Do Reimbursements Count As Income Are Reimbursements Taxable Income When a reimbursement is paid to an employee or the business it must be properly recorded for it to be considered nontaxable For instance on an employee s pay stub a reimbursement must be noted as such and not merely included among the employee s other income

Reimbursements is money that you already made and paid taxes on that you are reimbursed for So no they aren t in your gross income You should include the total income you claim on the invoice and then claim the mileage and parking as expenses if these were solely work related What you declare depends on whether you are

Do Reimbursements Count As Income

Do Reimbursements Count As Income

http://awajis.com/wp-content/uploads/2020/04/Do-Student-Loans-Count-As-Income_.png

https://blog.faradars.org/wp-content/uploads/2021/03/what-is-tax.jpg

Solved Where Do Reimbursements Go On Chart Of Accounts

https://quickbooks.intuit.com/learn-support/image/serverpage/image-id/44196iD69887BCDA45FF28?v=v2

Do expense reimbursements count as income And are reimbursed expenses taxable To answer both questions No For the employee expense reimbursements are not considered income since the reimbursed funds are simply replacing personal funds expended When to Record Reimbursed Expenses as Revenue If a customer agrees to reimburse you for certain expenses then you can record the reimbursed expenses as revenue The underlying GAAP standard that addresses this issue is the Emerging Issues Task Force EITF issue number 01 14 Income Statement Characterization of Reimbursements

The IRS considers some employee benefits to be taxable income But do employee expense reimbursements fall into that category Learn more Expense reimbursements aren t employee income so they don t need to be reported as such Although the check or deposit is made out to your employee it doesn t count as

Download Do Reimbursements Count As Income

More picture related to Do Reimbursements Count As Income

Basic Income And The New Universalism Basic Income Medium

https://cdn-images-1.medium.com/max/2600/1*taxwIeVv_rLX3GbxQHmdDw.jpeg

Solved Where Do Reimbursements Go On Chart Of Accounts

https://quickbooks.intuit.com/learn-support/image/serverpage/image-id/44193iFB0C1BE37AA08759?v=v2

Income Stream Stock Illustrations 454 Income Stream Stock Clip Art

https://clipart-library.com/2023/27b47ca29ec3a8660d15ca576166f48f.jpg

The money employers pay employees as reimbursement for substantiated business expenses is not subject to employment tax or income tax A business expense reimbursement occurs when the employer refunds business expenses initially paid by employees When you work on your Schedule C to report your income and expenses as an independent contractor you will report the full amount as income when you enter the Form 1099 MISC Then you will include the amounts that were reimbursed to you as an expense

If your business uses an accountable plan reimbursements are not taxable You do not have to withhold or contribute income FICA or unemployment taxes To have an accountable plan your employees must meet all three of the following rules Expense reimbursements generally do not count as income on a 1099 unless the payer does not use an accountable plan An accountable plan requires substantiation such as receipts to prove that expenses were incurred for business purposes

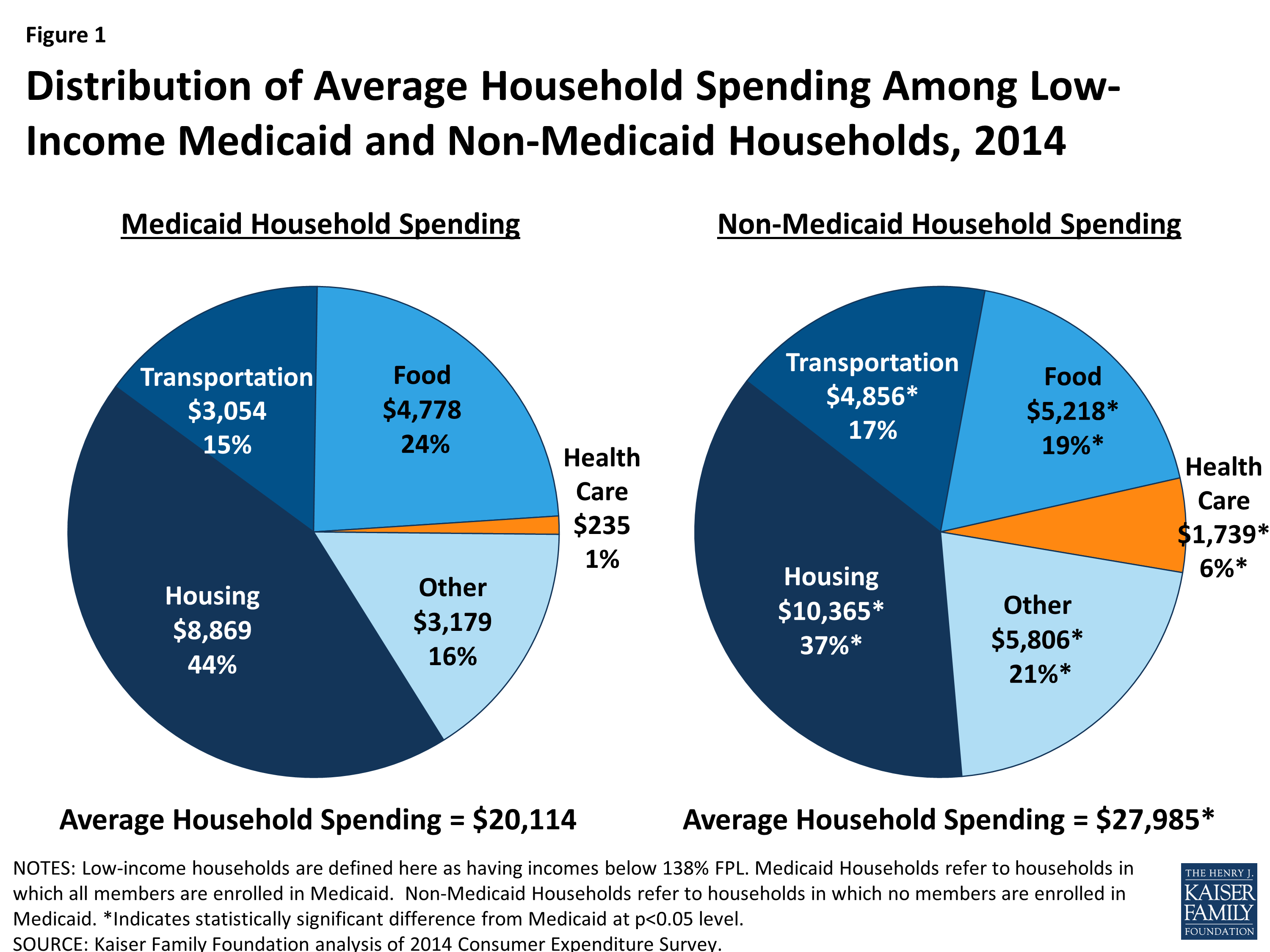

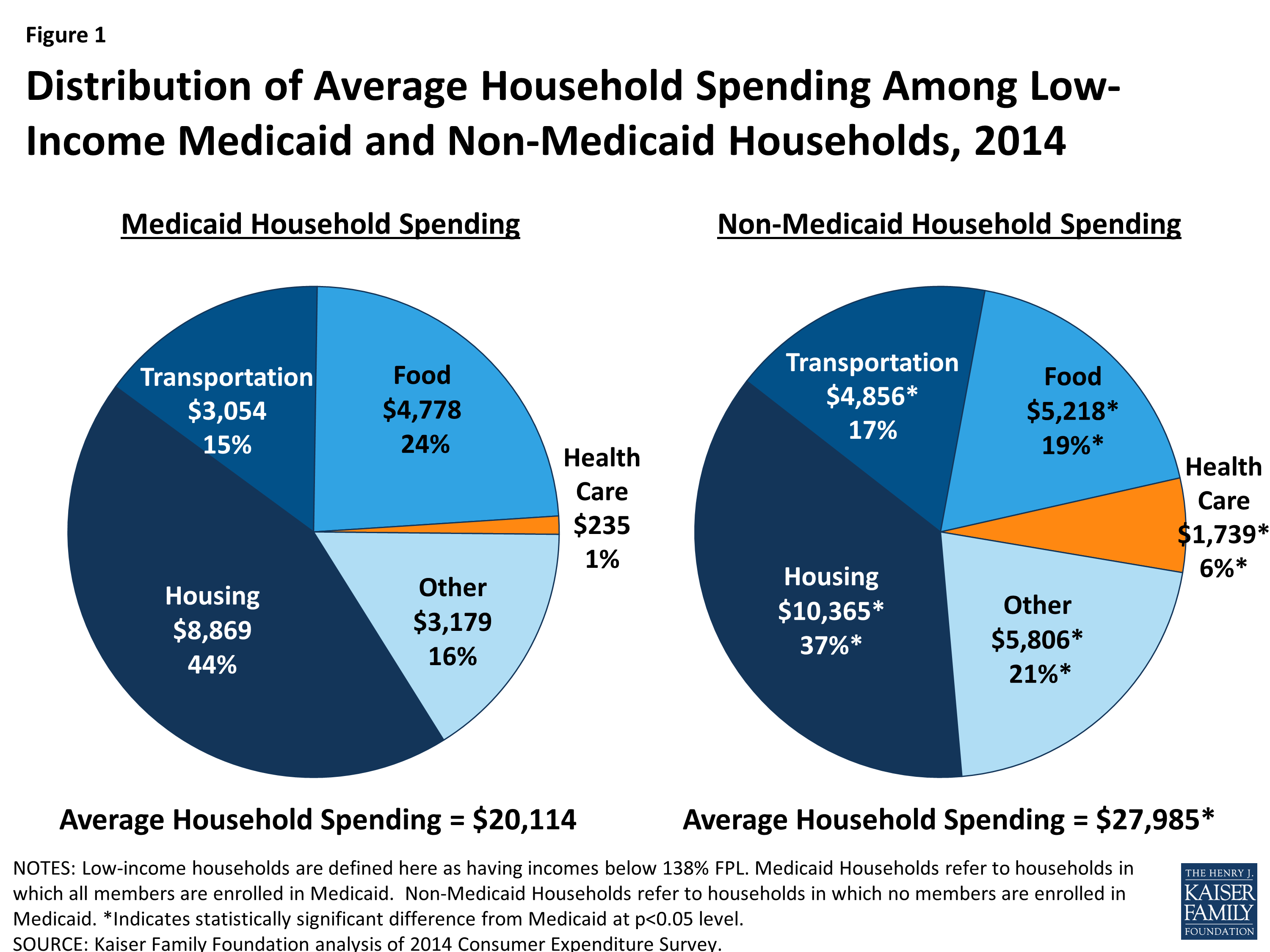

Health Care Spending Among Low Income Households With And Without

https://www.kff.org/wp-content/uploads/2016/02/8832-figure-1.png

NYC Owes Child Care Providers Millions In Reimbursements

https://nypost.com/wp-content/uploads/sites/2/2022/09/nyc-delays-payments-early-ed-001.jpg?quality=75&strip=all&w=1535

https://bizfluent.com

Are Reimbursements Taxable Income When a reimbursement is paid to an employee or the business it must be properly recorded for it to be considered nontaxable For instance on an employee s pay stub a reimbursement must be noted as such and not merely included among the employee s other income

https://www.reddit.com › personalfinance › comments › ...

Reimbursements is money that you already made and paid taxes on that you are reimbursed for So no they aren t in your gross income

The Income Streams Community Lagos

Health Care Spending Among Low Income Households With And Without

How To Do Reimbursements In Quickbooks Scribe

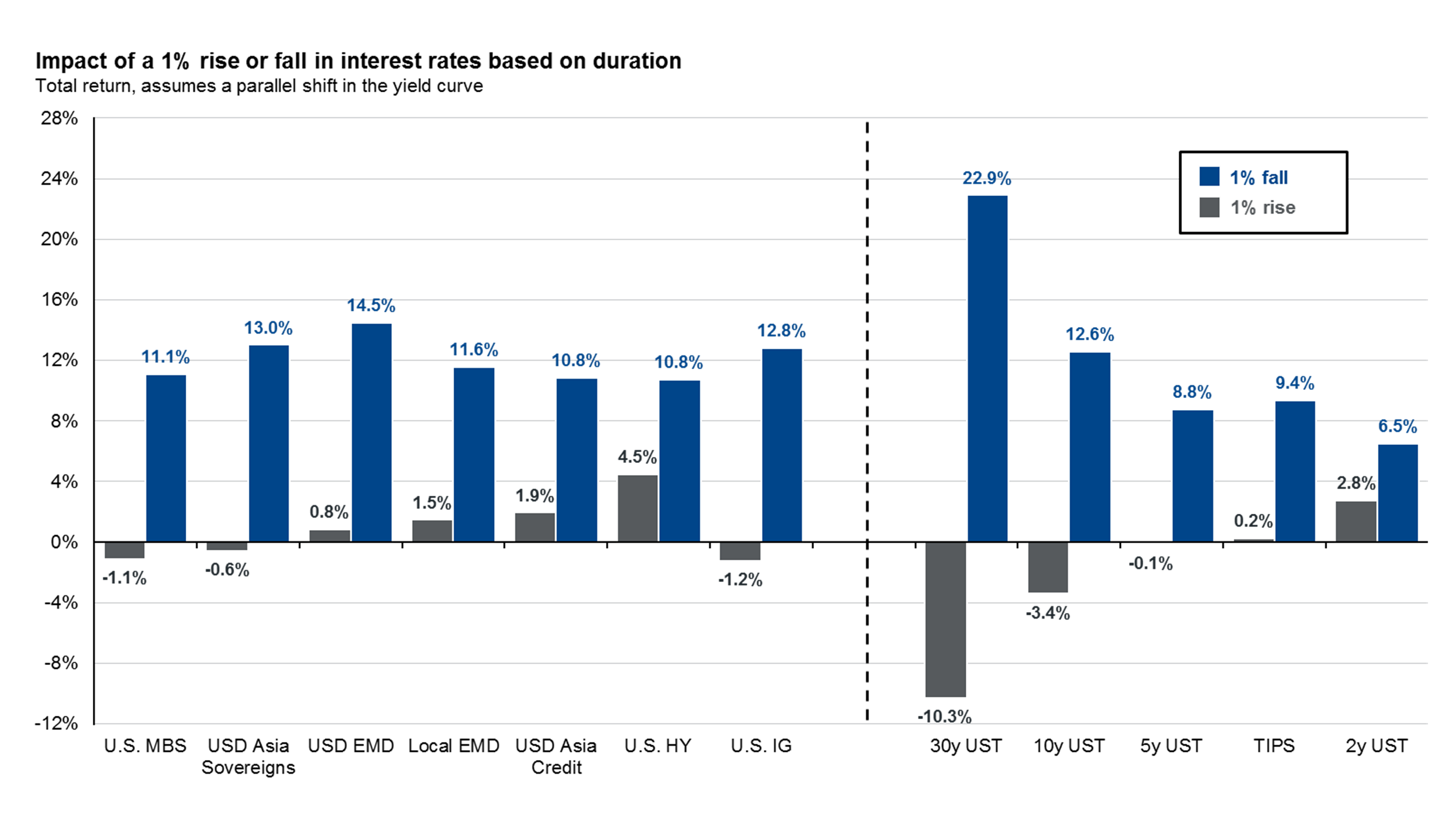

Global Fixed Income Yields And Risks

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

Outstanding 26as Of Income Tax Act Balance Sheet A Level Business

Outstanding 26as Of Income Tax Act Balance Sheet A Level Business

Income Tax Practitioner Dhaka

Foreign Income Tax Offset Tax Warning

5 Reasons You Should File Income Tax Return Even If You Don t Have

Do Reimbursements Count As Income - Expense reimbursements aren t employee income so they don t need to be reported as such Although the check or deposit is made out to your employee it doesn t count as