Mlr Rebates Explained All rebates must be issued to consumers by August 1 st of the year following the applicable MLR reporting period i e August 2012 for the 2011 reporting period

The following questions and answers provide information on the federal tax consequences to a health insurance issuer that pays a MLR rebate and an individual policyholder that receives Medical loss ratio MLR is a measure of the percentage of premium dollars that a health plan spends on medical claims and quality improvements versus administrative costs The Affordable Care Act ACA set minimum MLR

Mlr Rebates Explained

Mlr Rebates Explained

https://www.fosterthomas.com/wp-content/uploads/2022/09/MedicalRebateCheck-2048x1366.jpg

Employers Must Follow Guidelines When Issuing MLR Rebates

https://insights.bukaty.com/hubfs/iStock-931061716.jpeg#keepProtocol

MLR Rebates

https://www.basusa.com/hubfs/Stock Images/Business Graphics/iStock-1181224377.jpg

INTRODUCTION The ACA requires medical insurance companies Insurer or Insurers to pay annual Medical Loss Ratio MLR rebates to policyholders by each September 30 if the If you re an employer providing health insurance you re likely familiar with MLR rebate checks So why are they important and what do you do if you receive one as an organization Insurance carriers began issuing MLR

Quick Facts Insurers must perform annual reporting to the U S Department of Health and Human Services HHS by July 31 of their Medical Loss Ratio MLR and its calculation Any resulting rebate must be paid to Medical Loss Ratio MLR is the percent of premiums an insurance company spends on claims and expenses that improve health care quality The health care reform law requires insurance

Download Mlr Rebates Explained

More picture related to Mlr Rebates Explained

Rebates Are Available

https://s2.studylib.es/store/data/006704116_1-c88289a7183370d12db56e1d769b4e05-768x994.png

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63bbe19de7d3d4408c132ae8_why-rebates-are-important-manufacturers-distributors-2400x1348px4 (1).png

Tire Pros Rebates

https://tireprosrebates.acbpromotions.com/App_Themes/Client/Images/TireProsLoveTheDrive.png

The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement also When is an MLR rebate required Under the ACA a health insurance issuer must spend at least 80 85 depending on the market segment of the premium dollars it receives on medical

What Are MLR Rebates The Medical Loss Ratio provision of the Affordable Care Act ACA requires health insurers to spend a certain percentage of premium dollars on Under the Affordable Care Act ACA health insurance issuers offering coverage in the group or individual markets must meet medical loss ratio MLR standards or provide rebates to pol

Rebates Are Inherently Collaborative YouTube

https://i.ytimg.com/vi/_iXRRf5CqGU/maxresdefault.jpg

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

https://www.kff.org/affordable-care-act/fa…

All rebates must be issued to consumers by August 1 st of the year following the applicable MLR reporting period i e August 2012 for the 2011 reporting period

https://www.irs.gov/newsroom/medical-loss-ratio-mlr-faqs

The following questions and answers provide information on the federal tax consequences to a health insurance issuer that pays a MLR rebate and an individual policyholder that receives

CIS TAX REBATES EXPLAINED UK YouTube

Rebates Are Inherently Collaborative YouTube

How Do Home Rebates Work DC MD VA Home Rebates

Rebates Synonyms 86 Words And Phrases For Rebates

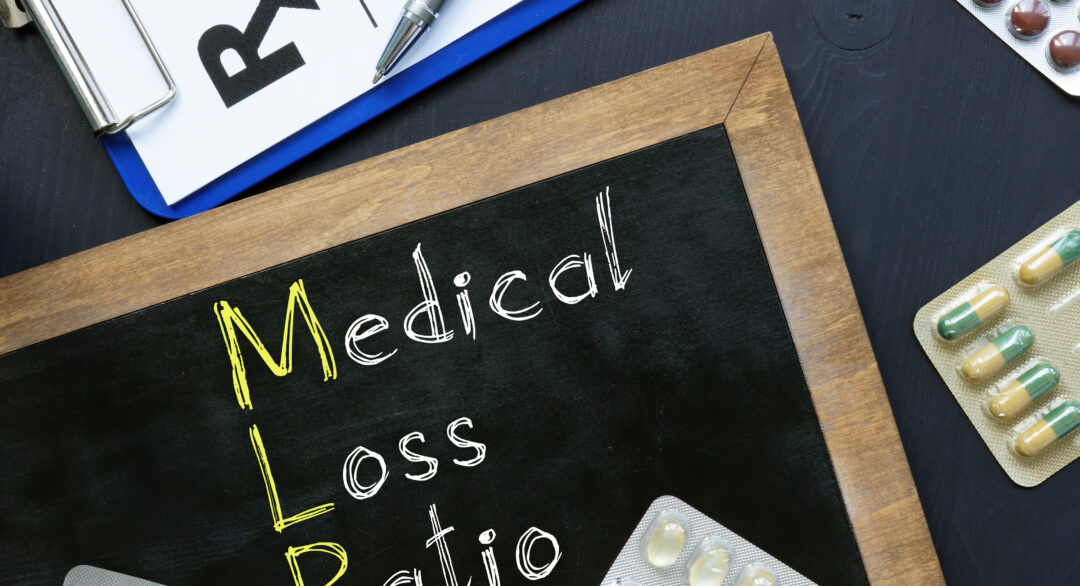

REBATES Bingo Card

Website Aims To Make Rebates Easier To Get

Website Aims To Make Rebates Easier To Get

Helping Employers Understand How To Use MLR Rebates

Tax Rebates And Savings Explained Accountly

Milwaukee Tool Rebates Printable Rebate Form

Mlr Rebates Explained - INTRODUCTION The ACA requires medical insurance companies Insurer or Insurers to pay annual Medical Loss Ratio MLR rebates to policyholders by each September 30 if the