Montana Energy Tax Credits This allows tax exempt entities to now directly qualify for many tax credits including those for clean commercial vehicles and renewable energy production or investment View information on opportunities below organized by recipient and tax credit

What is the Montana tax rebate for energy What is the federal tax rebate for solar in 2024 What can you write off for the solar tax credit Learn about Montana solar incentives tax DEQ currently offers grants and loan programs for alternative energy systems alternative fuel transportation and electric vehicle infrastructure Additional tax credits and rebates recently passed by congress will roll out soon

Montana Energy Tax Credits

Montana Energy Tax Credits

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

17 Times Billboard Global Top 10 Rapper Announces Exclusive Membership

https://nulltx.com/wp-content/uploads/2022/05/french-montana-music-nft-collection.jpg

A federal investment tax credit ITC for the installation costs of a solar PV solar water heating system a wind turbine no larger than 100 kilowatts geothermal heat pump and certain other technologies is available to qualifying individuals and businesses with no upper dollar limit You may use this form to claim your energy conservation installation credit Eligibility Any individual Montana resident Businesses may be eligible for the Energy Conservation Investment Deduction Qualifying Expenditures The costs of materials and equipment that reduce the waste or dissipation of energy or reduce the amount of energy

The State of Montana offers three home energy related tax credits for each tax payer For more information call the Montana Department of Revenue at 1 866 859 2254 or click on their Energy Related Tax Relief information page at https revenue mt gov Montana solar rebates and incentives 2024 guide The average Montana solar shopper will save 4 138 from the federal tax credit alone Montana s other property tax exemption and net metering program bring down the cost

Download Montana Energy Tax Credits

More picture related to Montana Energy Tax Credits

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Let The Sunshine In Solar Energy Tax Reduction Frost Brown Todd

https://frostbrowntodd.com/app/uploads/2023/03/clean-renewable-energy-or-electricity-production-tax-credits-and-incentives-financial-concept-green-energy-symbols-atop-coin-stack-eg-solar-panel-wind-turbine-fuel-cell-battery-and-the-word-tax-stockpack-gettyimages-scaled.jpg

Ennis Montana Montana Custom Log Homes

https://www.montanacustomloghomes.com/wp-content/uploads/2022/04/mclh_logo.png

The Inflation Reduction Act provides rebates and tax credits to make homes more energy efficient and could bring job opportunities to Montana as well The bill includes 9 billion across two rebate programs for people to retrofit their homes Additional resources are available such as tax credits Home Electrification Rebates Home Efficiency Rebates implementation support and other cross cutting assistance to help Montanans offset their costs Learn more at energy gov save Savings estimates cumulative over

The federal solar investment tax credit ITC is the most significant financial incentive for most homeowners buying solar panels in Montana It reduces your federal income tax Montana clean energy tax credits and low interest loans help reduce upfront costs for individuals who improve the energy efficiency of their homes or install renewable energy systems on their property

Receive Your Tax Credits

https://pacificinterwest.com/wp-content/uploads/2021/04/piw_45Lenergytaxcredits-1.jpg

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

https://www.deq.mt.gov/energy/Programs/tax-credits

This allows tax exempt entities to now directly qualify for many tax credits including those for clean commercial vehicles and renewable energy production or investment View information on opportunities below organized by recipient and tax credit

https://www.forbes.com/.../montana-solar-incentives

What is the Montana tax rebate for energy What is the federal tax rebate for solar in 2024 What can you write off for the solar tax credit Learn about Montana solar incentives tax

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

Receive Your Tax Credits

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

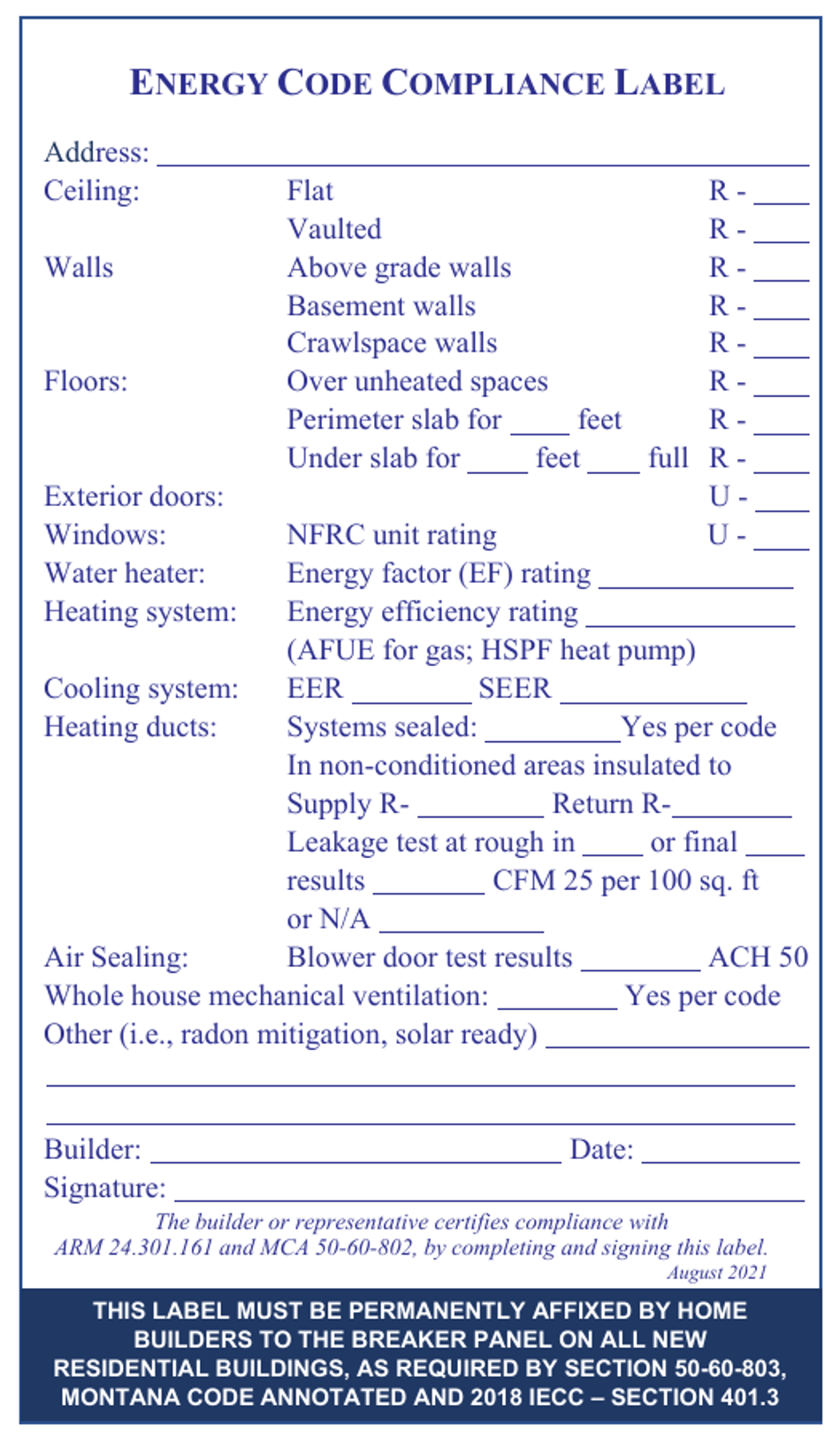

Montana Energy Code Compliance Label Fill Out Sign Online And

Federal Solar Tax Credit What It Is How To Claim It For 2024

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

2023 Residential Clean Energy Credit Guide ReVision Energy

IRS Updates On Residential Energy Credits Key Insights

Montana Energy Tax Credits - Montana provides several solar incentives to encourage the adoption of solar energy including tax credits grants and loan programs that help make solar installations more affordable for residents and businesses