Are Employee Discounts Taxable Income Verkko 1 syysk 2017 nbsp 0183 32 Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount

Verkko 20 marrask 2017 nbsp 0183 32 Any discount exceeding the threshold is taxable income to the employee To be qualified the services or property excluding real estate or Verkko 3 elok 2023 nbsp 0183 32 The benefits are subject to income tax withholding and employment taxes Fringe benefits include cars and flights on aircraft that the employer provides

Are Employee Discounts Taxable Income

Are Employee Discounts Taxable Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

Unrelated Business Taxable Income

https://swcllp.com/wp-content/uploads/2022/08/UBTI-Header-940x675.png

Income Tax Deadlines Are Normalizing But Not All Deductions Are

https://cdn-res.keymedia.com/cms/images/ca/155/0394_637792028600257200.jpg

Verkko 1 elok 2022 nbsp 0183 32 If the discount brings the price paid by the employee below the cost the goods or services would be to provide a taxable benefit under the benefits Verkko 24 tammik 2023 nbsp 0183 32 Yes When the person receiving an incentive or reward is an employee employers should withhold taxes on the value of the gift The IRS gives employers the option of withholding taxes at

Verkko What s New Cents per mile rule The business mileage rate for 2023 is 65 5 cents per mile You may use this rate to reimburse an employee for business use of a personal Verkko 1 syysk 2017 nbsp 0183 32 Sec 132 a 2 allows employers to provide a qualified employee discount that is excludable from an employee s taxable income A qualified employee discount is defined under Sec 132 c

Download Are Employee Discounts Taxable Income

More picture related to Are Employee Discounts Taxable Income

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280.png

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg

Income Tax Overview Booklet CIBC Private Wealth Page 2

https://view.publitas.com/39896/1424428/pages/d646d165-01a2-40c3-ab00-9956e1989714-at1600.jpg

Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 Fringe benefits may be taxed at the employee s income tax rate or the employer may elect to withhold a flat supplemental wage rate of 22 on the benefit s Verkko Published 22 May 2014 Updated 4 April 2022 see all updates Contents EIM20000 EIM21600 EIM21602 EIM21704 Particular benefits discounts Section 203 2

Verkko If your employer sells you property or services at a discount you may be able to exclude the amount of the discount from your income The exclusion applies to discounts on Verkko 15 lokak 2019 nbsp 0183 32 It is not taxable because the transaction is not a barter transaction The discount is not offered in exchange for a specific thing like an amount of work It is

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

Employee Discount Definition Types And Examples Marketing91

https://www.marketing91.com/wp-content/uploads/2022/12/Employee-Discount.jpg

https://www.thetaxadviser.com/issues/2017/sep/irs-reminders-emplo…

Verkko 1 syysk 2017 nbsp 0183 32 Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount

https://www.bdo.com/insights/tax/irs-clarifies-rules-on-employee...

Verkko 20 marrask 2017 nbsp 0183 32 Any discount exceeding the threshold is taxable income to the employee To be qualified the services or property excluding real estate or

60k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Filling Tax Form Tax Payment Financial Management Corporate Tax

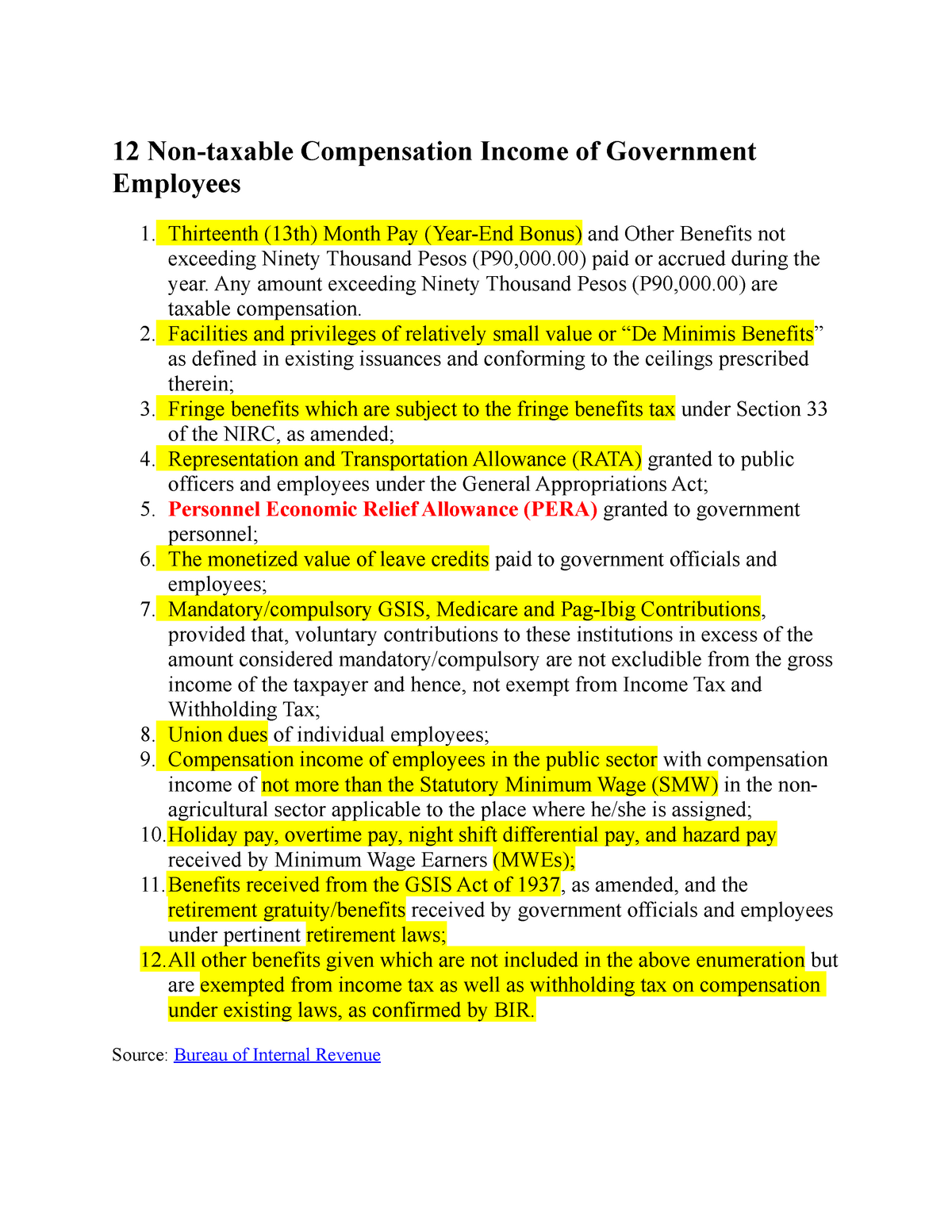

Solved Please Note That This Is Based On Philippine Tax System Please

Quinte Bookkeeping Income Tax Service Deseronto ON

Extra Income

Write Off An Employee s Loan Tax Tips Galley And Tindle

Write Off An Employee s Loan Tax Tips Galley And Tindle

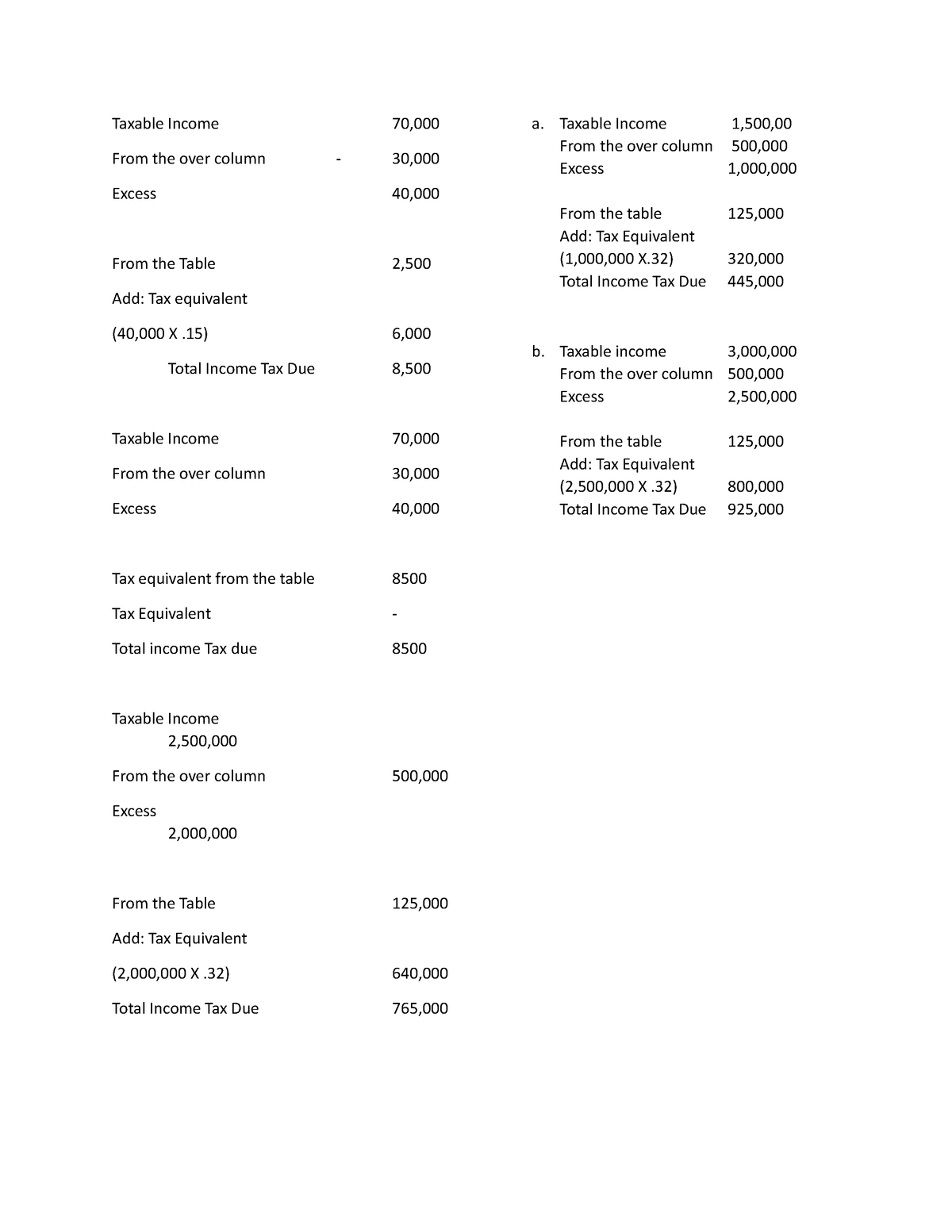

Taxable Income Notes Taxable Income 70 Taxable Income 70 From The

Calculate My Income Tax SuellenGiorgio

8 Brilliant Passive Income Ideas With No Money Passive Income Wise

Are Employee Discounts Taxable Income - Verkko 21 marrask 2022 nbsp 0183 32 Again employee discounts are taxable if they exceed the IRS limits Discount amounts in excess of the IRS limits are subject to income Social