Montana State Tax Return Address If you are filing an individual income tax return that includes a payment mail your return and check to Montana Department of Revenue PO Box 6308 Helena MT 59604 6308 If you are paying an estimated individual income tax payment mail your voucher and payment to Montana Department of Revenue PO Box 6309

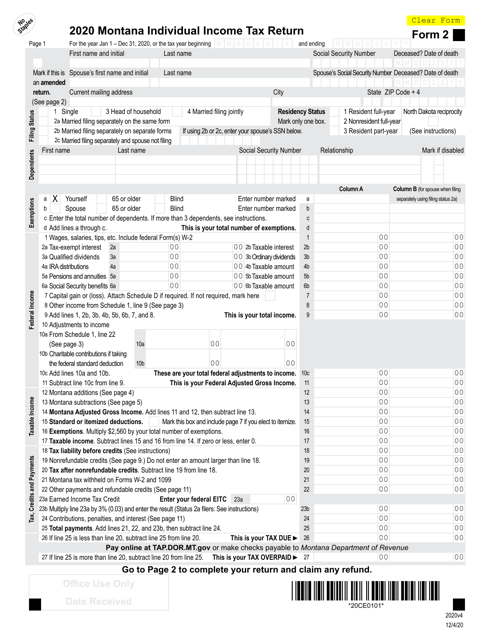

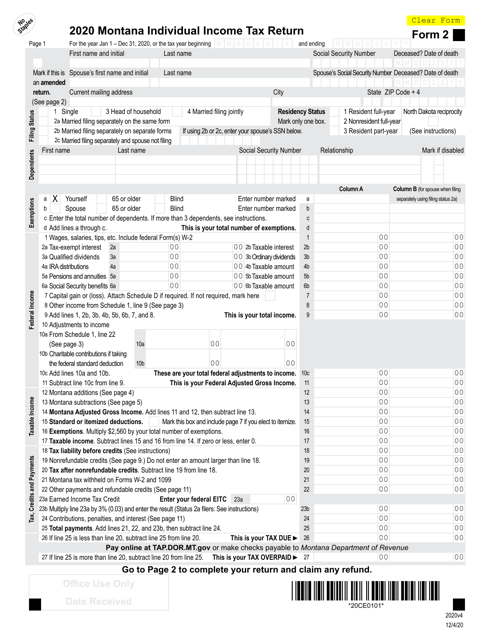

You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state Learn more about Montana Residency or see the Nonresident Part Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information Department of Revenue Mitchell Building 125 N Roberts P O Box 5805 Helena MT 59604 5805 Website MTRevenue gov TTY

Montana State Tax Return Address

Montana State Tax Return Address

https://mt-us.icalculator.com/img/og/US/19.png

California Tax Guide CA State Tax Information Rates 2023

https://i0.wp.com/www.communitytax.com/wp-content/uploads/2021/03/shutterstock_768140314-scaled.jpg

2023 Montana State Tax Calculator For 2024 Tax Return

https://mt-us.icalculator.com/img/og/US/23.png

File Your Tax Return or Where s my Refund File Upload for W 2s 1099s MW 3s Montana REAL ID File an Unemployment Claim Online Driver License Renewal Changing your address with the Montana Department of Revenue is easy You can download a change of address form at MTRevenue gov or request one from our Call Center at 406 444 6900 Montanans who haven t filed state returns in three years or more will also receive any refund on a paper check

Tap dor mt gov is a secure online portal for filing and paying taxes in Montana You can also check your refund status find unclaimed property and more Form 2 Montana s itemized deductions are the same as federal itemized deductions with a few differences Montana law allows a federal income tax deduction of up to 5 000 or 10 000 for MFJ Taxpayers itemizing on the federal return receive the deduction for state income taxes paid

Download Montana State Tax Return Address

More picture related to Montana State Tax Return Address

2024 Montana State Tax Calculator For 2025 Tax Return

https://mt-us.icalculator.com/img/og/US/24.png

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2020-Montana-Income-Tax-Rates.png

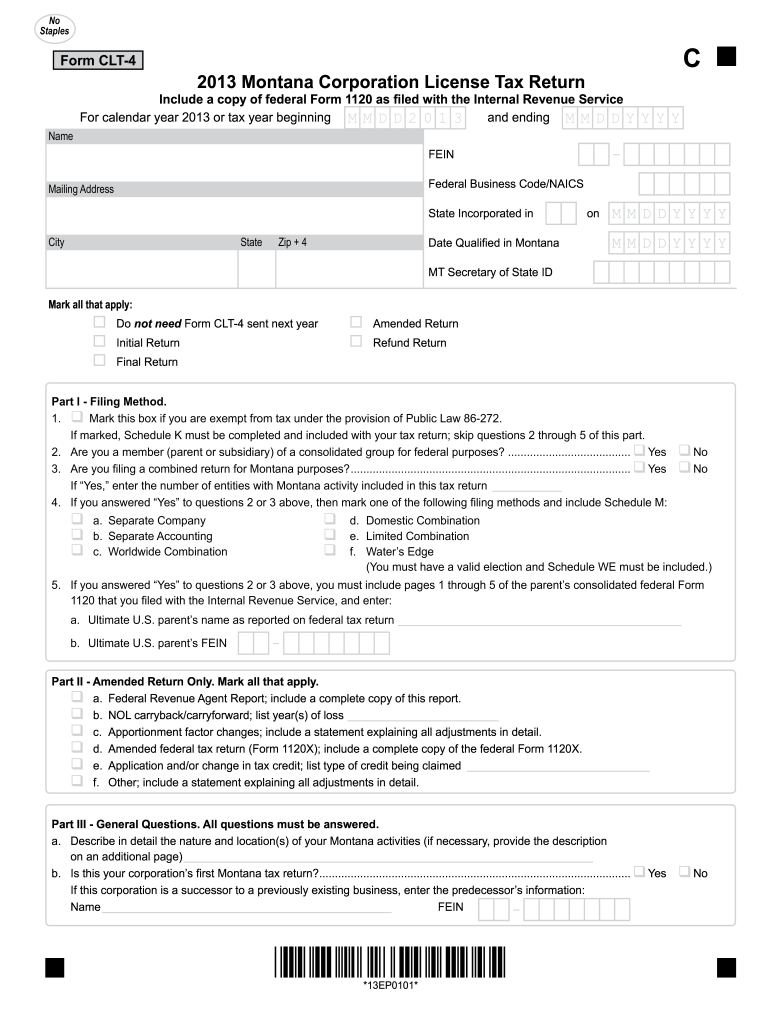

Tax Exemption Request

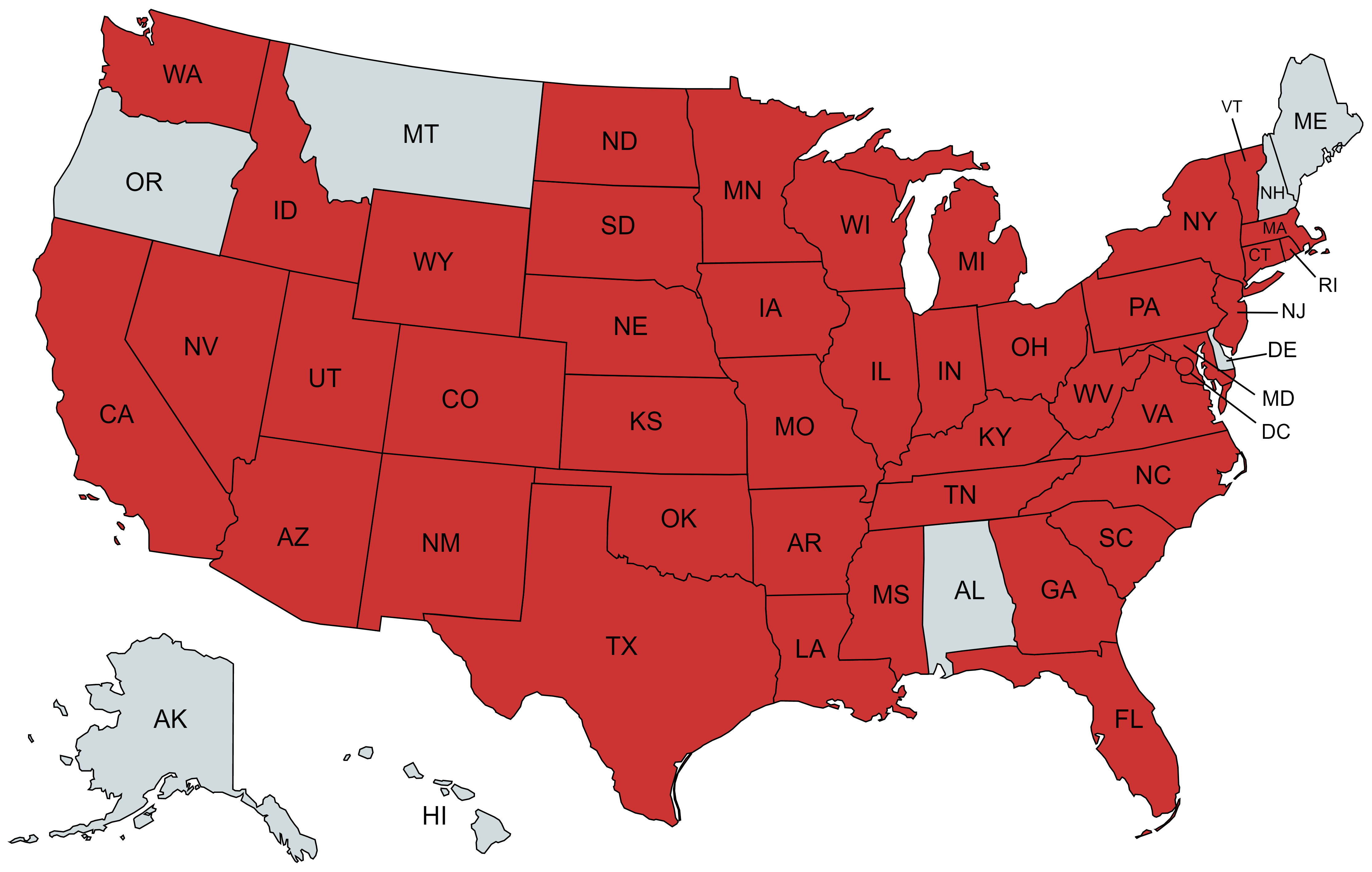

https://cdn11.bigcommerce.com/s-s4b2ood0lf/product_images/uploaded_images/salestaxmap6-22.png

Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Montana These Where to File addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in Montana during Calendar Year 2023 Home Tax Resources How to file a Montana income tax return Written by Deb Hipp December 14 2018 6 min read In a Nutshell Due to the COVID 19 pandemic Montana has extended its filing and payment deadline

You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state Learn more about Montana Residency or see the Nonresident Part Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information Where s My Refund It can take up to 90 days to issue your refund and we may need to ask you to verify your return Please check your refund status using Where s My Refund in our TransAction Portal TAP Check Your Refund Status in TAP Using Where s My Refund is the easiest way to check on your refund

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

Montana State Tax Form 2023 Printable Forms Free Online

https://www.incometaxpro.net/images/forms/2022/montana-tax-forms.png

https://ttlc.intuit.com/community/taxes/discussion/...

If you are filing an individual income tax return that includes a payment mail your return and check to Montana Department of Revenue PO Box 6308 Helena MT 59604 6308 If you are paying an estimated individual income tax payment mail your voucher and payment to Montana Department of Revenue PO Box 6309

https://mtrevenue.gov

You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state Learn more about Montana Residency or see the Nonresident Part Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information

IRS Mailing Addresses For Tax Returns And Other Tax S E File 107 6

Montana Income Tax Information What You Need To Know On MT Taxes

Colorado Earned Income Tax Credit Get Ahead Colorado

Fillable Online Revenue Mt Form CLT 4 Montana Department Of Revenue

Montana Tax Forms And Instructions For 2021 Form 2

Montana Estimated Tax Form Worksheet Printable Printable Forms Free

Montana Estimated Tax Form Worksheet Printable Printable Forms Free

Form 1040x 2023 Printable Forms Free Online

Montana Department Of Revenue YouTube

Free Printable State Tax Forms Printable Forms Free Online

Montana State Tax Return Address - File Your Tax Return or Where s my Refund File Upload for W 2s 1099s MW 3s Montana REAL ID File an Unemployment Claim Online Driver License Renewal