Minnesota Property Tax Refund Limit Has no income limit and the maximum refund is 1 000 You may qualify if all of these are true You owned and occupied your home on January 2 2023 and January 2 2024 Your net property tax on your homestead increased by more than 12 from 2023 to 2024 The increase was at least 100

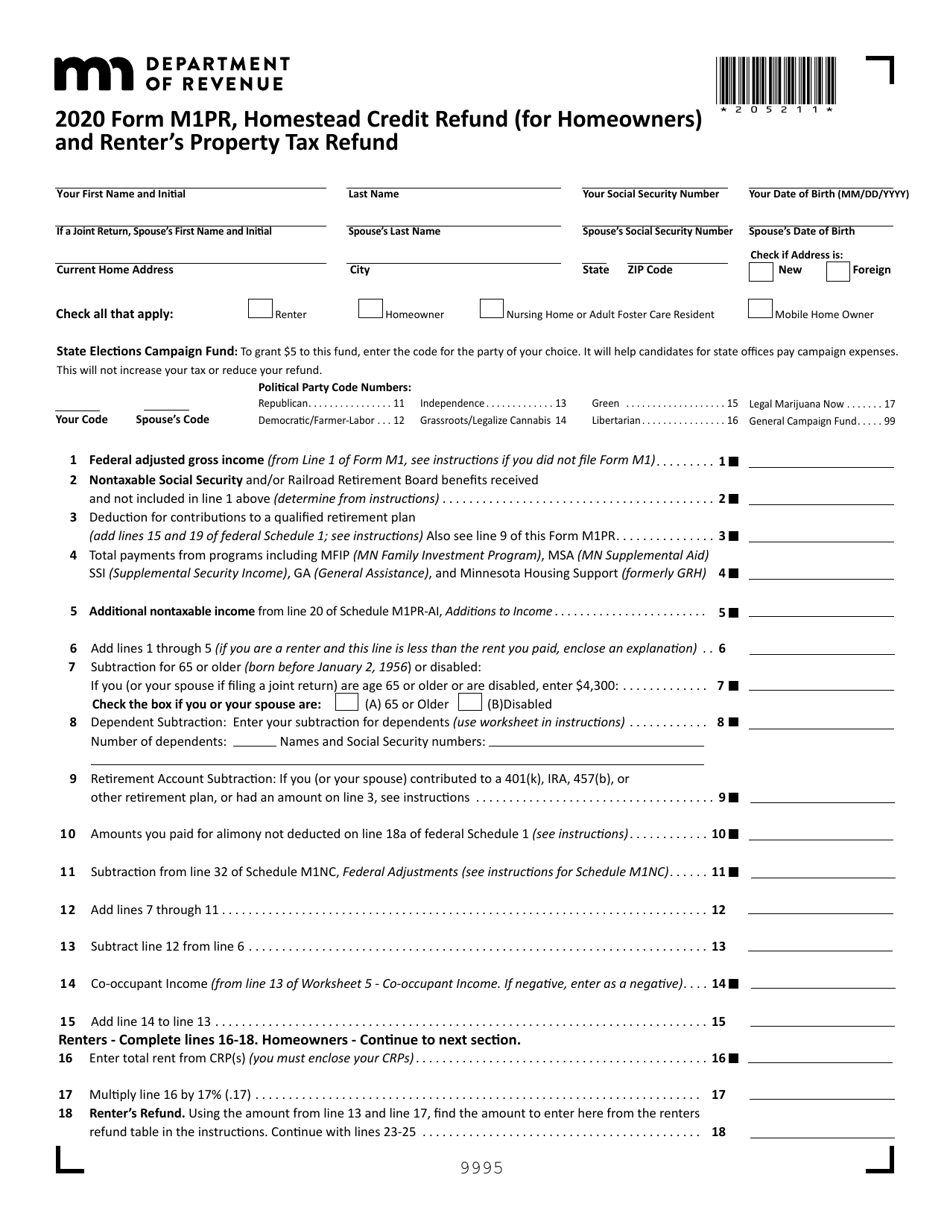

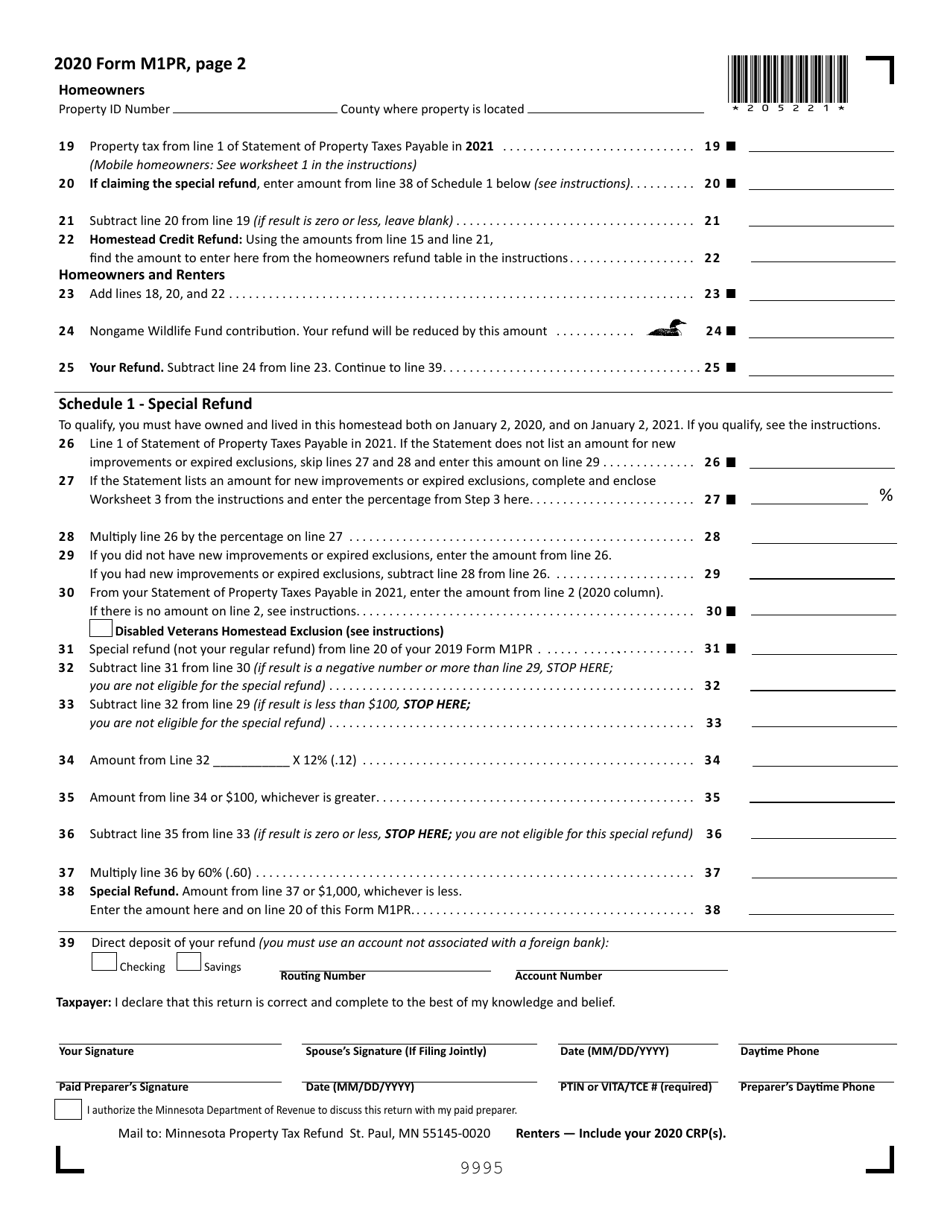

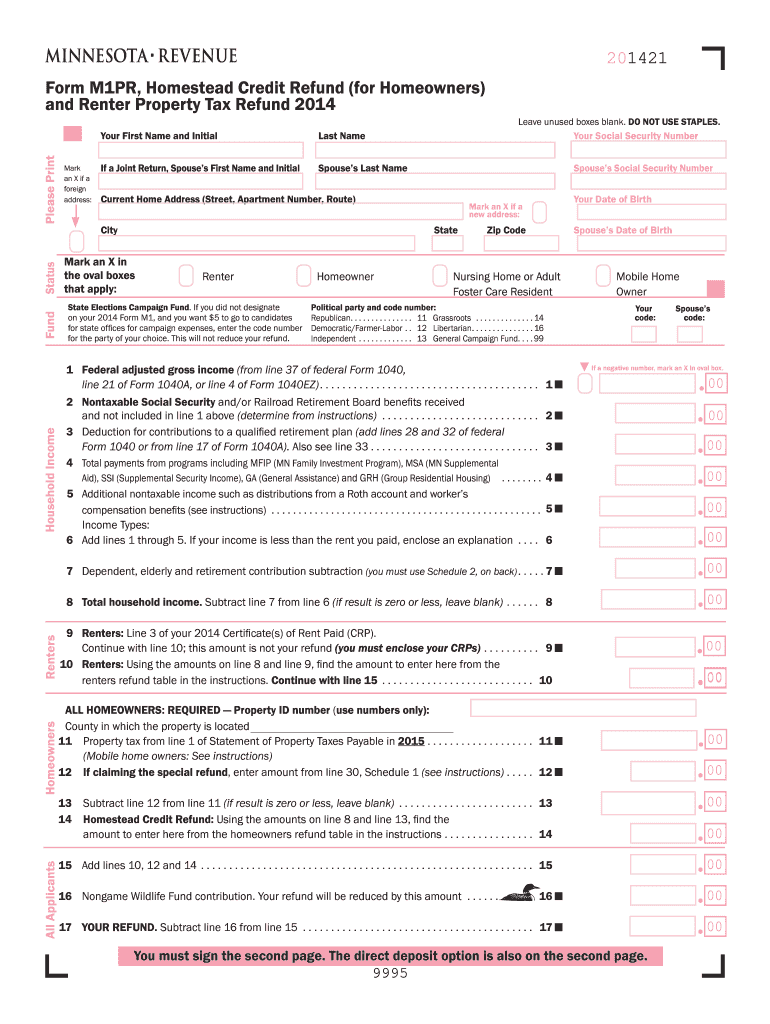

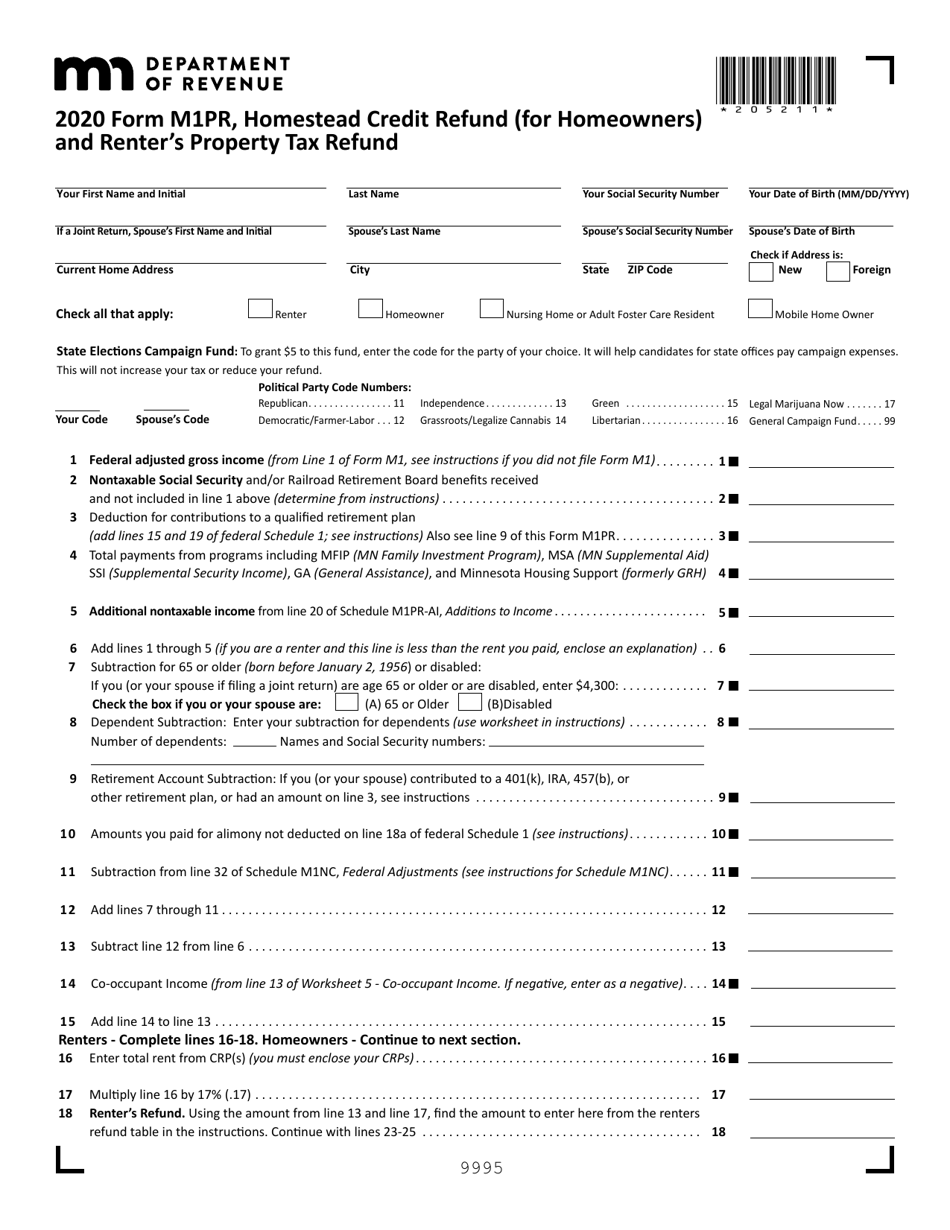

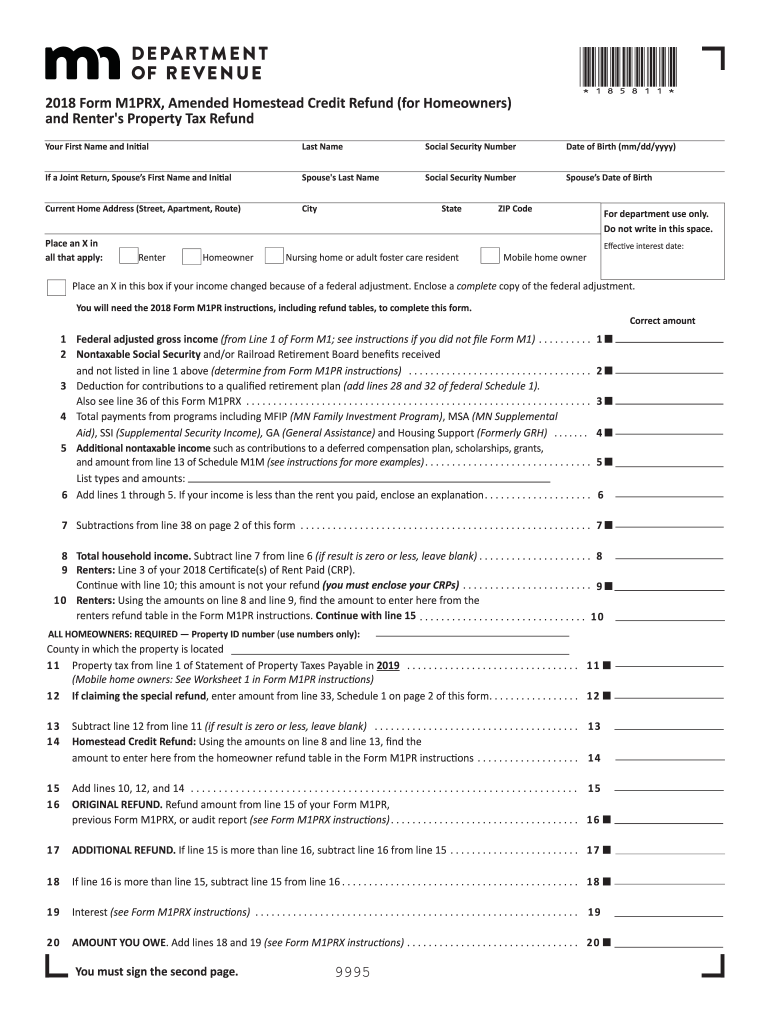

For refund claims filed in 2024 based on property taxes payable in 2024 and 2023 household income the maximum refund is 3 310 Homeowners whose income exceeds 135 410 are not eligible for a refund How are claims filed Refund claims are filed using the Minnesota Department of Revenue DOR Schedule M1PR which is 2023 Property Tax Refund Return M1PR Instructions pdf To apply for a refund complete lines 1 15 to determine your total household income If you are applying with your spouse you must include both of your incomes If a line does not apply to you or if the amount is zero leave the line blank Homeowners Above line 19 provide the property

Minnesota Property Tax Refund Limit

Minnesota Property Tax Refund Limit

https://data.templateroller.com/pdf_docs_html/2219/22192/2219253/form-m1pr-homestead-credit-refund-for-homeowners-and-renter-s-property-tax-refund-minnesota_print_big.png

Tax Refund Real Estate Tax Refund Minnesota

http://surfsongnorthwildwood.com/wp-content/uploads/2012/12/Rates2013.jpeg

When Are Minnesota Property Tax Refunds Sent Out U ukumdesigns

http://losthorizons.com/tax/taximages2/JordanJ/JordanJMN2015.jpg

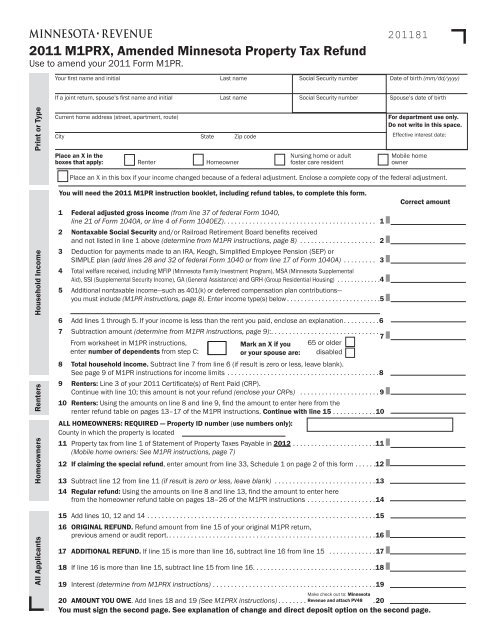

For refund claims filed in 2022 based on property taxes payable in 2022 and 2021 household income the maximum refund is 2 930 Homeowners whose income exceeds 119 790 are not eligible for a refund How are claims filed Refund claims are filed using the Minnesota Department of Revenue DOR Schedule M1PR which is Minnesota allows a property tax credit to renters and homeowners who were residents or part year residents of Minnesota during the tax year Who can claim the credit Homeowners with household income less than 135 410 can claim a refund up to 3 310 Homeowners and mobile home owners must have owned and lived in your

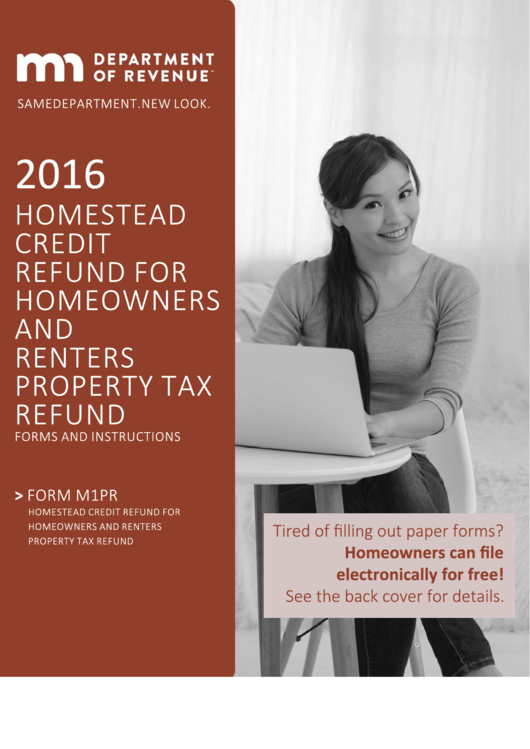

You may be eligible for a refund based on your household income see pages 8 and 9 and the property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements Other Requirements You must be a Minnesota resident or part year resident to qualify for a property tax refund Your household income affects your eligibility and refund amount for the Property Tax Refund Generally it includes your federal adjusted gross income and certain nontaxable income To calculate household income including subtractions that may help you qualify see the line instructions for Form M1PR Homestead Credit Refund for Homeowners

Download Minnesota Property Tax Refund Limit

More picture related to Minnesota Property Tax Refund Limit

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

https://data.templateroller.com/pdf_docs_html/2219/22192/2219253/page_2_thumb_950.png

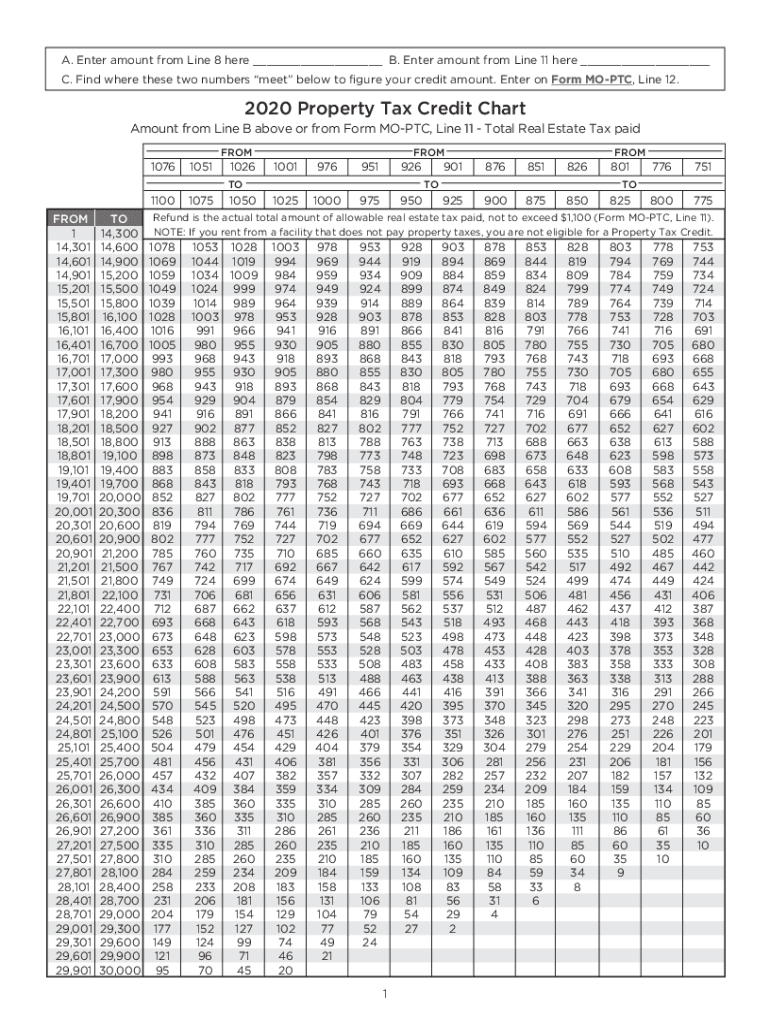

2020 Form MO MO PTC Chart Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/535/790/535790049/large.png

2014 Mn Form Property Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/6/962/6962354/large.png

If you are a homeowner you may also be eligible for a special property tax refund This refund has no income limit and the maximum refund is 2 500 You may qualify if all of these are true You owned and occupied your home on January 2 2022 and January 2 2023 Your net property tax on your homestead increased by more than 6 from The maximum special refund is 1 000 Note If you use part of your home for a business make sure you read Special Situations on page 10 of the Minnesota Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Instructions PDF Assessor s Office Homesteads Show All Answers 1

1 Can I get a property tax refund if I own my own house Yes No 2 Do I have to file my renter s refund with my regular taxes on April 15 Yes No 3 Can I file my renter s refund after August 15 Yes No Have any questions Talk with us directly using LiveChat For refund claims filed in 2021 based on property taxes payable in 2021 and 2020 household income the maximum refund is 2 840 Homeowners whose income exceeds 116 180 are not eligible for a refund How are claims filed

Fillable Online Form M1PR Homestead Credit Refund Fax Email Print

https://www.pdffiller.com/preview/102/13/102013958/large.png

Minnesota Tax Rebate Checks Apply Online For Property Tax Refund NCBlpc

https://ncblpc.org/wp-content/uploads/2023/08/Minnesota-Tax-Rebate-Checks.png

https://www.revenue.state.mn.us/sites/default/...

Has no income limit and the maximum refund is 1 000 You may qualify if all of these are true You owned and occupied your home on January 2 2023 and January 2 2024 Your net property tax on your homestead increased by more than 12 from 2023 to 2024 The increase was at least 100

https://www.house.mn.gov/comm/docs/J-r0JG5...

For refund claims filed in 2024 based on property taxes payable in 2024 and 2023 household income the maximum refund is 3 310 Homeowners whose income exceeds 135 410 are not eligible for a refund How are claims filed Refund claims are filed using the Minnesota Department of Revenue DOR Schedule M1PR which is

Deadline For MN Property Tax Refund Is Approaching Saint Paul MN Patch

Fillable Online Form M1PR Homestead Credit Refund Fax Email Print

When Are Minnesota Property Tax Refunds Sent Out U ukumdesigns

Minnesota Fiduciary Income Tax Return Instructions TAX

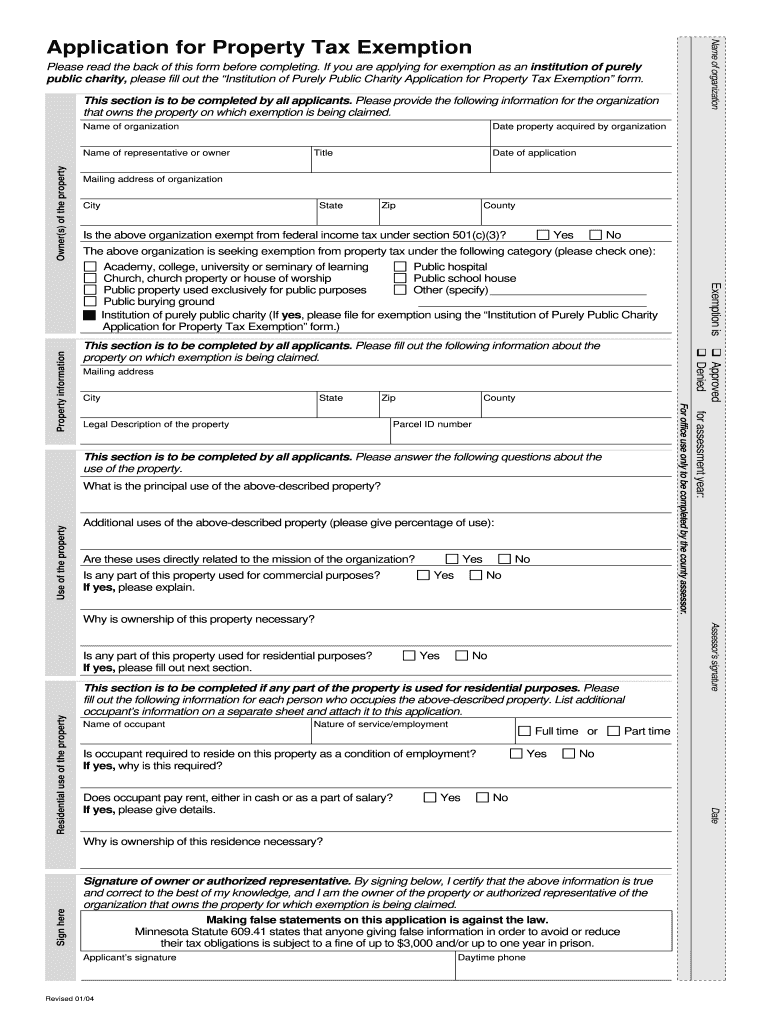

Minnesota Property Tax Exemptions Fill Online Printable Fillable

/cdn.vox-cdn.com/uploads/chorus_image/image/63598851/taxsalepropertylist_e1533344034190.0.jpg)

When Are Minnesota Property Tax Refunds Sent Out U ukumdesigns

/cdn.vox-cdn.com/uploads/chorus_image/image/63598851/taxsalepropertylist_e1533344034190.0.jpg)

When Are Minnesota Property Tax Refunds Sent Out U ukumdesigns

How Do I Check My Mn Property Tax Refund Property Walls

Hecht Group How To Pay Your Minnesota Property Taxes Online

How Much Is Mn Renters Property Refund Leia Aqui Does Minnesota Have

Minnesota Property Tax Refund Limit - For refund claims filed in 2022 based on property taxes payable in 2022 and 2021 household income the maximum refund is 2 930 Homeowners whose income exceeds 119 790 are not eligible for a refund How are claims filed Refund claims are filed using the Minnesota Department of Revenue DOR Schedule M1PR which is