Are Discounts Taxable Any discount exceeding the threshold is taxable income to the employee To be qualified the services or property excluding real estate or investment property must be offered for sale to customers in the ordinary course of the employer s business in which the employee normally works

Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount exclusion does not apply to property or services provided by a different employer through a reciprocal agreement to provide discounts to employees of the other employer If you claim the 100 you WOULD HAVE received as income then you can deduct the 20 discount Its more common to report the 80 you received as income You cannot report income of 80 and the 20 discount given

Are Discounts Taxable

Are Discounts Taxable

https://i.pinimg.com/736x/72/fb/1b/72fb1b32b23fe54f8624e49b499ee52d.jpg

SIP Law Firm Latest Tax Regulation 5 Taxable Services Subject

https://siplawfirm.id/wp-content/uploads/2022/12/tax.jpg

What Amount Is Subject To VAT

https://blog.taxworld.ie/hubfs/taxable amount.jpg#keepProtocol

The IRS Office of Chief Counsel released Memorandum 20171202F on March 24 2017 that walks through the process of determining whether an employer s friends and family discounts are taxable or non taxable It outlines and discusses qualified employee discounts as it relates to services You ve on the right track with apply discounts to a taxable item You ll need to use a discount line item if you need to apply a discount to one or more items You need to create a discount item first before apply it on the invoice Here s how Click the Lists menu and select Item List from the drop down menu in QuickBooks

Therefore a neutral sales tax should deduct coupon amounts before calculating tax so that discounts by coupon are treated uniformly with discounts by other methods Are taxes levied on the original price or the discounted amount How are taxes applied for different types of discounts What are the responsibilities of sellers and customers What role does technology play This article tackles these questions and more Let s get started Sales tax basics

Download Are Discounts Taxable

More picture related to Are Discounts Taxable

Salary Received By A Member Of Parliament Is Taxable Under The Head

https://ttplimages.imgix.net/tax-practice-images/IT-OS-R-1.jpg?w=1200

Discount Reports Eposability

https://k-series-support.lightspeedhq.com/hc/article_attachments/4403634127003/Discounts_and_Corrections.png

30 Percent Discount Clip Art Image Gallery Yopriceville High Clip

https://clipart-library.com/2023/Discount_Sticker_PNG_Clipart_Picture.png

You might wonder is a discount included in the sales price subject to tax or is it excluded from the tax base Is a coupon included in the sales price Are delivery charges included For example if you re an employer who gives staff a 25 discount on all goods and your mark up is always 75 you can be confident there s no taxable benefit But your costing process for a job should allow you to establish if

[desc-10] [desc-11]

Image Representing Exciting Discounts

https://pics.craiyon.com/2023-09-20/a9015ba9836442cea14df1099c32b7ed.webp

Event Pricing Discounts

https://cc.sj-cdn.net/instructor/8s4121m3bfgc-neon-one-academy/courses/3vfdisgkk0hu0/promo-image.1695666502.png

https://www.bdo.com/insights/tax/irs-clarifies...

Any discount exceeding the threshold is taxable income to the employee To be qualified the services or property excluding real estate or investment property must be offered for sale to customers in the ordinary course of the employer s business in which the employee normally works

https://www.thetaxadviser.com/issues/2017/sep/irs...

Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount exclusion does not apply to property or services provided by a different employer through a reciprocal agreement to provide discounts to employees of the other employer

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Image Representing Exciting Discounts

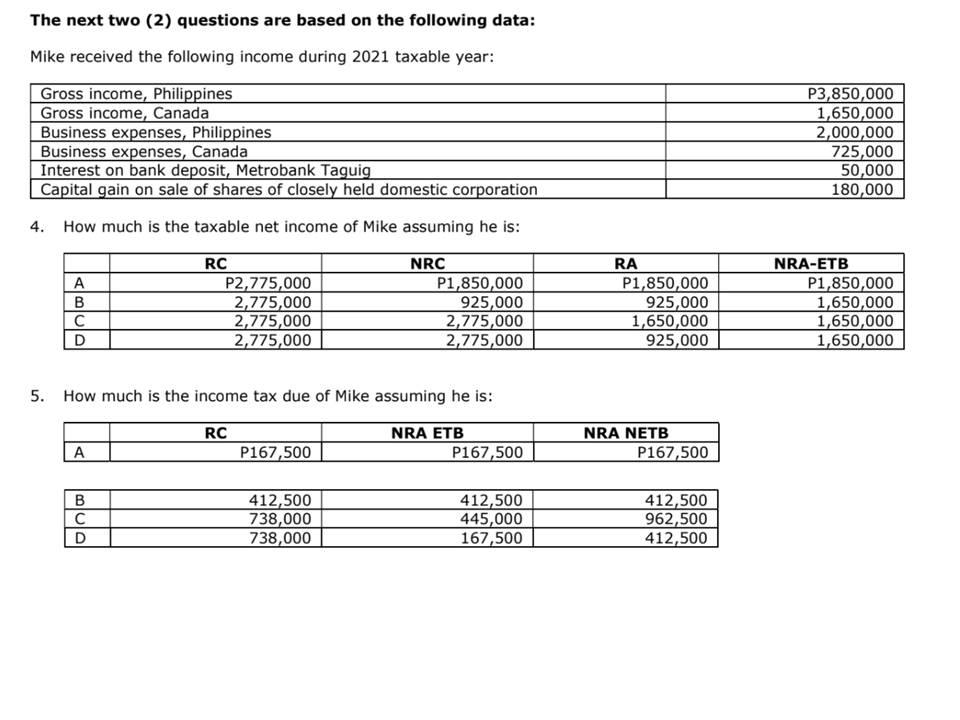

Solved Please Note That This Is Based On Philippine Tax System Please

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

All things spatial November 2016

Which Of These Two Tax Tips Is Best For A Retiree Ant Book

Which Of These Two Tax Tips Is Best For A Retiree Ant Book

The Next Two 2 Questions Are Based On The Following Chegg

What Is Taxable Income And How To Calculate Taxable Income

Apprintable Deals 2023 55 Off Topdealspy

Are Discounts Taxable - The IRS Office of Chief Counsel released Memorandum 20171202F on March 24 2017 that walks through the process of determining whether an employer s friends and family discounts are taxable or non taxable It outlines and discusses qualified employee discounts as it relates to services