Nassau County Star Exemption Income Limits STAR exemption amounts for school year 2024 2025 Nassau County The above exemption amounts were determined using the latest data available These exemptions are subject to change as more current data becomes available

Your income must be equal to or less than the Enhanced STAR income limit The income limit applies to the combined incomes of all owners residents and non residents and any owner s spouse who resides at the property For STAR purposes income means federal adjusted gross income minus the taxable amount of total A 1 The Basic STAR Exemption is for all homeowners regardless of age with an annual household income of 500 000 or less 2 The Enhanced STAR Exemption is available to senior citizen homeowners who are 65 years of age or older during the year in which the exemption takes effect and whose annual income does not exceed 83 300 Senior

Nassau County Star Exemption Income Limits

Nassau County Star Exemption Income Limits

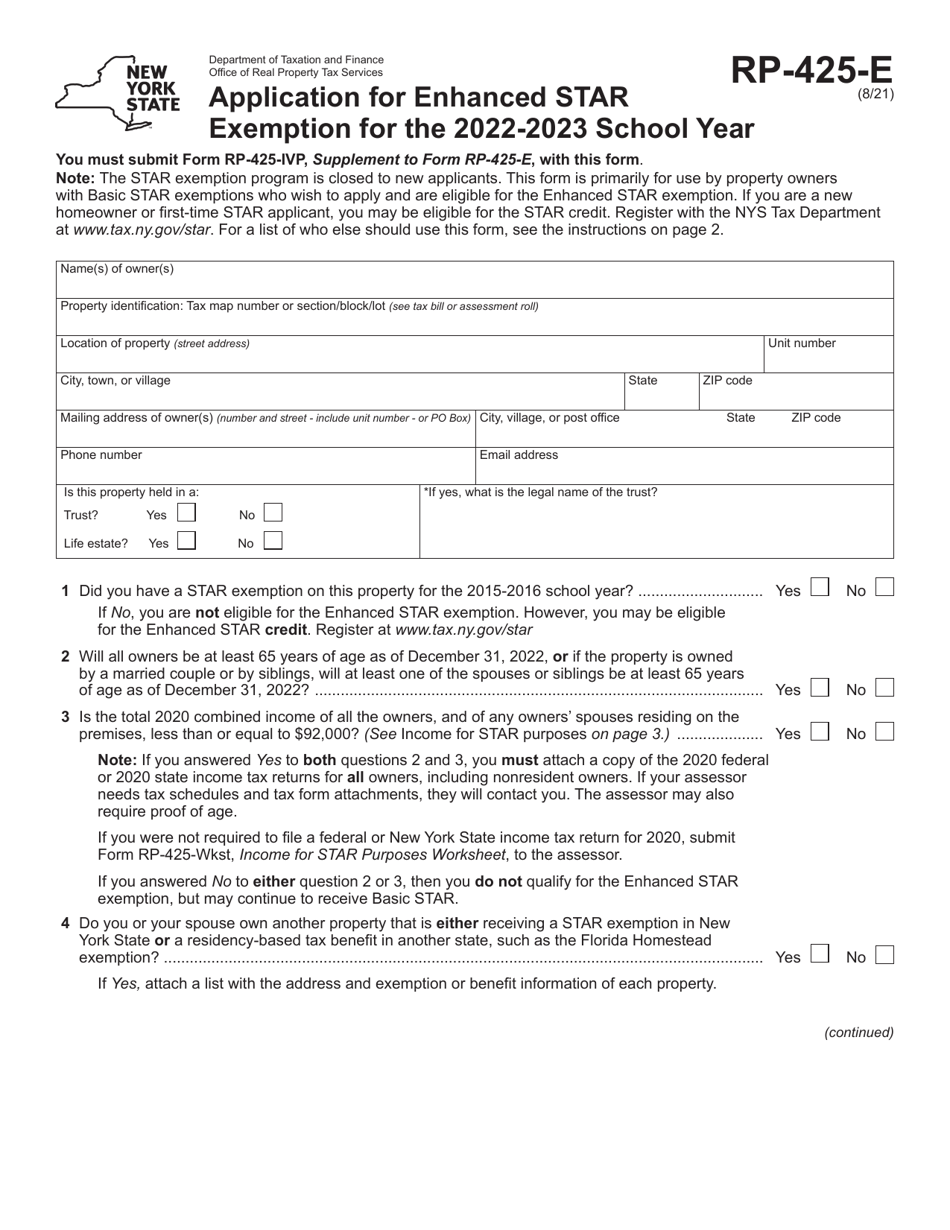

https://data.formsbank.com/pdf_docs_html/98/980/98025/page_1_thumb_big.png

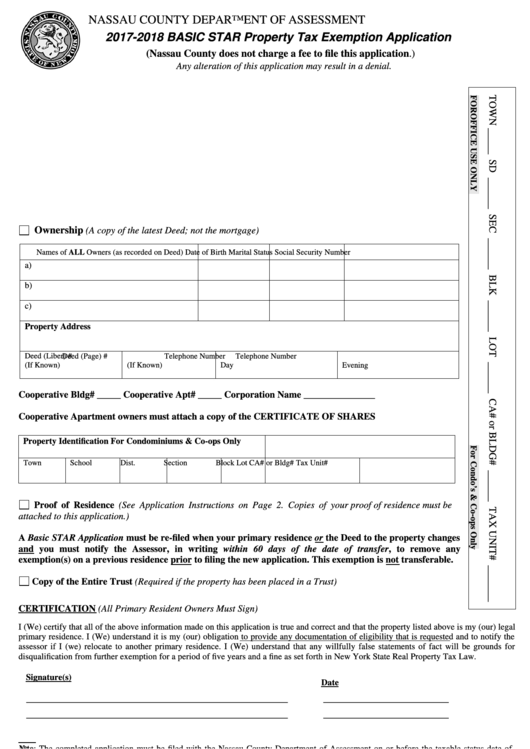

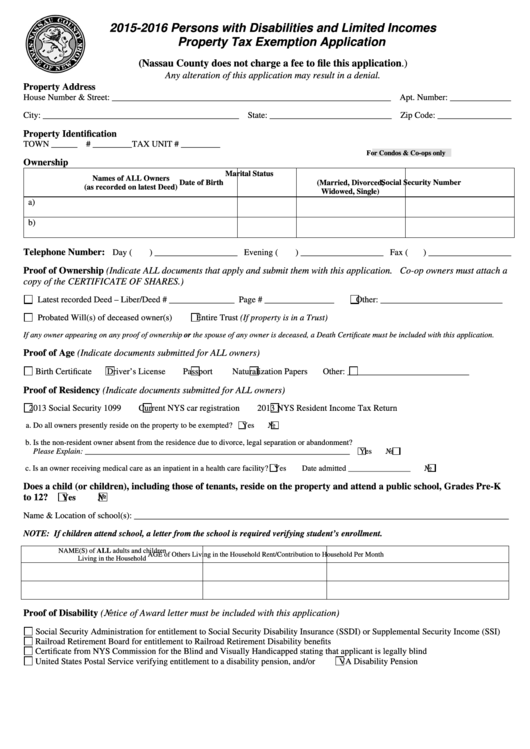

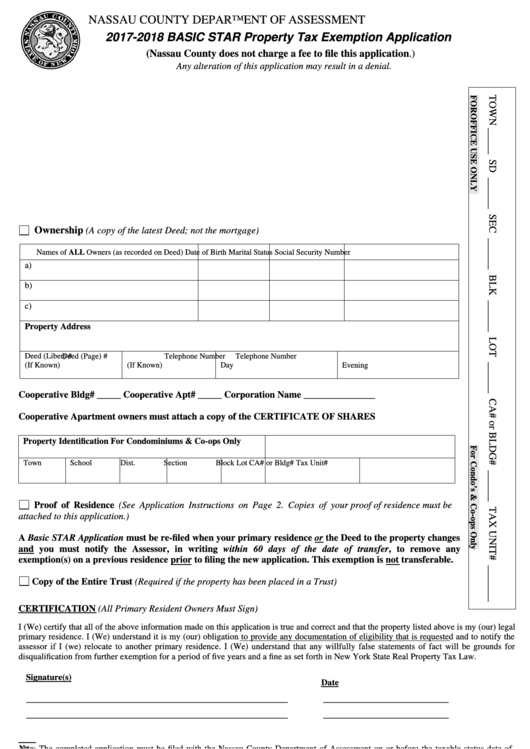

Nassau County Star Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/nassau-county-property-tax-exemption-application-printable-pdf-download.png

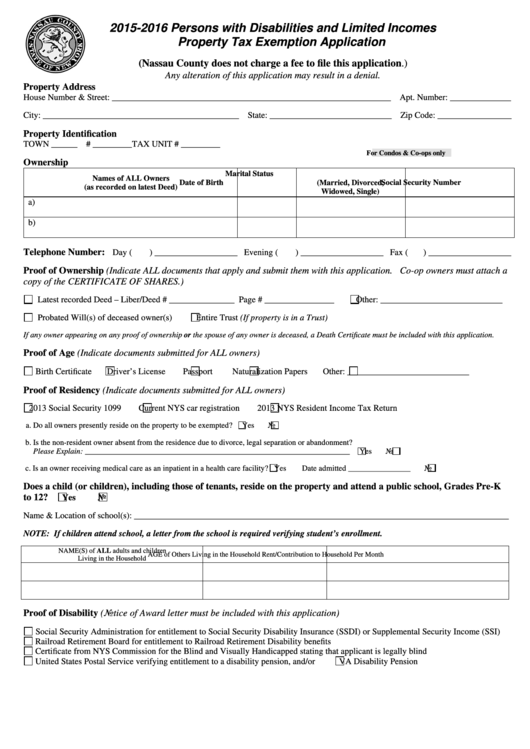

Nassau Notebook MetroCard Use On NICE Buses Enhanced STAR Exemption

https://patch.com/img/cdn/users/83523/2011/12/raw/a09dff62272ec31035ca04c929e5a8a8.jpg

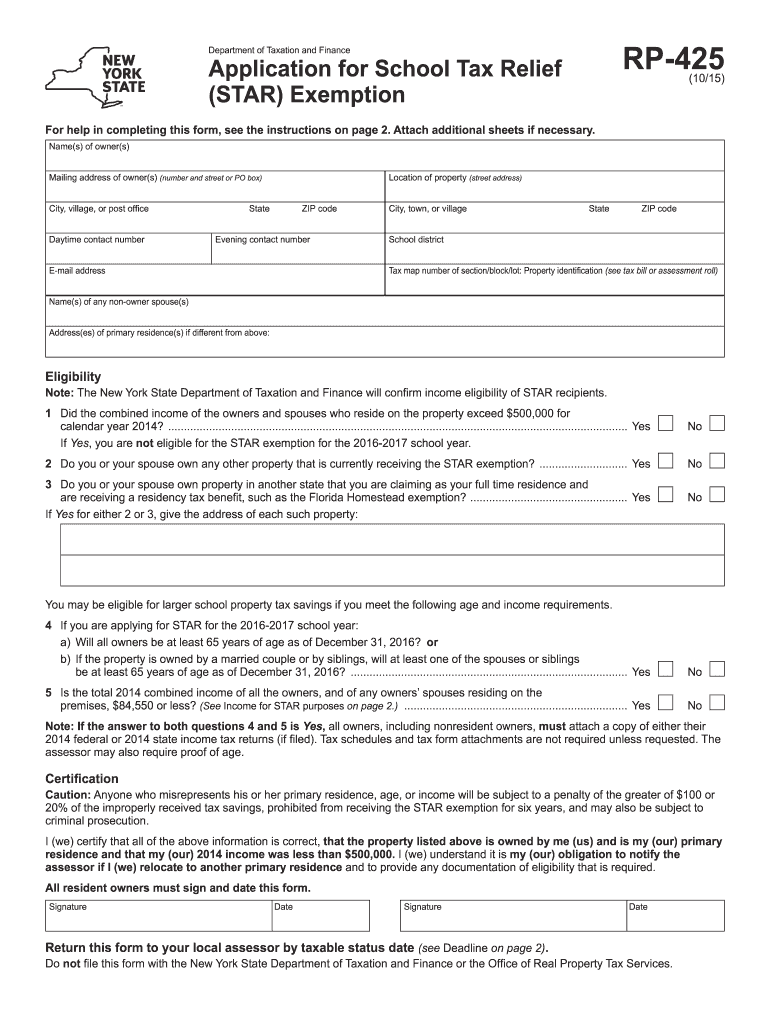

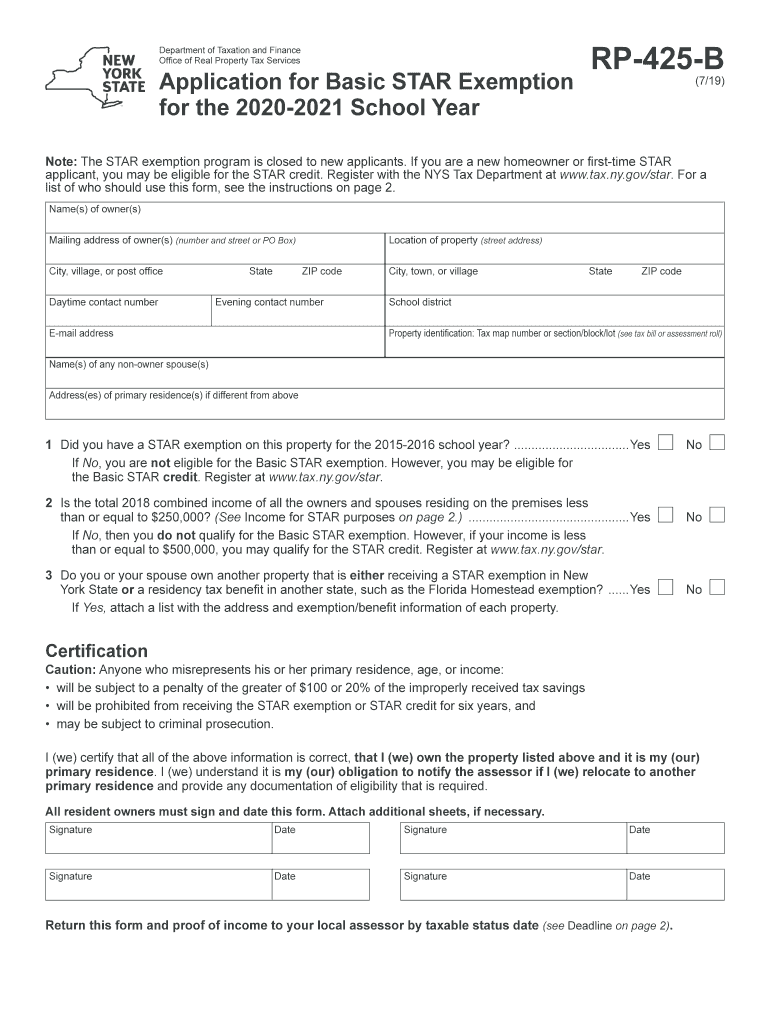

Whether you receive the STAR exemption or the STAR credit there are two parts to the STAR program BASIC STAR and ENHANCED STAR BASIC STAR Who is eligible for BASIC STAR available for owner occupied primary residences the income limit for the Basic STAR credit is 500 000 the income limit for the Basic STAR The combined income limit for the Basic STAR exemption is 250 000 For the 2024 STAR benefit refer to your 2022 income tax form Based on the first 30 000 of the full value of a home If your income is greater

Basic STAR Available for owner occupied primary residences where the resident owners and their spouses income is less than 500 000 Property owners who currently receive a Basic STAR exemption on their school tax bill will continue to receive the exemption unless their household income is above 250 000 The basic exemption is limited to 10 years but there is no time limit for the disabled portion of this exemption In both instances the exemption is limited to the primary residence of the veteran and is applicable only to general municipal taxes not to

Download Nassau County Star Exemption Income Limits

More picture related to Nassau County Star Exemption Income Limits

Star Exemption 2015 2023 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/646/100646452/large.png

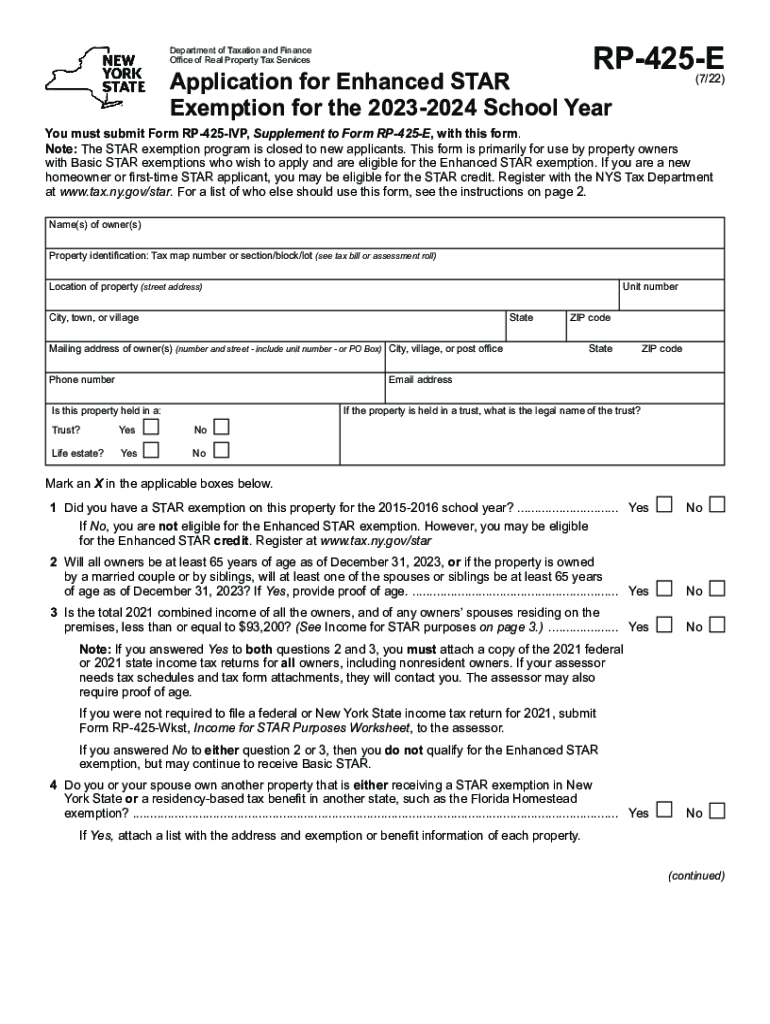

Enhanced Star Program 2022 2023 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/624/625/624625208/large.png

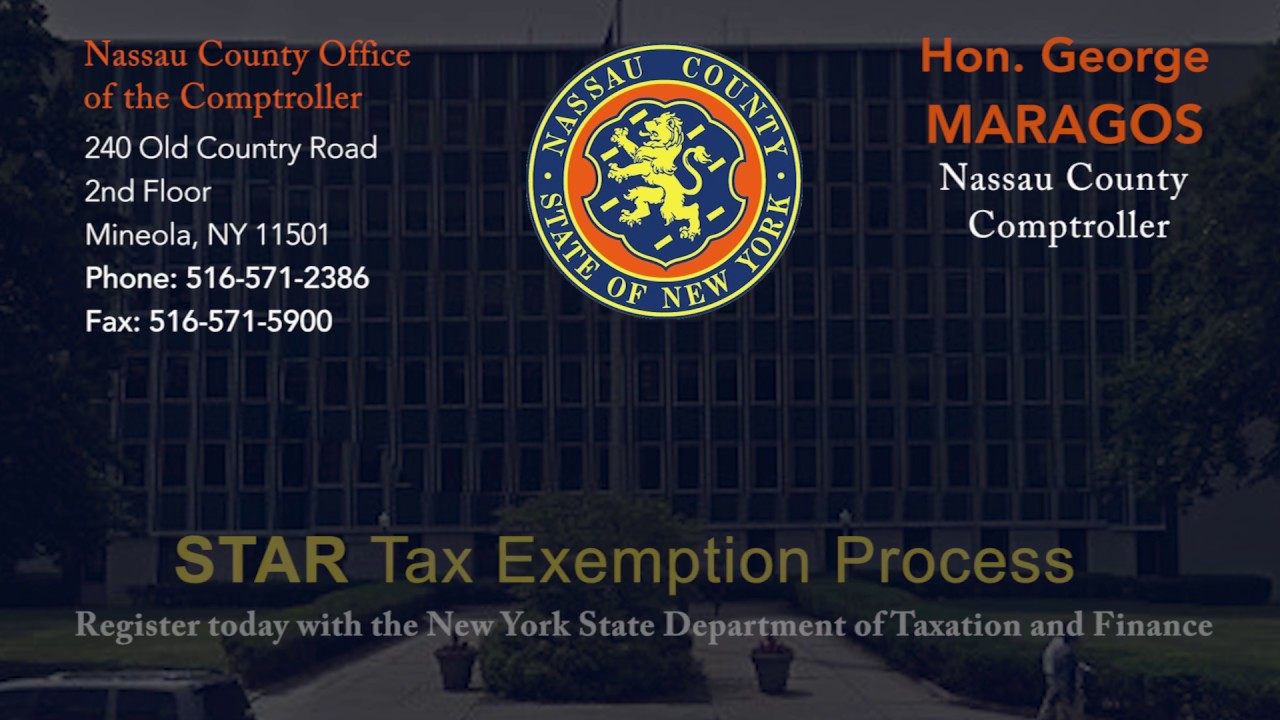

STAR Exemption Procedure YouTube

https://i.ytimg.com/vi/-gL-Sw0yLA0/maxresdefault.jpg

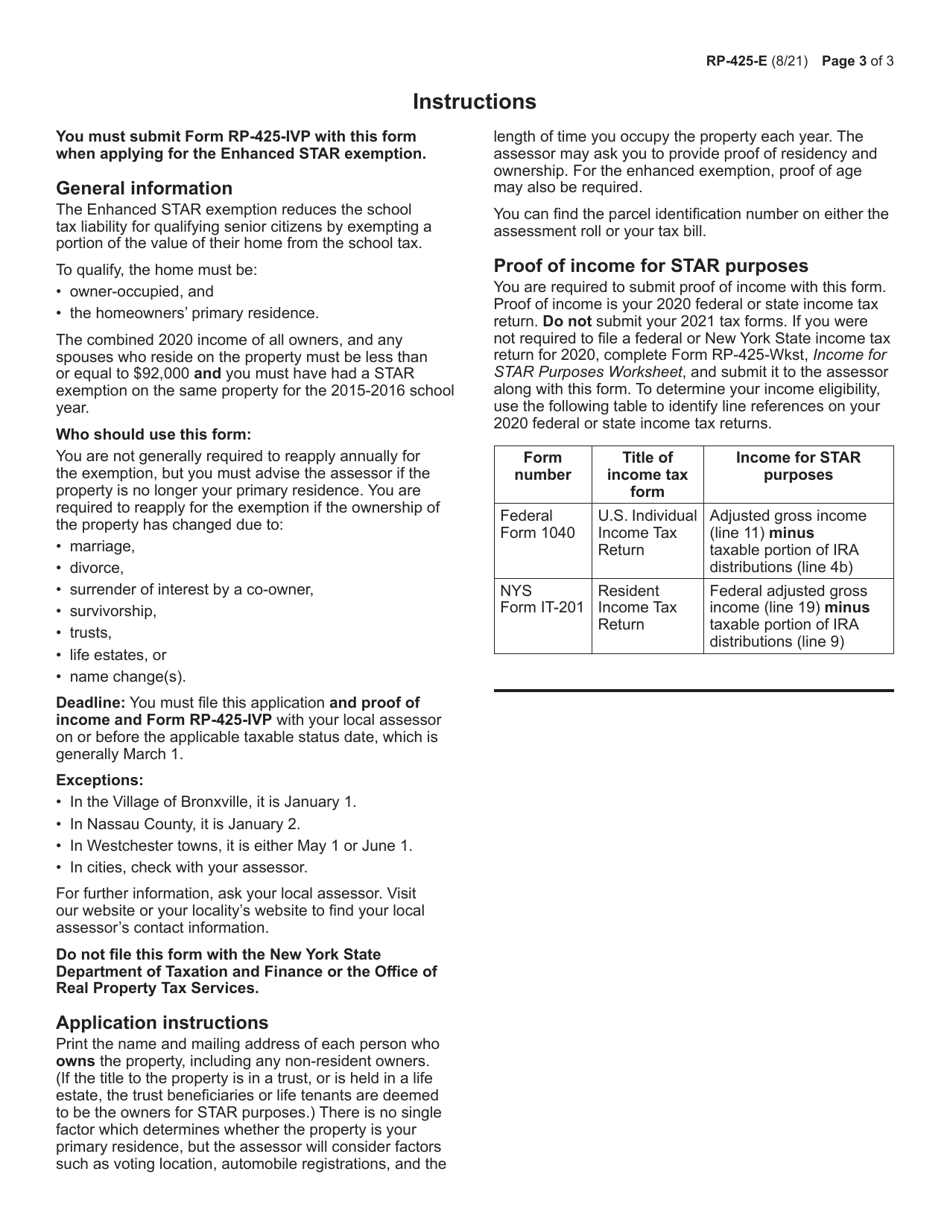

There are two programs available the Enhanced STAR School Tax Assessment Relief program and the Senior Citizens Property Tax Exemption Enhanced STAR provides seniors aged 65 and older whose annual household income does not exceed 86 300 in the year 2017 a partial exemption from School taxes The income requirement can STAR exemption amounts for school year 2023 2024 Nassau County The above exemption amounts were determined using the latest data available These exemptions are subject to change as more current data becomes available

2023 final STAR credit and exemption savings amounts Nassau County The table below displays the final STAR credits and STAR exemption savings that homeowners received in 2023 The amounts vary by municipality and school district To find the amounts in your jurisdiction Current Enhanced STAR Exemption recipients who are not enrolled in the Income Verification Program must continue to file a renewal application with the Nassau County Department of Assessment each year Basic STAR The Basic STAR Exemption is for all homeowners regardless of age

Q A How STAR Exemption Is Changing

https://www.gannett-cdn.com/-mm-/ecf0bf815876fd176fb882f8010823c0062c05fe/c=0-50-534-350&r=x803&c=1600x800/local/-/media/2016/05/11/Binghamton/B9322036621Z.1_20160511060916_000_GGOEB9MSD.1-0.jpg

SHTETL Reverse View Jewish Art Sculptor Lion Sculpture

https://i.pinimg.com/736x/e5/c1/28/e5c12811d13755d094d347a1f330f989.jpg

https://www.tax.ny.gov/pit/property/star/exemption...

STAR exemption amounts for school year 2024 2025 Nassau County The above exemption amounts were determined using the latest data available These exemptions are subject to change as more current data becomes available

https://www.tax.ny.gov/pit/property/star/rp-425-mbe.htm

Your income must be equal to or less than the Enhanced STAR income limit The income limit applies to the combined incomes of all owners residents and non residents and any owner s spouse who resides at the property For STAR purposes income means federal adjusted gross income minus the taxable amount of total

Rent And Mortgage Assistance For Nassau County Residents

Q A How STAR Exemption Is Changing

Star Afflication Rp 425 B Form Fill Out And Sign Printable PDF

What Is The Basic STAR Property Tax Credit In NYC Hauseit

Taking Full Advantage Of Nassau County s Property Tax Exemption

Elvis Fans Of Nashville On Instagram July 19 1975 Elvis Performed

Elvis Fans Of Nashville On Instagram July 19 1975 Elvis Performed

Form RP 425 E Download Fillable PDF Or Fill Online Application For

No Hand holding In Exemption Process

Form RP 425 E Download Fillable PDF Or Fill Online Application For

Nassau County Star Exemption Income Limits - New STAR applicants and current Basic STAR exemption recipients with household incomes greater than 250 000 and less than or equal to 500 000 will receive a STAR credit in the form of a check mailed from the New York State Department of