Are Energy Rebates Taxable Income In this instance the receipts or energy subsidies received are higher than payments for gas and electricity both are on monthly standing orders Presumably the

As of 1 October 2023 it means that a typical household using a medium amount of energy and paying by direct debit would pay 1 874 per year or around 156 per month Find out how Ofgem Exclusion of income for volunteer firefighters and emergency medical responders If you are a volunteer firefighter or emergency medical responder you may be able to exclude

Are Energy Rebates Taxable Income

Are Energy Rebates Taxable Income

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable-1038x576.png

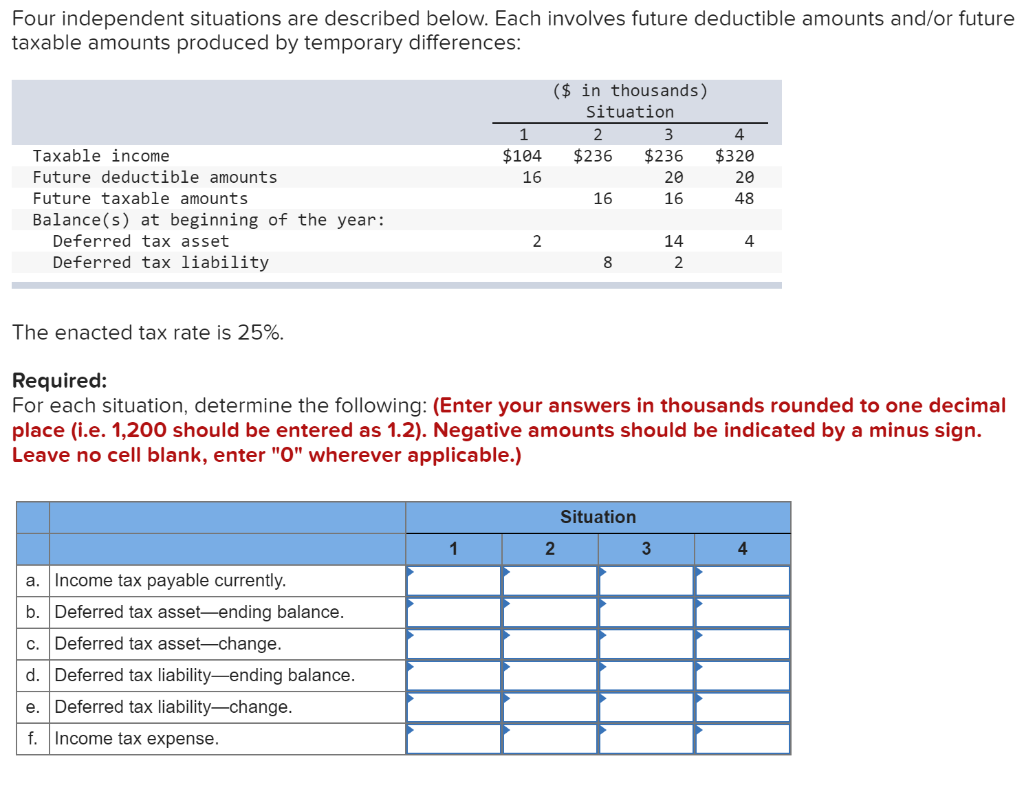

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Employee Gifts Are They Taxable Income Tax Deductible For The Company

https://www.gannett-cdn.com/-mm-/53ed1c02a484aa0c0dd5755eb74649939ad78bce/c=0-296-1077-905/local/-/media/2017/11/30/TennGroup/Nashville/636476613769144276-1212-LBMC.jpg?width=3200&height=1680&fit=crop

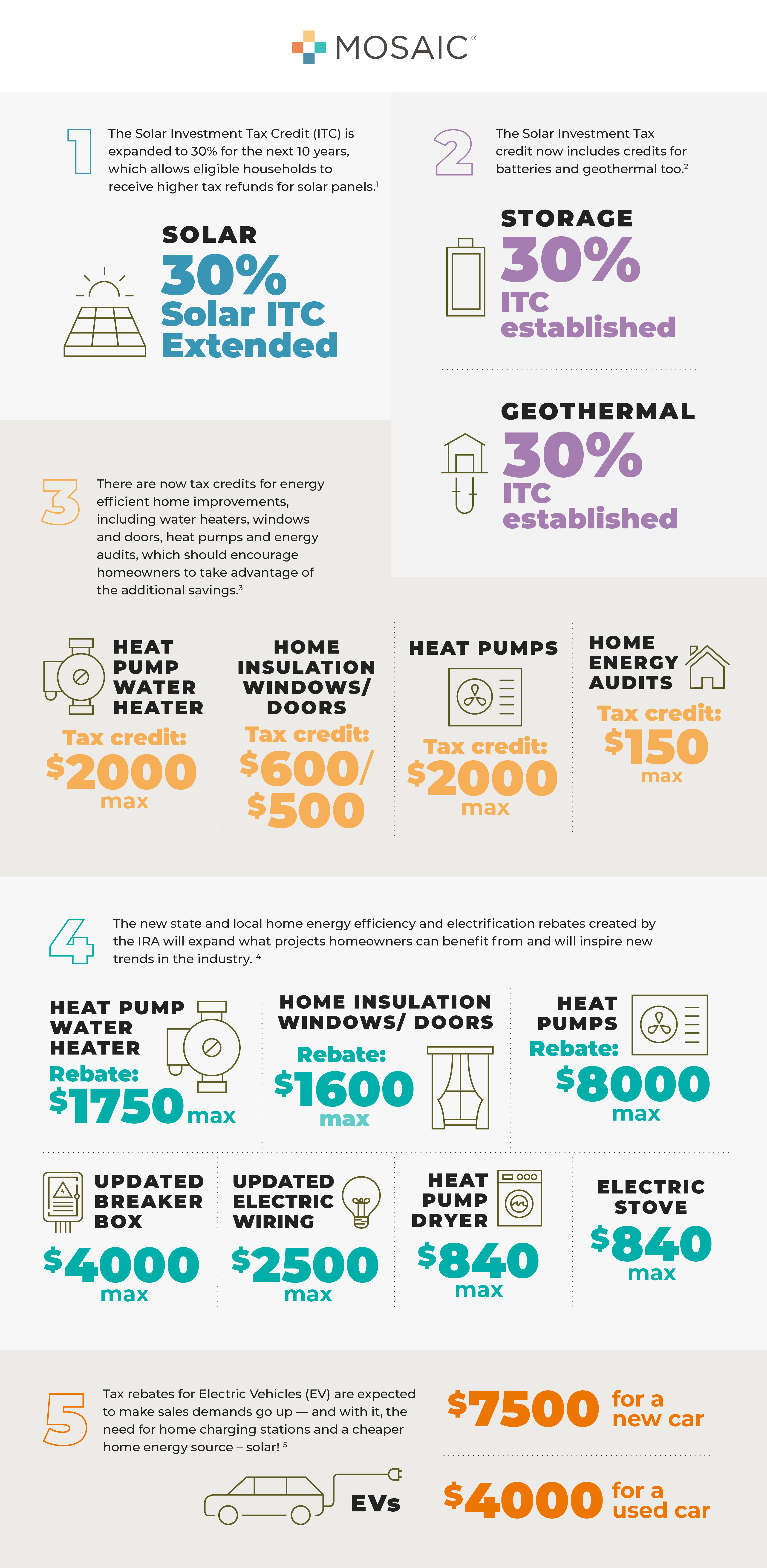

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

For example the City of Long Beach CA offered rebates of up to 500 to encourage the purchase of solar water heaters tank less water heaters energy efficient Energy Tax Credit An energy tax credit is given to homeowners who make their homes more energy efficient by installing energy efficient improvements There are

Download Are Energy Rebates Taxable Income

More picture related to Are Energy Rebates Taxable Income

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

These incentives include income tax incentives sales or property tax incentives rebates grants loans industry support and bonds these vary by jurisdiction There are many forms of renewable energy including The IRA includes a 7 500 consumer tax credit for electric vehicle purchases you are eligible if your adjusted gross income is up to 150 000 for individuals or

Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 11 When The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Rebate And Tax Credit Management Quick Electricity

https://quickelectricity.com/wp-content/uploads/2022/07/Energy-Rebates-and-Tax-Credits-Financial-Management-Services-for-Energy-1500x1000.jpg

InnoLED Lighting Understanding Energy Rebates

https://www.innoledlighting.com/wp-content/uploads/2018/07/Document-big-hd.png

https://www.accountingweb.co.uk/any-answers/energy...

In this instance the receipts or energy subsidies received are higher than payments for gas and electricity both are on monthly standing orders Presumably the

https://www.which.co.uk/news/article/everything...

As of 1 October 2023 it means that a typical household using a medium amount of energy and paying by direct debit would pay 1 874 per year or around 156 per month Find out how Ofgem

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

Rebate And Tax Credit Management Quick Electricity

Learn More About The Inflation Reduction Act IRA Mosaic

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Invest In NPS Account To Reduce Your Taxable Income The Economic Times

Invest In NPS Account To Reduce Your Taxable Income The Economic Times

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

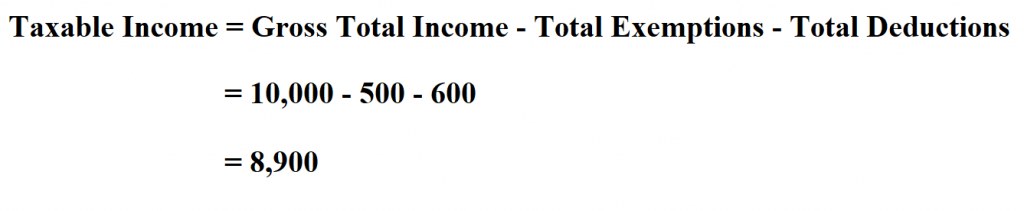

How To Calculate Taxable Income

How To Calculate Accounts Payable Formula Modeladvisor

Are Energy Rebates Taxable Income - Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of