Are Rebates Taxable Income You re probably familiar with all the different credit card companies offering cash back rewards or even those mail in rebate offers you receive on certain goods But if you think you need to report these rewards on your tax return you ll be happy to know that it isn t necessary in most cases

How the IRS interprets taxing rebates points and rewards can be confusing at best For example your credit card rewards may be taxable income Sometimes however the IRS considers these rewards as a discount not as income A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s

Are Rebates Taxable Income

Are Rebates Taxable Income

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable-1038x576.png

Are 2022 Tax Rebates Considered taxable Income YouTube

https://i.ytimg.com/vi/Kqpil_lM9jY/maxresdefault.jpg

Forbes On Twitter Are State Tax Refunds And Rebates Federally Taxable

https://pbs.twimg.com/media/FohbLfQX0AEHgbM.jpg

The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and timing Recently the IRS has taken steps to reduce some of the confusion Most tax experts agree that credit card rewards earned through the use of the card are non taxable rebates and that you should be fine as long as you spend money to get something

Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away A rebate received by a buyer from the party to whom the buyer directly or indirectly paid the purchase price for an item is an adjustment in purchase price not an accession to wealth and is not includible in the buyer s gross income

Download Are Rebates Taxable Income

More picture related to Are Rebates Taxable Income

Are Buyer Agent Commission Rebates Taxable In NYC YouTube

https://i.ytimg.com/vi/aJwAZbWrXb4/maxresdefault.jpg

Ma Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

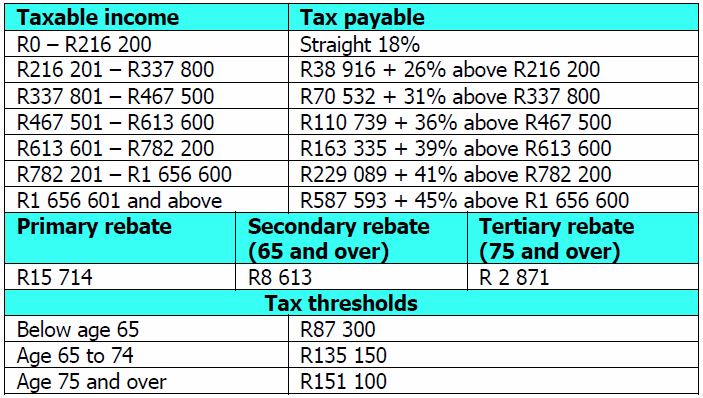

How To File Your Income Taxes In South Africa In 2023 Expatica

https://www.expatica.com/app/uploads/sites/12/2014/05/income-tax-south-africa.jpg

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable The IRS could not in opposition to its long standing policy of treating credit card rewards for the purchase of products or services as nontaxable purchase rebates require taxpayers to include in income large amounts of credit card rewards they received for purchasing Visa gift cards

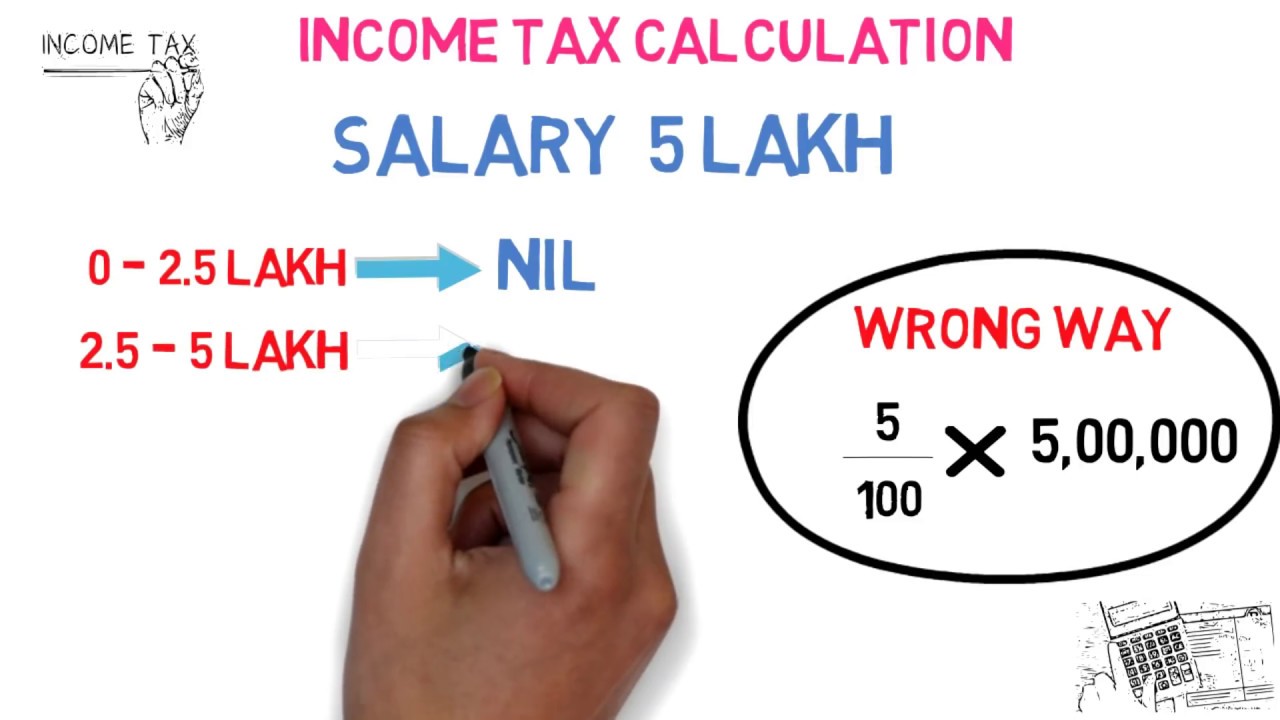

Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 12 500 is available for taxpayers with an annual income of up to Rs 5 lakh as applicable to the financial year 2023 24 for taxpayers who opt the old tax regime No you don t have to declare credit card cash back on your taxes because the IRS does not consider it to be taxable income Instead the IRS considers that cash back to be a rebate

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

https://iiptr.com/wp-content/uploads/2023/01/Are-GST-Rebates-Taxable-Top-10-Reasons-To-Claim-A-GST-Rebate.jpg

2022 Tax Brackets JeanXyzander

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

https://turbotax.intuit.com/tax-tips/irs-tax...

You re probably familiar with all the different credit card companies offering cash back rewards or even those mail in rebate offers you receive on certain goods But if you think you need to report these rewards on your tax return you ll be happy to know that it isn t necessary in most cases

https://www.hackyourtax.com/taxing-rebates-points-rewards

How the IRS interprets taxing rebates points and rewards can be confusing at best For example your credit card rewards may be taxable income Sometimes however the IRS considers these rewards as a discount not as income

Are Rebates Important YouTube

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

IRS Says 21 State Rebates Including California Middle Class Tax Refunds

New Income Tax Calculation Rebate 2018 19 Explained YouTube

What Are Forex Rebates

Rebate Calculations 101 How Are Rebates Calculated Enable

Rebate Calculations 101 How Are Rebates Calculated Enable

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Are Rebates Taxable Income - Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away