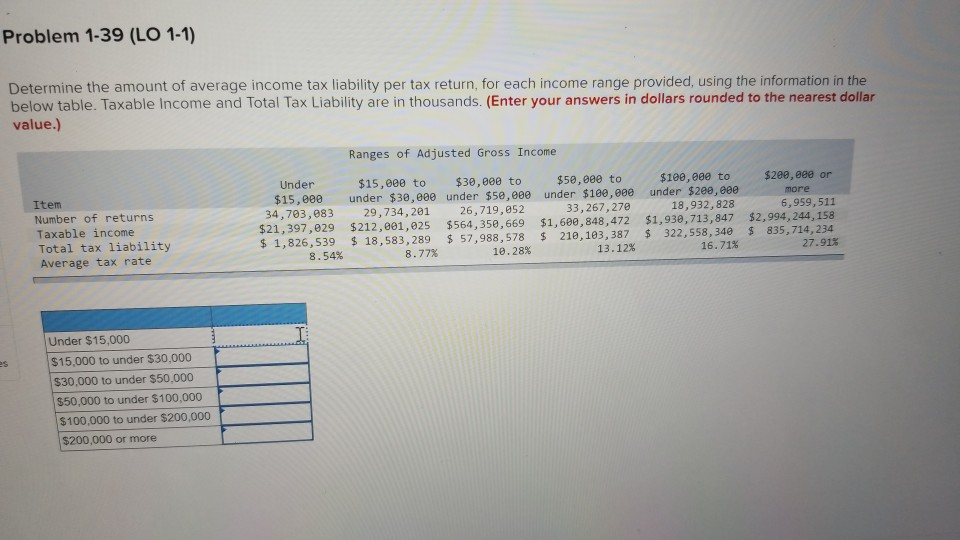

Solved Problem 1 39 LO 1 1 Determine The Amount Of Average Chegg

https://media.cheggcdn.com/media/9ec/9ec51619-cf20-4157-94f9-e208f37c3ee5/image.png

Web 13 juin 2012 nbsp 0183 32 Based on the forgoing the IRS was faced with the following question Does the liability to provide rebates become fixed and determinable when 1 customers Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Web Federal taxability of LI rebates and similar utility incentives matters to water utilities because if the payments are taxable the water utility may be required to issue an IRS Form Web 15 f 233 vr 2023 nbsp 0183 32 As such taxpayers received a refund of 14 0312 of their 2021 tax liability This also means that state taxpayers only received the refund if they incurred a state tax liability on their

Download Tax Liability Rebate

More picture related to Tax Liability Rebate

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

When Is Deadline For Filing Federal Income Tax Return In 2023 Hint It

https://www.cleveland.com/resizer/krc8eeQr-0G_LEI9_f5VjPi3P8o=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/XTF5BGYTKZCIZABPEIAPM6BJ3Y.jpg

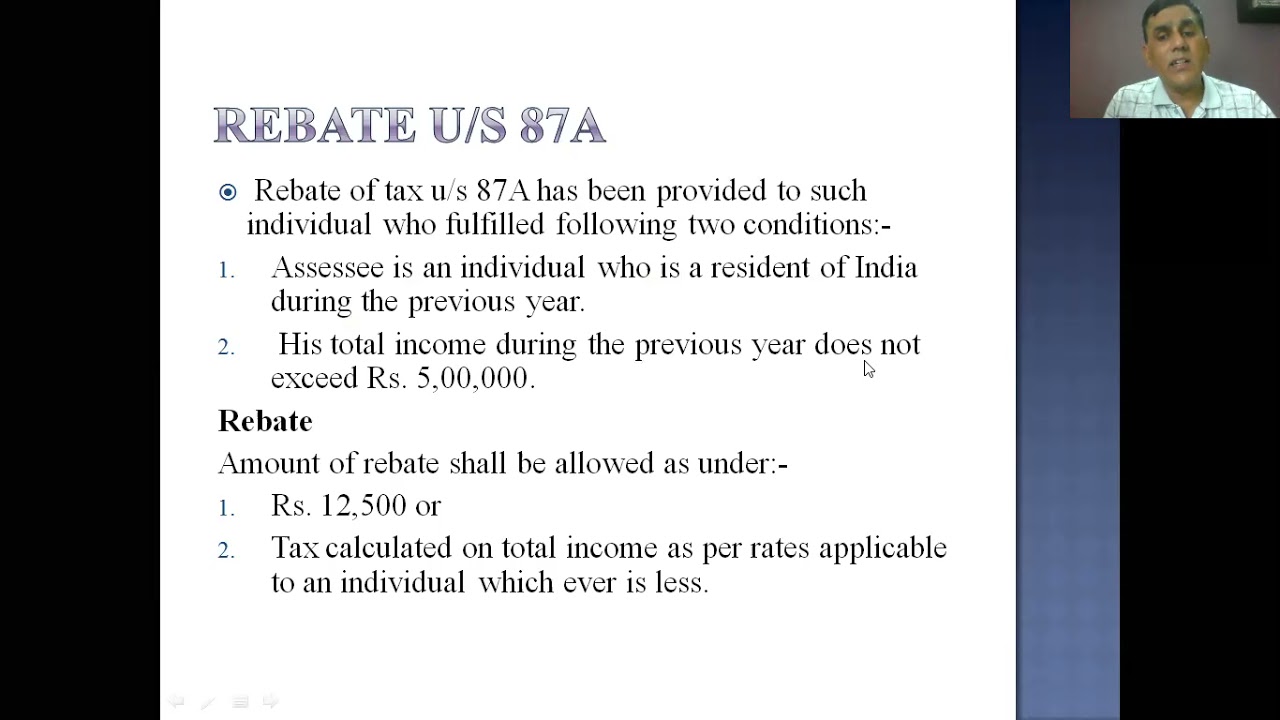

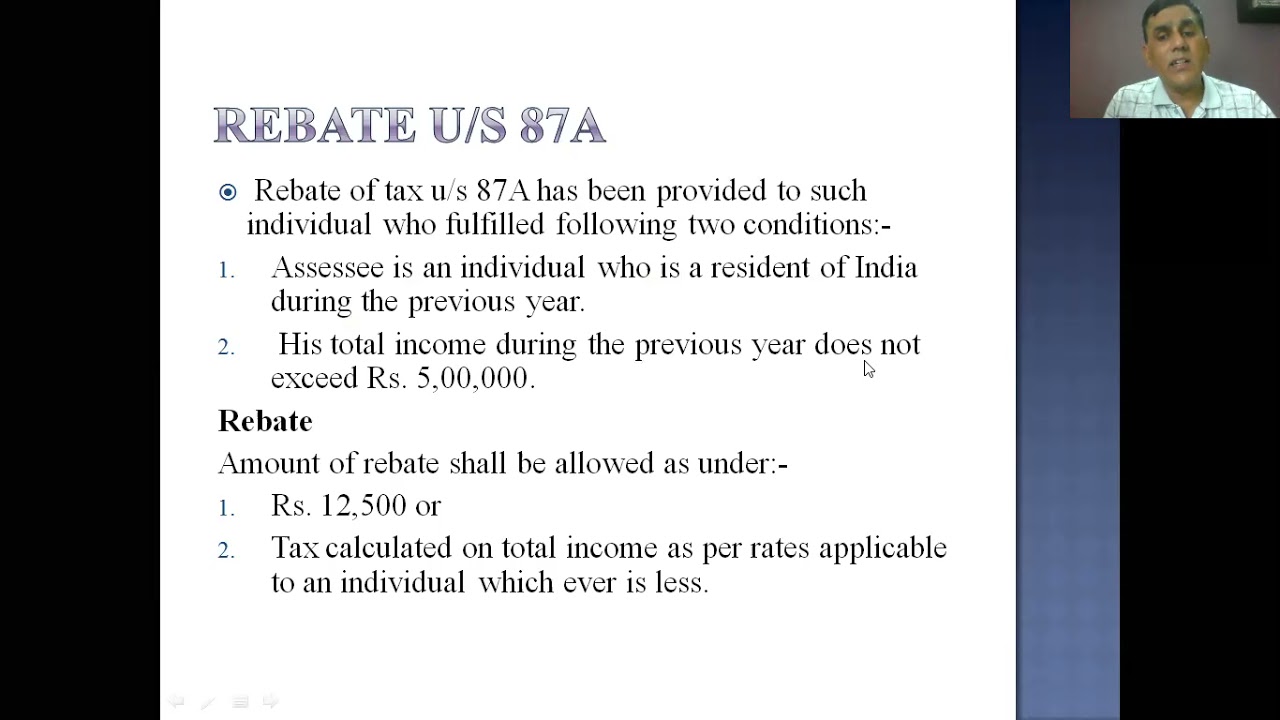

Web 2 d 233 c 2022 nbsp 0183 32 Note 1 Rebate u s 87A is applicable in case of new tax regime and needs to be availed for the amount of tax payable or Rs 12 500 whichever is lesser resulting in NIL tax liability provided the Web 15 janv 2022 nbsp 0183 32 Tax liability before rebate under sections 86 section 89 sections 90 90A and 91 if any XXXXX Less Rebate under sections 86 section 89 sections 90 90A

Web 20 d 233 c 2022 nbsp 0183 32 Individuals should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021 Find the Amount of Your Web 10 janv 2022 nbsp 0183 32 Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20 000 per YA for a period of three

Computation Of Tax Liability Rebates Reliefs YouTube

https://i.ytimg.com/vi/NjK-0HX6alg/maxresdefault.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-e...

Web 13 avr 2022 nbsp 0183 32 Generally tax refunds are applied to tax you owe on your return or your outstanding federal income tax liability If you are eligible for a 2020 Recovery Rebate

https://www.papayaglobal.com/glossary/tax-rebate

Web A tax rebate is a reimbursement made to a taxpayer for an excess amount paid in taxes during the year It occurs when the taxes paid by an individual or a business through

Strategies To Maximize The 2021 Recovery Rebate Credit

Computation Of Tax Liability Rebates Reliefs YouTube

Decoding Section 87A Rebate Provision Under Income Tax Act

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Net Operating Losses Deferred Tax Assets Tutorial

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Deferred Tax Assets And Liabilities Examples Balance Sheet Format

Tax Liability Meaning Formula Calculation How It Works

HOW TO COMPUTE TAX LIABILITY REBATE U S 87A YouTube

Tax Liability Rebate - Web When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is refunded at the end of the