Are Discounts Taxable Income Verkko 20 marrask 2017 nbsp 0183 32 Any discount exceeding the threshold is taxable income to the employee To be qualified the services or property excluding real estate or

Verkko 15 lokak 2019 nbsp 0183 32 It is not taxable because the transaction is not a barter transaction The discount is not offered in exchange for a specific thing like an amount of work It is Verkko 1 elok 2022 nbsp 0183 32 If the discount brings the price paid by the employee below the cost the goods or services would be to provide a taxable benefit under the benefits code will

Are Discounts Taxable Income

Are Discounts Taxable Income

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280-1024x769.png

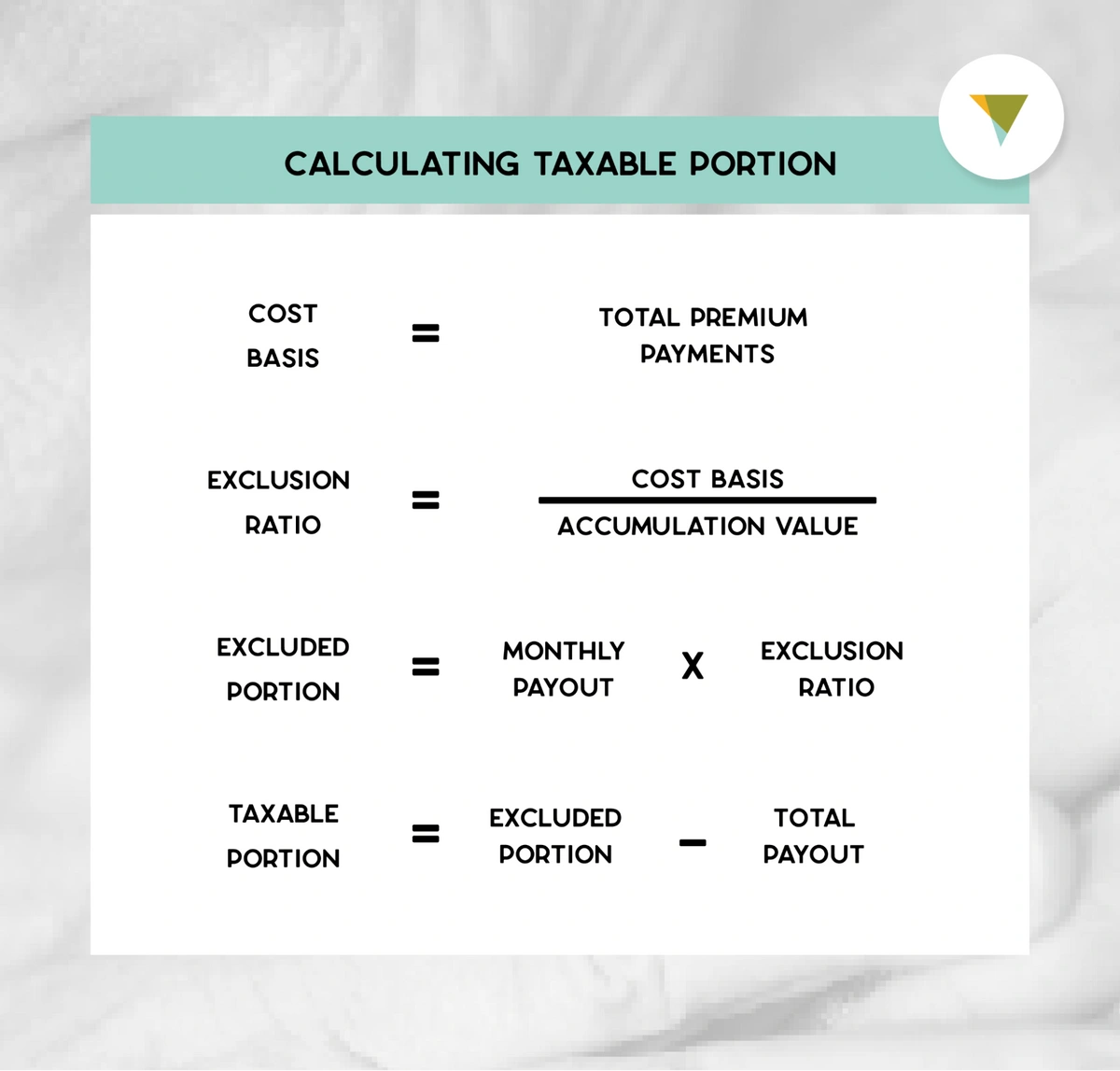

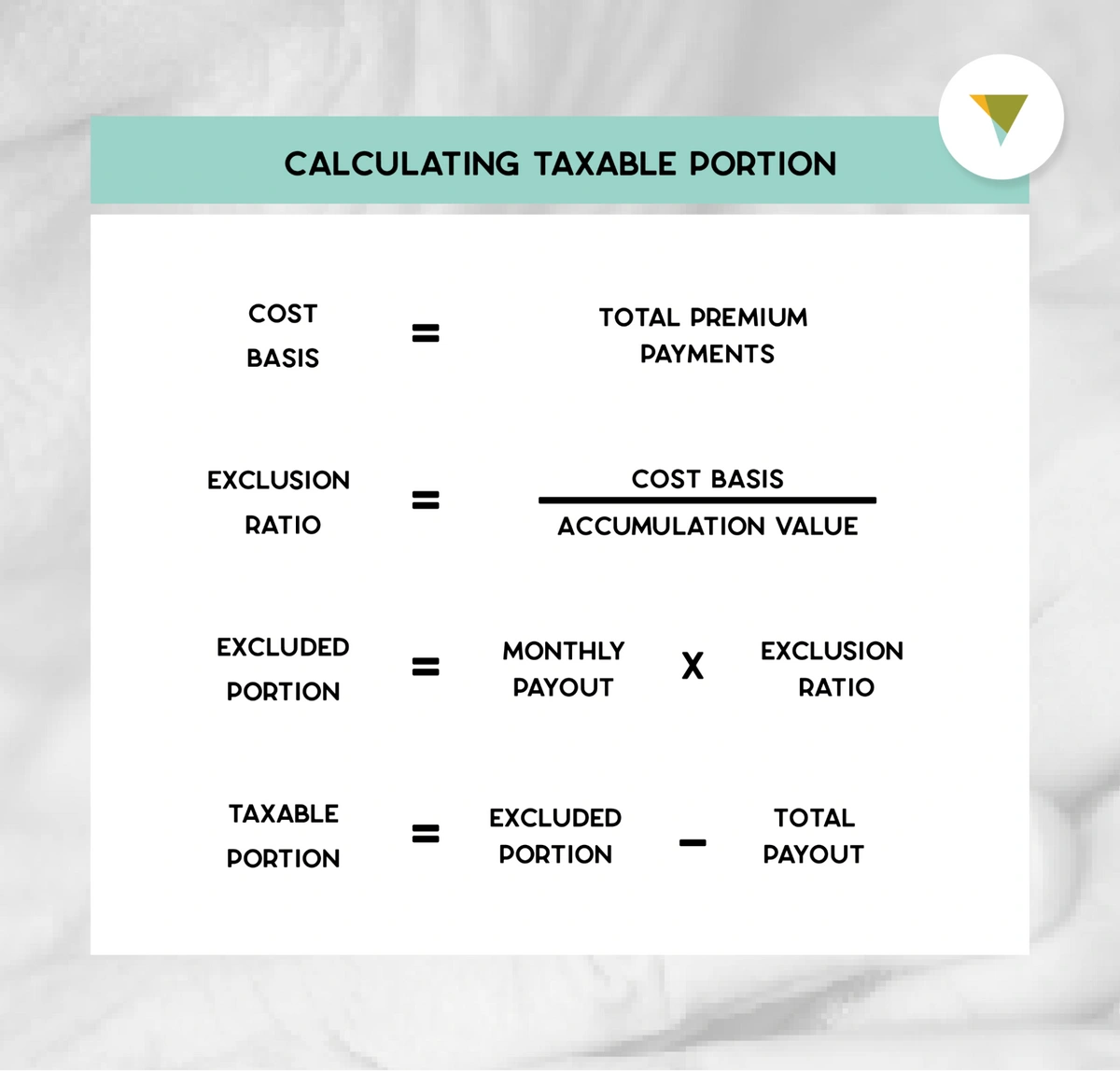

How To Calculate The Taxable Income Of An Annuity

https://cdn.buttercms.com/XcS30FnbSIuKWap6KZ6w

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg

Verkko 1 marrask 2023 nbsp 0183 32 Taxable income comes from compensation businesses partnerships and royalties among others Taxable income is generally less than adjusted gross Verkko 28 lokak 2022 nbsp 0183 32 That puts your taxable income at 70 050 that s your AGI of 83 000 minus the 12 950 standard deduction This puts you in the 22 tax bracket

Verkko However the value of any discount provided to an individual who does not fit within the definition of employee for this purpose is taxable income to the employee who Verkko 3 elok 2023 nbsp 0183 32 The benefits are subject to income tax withholding and employment taxes Fringe benefits include cars and flights on aircraft that the employer provides free or

Download Are Discounts Taxable Income

More picture related to Are Discounts Taxable Income

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/780/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

120k Salary Effective Tax Rate V s Marginal Tax Rate MH Tax 2024

https://mh.icalculator.com/img/og/MH/100.png

Income Tax Overview Booklet CIBC Private Wealth Page 2

https://view.publitas.com/39896/1424428/pages/d646d165-01a2-40c3-ab00-9956e1989714-at1600.jpg

Verkko 19 lokak 2023 nbsp 0183 32 Key Takeaways Income received as wages salaries commissions rental income royalty payments stock options dividends and interest and self Verkko 30 syysk 2023 nbsp 0183 32 Gross income is all income from all sources that isn t specifically tax exempt under the Internal Revenue Code Taxable income starts with gross income

Verkko 1 syysk 2017 nbsp 0183 32 Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount Verkko 1 syysk 2017 nbsp 0183 32 Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

https://bi.icalculator.com/img/og/BI/100.png

https://www.bdo.com/insights/tax/irs-clarifies-rules-on-employee...

Verkko 20 marrask 2017 nbsp 0183 32 Any discount exceeding the threshold is taxable income to the employee To be qualified the services or property excluding real estate or

https://money.stackexchange.com/questions/115826/are-friends-and...

Verkko 15 lokak 2019 nbsp 0183 32 It is not taxable because the transaction is not a barter transaction The discount is not offered in exchange for a specific thing like an amount of work It is

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

Filling Tax Form Tax Payment Financial Management Corporate Tax

Solved Please Note That This Is Based On Philippine Tax System Please

Extra Income

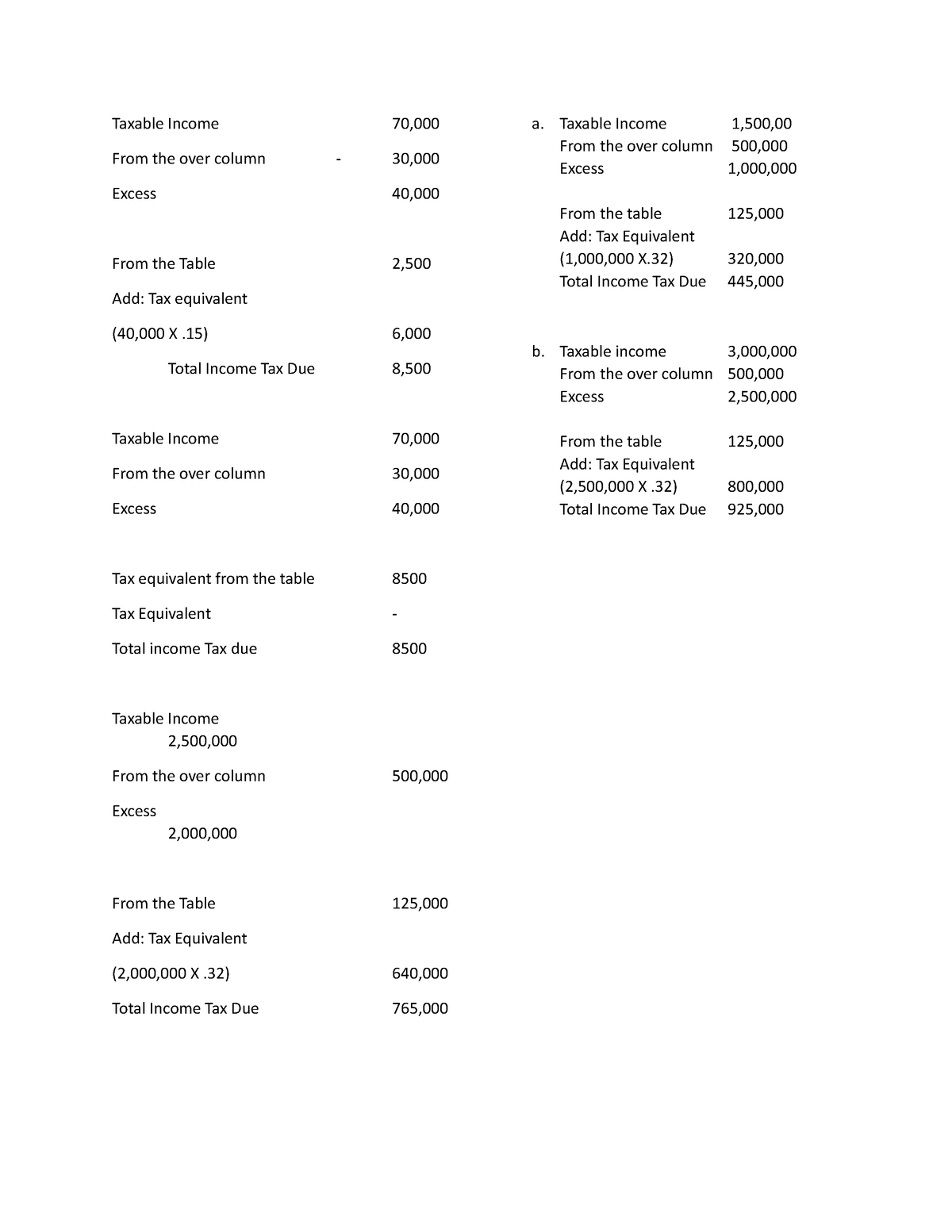

Taxable Income Notes Taxable Income 70 Taxable Income 70 From The

All things spatial November 2016

All things spatial November 2016

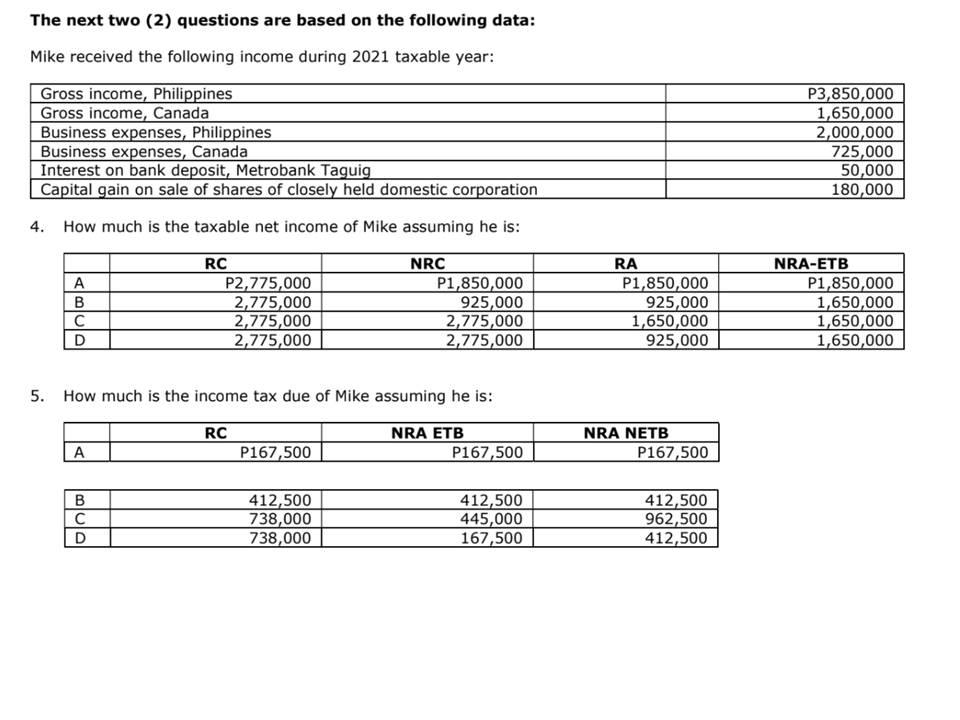

The Next Two 2 Questions Are Based On The Following Chegg

15 Best Tips For High Earners To Reduce Taxable Income 2024 Playbook

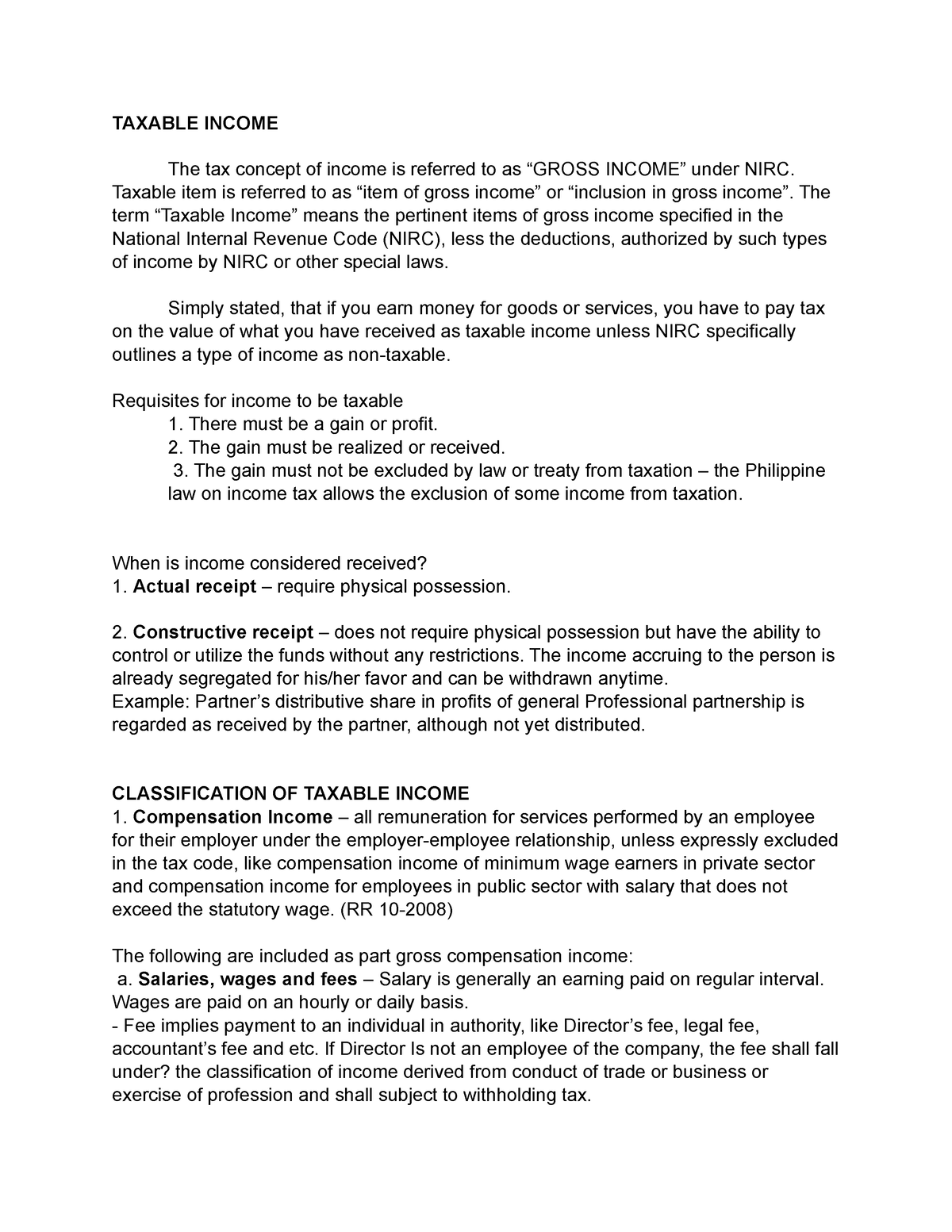

Taxable Income Notes TAXABLE INCOME The Tax Concept Of Income Is

Are Discounts Taxable Income - Verkko 3 elok 2023 nbsp 0183 32 The benefits are subject to income tax withholding and employment taxes Fringe benefits include cars and flights on aircraft that the employer provides free or