Are Solar Credits Taxable Income IR 2024 97 April 5 2024 The Department of Treasury and the IRS today issued Announcement 2024 19 that addresses the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal income taxes equal to 30

Are Solar Credits Taxable Income

Are Solar Credits Taxable Income

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Best Solar Buyback Rates In Texas Best Company Who Buyback Solar

https://i.ytimg.com/vi/2tuVsOXDcP0/maxresdefault.jpg

What Are Tax Credits Your Adjustments Deductions And Exemptions

https://img.homeworklib.com/questions/6715d9a0-0f03-11eb-8c88-c90d31bb6c59.png?x-oss-process=image/resize,w_560

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download Are Solar Credits Taxable Income

More picture related to Are Solar Credits Taxable Income

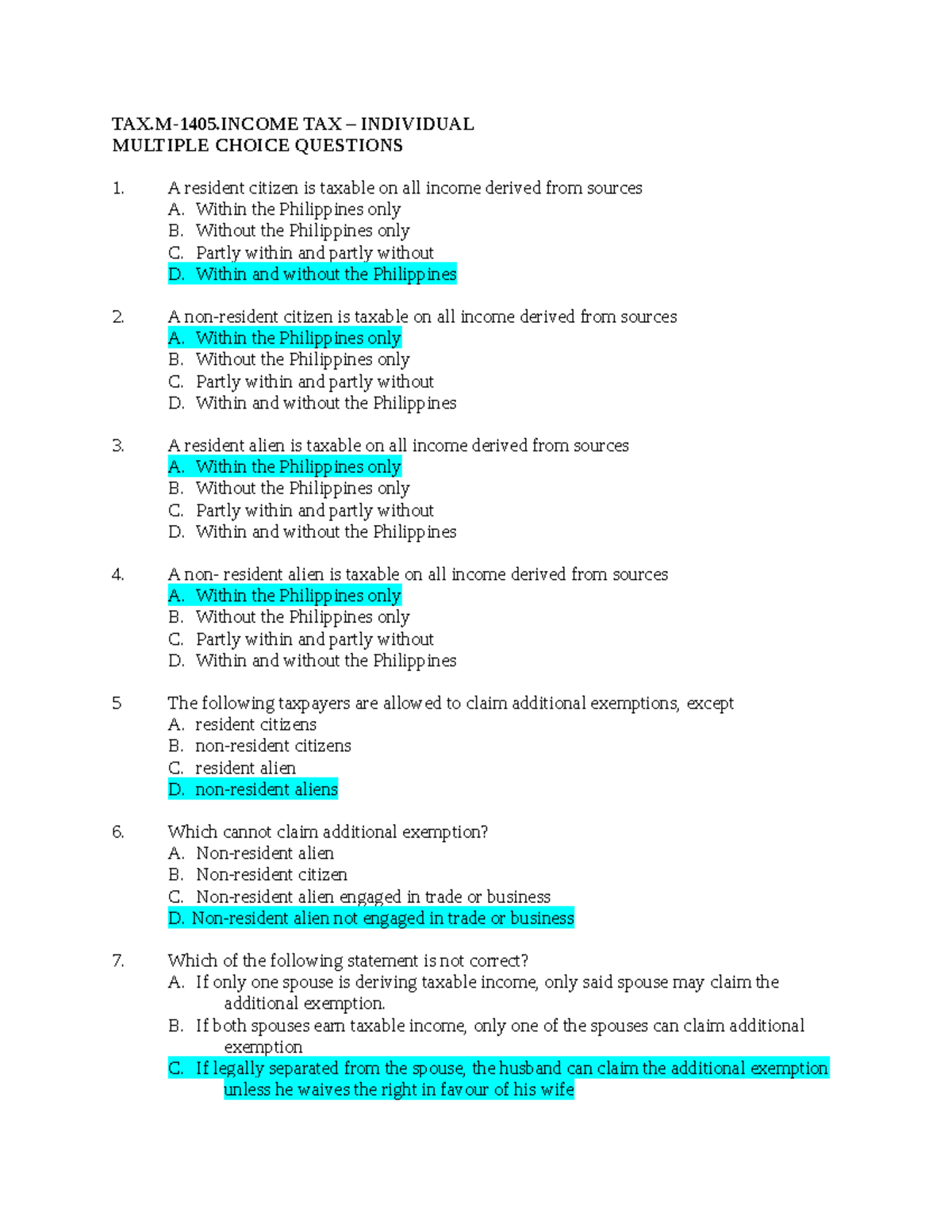

14965412 Note TAX M 1405 TAX INDIVIDUAL MULTIPLE CHOICE QUESTIONS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4bdbb6752aa539cedbc2cca3ce42f694/thumb_1200_1553.png

The Looming Sunset Of The Solar Credits Subsidy

https://www.australiansolarquotes.com.au/wp-content/uploads/2016/06/Looming-Sunset-of-Solar-Credits-Subsidy-2.png

NY Solar Credits Are Among The Best In The Nation LI Power Solutions

https://www.lipowersolutions.com/wp-content/uploads/2022/06/NY-Solar-Credits.jpg

The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your total project The ATO has confirmed in a number of private binding rulings that there are no specific legislative provisions relating to payments received from electricity suppliers so it is not statutory income

In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will stay at 30 for the next nine years until 2033 at which point it will drop to 26 There is no cap to the value you can claim for your credit and there are no income limits for claiming the credit The federal solar tax credit is a clean energy credit that you can claim on your federal returns This tax credit is not valued at a set dollar amount rather it s a percentage of what you spend to install a residential solar photovoltaic PV system

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

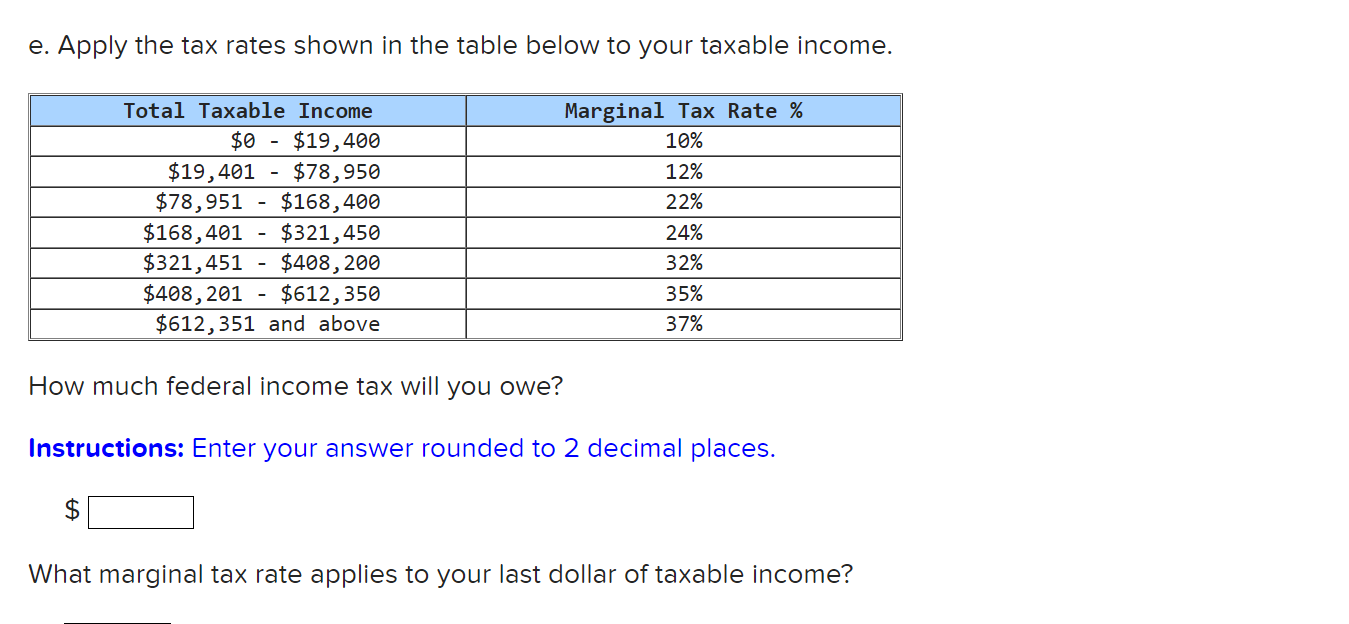

For Tax Purposes gross Income Is All The Money A Person Receives In

https://img.homeworklib.com/images/1e2b89e4-55e2-4a4f-b14c-62a8e8749f84.png?x-oss-process=image/resize,w_560

https://www.irs.gov/newsroom/treasury-irs-issue...

IR 2024 97 April 5 2024 The Department of Treasury and the IRS today issued Announcement 2024 19 that addresses the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

How Solar Tax Credits Work Blue Raven Solar YouTube

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

New Start Group Inc

Social Security Maximum Taxable Earnings DisabilityTalk

Understanding Your Tax Forms The W 2

How Net Metering Solar Credits Work Supreme Solar Electric

How Net Metering Solar Credits Work Supreme Solar Electric

Can A Nonrefundable Tax Credit Increase My Refund Leia Aqui What Is

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

Solved For Tax Purposes gross Income Is All The Money A Chegg

Are Solar Credits Taxable Income - For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and