Are Reimbursements Taxable Income Ato It s an estimate of costs you might incur for expenses or compensation for certain conditions of your employment An allowance is different to a reimbursement A

Is a reimbursement assessable income If your organisation reimburses a volunteer for using their own assets or paying for something on behalf of the organisation the Therefore if you are paid 50 000 a year with 5 000 allowance your total taxable income is 55 000 However while it adds to your total taxable income you can still claim a deduction

Are Reimbursements Taxable Income Ato

Are Reimbursements Taxable Income Ato

https://www.patriotsoftware.com/wp-content/uploads/2017/11/are-reimbursements-taxable-768x432.jpg

Taxable Income Formula Financepal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1.png

Expenses 101 Proper Substantiation Of Business Expenses Justworks

https://images.ctfassets.net/mnc2gcng0j8q/4FzDkYdFDO6aSY6KAO4KiW/cb787dd04f71d673f4da9bb3a8d5a90d/Expenses_101__Proper_Substantiation_of_Business_Expenses.png?w=1800&

Reimbursements are not taxable superable or reportable as income so you don t have to pay it via payroll Many payers do pay via payroll for convenience only because all Based on your summary the items appear to be reimbursements They would be subject to the FBT rules although a nil value or an FBT exemption might apply to some of the

Assessable income under the Income Tax Assessment Act 1936 ITAA Other than living away from home allowances most allowances will fall for consideration under the ITAA On the When an employee pays for something on behalf of the employer such as postage the expense is reimbursed However the reimbursement is currently included in the

Download Are Reimbursements Taxable Income Ato

More picture related to Are Reimbursements Taxable Income Ato

Are Employee Reimbursements Taxable Mesh

https://meshpayments.com/wp-content/uploads/2022/12/profit-700-418-1.png

Are SECA And Income Tax Reimbursements Taxable

https://static.wixstatic.com/media/5d88f9_aadee3f99348416fb26a465a8aced68d.jpg/v1/fill/w_1000,h_909,al_c,q_85,usm_0.66_1.00_0.01/5d88f9_aadee3f99348416fb26a465a8aced68d.jpg

Unlocking Tax Benefits ATO Regulations On Rental Expenses

https://www.bloomwealth.com.au/wp-content/uploads/2023/05/guidelines-from-ato-1024x683.jpg

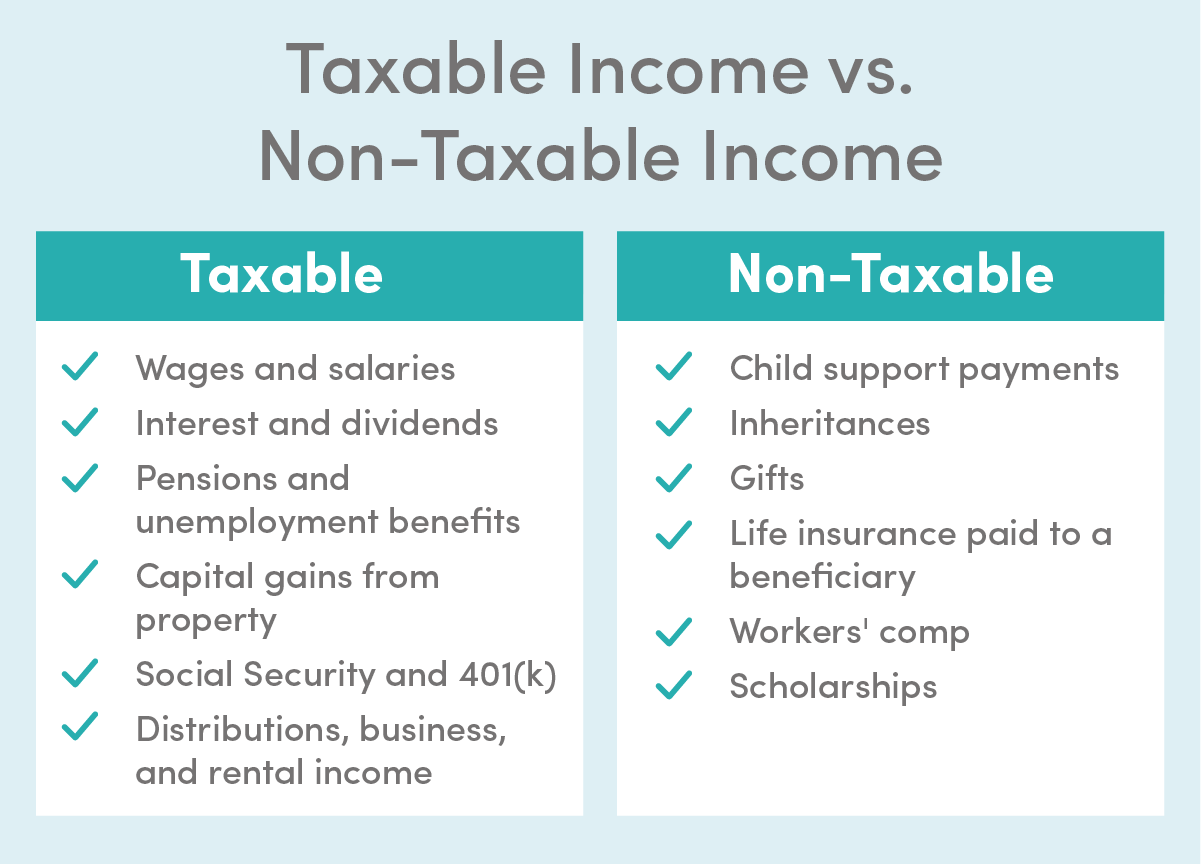

Reimbursements are generally not considered taxable income for employees However they have to meet three main criteria if they re to be considered legitimate business related reimbursements As you might expect Where your compensation payment includes an amount that is a refund or reimbursement of adviser fees and these fees were previously claimed a tax deduction by

On the one hand allowances The employee may be able to claim a deduction against the allowance for a work related expense incurred On the other hand reimbursements The employee will not be able to claim a tax deduction for Are reimbursements taxable income In general reimbursements are not considered taxable income when they are made for genuine work related expenses which

Are Moving Reimbursements Taxable

https://www.payrollpartners.com/wp-content/uploads/2022/08/August-31-2022-2048x1365.jpg

What Is Taxable Income 2023

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

https://www.ato.gov.au › individuals-and-families › ...

It s an estimate of costs you might incur for expenses or compensation for certain conditions of your employment An allowance is different to a reimbursement A

https://www.ato.gov.au › ... › reimbursements

Is a reimbursement assessable income If your organisation reimburses a volunteer for using their own assets or paying for something on behalf of the organisation the

Are QSEHRA Reimbursements Taxable

Are Moving Reimbursements Taxable

Employee Expense Reimbursement 101 What You Need To Know Rosenberg

Are The Reimbursements For The Closing Costs For A Relocation Taxable

Sole Trader Tax Rate This Is How Much You ll Pay In 2022

What Counts As Taxable And Non Taxable Income For 2023 The Official

What Counts As Taxable And Non Taxable Income For 2023 The Official

Dealing With Employee Expenses Identifying Setting Limits Proper

Wanderly Travel Nurse Tax Guide Tax Guide Travel Nursing Tax

Blog Paper Trails HR Payroll Services Maine

Are Reimbursements Taxable Income Ato - When an employee pays for something on behalf of the employer such as postage the expense is reimbursed However the reimbursement is currently included in the