Tax Liability Refund Massachusetts Updated August 21 2023 To check the status of your personal income tax refund you ll need the following information Tax year of the refund Your Social Security

Refunds will be provided in proportion to Massachusetts income tax liability incurred by taxpayers in the immediately preceding taxable year Tax Year 2021 In the Eligible Massachusetts taxpayers generally received a 2022 tax refund of about 14 of their 2021 Massachusetts income tax liability However if you have unpaid taxes or owe child support the

Tax Liability Refund Massachusetts

Tax Liability Refund Massachusetts

https://taxfoundation.org/wp-content/uploads/2019/03/paf-5-featurd-01.png

Tax Largie Inc Blog TAX LARGIE INC

http://www.taxlargiecpa.com/uploads/8/5/3/9/85397038/where-s-my-refund_2.jpg

Massachusetts Residents Enjoy A Bonus State Refund November 2022

https://patterson-solutions.com/wp-content/uploads/2022/09/MA-Form-1_half-page_tax-refunds.jpg

Refunds stipulated under a tax cap law known as Chapter 62F which will collectively return nearly 3 billion in excess state revenues to taxpayers will translate into 14 of a resident s 2021 To be eligible for a refund the administration said individuals must have filed a 2021 state tax return on or before Oct 17 2022 An individual s credit may be reduced due to refund intercepts including for unpaid taxes

Massachusetts taxpayers are slated to receive hundreds of dollars in direct relief starting this November as officials return nearly 3 billion in excess revenues as stipulated by a 1980s Massachusetts announces plan to return 2 941 billion to taxpayers starting in November Individuals can expect 13 refund of tax liability officials said

Download Tax Liability Refund Massachusetts

More picture related to Tax Liability Refund Massachusetts

Get The Best Tax Liability Reduction Strategies With Zero Risk Trust

https://www.dailymoss.com/wp-content/uploads/2022/08/get-the-best-tax-liability-reduction-strategies-with-zero-risk-trust-creation-62f3595e91b85.jpg

Good News Taxpayers Can Now Adjust Previous Years Tax Refunds Against

https://tax.net.pk/wp-content/uploads/2022/09/Tax-Refunds-Adjustment-against-Current-year-tax-liability-tab-restored-by-FBR.png

Refund Policy

https://assets.cdn.filesafe.space/rUukdFpateiq4Majahwr/media/65947ca5da489a862f2f8256.png

What you need to know about the latest Massachusetts tax refund including how much your rebate will be who is eligible and when you can expect it The administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 14 of their Massachusetts Tax Year 2021 personal income tax liability As an example a person who made 50 000 last

Beginning in November 2 941 billion in refunds will be distributed to about 3 6 million eligible taxpayers in proportion to personal income tax liability in Massachusetts The administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 14 of their Massachusetts Tax Year 2021 personal income tax liability As an example a person who made 50 000 last

Reducing New Commerce Liability

https://tminus365.com/wp-content/uploads/2022/01/reduceLiability2.png

costsegregation costsegregationservices bonusdepreciation

https://i.pinimg.com/originals/fa/19/dd/fa19dd0413de159b6b6ad6fb699b8f2a.jpg

https://www.mass.gov/how-to/check-the-status-of...

Updated August 21 2023 To check the status of your personal income tax refund you ll need the following information Tax year of the refund Your Social Security

https://www.mass.gov/news/distribution-of-excess...

Refunds will be provided in proportion to Massachusetts income tax liability incurred by taxpayers in the immediately preceding taxable year Tax Year 2021 In the

How An Independent Property Valuation Can Reduce Your Capital Gains Tax

Reducing New Commerce Liability

Cost And Budget Management Gururo

Ensuring Your Independent Contractors Don t Deliver Wisconsin

When Will I Get My Massachusetts Tax Refund From Chapter 62F

How To Lower Tax Liability When Selling Property MO Property Consultants

How To Lower Tax Liability When Selling Property MO Property Consultants

Reducing Tax Liability By Receiving Rent From Children A Valid Tax

Tax Harvesting Maximising Tax Efficiency In Your Investments

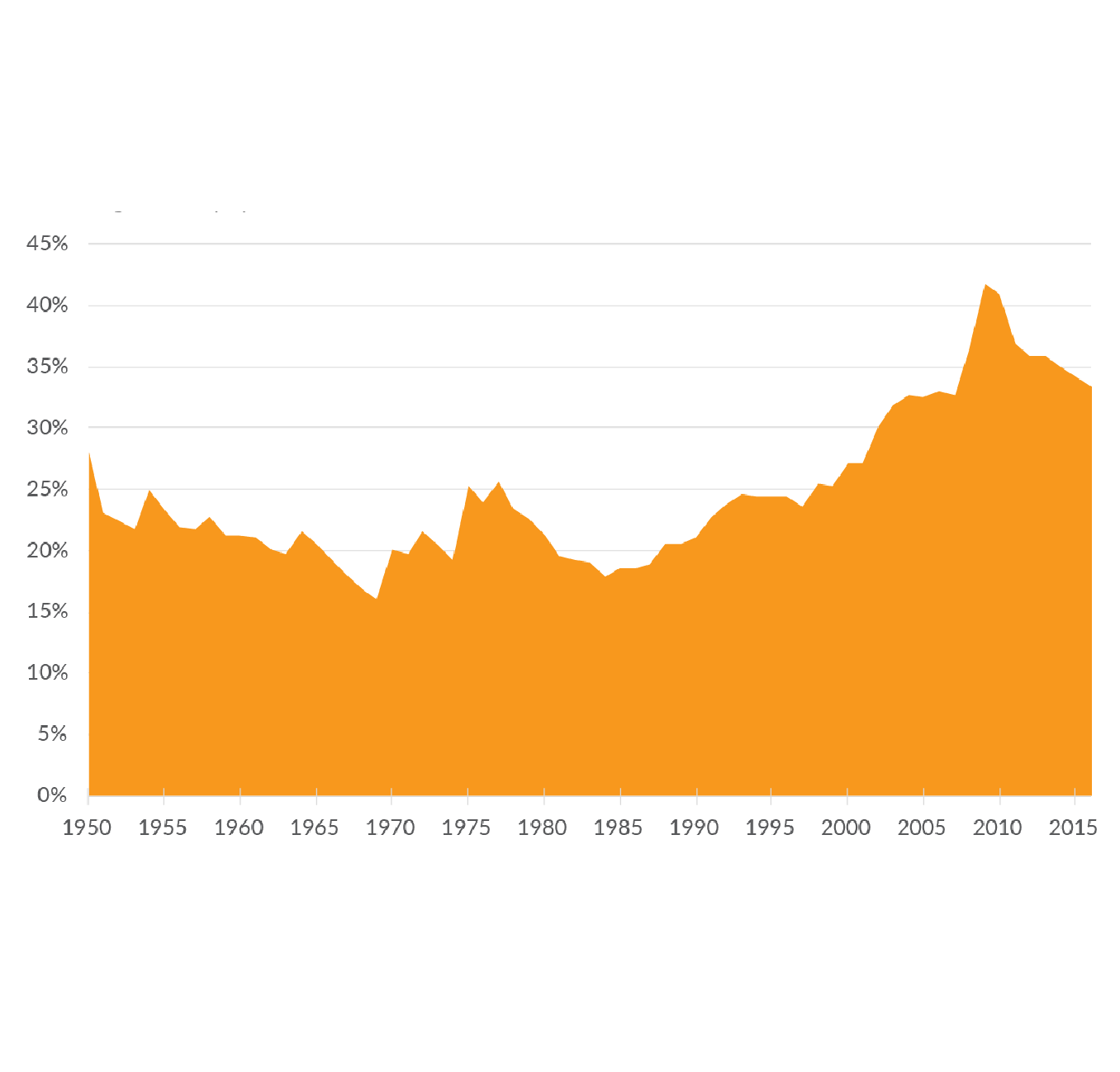

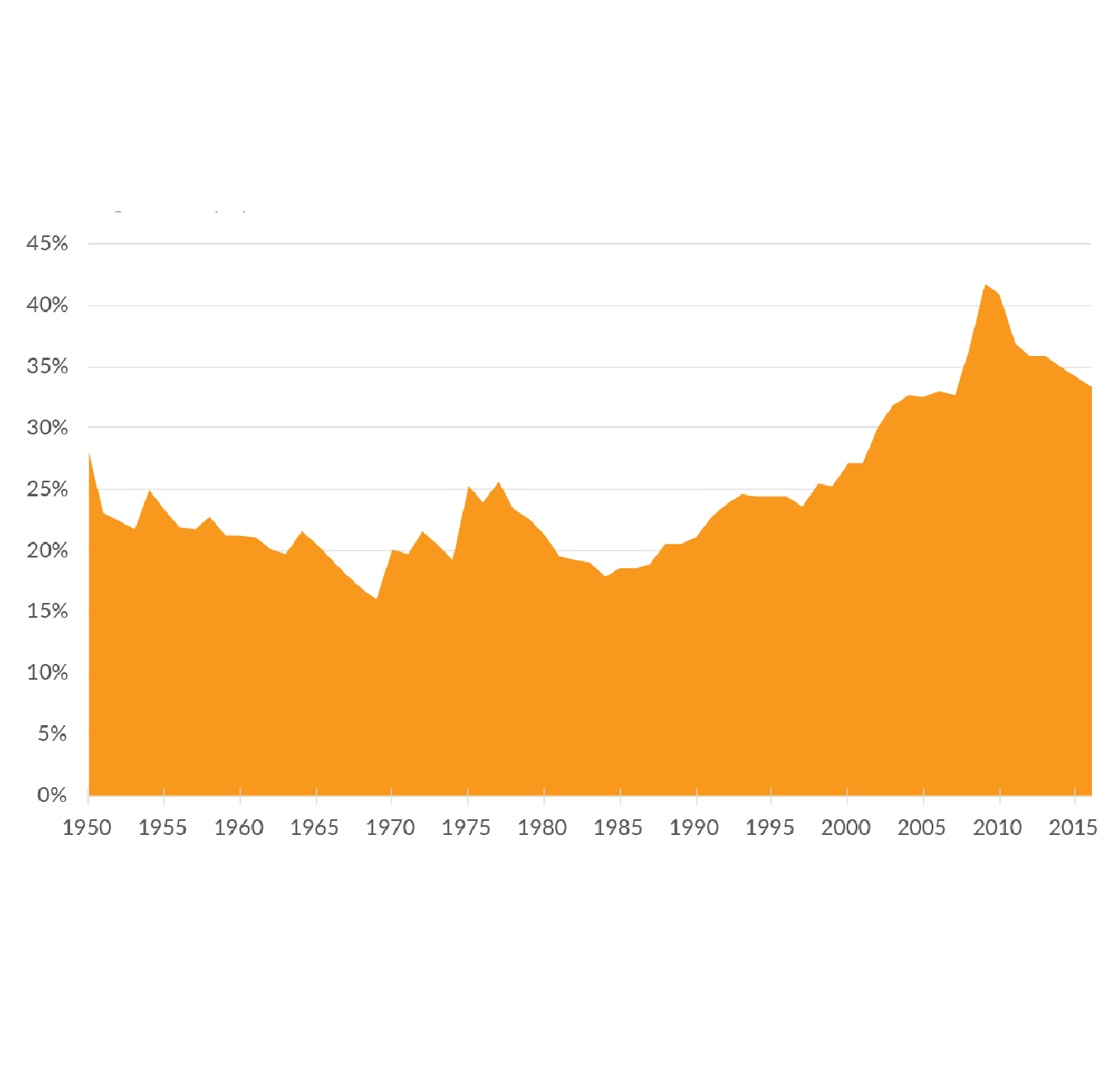

It s About Your Total Tax Liability Not Your Refund Tax Policy Center

Tax Liability Refund Massachusetts - Each eligible resident received a Massachusetts tax refund via check or direct deposit which amounted to about 14 of their state income tax liability from their 2021 tax