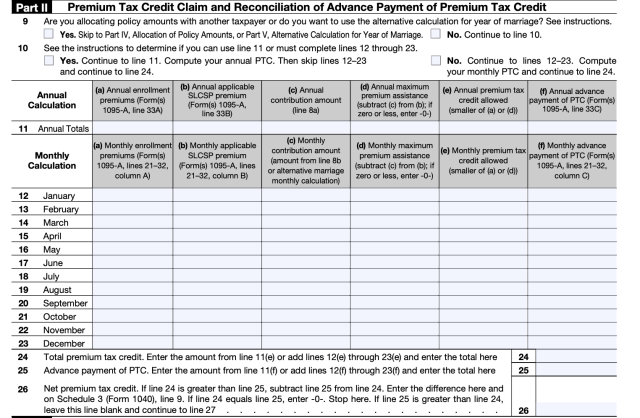

Monthly Advance Tax Credit Has A Zero Entered If the total in column B row 33 of your 1095 A was zero it s because either you qualified for a tax credit discount and chose not to get it in advance or you didn t

If you choose to have advance payments of the Premium Tax Credit made on your behalf you will reconcile the amount paid in advance with the actual credit you compute when Answered When the 1095 A list zeroes in the column for SLCSP it generates this error So basically I am reporting the 1095 correctly but it creates

Monthly Advance Tax Credit Has A Zero Entered

Monthly Advance Tax Credit Has A Zero Entered

http://iclclasses.com/wp-content/uploads/2021/07/advance-tax.jpg

Advance Tax For Senior Citizen Swati K And Co

https://www.swatikandco.com/images/advance_tax_sc.jpeg

Advance Tax Online Payment Process Due Date Calculation

https://navi.com/blog/wp-content/uploads/2022/04/Advance-Tax.jpg

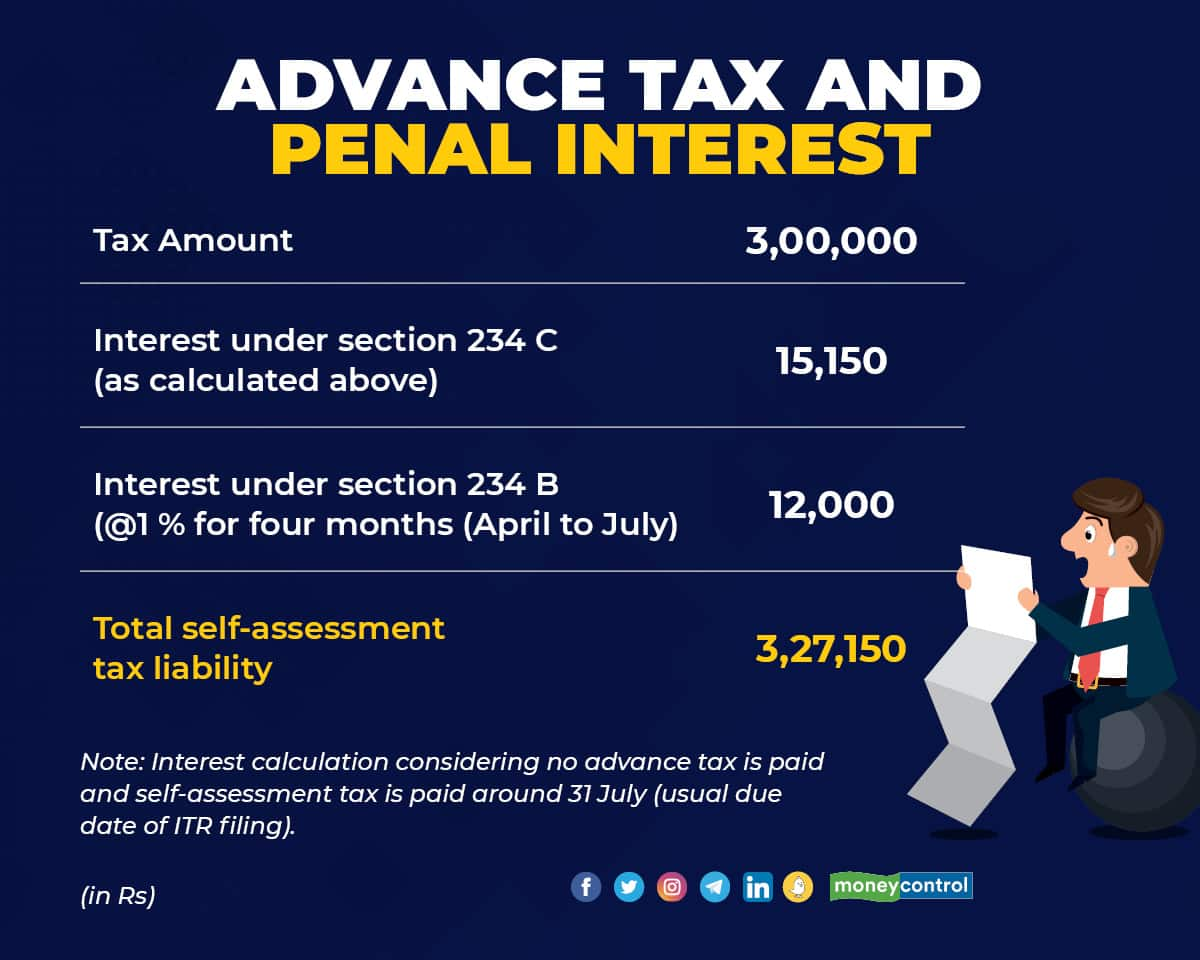

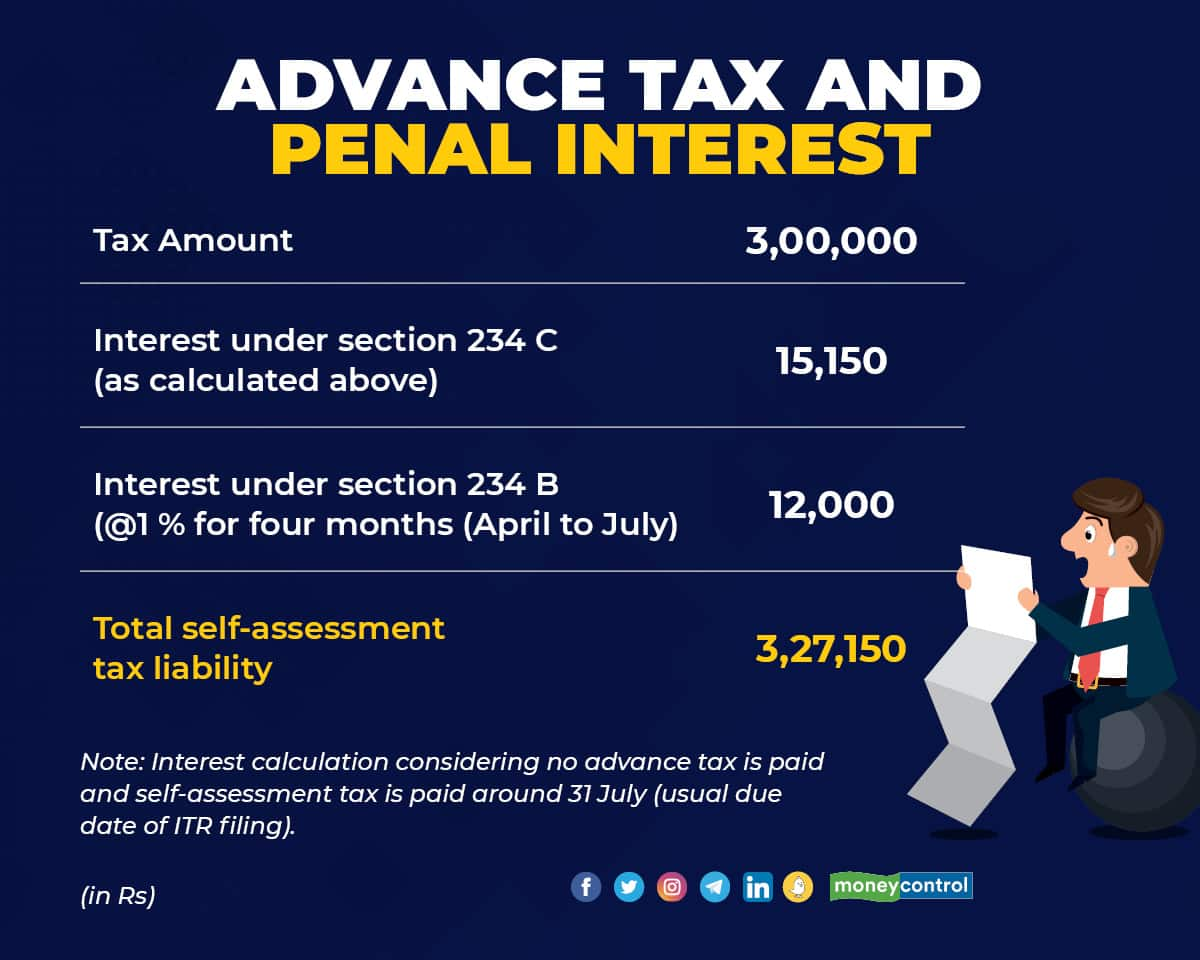

In the Smart Check section of Turbotax Deluxe all of the fields on my 1095 A where I entreed 0 00 are being flagged I only had a Marketplace plan for three To reconcile you compare two amounts the premium tax credit you used in advance during the year and the amount of tax credit you qualify for based on your final income You ll use IRS Form 8962 to do this

The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the If you received a tax credit to lower your monthly health insurance payment you are required to reconcile those advance payments using Form 8962 when you file your tax

Download Monthly Advance Tax Credit Has A Zero Entered

More picture related to Monthly Advance Tax Credit Has A Zero Entered

Liability For Advance Payment Of Tax Section 207

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/AdvanceTax-Refund/Advance Tax.jpg

Know All About Advance Tax Due Dates Succinct FP

https://www.succinctfp.com/wp-content/uploads/2012/09/Advance-Tax-FY-2016-17-AY-2017-18.png

The Advance Child Tax Credits Johnson CPA Bellmore Long Island NY

https://www.johnsoncpatax.com/wp-content/uploads/2021/10/CHILD-TAX-CREDIT.png

The Internal Revenue Service recently announced that taxpayers with excess advanced Premium Tax Credit APTC for 2020 are not required to file Form The general rule is they don t qualify for the credit if they are under 100 So it seems like they don t qualify There are a few exceptions to that rule one of which

Monthly Advance Premium Tax Credit The amount of advanced premium tax credit payments the Marketplace sends monthly to your insurer Step Three Changes in The 1095 A will usually show 0 in the SLCSP column whenever the taxpayer had not previously applied for an advanced premium tax credit In some

Have You Paid Your Advance Tax The Fourth And Final Instalment Of

https://images.moneycontrol.com/static-mcnews/2022/03/Advance-tax_001.jpg

Salary Adjustment Form Template Fill Online Printable Fillable

https://newdocer.cache.wpscdn.com/photo/20190820/18bd804f11e14c53a2310e11f9e7208c.jpg

https://ttlc.intuit.com/community/taxes/discussion/...

If the total in column B row 33 of your 1095 A was zero it s because either you qualified for a tax credit discount and chose not to get it in advance or you didn t

https://www.irs.gov/affordable-care-act/...

If you choose to have advance payments of the Premium Tax Credit made on your behalf you will reconcile the amount paid in advance with the actual credit you compute when

Advance Tax Who Should Pay Due Date Onlineideation

Have You Paid Your Advance Tax The Fourth And Final Instalment Of

Who Gets The 1400 Tax Credit Leia Aqui Who Is Eligible For The 1400

How Do I Calculate My Premium Tax Credit

Understanding Of Advance Tax Taxation Trading Q A By Zerodha All

Instalment Of Advance Tax Payment Due Date For FY 2022 23

Instalment Of Advance Tax Payment Due Date For FY 2022 23

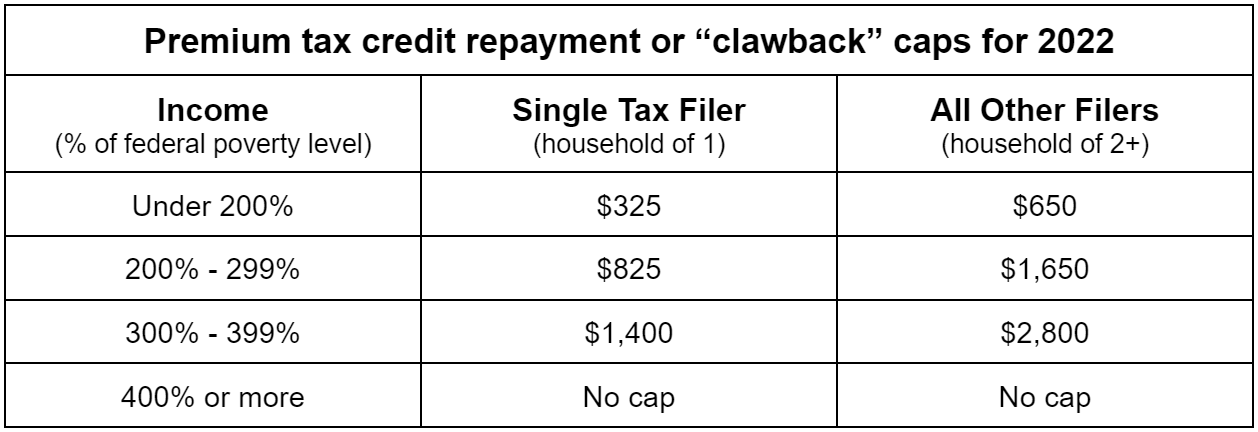

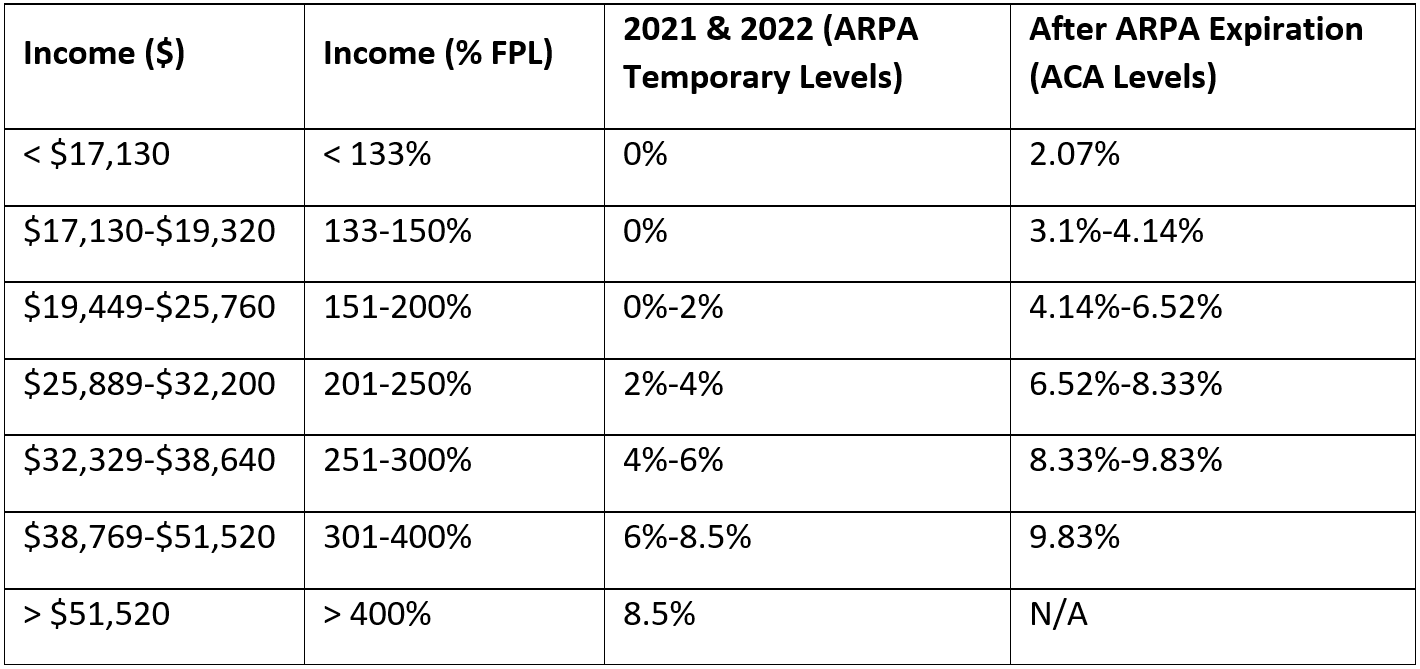

After The American Rescue Plan s Enhanced Premium Tax Credits End AAF

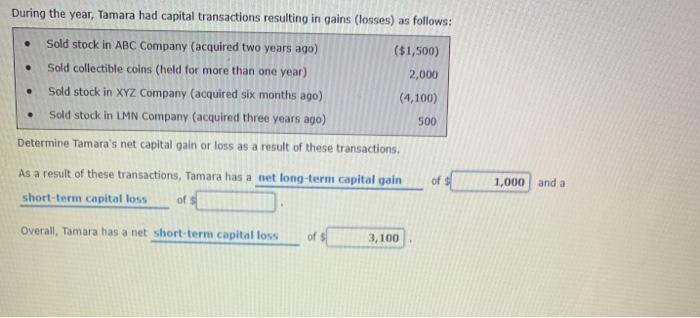

Solved Compute The 2020 Standard Deduction For The Following Chegg

Advance Tax Are You Required To Pay Advance Tax What Are Consequences

Monthly Advance Tax Credit Has A Zero Entered - If your estimated income falls between 100 and 400 of the federal poverty level for a household of your size you can claim the premium tax credit You