Montana Tax Return 2023 Waiting for Your Refund Check the status of your refund with the Where s My Refund tool in our TransAction Portal TAP Unexpected server response 403 while retrieving PDF https mtrevenue gov download 83160 This booklet addresses most tax filing situations

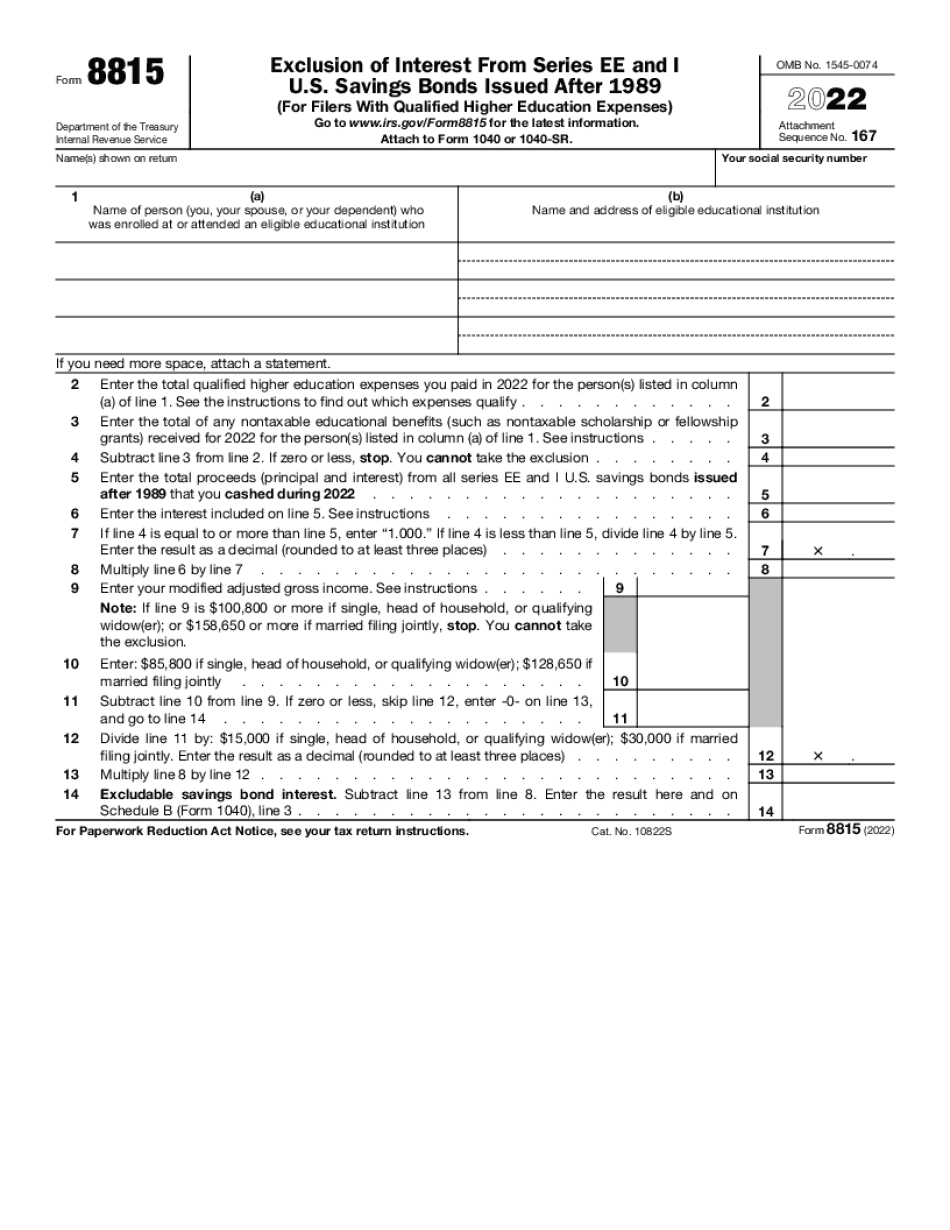

Individual Income Tax If you live or work in Montana you may need to file and pay individual income tax These resources can help you determine your filing requirements and options The Office of the Commissioner for Revenue urges the public to submit the Income Tax return online and benefit from an extension until the 31 July 2023 You can submit your income tax return online by logging into https mytax cfr gov mt using your e id account

Montana Tax Return 2023

Montana Tax Return 2023

https://www.pdffiller.com/preview/454/878/454878824/large.png

Montana State Tax Form 2023 Printable Forms Free Online

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

Taxes Fees Montana Department Of Revenue

https://mtrevenue.gov/wp-content/themes/Revenue2022/assets/images/siteheader.png

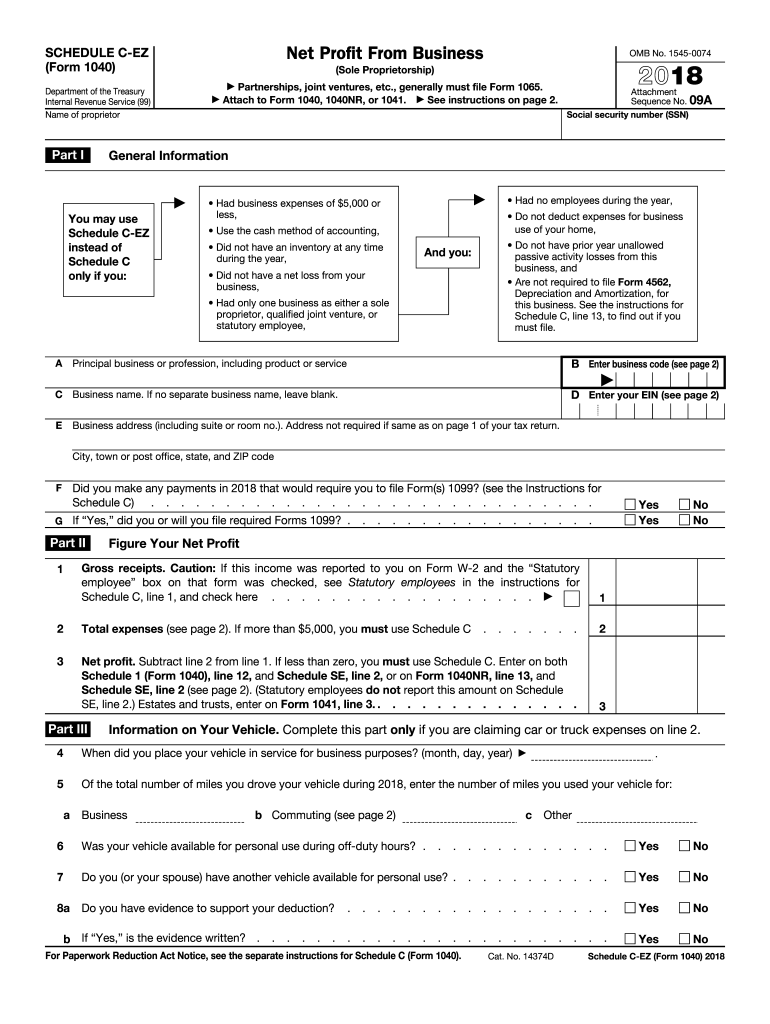

Form 2 is the official Montana Individual Income Tax Return used by residents of Montana to report their income and calculate any taxes owed or refundable to the state of Montana MT for tax year 2023 Montana began sending payments to eligible residents in early July and most income tax rebates will be sent by August 31 2023 according to the Montana Department of Revenue

Department of Revenue Business and Income Tax Division 2023 Montana Income Tax Update Webinar Download the slides here https mtrevenue gov wp content upl If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021 taxes If you meet those requirements but paid less than 1 250 in

Download Montana Tax Return 2023

More picture related to Montana Tax Return 2023

Montana Tax Forms And Instructions For 2022 Form 2

https://www.incometaxpro.net/images/forms/2022/montana-tax-forms.png

Montana Estimated Tax Voucher VOUCHERJAB

https://i2.wp.com/data.formsbank.com/pdf_docs_html/227/2278/227840/page_1_thumb_big.png

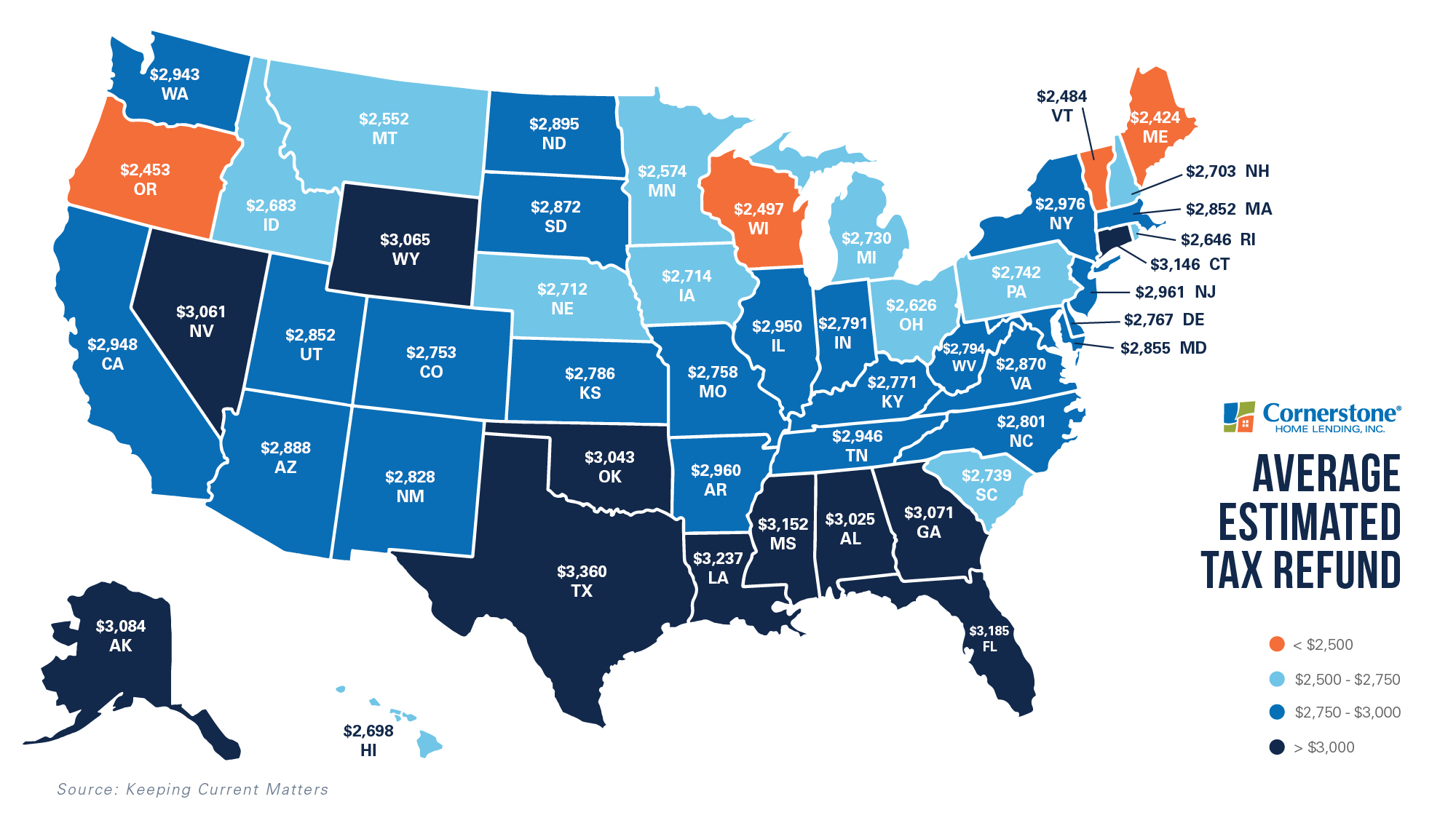

Tax Return 2021 Could Your Refund Make Homeownership A Reality

https://www.houseloanblog.net/wp-content/uploads/2021/05/210018_SM_BLOG_Tax-Refund-Toward-Down-Payment3.jpg

Montana has a state income tax that ranges between 1 and 6 75 which is administered by the Montana Department of Revenue TaxFormFinder provides printable PDF copies of 79 current Montana income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 2023 Tax Calculator for Montana The 2023 tax rates and thresholds for both the Montana State Tax Tables and Federal Tax Tables are comprehensively integrated into the Montana Tax Calculator for 2023 This tool is freely available and is designed to help you accurately estimate your 2024 tax return Historic Tax Tables supported for Montana

Montana has made the following changes for the 2023 tax year Tax Laws The due date for filing a Montana income tax return is extended to April 15 2024 The Montana Standard deduction amounts have changed to the following for 2023 Single under age 65 5 540 age 65 or older 8 500 Head of Household under age 65 11 080 age 65 or older Are you looking for your Montana tax refund Find information on your refund status and how we protect your refund from identity thieves

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

Montana Tax Forms And Instructions For 2021 Form 2

https://www.incometaxpro.net/images/forms/2021/montana-tax-forms.png

https://mtrevenue.gov/publications/montana-form-2...

Waiting for Your Refund Check the status of your refund with the Where s My Refund tool in our TransAction Portal TAP Unexpected server response 403 while retrieving PDF https mtrevenue gov download 83160 This booklet addresses most tax filing situations

https://mtrevenue.gov/taxes/individual-income-tax

Individual Income Tax If you live or work in Montana you may need to file and pay individual income tax These resources can help you determine your filing requirements and options

4 Smart Investments Using Your Tax Return

Prepare And File Form 2290 E File Tax 2290

Tax Return Forms Schedules E File In 2023 For 2023 Returns Fill

Printable A4 Form 2023 Fillable Form 2023 IMAGESEE

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

Simplified Income Tax Return Online TaxNodes

Simplified Income Tax Return Online TaxNodes

What We Think Are The 5 Best Uses For Your Tax Return New Dimensions

NFocus Tax Service LLC Clearwater FL

2023 Tax Bracket Changes PBO Advisory Group

Montana Tax Return 2023 - Form 2 is the official Montana Individual Income Tax Return used by residents of Montana to report their income and calculate any taxes owed or refundable to the state of Montana MT for tax year 2023