Are Reimbursements Taxable Income In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

That such payments are taxable for a variety of reasons relying on India s strong source rule of taxation 1 3 This report seeks to address some typical issues relating to taxability of reimbursements in light of the prevalent tax legislation and the courts rulings in India 1 Foreword Are Reimbursements Taxable Income When a reimbursement is paid to an employee or the business it must be properly recorded for it to be considered nontaxable For instance on an employee s pay stub a reimbursement must be noted as such and not merely included among the employee s other income

Are Reimbursements Taxable Income

Are Reimbursements Taxable Income

https://www.patriotsoftware.com/wp-content/uploads/2017/09/reimbursements-taxable-RS11302.jpg

Are CACFP Reimbursements Taxable Income Taking Care Of Business

http://static1.squarespace.com/static/62b201e44c6b053d7de1621c/t/62b2478a23ac065522fcad57/1655858415048/33544588098_8e2c7535ce_b.jpg?format=1500w

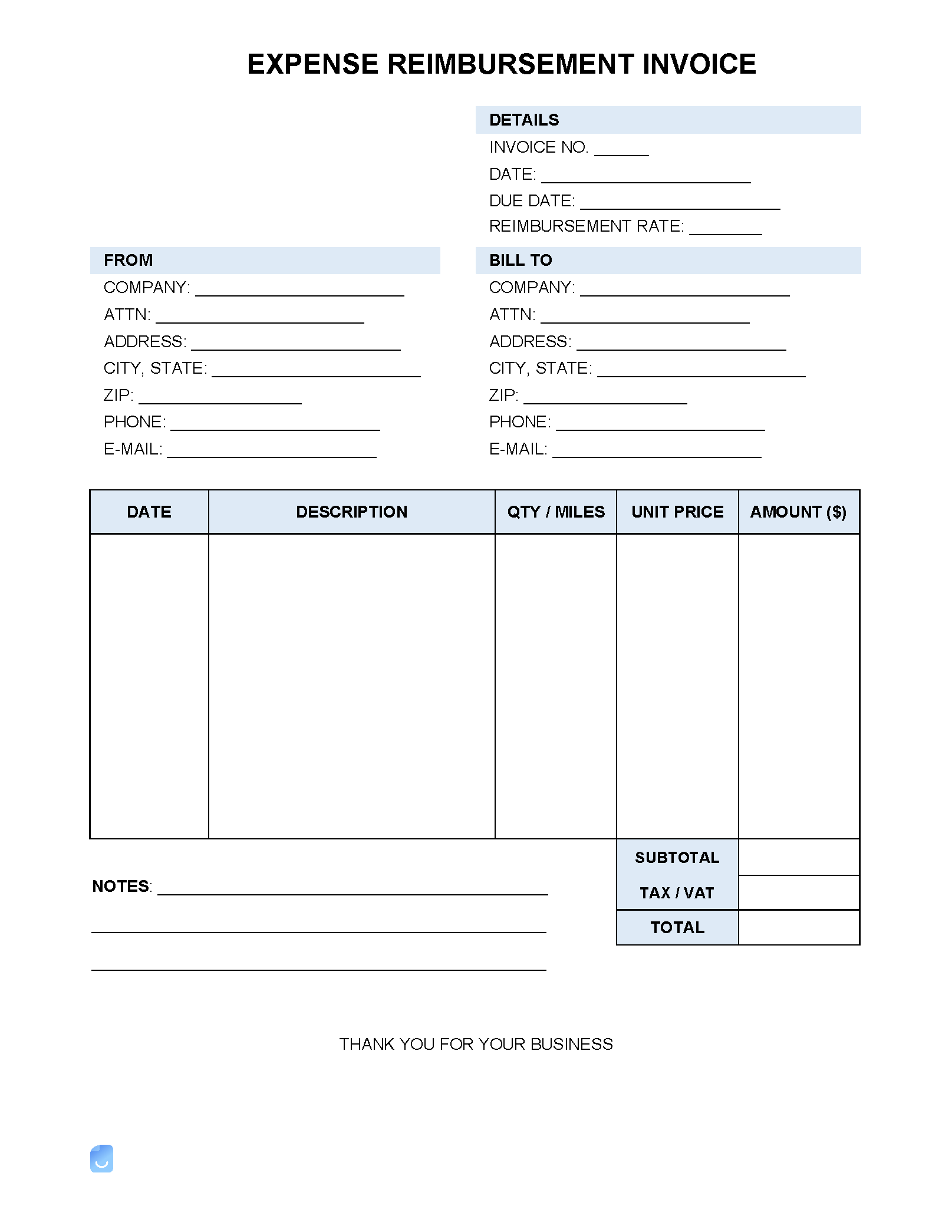

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

The IRS considers some employee benefits to be taxable income But do employee expense reimbursements fall into that category Learn more Reimbursements under a nonaccountable plan are wages and are subject to taxes You must report these wages and deposit taxes on them Include the reimbursements and taxes on the employee s Form W 2

Depending on the type of plan an organization uses expense reimbursements may be considered taxable income for the employee and the employer may be required to report it on the employee s W 2 form There are two types of expense reimbursement plans accountable plans and nonaccountable plans Are reimbursements taxable for the employee Generally speaking employees are not required to report reimbursements as income or wages and therefore are not taxable Nevertheless there are some exceptions

Download Are Reimbursements Taxable Income

More picture related to Are Reimbursements Taxable Income

Are SECA And Income Tax Reimbursements Taxable

https://static.wixstatic.com/media/5d88f9_aadee3f99348416fb26a465a8aced68d.jpg/v1/fill/w_1000,h_909,al_c,q_85,usm_0.66_1.00_0.01/5d88f9_aadee3f99348416fb26a465a8aced68d.jpg

Are Reimbursements Taxable IRS Guidelines On Reimbursements

https://www.patriotsoftware.com/wp-content/uploads/2017/11/are-reimbursements-taxable-1024x576.jpg

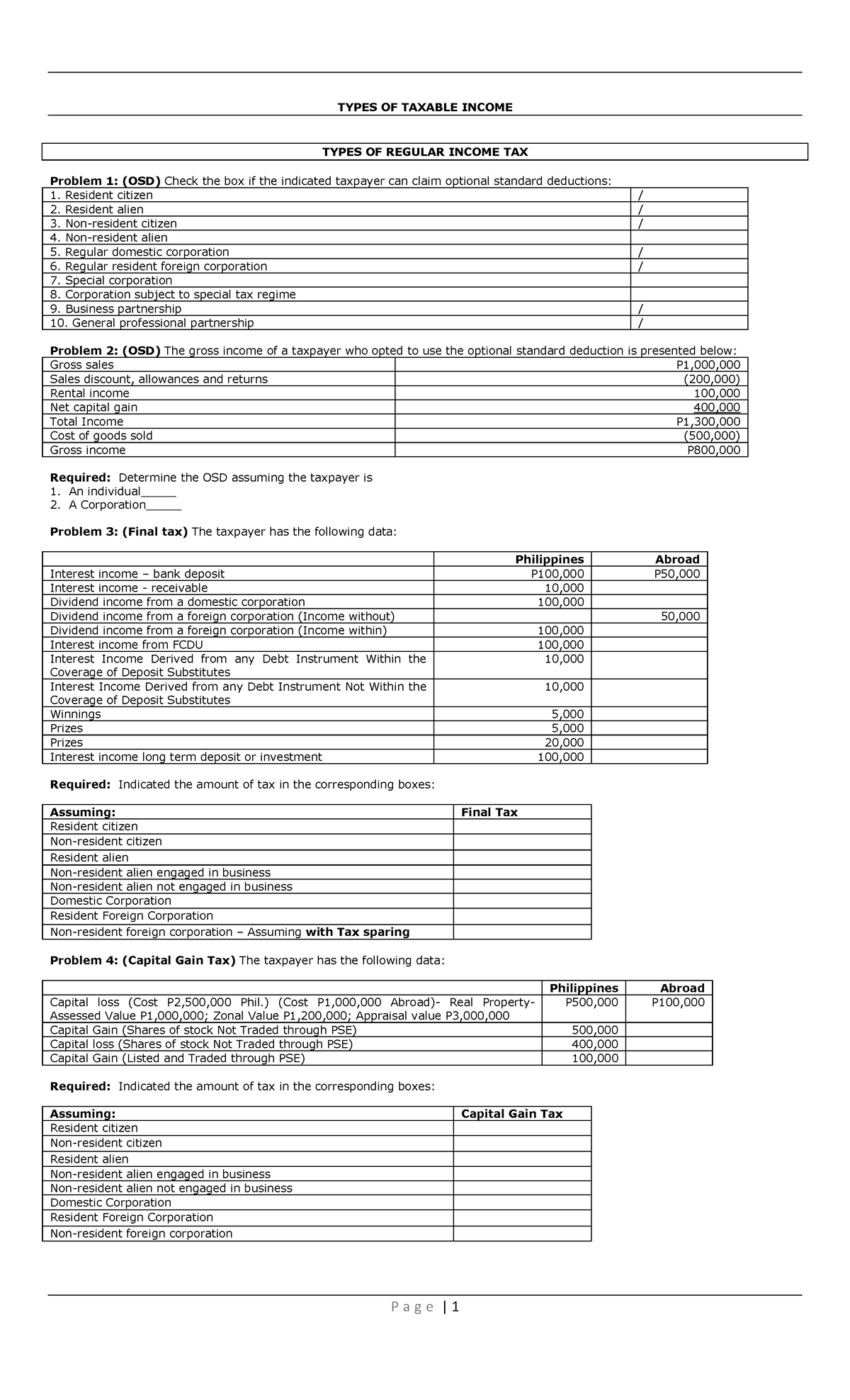

10 Types Of Taxable Income Student TYPES OF TAXABLE INCOME TYPES OF

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/b7a872ad0a19b88c31effcac3e87cba0/thumb_1200_1976.png

Are Reimbursements Taxable Paying wages to employees always involves withholding and contributing taxes but with reimbursements it all revolves around accountable and non accountable plans That s because IRS reporting requirements are built around these two types of plans Do expense reimbursements count as income And are reimbursed expenses taxable To answer both questions No For the employee expense reimbursements are not considered income since the reimbursed funds are simply replacing personal funds expended

How to determine whether specific types of benefits or compensation are taxable Procedures for computing the taxable value of fringe benefits Rules for withholding federal income Social Security and Medicare taxes from taxable fringe Reimbursements under an accountable plan are not considered taxable income since they re strictly for substantiated business related expenses within reasonable limits This arrangement benefits both parties by ensuring compliance with IRS guidelines and avoiding additional tax liabilities

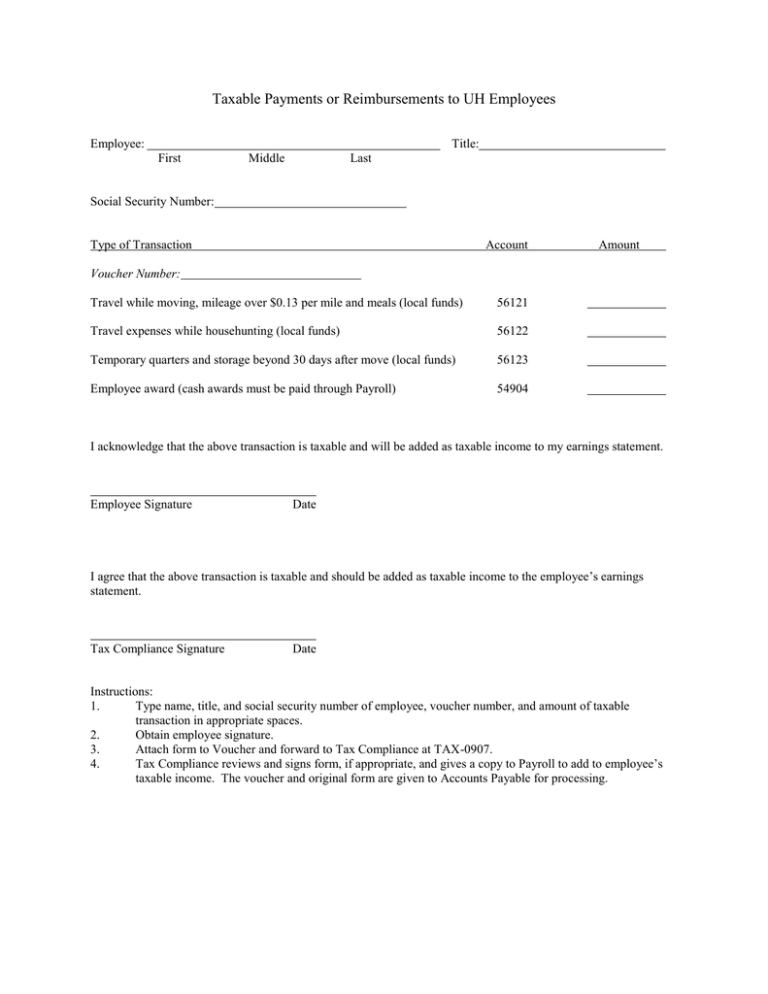

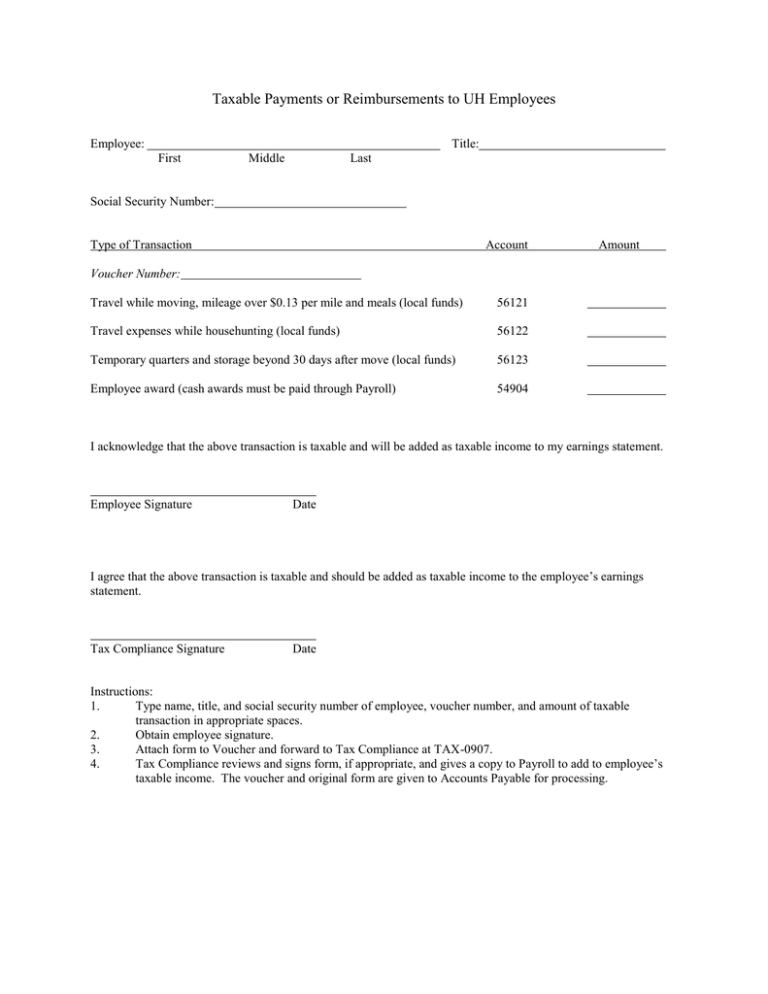

Taxable Payments Or Reimbursements To UH Employees

https://s2.studylib.net/store/data/014545700_1-7e4bdd9328a73bb7934b63bf1f5b95d3-768x994.png

Basic Income And The New Universalism Basic Income Medium

https://cdn-images-1.medium.com/max/2600/1*taxwIeVv_rLX3GbxQHmdDw.jpeg

https://www.irs.gov › publications

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

https://www.pwc.in › assets › pdfs › publications › ...

That such payments are taxable for a variety of reasons relying on India s strong source rule of taxation 1 3 This report seeks to address some typical issues relating to taxability of reimbursements in light of the prevalent tax legislation and the courts rulings in India 1 Foreword

Filling Tax Form Tax Payment Financial Management Corporate Tax

Taxable Payments Or Reimbursements To UH Employees

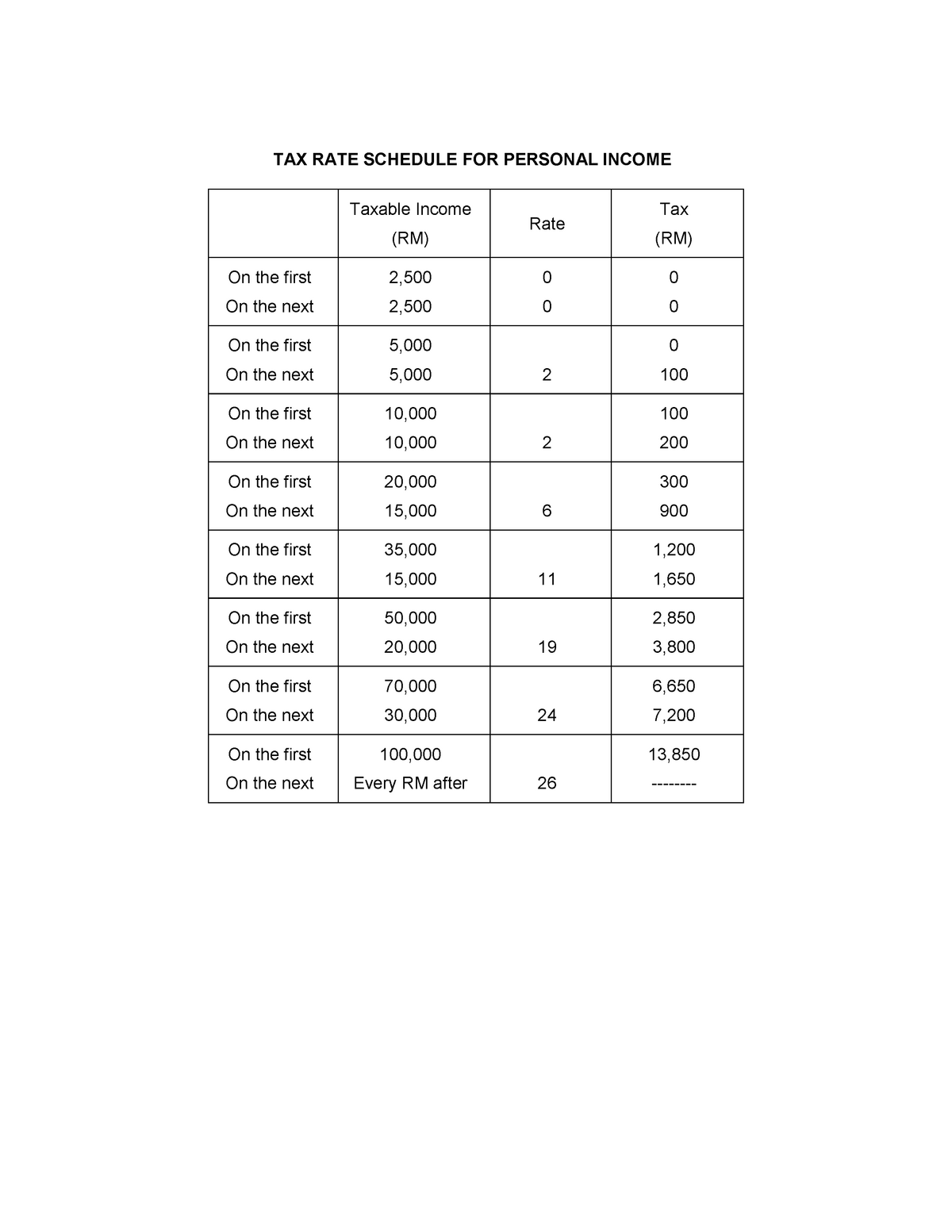

Income TAX Table Dr Salim TAX RATE SCHEDULE FOR PERSONAL INCOME

A Guide To Reimbursement Workstem

Solved He Required Determine The Average Amount Of Taxable Income

Are Reimbursements Taxable How To Handle Surprise Employee Expenses

Are Reimbursements Taxable How To Handle Surprise Employee Expenses

What Is An Allowance What Is A Reimbursement How Are They Treated

What Is Taxable Income Explanation Importance Calculation Bizness

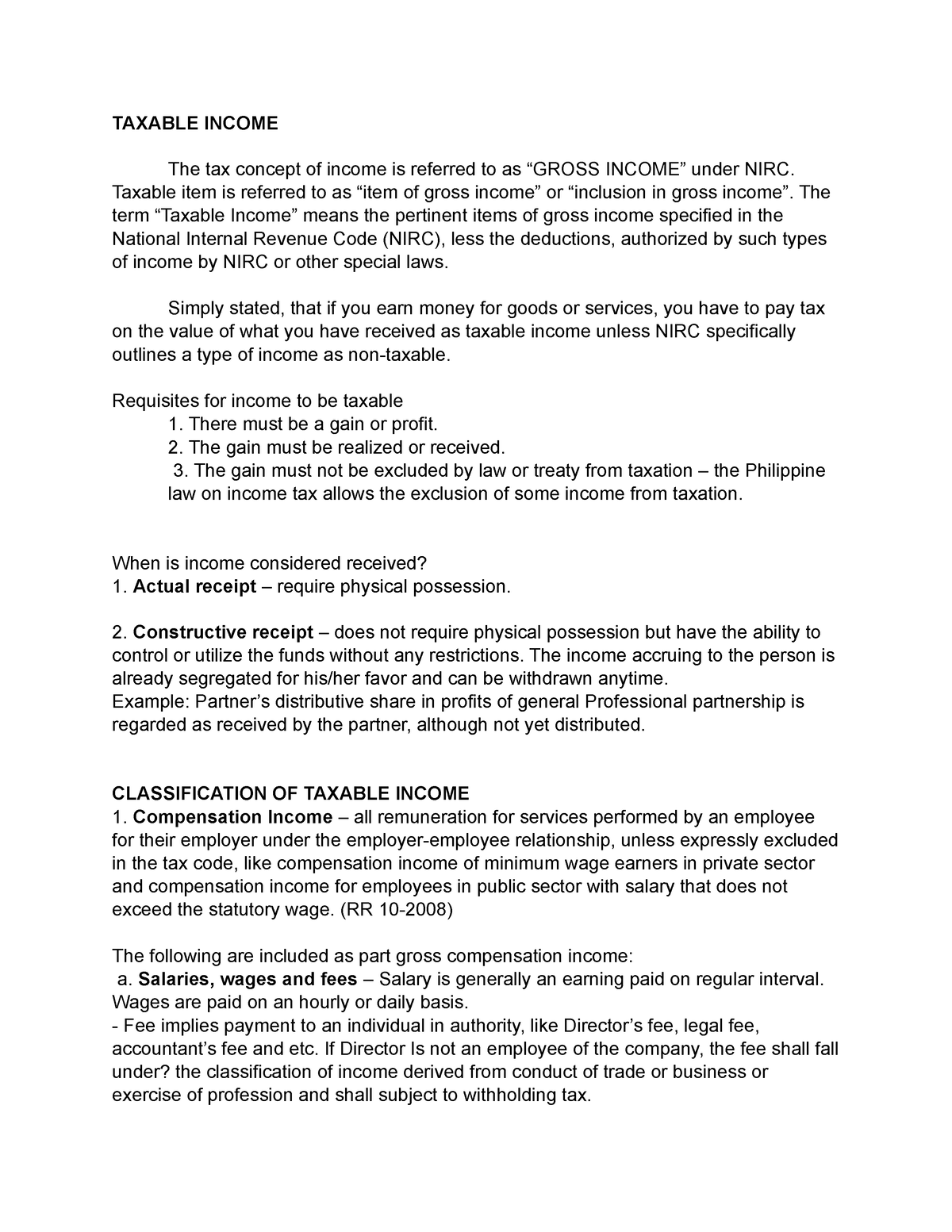

Taxable Income Notes TAXABLE INCOME The Tax Concept Of Income Is

Are Reimbursements Taxable Income - Depending on the type of plan an organization uses expense reimbursements may be considered taxable income for the employee and the employer may be required to report it on the employee s W 2 form There are two types of expense reimbursement plans accountable plans and nonaccountable plans