Are Solar Rebates Taxable Income The solar tax credit is nonrefundable so you won t receive a separate check for that 30 savings but it will lessen what you owe in taxes which means you ultimately get a bigger tax refund

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar

Are Solar Rebates Taxable Income

Are Solar Rebates Taxable Income

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

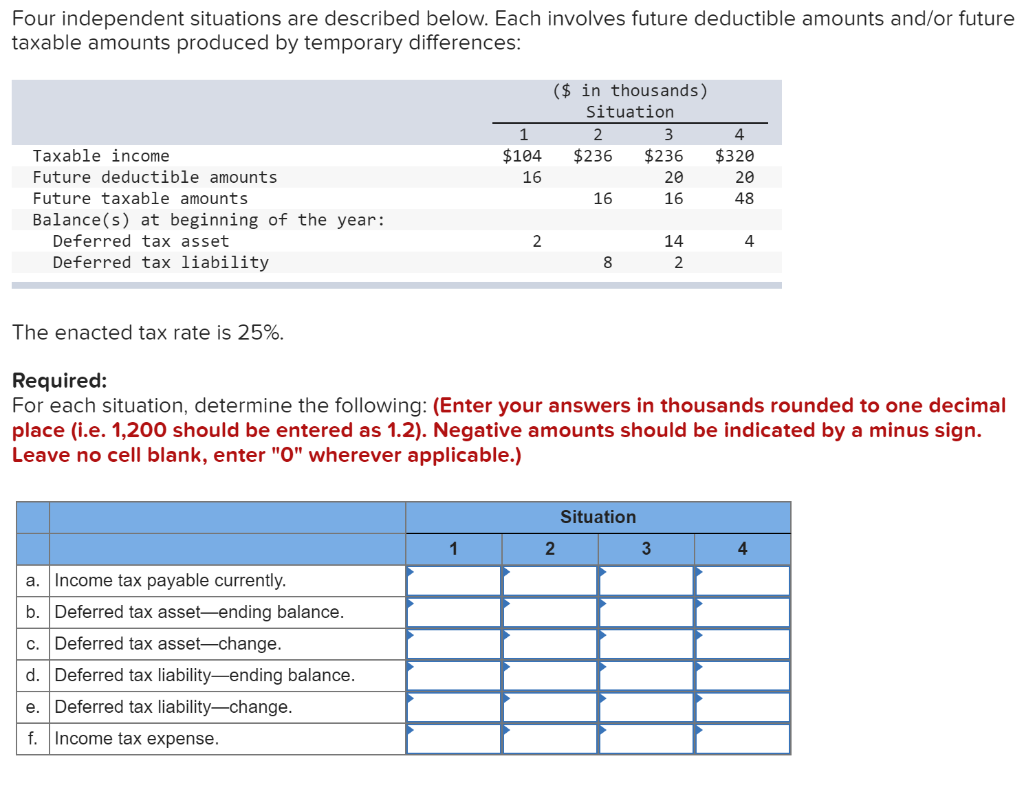

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Employee Gifts Are They Taxable Income Tax Deductible For The Company

https://www.gannett-cdn.com/-mm-/53ed1c02a484aa0c0dd5755eb74649939ad78bce/c=0-296-1077-905/local/-/media/2017/11/30/TennGroup/Nashville/636476613769144276-1212-LBMC.jpg?width=3200&height=1680&fit=crop

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is 30 Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house

Key points The federal solar tax credit lowers your tax liability for qualifying solar system expenses The federal solar tax credit can be claimed anytime between 2022 through A solar PV system are excluded from income taxes through an exemption in federal law 11 When this is the case the utility rebate for installing solar is subtracted from your system costs

Download Are Solar Rebates Taxable Income

More picture related to Are Solar Rebates Taxable Income

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280.png

Tax Reductions Rebates And Credits

https://sb.studylib.net/store/data/008702919_1-5fc3b4877f75d05a02ea5cfa273ba161-768x994.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

Generally a taxpayer is not required to reduce the purchase price or cost of property acquired with a governmental energy efficiency incentive unless that incentive Rebates paid at the time of sale under two home energy rebate programs created in the Inflation Reduction Act are not includible in individual purchasers gross income or cost

These rebates can work in addition with the federal tax credit to increase the savings of going solar For example Oregon offers rebates of up to 5 000 for solar systems and 2 500 for The IRS has issued guidance providing that rebates for energy efficient improvements under two Department of Energy DOE programs will generally not be

Taxable Payments Annual Report Bosco Chartered Accountants

https://bosco.accountants/wp-content/uploads/2019/06/1660x1105-subcontractors.jpg

Are State Tax Refunds And Rebates Federally Taxable It Depends Https

https://pbs.twimg.com/media/FohbLfQX0AEHgbM.jpg

https://www.energysage.com/solar/sola…

The solar tax credit is nonrefundable so you won t receive a separate check for that 30 savings but it will lessen what you owe in taxes which means you ultimately get a bigger tax refund

https://www.nerdwallet.com/article/taxe…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

Lowering Personal Income Tax PIT Government PH

Taxable Payments Annual Report Bosco Chartered Accountants

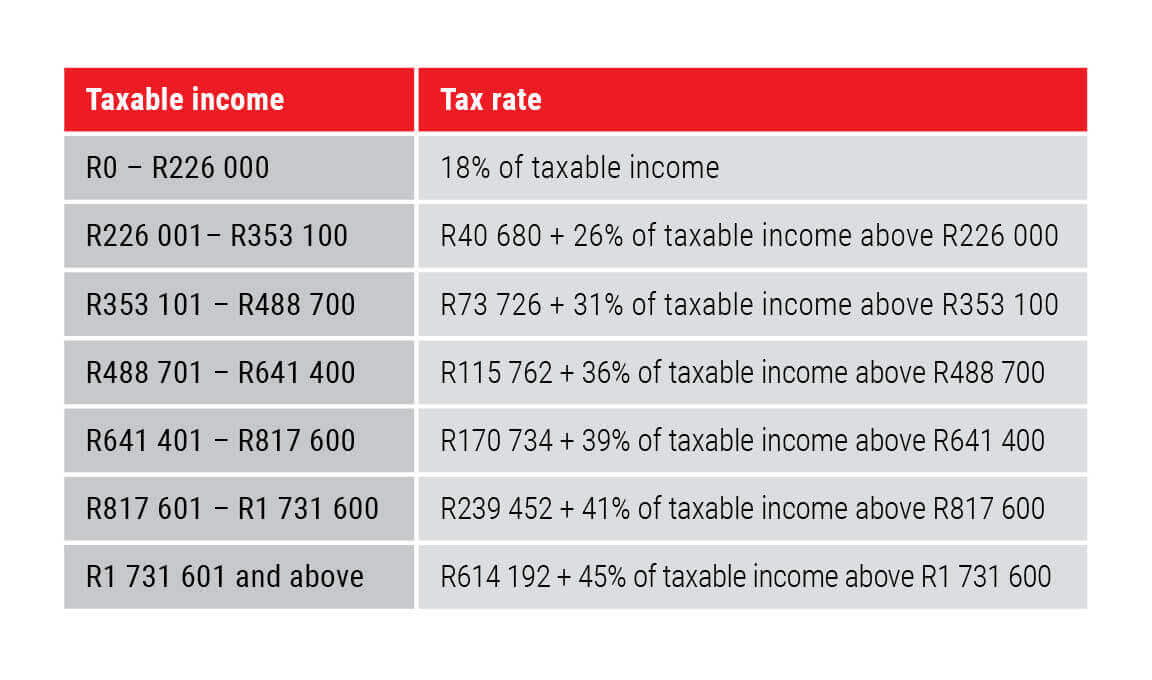

Allan Gray 2022 Budget Speech Update

Savings Rebates Application BWFL

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

How To Calculate Accounts Payable Formula Modeladvisor

How To Calculate Accounts Payable Formula Modeladvisor

Taxable Vs Non taxable Benefits What You Should Know About Them Talk

How To Reduce Your Taxable Income 2023

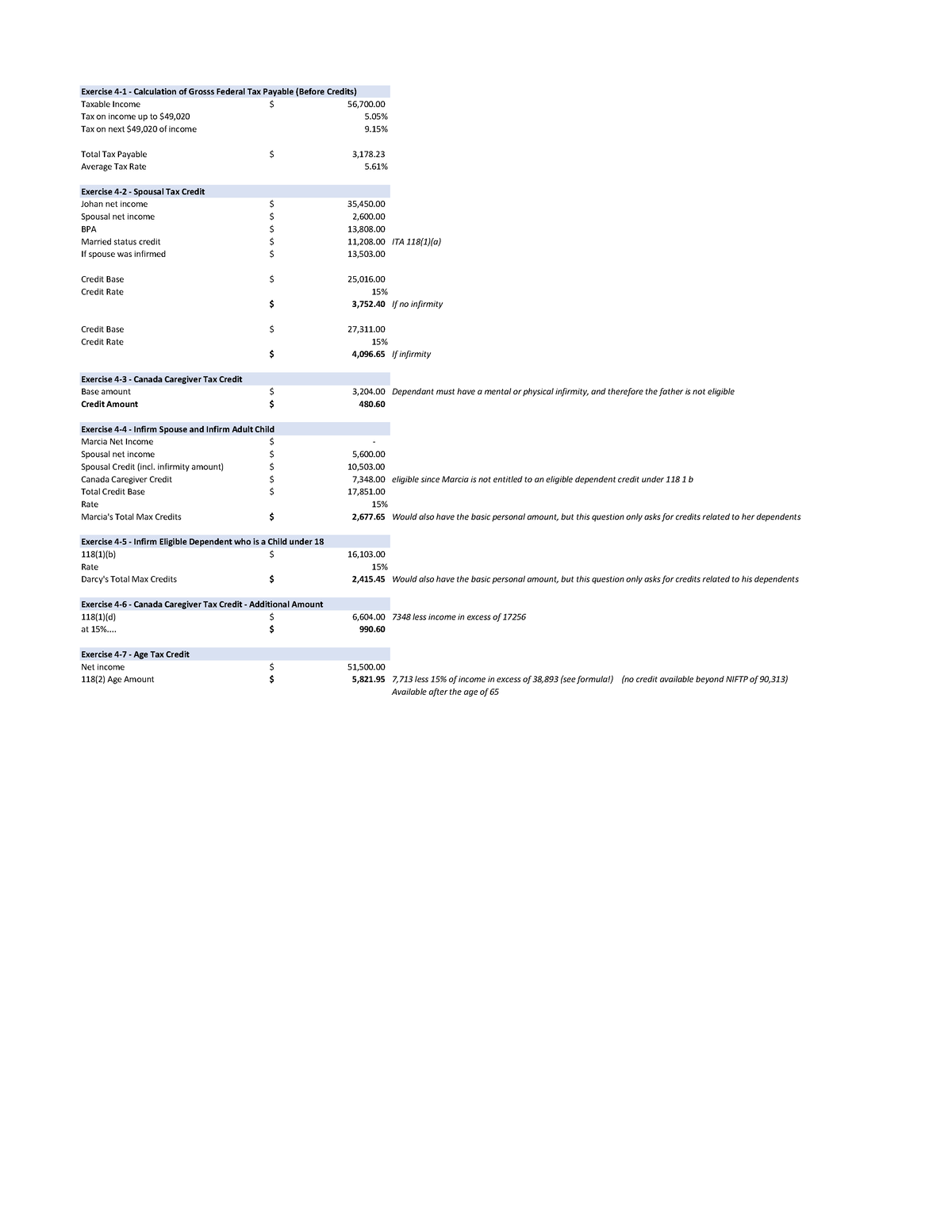

Chapter 4 Exercise Answers Taxable Income And Tax Payable For An

Are Solar Rebates Taxable Income - In 2023 Finance Minister Enoch Godongwana introduced a tax rebate for individuals and businesses who install solar panels The move was designed to incentivise