Mortgage Loan Tax Form Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file Use Form 1098 to report mortgage interest

If you hold a mortgage credit certificate and can claim the mortgage interest credit see Form 8396 If the interest was paid on a mortgage home equity loan To fill out the information about the mortgage interest you paid during the tax year you ll need a Form 1098 from your mortgage lender or mortgage servicer the company you make your mortgage

Mortgage Loan Tax Form

Mortgage Loan Tax Form

https://www.loanfasttrack.com/blog/wp-content/uploads/2021/07/mortgage-loan-1024x684.png

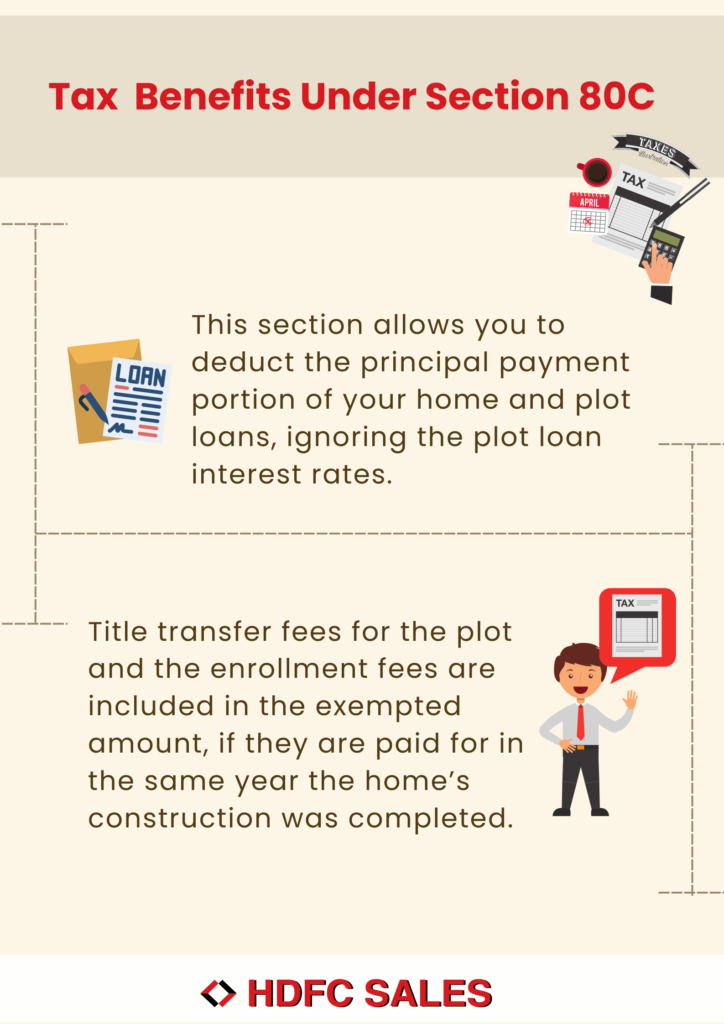

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

CAN YOU GET A MORTGAGE LOAN WITH STUDENT DEBT Toronto Real Estate

https://images.unsplash.com/photo-1544717305-2782549b5136?ixid=Mnw0MTQ1MnwwfDF8c2VhcmNofDV8fFNUVURFTlR8ZW58MHx8fHwxNjc3NTk5MDM5&ixlib=rb-4.0.3&q=80&w=1280

Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders IRS Form 1098 is a mortgage interest statement It s a tax form used by businesses and lenders to report mortgage interest paid to them of 600 or more

Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors What mortgage interest is tax deductible To take the mortgage interest deduction the interest paid must be on a qualified home Your first and second home may be considered qualified

Download Mortgage Loan Tax Form

More picture related to Mortgage Loan Tax Form

TAX ISSUES FOR EMPLOYER S CONCESSIONAL INTEREST LOAN Tax Planning For

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/05/A-1-3.jpg

Home Loan Tax Deduction Home Loans Tax Income Tax

https://i.pinimg.com/736x/d0/fe/30/d0fe302b889664b4a1cc0b1e9df27f60.jpg

5 Home Loan Tax Benefits Every Homebuyer Should Know Raunaq Foundations

https://www.raunaqfoundations.com/wp-content/uploads/shutterstock_1383141659-min-1024x684.jpg

Your mortgage lender should send you a Form 1098 in January or early February It details how much you paid in mortgage interest and points during the There are a number of tax deductions that you can take advantage of if you refinance a mortgage loan You can often deduct the full amount of interest you paid on your loan in the last year if you did a standard refinance on

You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebt edness However higher limitations 1 million 500 000 if Form 1098 and Form 1099 Differences The Form 1098 also known as Mortgage Interest Statement is used to report the amount of interest and related expenses you paid on

How You Can Maximize Your Home Loan Tax Benefits Credit Dharma

https://creditdharma.in/blog/wp-content/uploads/2024/01/HL_HLTB_FI.png

Mortgage Loan Review Happy Mortgage By Centennial Bank Student Loan

https://www.studentloanplanner.com/wp-content/uploads/2023/02/Mortgage-Loan-Review_-Happy-Mortgage-by-Centennial-Bank.jpg

https://www.irs.gov/forms-pubs/about-form-1098

Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file Use Form 1098 to report mortgage interest

https://www.irs.gov/pub/irs-pdf/f1098.pdf

If you hold a mortgage credit certificate and can claim the mortgage interest credit see Form 8396 If the interest was paid on a mortgage home equity loan

MORTGAGE LOAN OFFICER

How You Can Maximize Your Home Loan Tax Benefits Credit Dharma

Home Loan Concept On Craiyon

Mortgage Loan How To Apply Interest Rate Etc

Mortgage Loan Officer

Income Tax ShareChat Photos And Videos

Income Tax ShareChat Photos And Videos

High Interest Rates Mean A Boom For Fixed income Investments But Taxes

Tax Form For Self Employed

Statement Of Information Fillable Form Mortgage Printable Forms Free

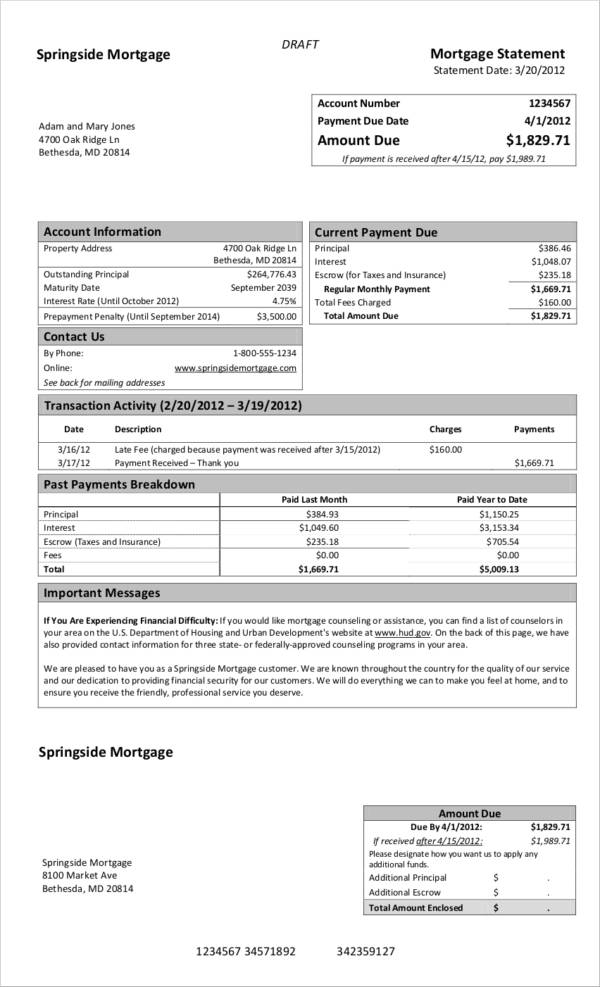

Mortgage Loan Tax Form - Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors