Is The Solar Tax Credit Taxable Income IR 2024 113 April 17 2024 WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Unfortunately the solar tax credit is non refundable If your tax credit is larger than the amount you owe for the year you won t get the excess back as a part of your refund check But that doesn t mean you re leaving money on the table

Is The Solar Tax Credit Taxable Income

Is The Solar Tax Credit Taxable Income

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar Published Mar 7 2024 9 32am Editorial Note We earn a commission from partner links on Forbes Advisor Commissions do not affect our editors opinions or evaluations Getty Adding solar

Download Is The Solar Tax Credit Taxable Income

More picture related to Is The Solar Tax Credit Taxable Income

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Solar Lowdown Customers Ask What Is The Solar Tax Credit Skyline

https://skylinesmartenergy.com/wp-content/uploads/2023/05/Hero-Locations.jpg

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

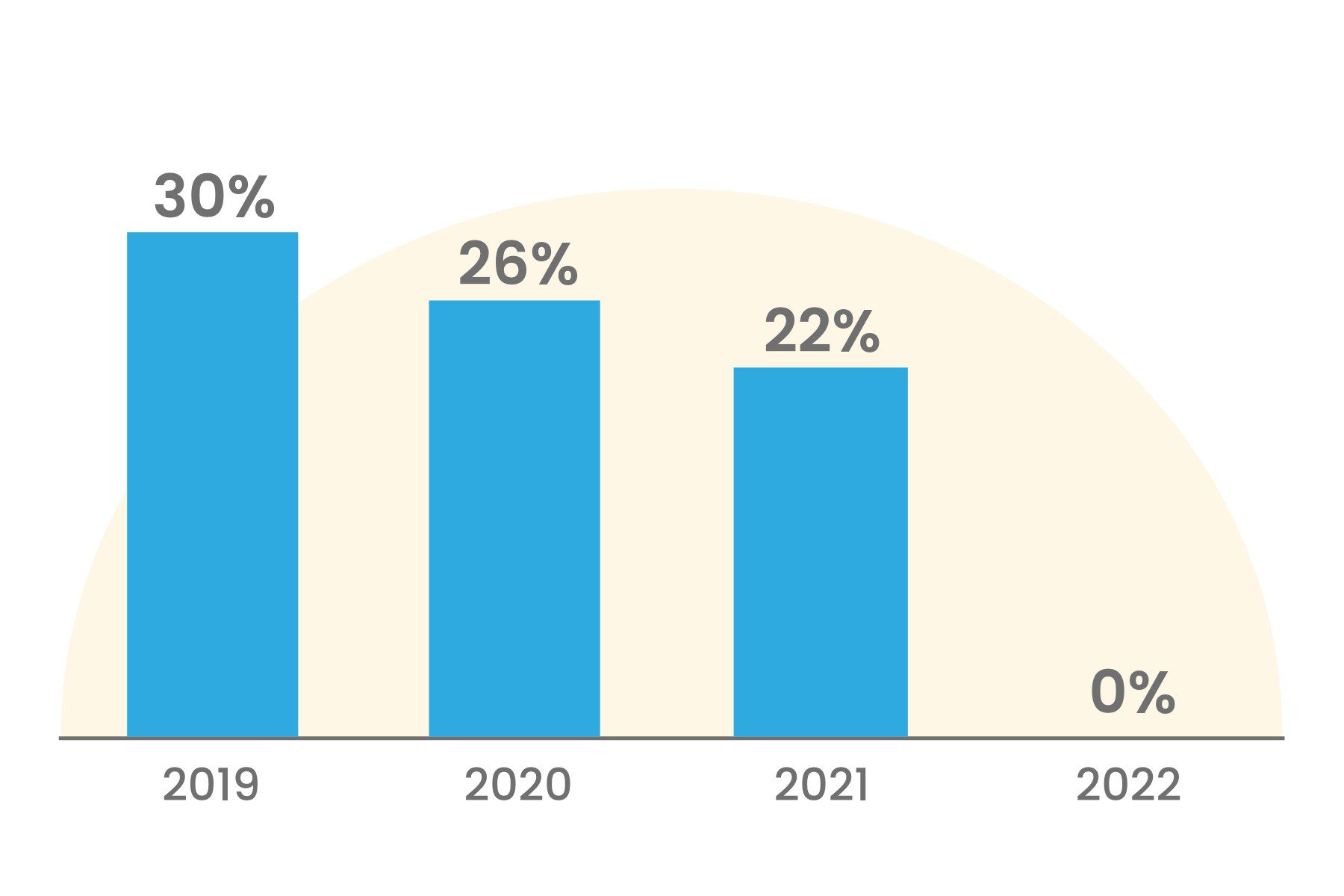

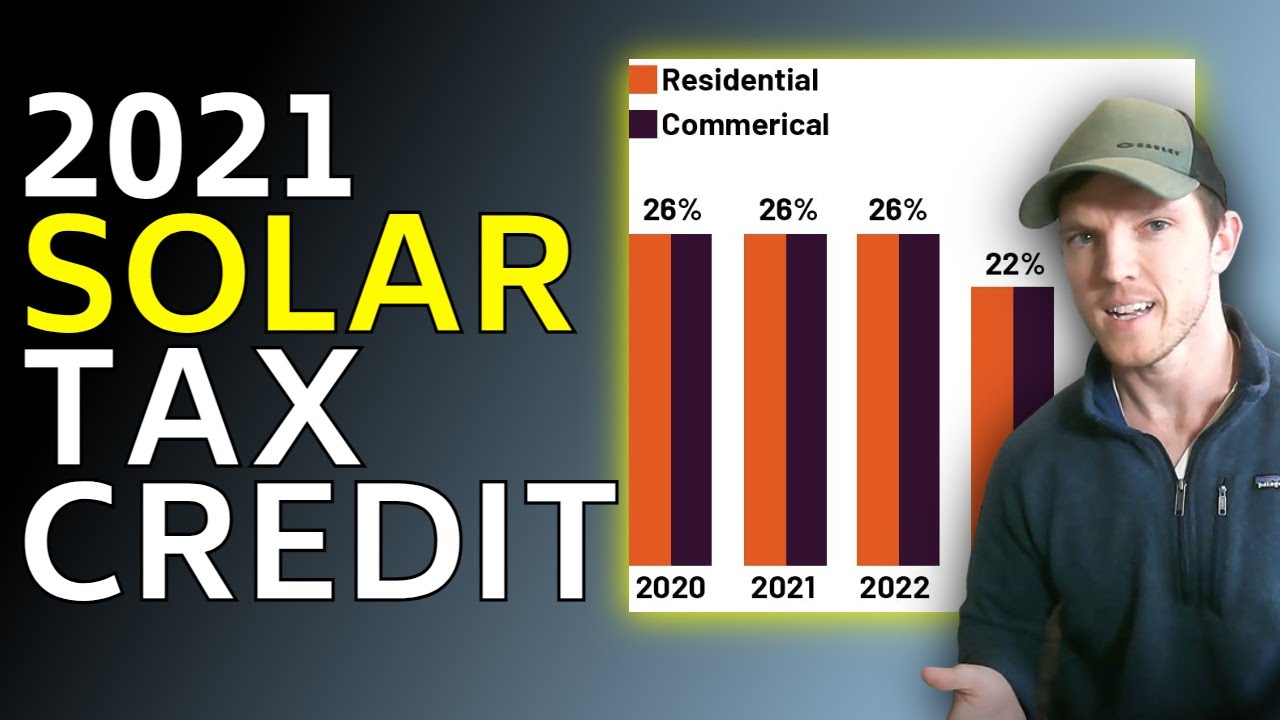

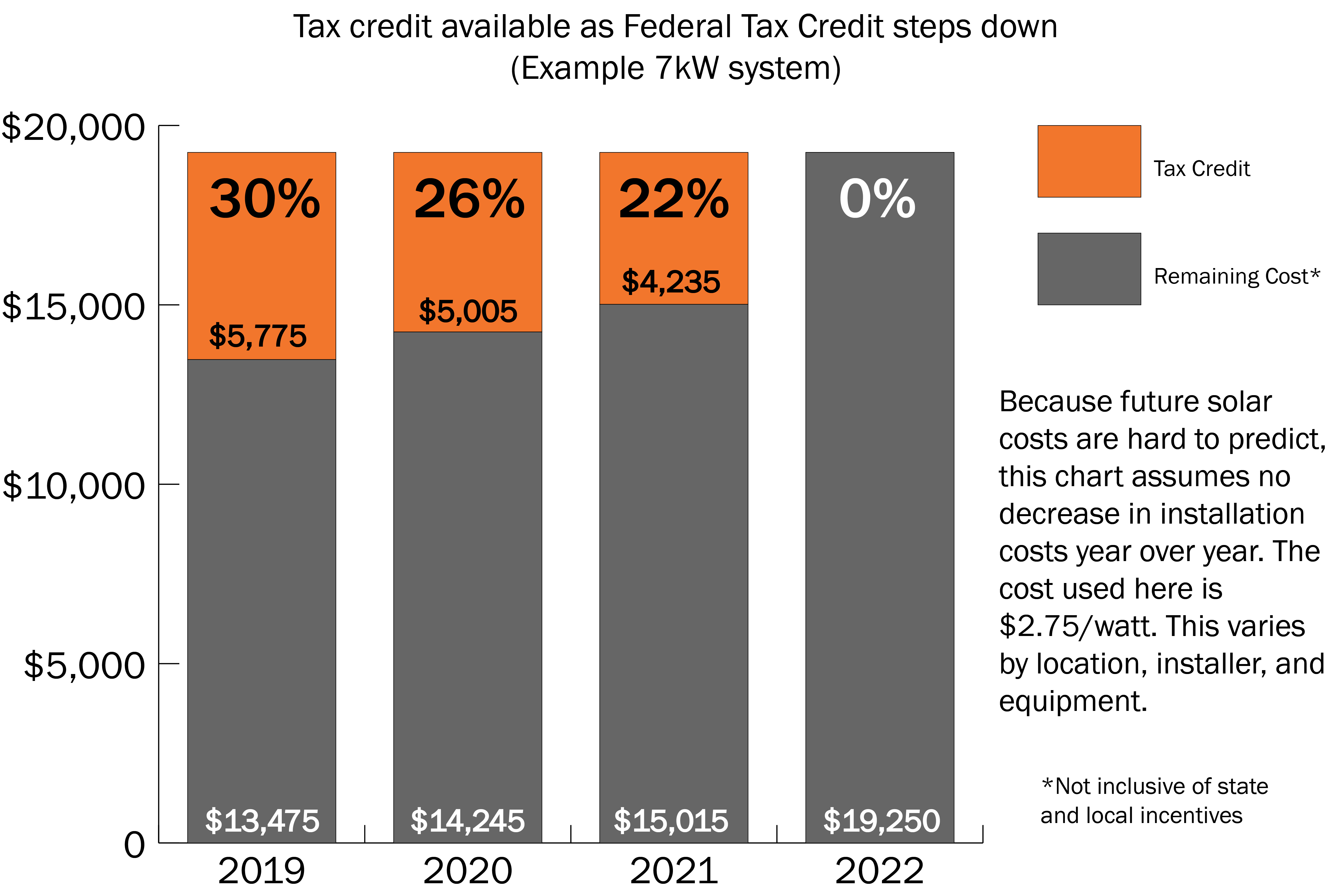

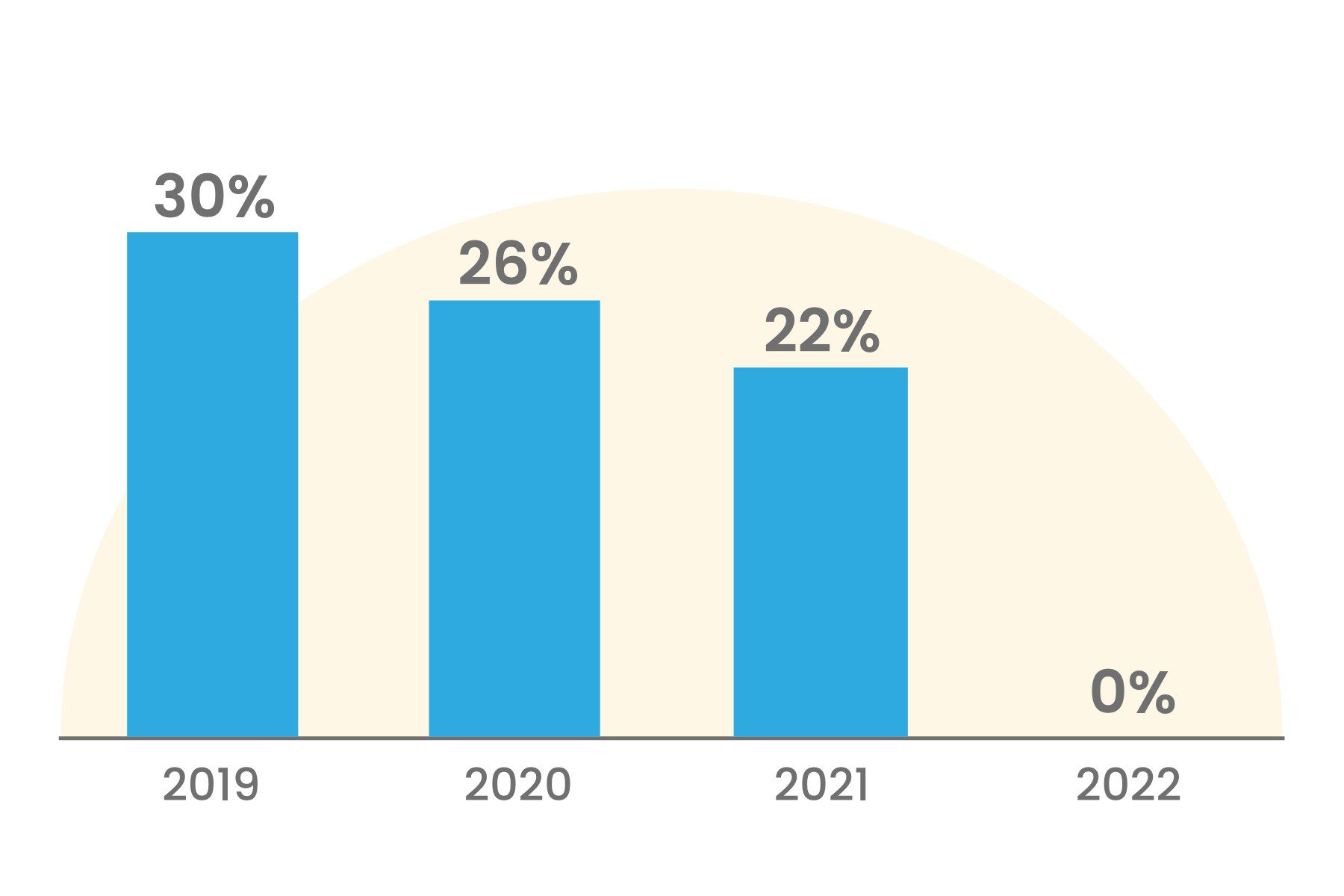

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035 The federal residential clean energy credit often known as the solar tax credit is a tax credit that can be claimed on your federal income taxes and which is equal to 30 of the total cost of installing solar

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/build/images/pages/solar-tax-credit/residential-bar-e0482b8d.png

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

https://i.ytimg.com/vi/u143Lcm-QG4/maxresdefault.jpg

https://www.irs.gov/newsroom/irs-updates...

IR 2024 113 April 17 2024 WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase

https://www.energy.gov/sites/default/files/2023-03/...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Solar Tax Credit Graph without Header Solar United Neighbors

Solar Tax Credit Guide And Calculator

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

The Solar Tax Credit How To Claim It Bright Solar IO

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

For Tax Purposes gross Income Is All The Money A Person Receives In

Is The Employee Retention Credit Taxable Income ERC Bottom Line Savings

The Federal Solar Tax Credit What You Need To Know 2022

Is The Solar Tax Credit Taxable Income - The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance