Military Spouse Income Tax Exemption EXPLANATION A state cannot tax income earned in that state by the military spouse if the military spouse and servicemember have each established a domicile outside the

Published January 18 2023 The rules governing where and in many cases if military members and their spouses pay state income taxes are changing thanks to a new law So if you meet the requirements of the Military Spouses Residency Relief Act both your income and the military income earned by your spouse in the military are free from taxation in the duty station state Both

Military Spouse Income Tax Exemption

Military Spouse Income Tax Exemption

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

H R Block Is Offering A Military Scholarship For Military Spouses And

https://i.pinimg.com/originals/2a/62/e5/2a62e548cadee78ce13ddb027230b4aa.jpg

Ask The Tax Whiz How To Compute Income Tax Under The New Income Tax

https://www.rappler.com/tachyon/2023/01/6-1.jpg

Published February 22 2012 As a military spouse tax time can be a bit stressful to say the least There are regular tax questions What are the new changes to tax law What The spouse of a servicemember is exempt from income taxation by a state when he or she Currently resides in a state different than the state of domicile Resides in

For tax years 2019 onward a military member s spouse may choose the military member s residency even if the couple did not share the residency prior to the move As you might guess there are some criteria you must If you serve in one of the combat zones recognized by the IRS you may be able to exclude combat income from taxation You may also want to see if special EITC rules apply

Download Military Spouse Income Tax Exemption

More picture related to Military Spouse Income Tax Exemption

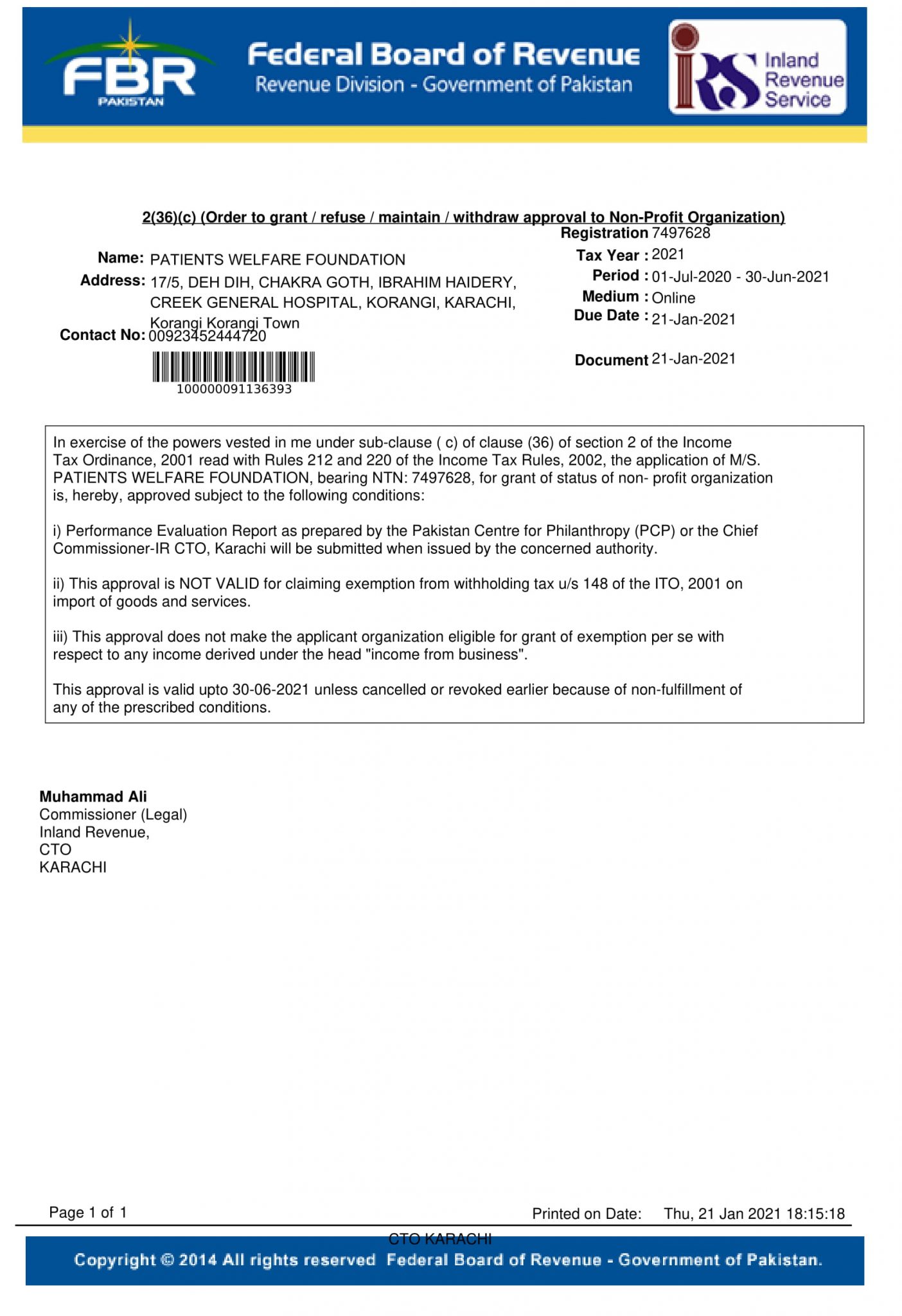

Tax Exemption Certificate PWF Pakistan

https://pwfpakistan.org/wp-content/uploads/2021/01/EXEMPTION-2021-30-06-2021-1404x2048.jpg

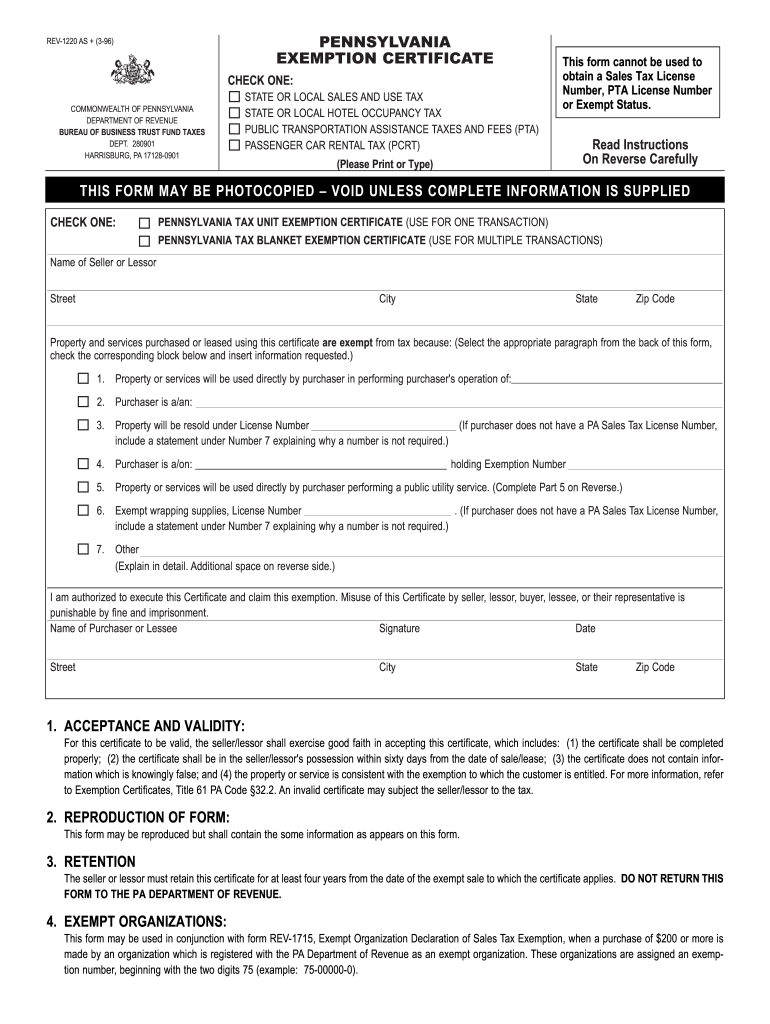

Pa Form Rct 103 Non Fillable Printable Forms Free Online

https://www.signnow.com/preview/0/211/211460/large.png

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

Published July 13 2021 You might have heard of a military spouses residency relief act a rule rumored to help military spouses But what is it and what does it mean and what Standard deduction amount increased For 2023 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 13 850

Effective for tax years beginning 2018 and after the Veterans Benefits and Transition Act allows the same tax benefits permitted to military personnel under the Servicemembers The deduction is limited to the rates for such expenses authorized for federal employees including per diem in lieu of subsistence Taxpayers use Form 2106 Employee

Claiming Military Retiree State Income Tax Exemption In SC Veterans

https://scdva.sc.gov/sites/scdva/files/Documents/Images/Military Retirement FS.png

Income Tax Exemption Of Nonstock Charitable Institutions

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1ialYN.img?w=1200&h=1522&m=4&q=99

https://home.army.mil/knox/application/files/2515/...

EXPLANATION A state cannot tax income earned in that state by the military spouse if the military spouse and servicemember have each established a domicile outside the

https://www.military.com/daily-news/2023/01/18/...

Published January 18 2023 The rules governing where and in many cases if military members and their spouses pay state income taxes are changing thanks to a new law

Clubbing Of Income Of Spouse Child A Complete Guide FY 2024

Claiming Military Retiree State Income Tax Exemption In SC Veterans

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Gsa Missouri Tax Exempt Form Form Example Download

Deloitte Tax hand

Five Little Lines That Will Help You Save Big On Taxes

Five Little Lines That Will Help You Save Big On Taxes

Florida Certificate Entitlement Complete With Ease AirSlate SignNow

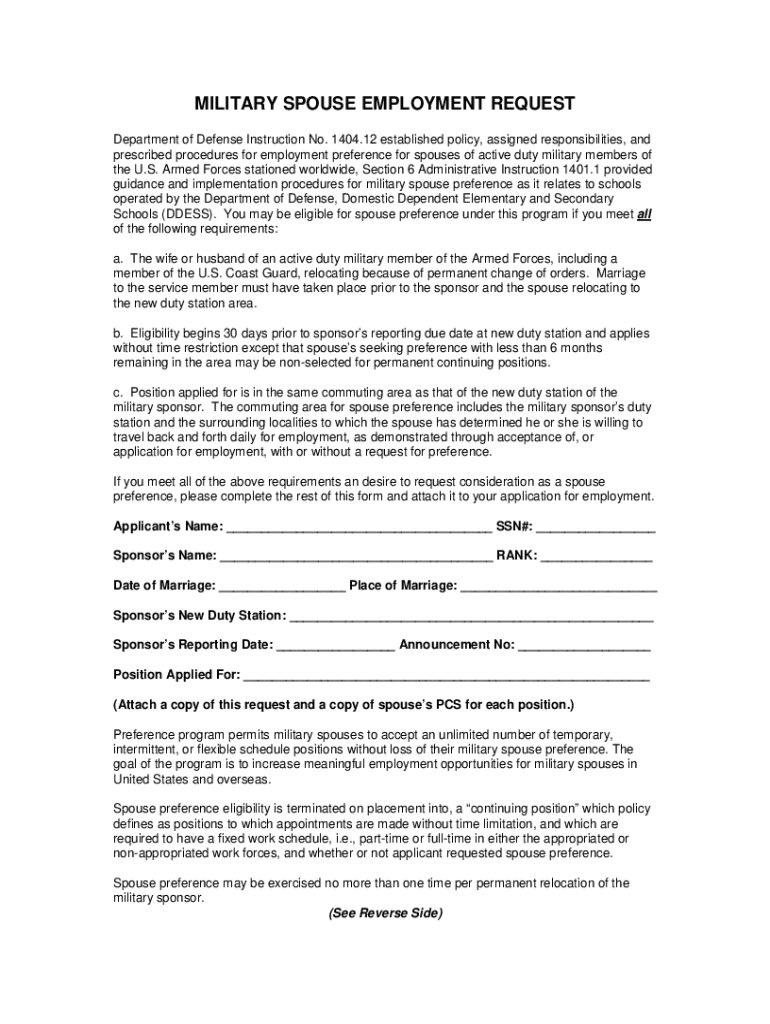

Military Spouse Preference Request 2015 2022 Fill And Sign Printable

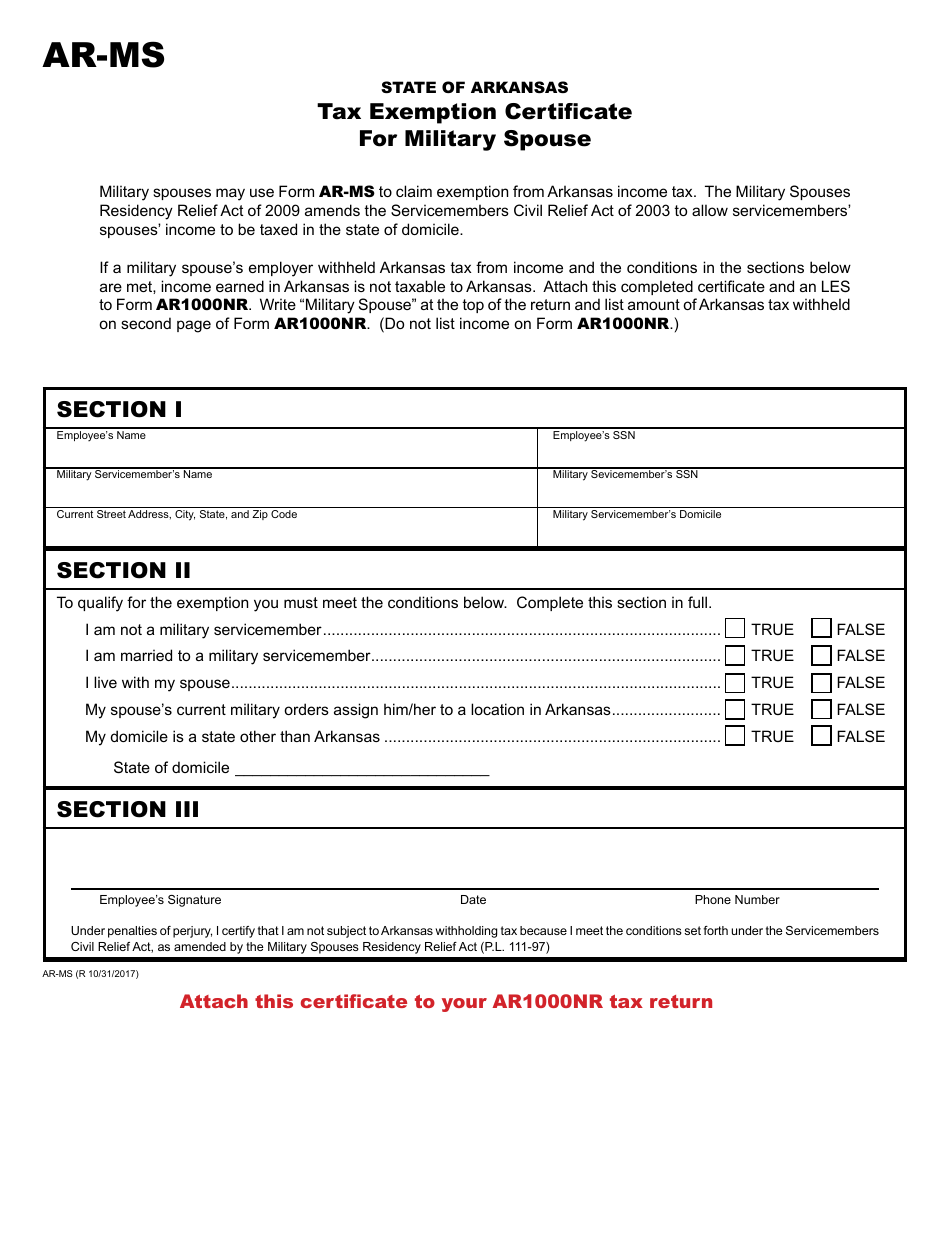

Form AR MS Fill Out Sign Online And Download Printable PDF Arkansas

Military Spouse Income Tax Exemption - This Act also provides an income tax exemption for the servicemember s spouse For example they can file a tax exemption when they earn wages in California under the