Mileage Tax Rebate Hmrc Web 1 ao 251 t 2023 nbsp 0183 32 You can claim mileage tax relief at the end of the tax year from HMRC To qualify here s what you need to do Keep accurate records of your business mileage

Web Tax year Amount 2023 to 2024 163 3 960 2022 to 2023 163 3 600 2021 to 2022 163 3 500 2020 to 2021 163 3 490 2019 to 2020 163 3 430 2018 to 2019 163 3 350 2017 to 2018 Web 11 oct 2021 nbsp 0183 32 If your employer pays part of your mileage costs then you still may be able to claim mileage tax relief from HMRC To find out if you re still eligible to claim Multiply your yearly business mileage by the current

Mileage Tax Rebate Hmrc

Mileage Tax Rebate Hmrc

http://www.sappscarpetcare.com/wp-content/uploads/2019/06/hmrc-business-mileage-rates-2016-17.jpg

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-1-1068x889.png

HMRC Give Tax Relief Pre approval Save The Thorold Arms

https://i0.wp.com/save.thethoroldarms.co.uk/wp-content/uploads/2016/06/20160525-EIS-Tax-Rebate-Letter-from-HMRC.jpg?w=2368&ssl=1

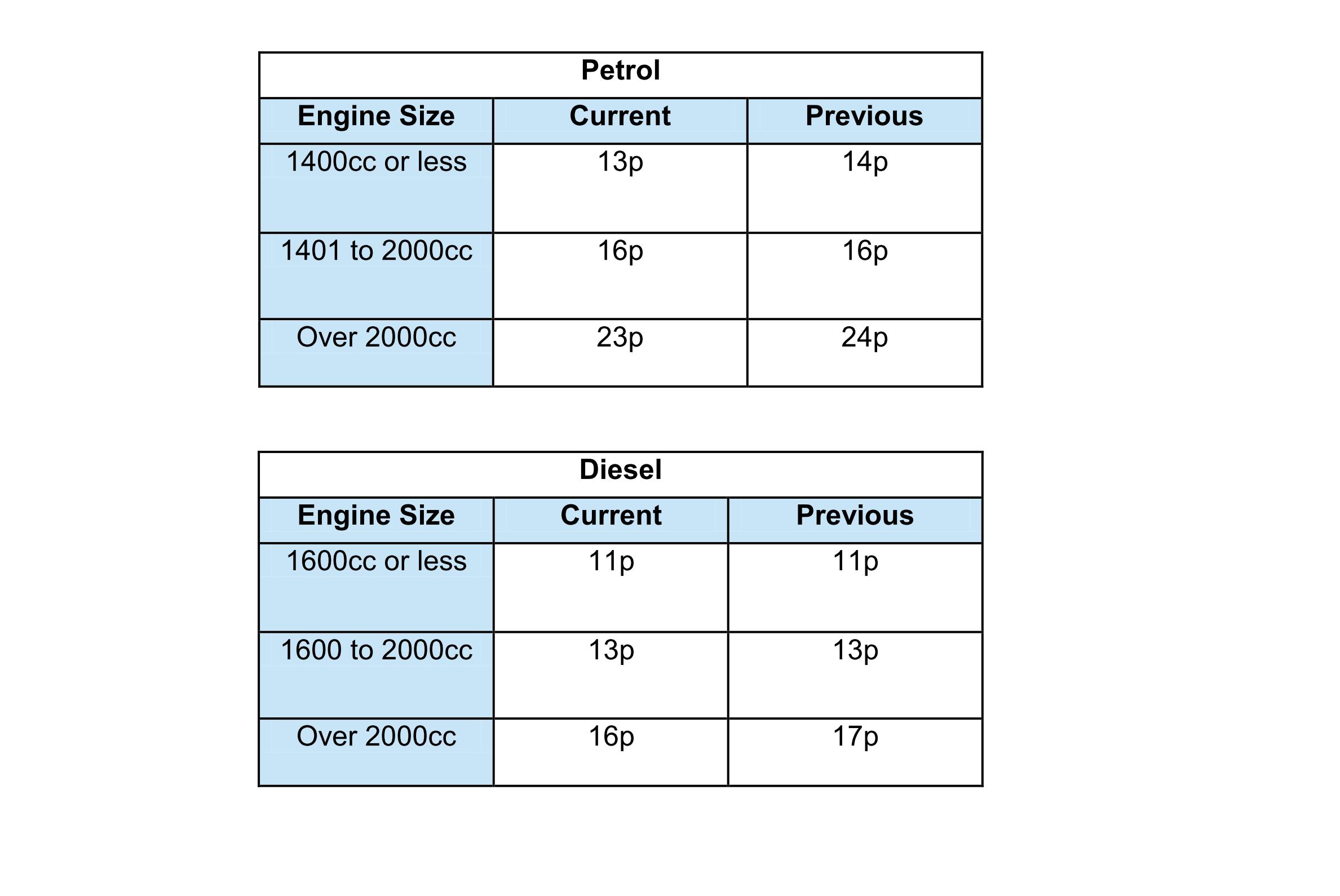

Web The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances Published 13 Web 30 d 233 c 2019 nbsp 0183 32 Employers can agree with HMRC to make separate optional reports of negative amounts under a scheme called Mileage Allowance Relief Optional Reporting

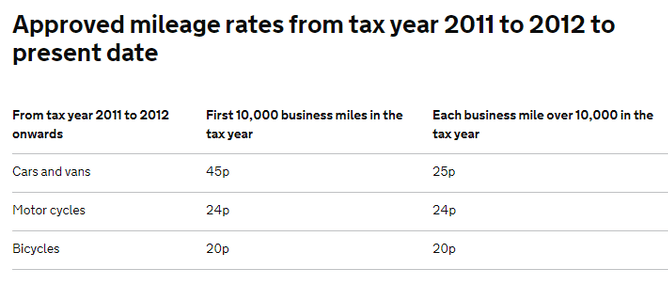

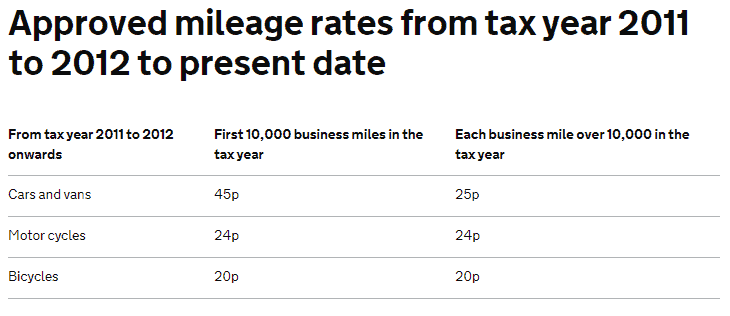

Web 25 juin 2021 nbsp 0183 32 June 25 2021 You can usually claim mileage tax relief on cars vans motorcycles or bicycles that you use for business purposes It applies to vehicles you pay for yourself leased or owned and company Web The current rates set by HMRC for mileage relief are 45p per mile for the first 10 000 miles of work travel in a year 25p per mile for any additional travel after that These rates are

Download Mileage Tax Rebate Hmrc

More picture related to Mileage Tax Rebate Hmrc

HMRC Approved Mileage Rates From 2011 12 Onwards

https://www.sexaccountants.co.uk/images/blog/4c0d4a7e67711dc551daf16d7d8b3955__5cb1/zoom668x284z100000cw668.png?etag=41d541899f8597af103bf7f6f59b437b

A Practical Guide To HMRC Expenses Compliance Webexpenses

https://www.webexpenses.com/wp-content/uploads/2017/03/VAT-mileage-allowance.png

Mileage Allowance A Simple Guide UK

https://triplogmileage.com/wp-content/uploads/2021/04/hmrc-Approved-mileage-rates.png

Web The average mileage expenses rebate made with RIFT Tax Refunds is worth 163 3 000 Many people don t realise that it s not something HMRC will automatically give back to you you Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Web 9 juin 2023 nbsp 0183 32 45p per mile is the tax free approved mileage allowance for the first 10 000 miles in the financial year it s 25p per mile thereafter If a business chooses to pay Web We provide a easy and quick way for claiming your mileage allowance rebate We only need a few details from you in order for our accountants to review your claim and

8 Bus Mileage Log Template SampleTemplatess SampleTemplatess

http://www.sampletemplatess.com/wp-content/uploads/2018/01/bus-mileage-log-template-eghga-elegant-mileage-expenses-hmrc-pliance-of-bus-mileage-log-template-euudz.gif

Hmrc Mileage Rates 2021 Own Car

https://www.dains.com/assets/images/PR/Fuel rates.jpg

https://www.driversnote.co.uk/hmrc-mileage-guide/mileage-allowance-relief

Web 1 ao 251 t 2023 nbsp 0183 32 You can claim mileage tax relief at the end of the tax year from HMRC To qualify here s what you need to do Keep accurate records of your business mileage

https://www.gov.uk/.../travel-mileage-and-fuel-rates-and-allowances

Web Tax year Amount 2023 to 2024 163 3 960 2022 to 2023 163 3 600 2021 to 2022 163 3 500 2020 to 2021 163 3 490 2019 to 2020 163 3 430 2018 to 2019 163 3 350 2017 to 2018

Hmrc Invoice Template

8 Bus Mileage Log Template SampleTemplatess SampleTemplatess

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Hmrc Meaning Uk

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

Hmrc Private Mileage Claim Form Erin Anderson s Template

Hmrc Private Mileage Claim Form Erin Anderson s Template

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

Claim HMRC Mileage In 2023 In 5 Simple Steps Driversnote

HMRC Mileage Claim The HMRC Mileage Claim Allows Claiming By An

Mileage Tax Rebate Hmrc - Web The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances Published 13