Do Mileage Reimbursements Count As Income If the employer pays a mileage rate equal to or less than the 2024 IRS business rate and properly tracks mileage the payments are tax free If the rate exceeds the federal

Are mileage reimbursements tax deductible Yes reimbursements based on the federal mileage rate are tax deductible And since they aren t considered income they re non taxable for your If your mileage reimbursement does not meet the IRS accountable plan requirements it will be taxed as income Here are some specific instances where reimbursement is taxed

Do Mileage Reimbursements Count As Income

Do Mileage Reimbursements Count As Income

https://www.ggkccpa.com/wp-content/uploads/2022/06/GGK-Increased-Optional-Standard-Mileage-Rates-1.png

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Does Mileage Reimbursement Count As Income Teamworks Group

https://static.wixstatic.com/media/9ebf87_acd1f15d388f489b84598c26427ea5d5~mv2.jpg/v1/fit/w_1000%2Ch_1000%2Cal_c%2Cq_80/file.jpg

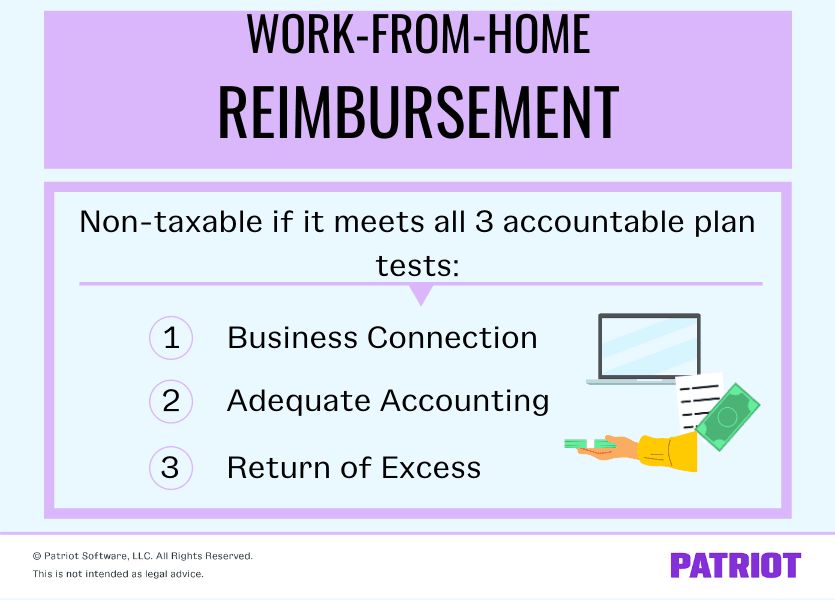

While they re not required by the IRS accountable plans help you set criteria that comply with IRS regulations on what reimbursements are deductible and what reimbursements count as taxable income Additionally mileage reimbursements are not considered income by the IRS and therefore are nontaxable provided the reimbursement is equal to the incurred

If your mileage reimbursement exceeds the IRS rate the difference is considered taxable income Comparably if your employer uses the IRS rate but does In other words reimbursement payments under or at the IRS limit do not count toward an employee s taxable income Because there s no federal law enforcing mileage

Download Do Mileage Reimbursements Count As Income

More picture related to Do Mileage Reimbursements Count As Income

Does VA Disability Count As Income CCK Law

https://cck-law.com/wp-content/uploads/2022/02/Does-VA-Disability-Count-as-Income_.jpg

Mileage Reimbursements And Errands V 22 YouTube

https://i.ytimg.com/vi/Z5MJbSh5svo/maxresdefault.jpg

Standard Mileage Rate Method Archives

https://falconexpenses.com/blog/wp-content/uploads/2019/02/MileageExpenseLog_Falcon.png

Reimbursements based on the federal mileage rate aren t considered income making them nontaxable to your employees Businesses can deduct those Simply put if you use the IRS standard mileage rate your employees reimbursements will be tax free If you want to reimburse them for other vehicle

Mileage reimbursement is a compensation process through which employees are reimbursed for using their personal vehicles during work related activities such as going If done under an accountable plan these reimbursements are not considered taxable income The Internal Revenue Service sets a standard mileage

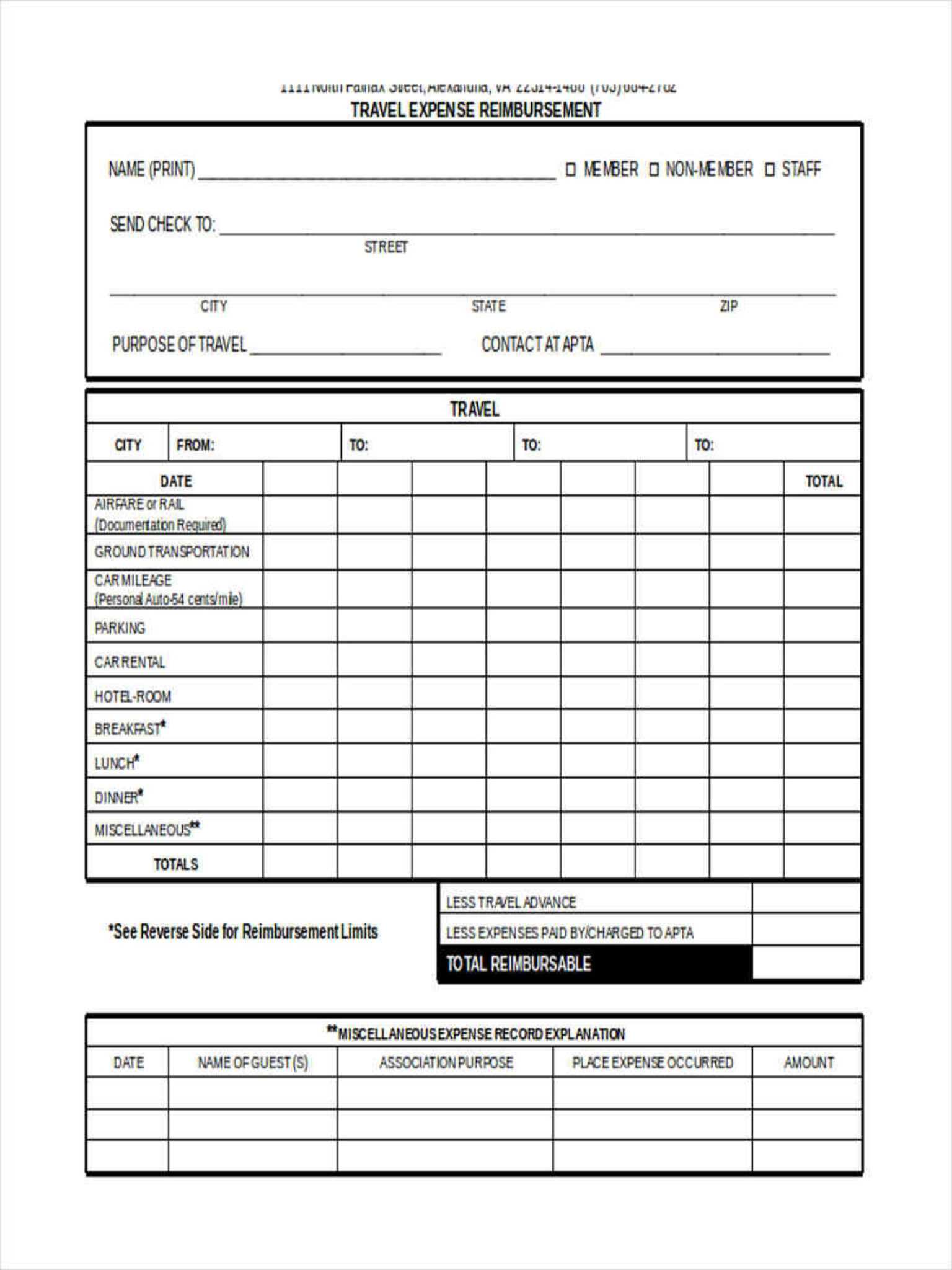

Nalp Fillable Travel Expense Form Printable Forms Free Online

https://pray.gelorailmu.com/wp-content/uploads/2020/01/033-travel-expense-reimbursement-form-template-ideas-report-with-reimbursement-form-template-word-1536x2048.jpg

What Is The Medicare Reimbursement Rates By Cpt Code

https://i1.wp.com/therathink.com/wp-content/uploads/2019/10/Untitled.png?w=1135&ssl=1

https://www.mburse.com/blog/is-a-mileage-reimbursement-taxable

If the employer pays a mileage rate equal to or less than the 2024 IRS business rate and properly tracks mileage the payments are tax free If the rate exceeds the federal

https://www.uschamber.com/co/run/finance/e…

Are mileage reimbursements tax deductible Yes reimbursements based on the federal mileage rate are tax deductible And since they aren t considered income they re non taxable for your

Cardata IRS Rules For Mileage Reimbursements

Nalp Fillable Travel Expense Form Printable Forms Free Online

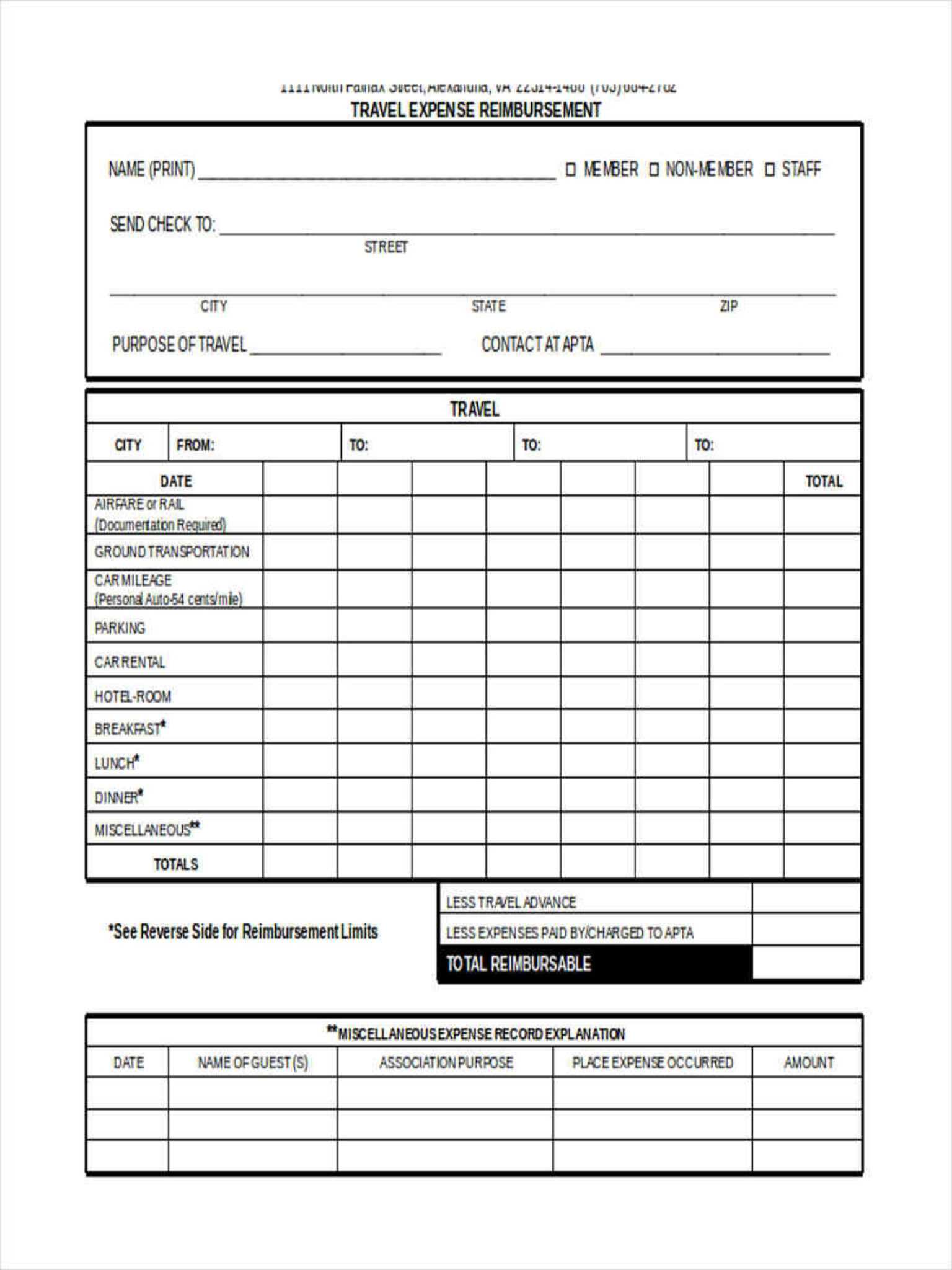

Printable Mileage Reimbursement Form Printable Forms Free Online

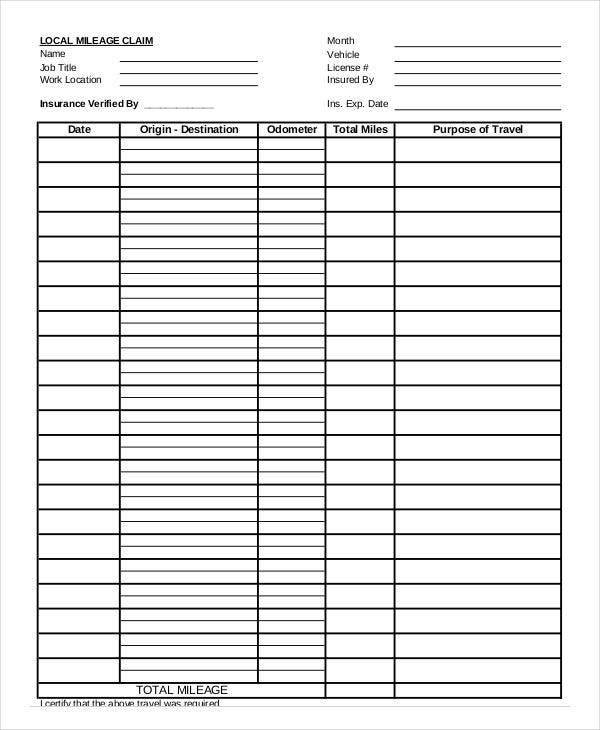

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

Do Reimbursements Count As Income On 1099 Just Wanted To Know In Case

Employee Travel Per Diem Request Ppt Download

Employee Travel Per Diem Request Ppt Download

150 Excel Mileage Calculator Page 5 Free To Edit Download Print

Everything You Need To Know About Mileage Reimbursements

Work from home Reimbursement Definition Taxes Policy

Do Mileage Reimbursements Count As Income - A mileage reimbursement is not taxable as long as it does not exceed the IRS mileage rate the 2023 rate is 65 5 cents per business mile If the mileage rate exceeds the IRS