Mini Split Tax Rebate 2024 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

Mini Split Tax Rebate 2024

Mini Split Tax Rebate 2024

https://www.myqualitycomfort.com/wp-content/uploads/2021/01/mini-split-tax-credit-1024x1024.png

Mitsubishi Mini Split Rebates 2023 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/mitsubishi-mini-split-rebates-by-state-2022-printable-rebate-form.png

Ductless Mini Split HP Rebate

https://rebates.energysavepa.com/hubfs/Rebates Website Redesign 2022/Rebate Products/AdobeStock_184753163_resize_crop.jpg

IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property Product Rebate Finder Enter your zip code to find rebates and other special offers on ENERGY STAR certified products available in your area mini multi split Systems Offer valid 01 01 2023 through 12 31 2032 Other restrictions may apply please visit the website for additional details There is also a tax credit of up to 250

Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits Independently certified to save energy ENERGY STAR products are a smart investment for energy efficiency you can Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Download Mini Split Tax Rebate 2024

More picture related to Mini Split Tax Rebate 2024

EMI Mini Split System Rebates N N Supply Company Inc Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/emi-mini-split-system-rebates-n-n-supply-company-inc.jpg?fit=1221%2C1506&ssl=1

Eversource Mini Split Rebates PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/residential-hvac-rebates.jpg?fit=927%2C1200&ssl=1

Fill Free Fillable Form 2021 Residential Mini split Heat Pump Rebate Form Mass Save PDF Form

https://var.fill.io/uploads/pdfs/html/fa7ff98f-3830-4823-9500-9d5537b3b0c9/bg2.png

Managing Energy Savings Residential homes with energy reduction of 35 are eligible for maximim rebate of 4 000 What you need to know Nonbusiness Energy Property Credit Tax Section 25C Effective January 1 2023 this tax credit gives homeowners up to 30 of the total of product and installation costs You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit This tax credit is good for 30 percent of the total cost of what you paid for your heat pump including the cost of labor up to 2 000 and it would be available through the end of 2032 Beyond

Ductless Mini Split AC Rebate

https://rebates.energysavepa.com/hubfs/Rebates Website Redesign 2022/Rebate Products/AdobeStock_276011916_resize.jpg

Mitsubishi Heat Pump Rebates 2022 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/rebates-on-mitsubishi-air-conditioning-ductless-duct-free-mini-split-102.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

https://www.energystar.gov/about/federal_tax_credits

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Mass Save Rebate Mini Split 2022 Mass Save Rebate Rebate2022

Ductless Mini Split AC Rebate

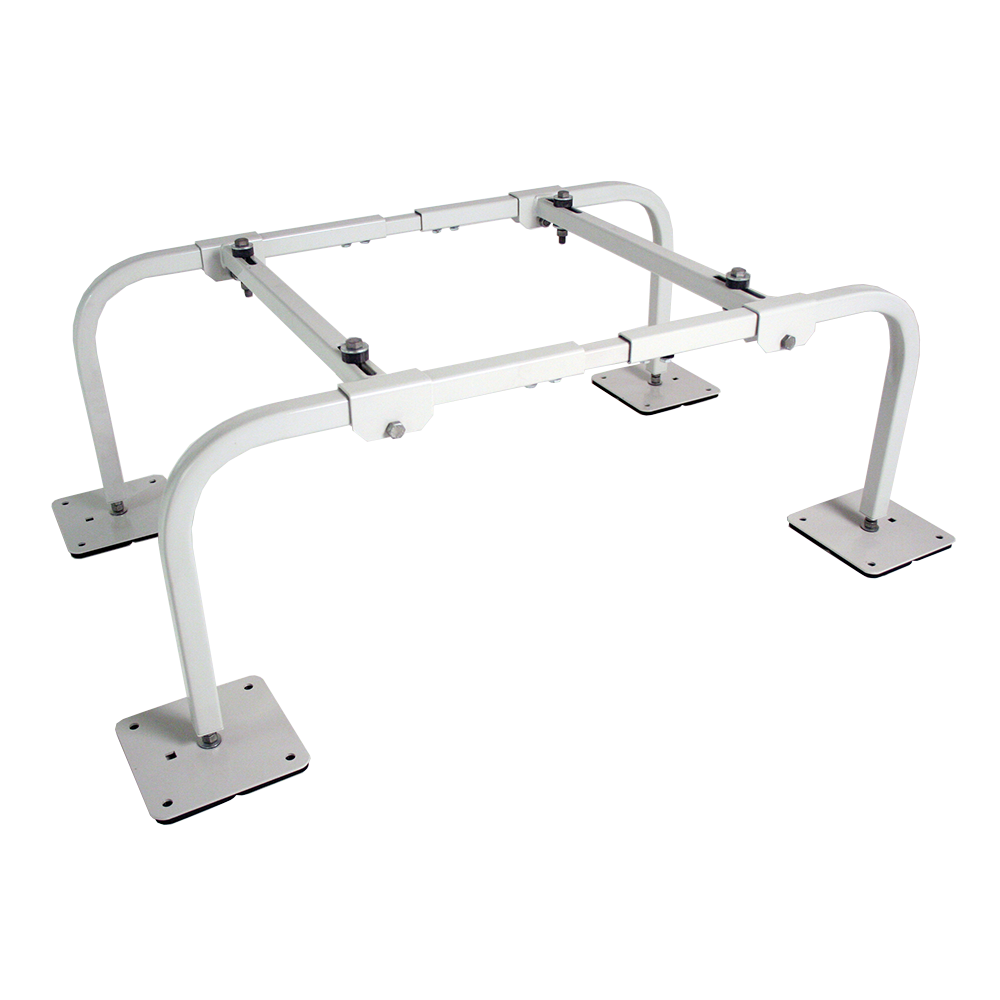

Mini Split Rail Support MIRO Industries Inc

Mass Save Rebates 2022 Mini Split Rebate2022 PumpRebate

Mini Split Rebates 2023 PumpRebate

Best Mini Split Air Conditioner The Air Conditioning Depot Bahamas

Best Mini Split Air Conditioner The Air Conditioning Depot Bahamas

Quick Sling Mini Split 1200 QSMS1200 DiversiTech

Do Mini Split Units Qualify For Federal Tax Credits

Quick Sling Mini Split 1201 Stainless QSMS1201 SS DiversiTech

Mini Split Tax Rebate 2024 - Product Rebate Finder Enter your zip code to find rebates and other special offers on ENERGY STAR certified products available in your area mini multi split Systems Offer valid 01 01 2023 through 12 31 2032 Other restrictions may apply please visit the website for additional details There is also a tax credit of up to 250