Mileage Claim Calculator Gov To work out how much you can claim for each tax year you ll need to keep records of the dates and mileage of your work journeys add up the mileage for each vehicle type you ve used for

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances In this post you can find our HMRC mileage claim calculator which calculates your mileage allowance using the mileage rate for 2023 and 2024 provided by HMRC The mileage claim calculator can be used to get a

Mileage Claim Calculator Gov

Mileage Claim Calculator Gov

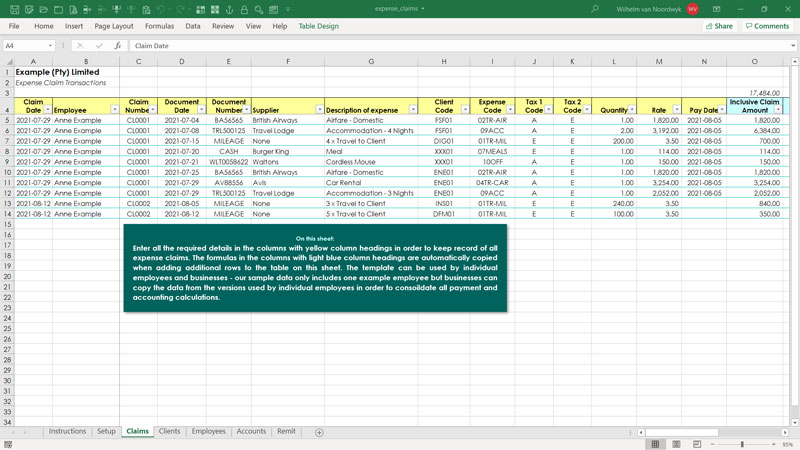

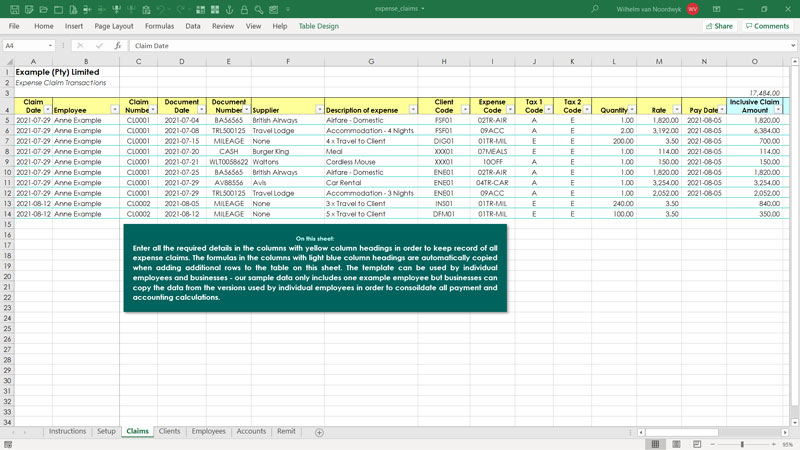

https://www.excel-skills.com/screenshots/expense_claims_sample_2.jpg

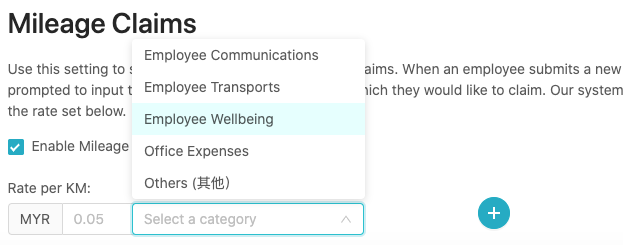

How To Calculate Mileage Claim In Malaysia Karen Rutherford

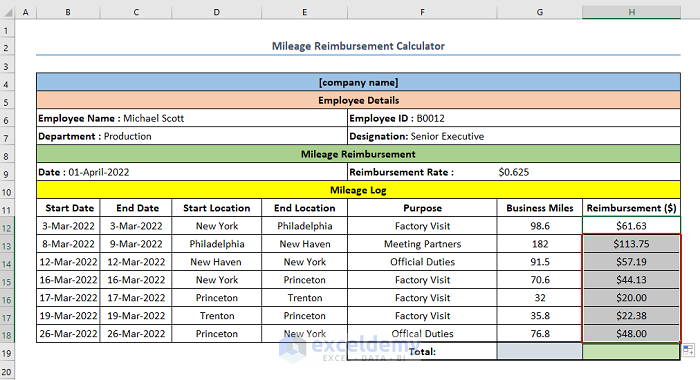

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-mileage-reimbursement-in-excel-4.png

Understanding The HMRC Mileage Claim Calculator Watermill Accounting

https://www.watermillaccounting.co.uk/wp-content/uploads/2024/02/HMRC-Mileage-Claim-Calculator-1080x675.png

What is Mileage Allowance Relief Learn how to make a proper HMRC mileage claim See the current rates and how much you can claim in tax deductions Use the Free Mileage Tax Relief Calculator to find out how much your Tax Mileage Rebate is worth and how to Claim Your Mileage Tax Back

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving Last updated Apr 11 2024 The following lists the Privately Owned Vehicle POV reimbursement rates for automobiles motorcycles and airplanes

Download Mileage Claim Calculator Gov

More picture related to Mileage Claim Calculator Gov

Calculator Daily Art Challenge Pixilart

https://art.pixilart.com/fe55845141d2.gif

Mileage Claim Calculator Malaysia Harry McDonald

https://blog.kakitangan.com/content/images/2020/07/Screenshot-2020-07-21-at-11.07.03-AM.png

Simple Expense Reimbursement Form 1 Excelxo

https://excelxo.com/wp-content/uploads/2018/02/simple-expense-reimbursement-form-1-601x466.png

Use the applicable mileage rates provided by HMRC to calculate your mileage expenses This can be the Approved Mileage Allowance Payments AMAP rates for self employed individuals or the company s own rates if you To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle Use HMRC s MAPs working sheet if you need help

To work out how much you can claim multiply the total business kilometres you travelled by the rate You also need to apportion for private and business use understand the Find standard mileage rates to calculate the deduction for using your car for business charitable medical or moving purposes

Business Spreadsheet Tools Custom Software Development Working Data

https://www.workingdata.co.uk/wp-content/uploads/2013/08/simple-excel-mileage-claim-tool-04.png

Scenarios To Try With A Comprehensive Retirement Calculator

https://www.newretirement.com/retirement/wp-content/uploads/2022/01/iStock-485392746.jpg

https://www.gov.uk/tax-relief-for-employees/vehicles-you-use-for-work

To work out how much you can claim for each tax year you ll need to keep records of the dates and mileage of your work journeys add up the mileage for each vehicle type you ve used for

https://www.gov.uk/government/publications/rates...

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances

Calculator Close up Free Stock Photo Public Domain Pictures

Business Spreadsheet Tools Custom Software Development Working Data

Millionaire Next Door Calculator Registrymzaer

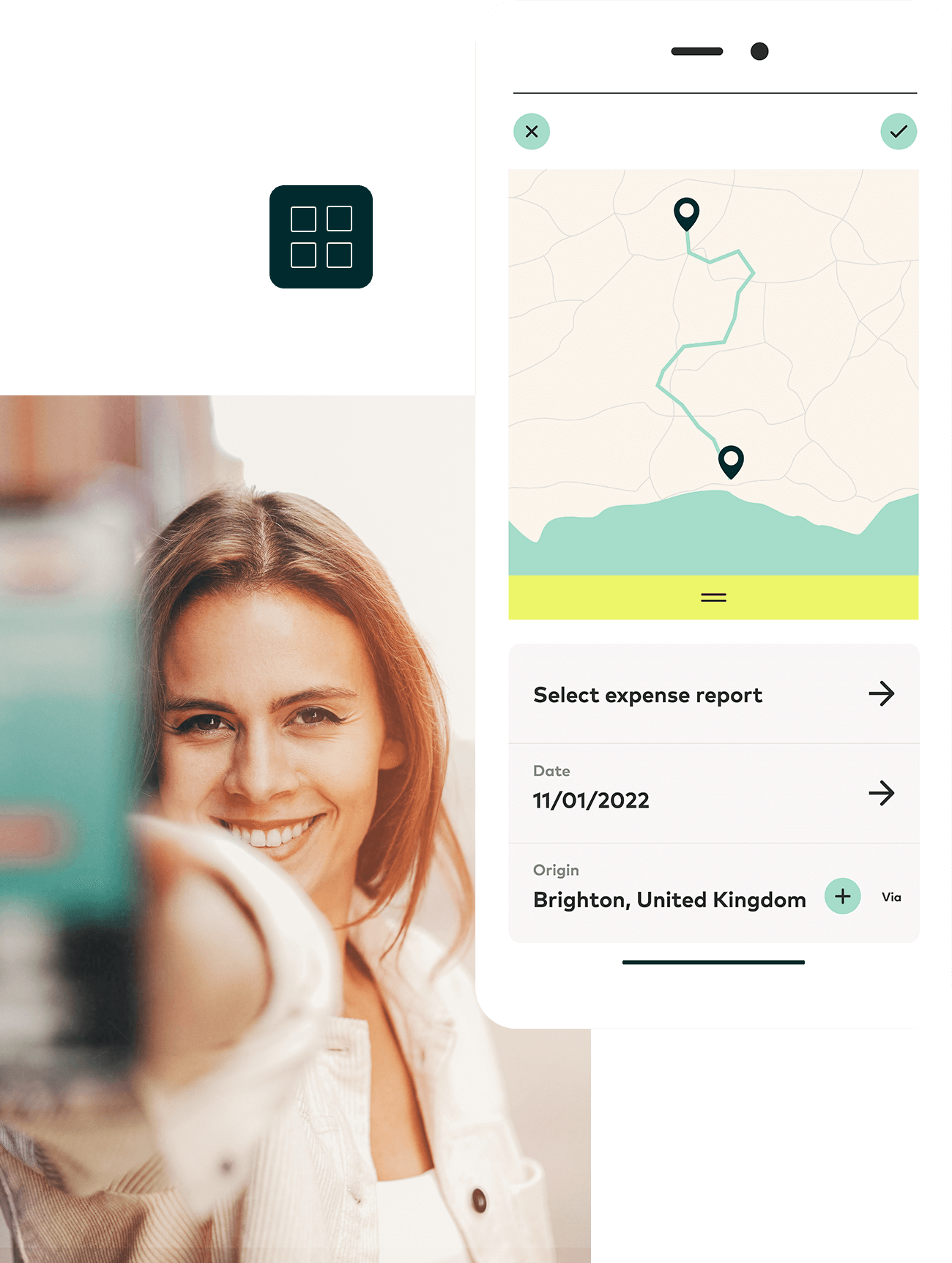

Multi Day Planner Calculator By Dmytro Prudnikov On Dribbble

High definition Image Of An Emi Calculator

Lot Size Calculator SMT FX

Lot Size Calculator SMT FX

How To Calculate Mileage Claim In Malaysia Claire Sharp

Findity Software 2024 Reviews Pricing Demo

8 Bus Mileage Log Template SampleTemplatess SampleTemplatess

Mileage Claim Calculator Gov - You may be able to calculate your car van or motorcycle expenses using a flat rate known as simplified expenses for mileage instead of the actual costs of buying and running your vehicle