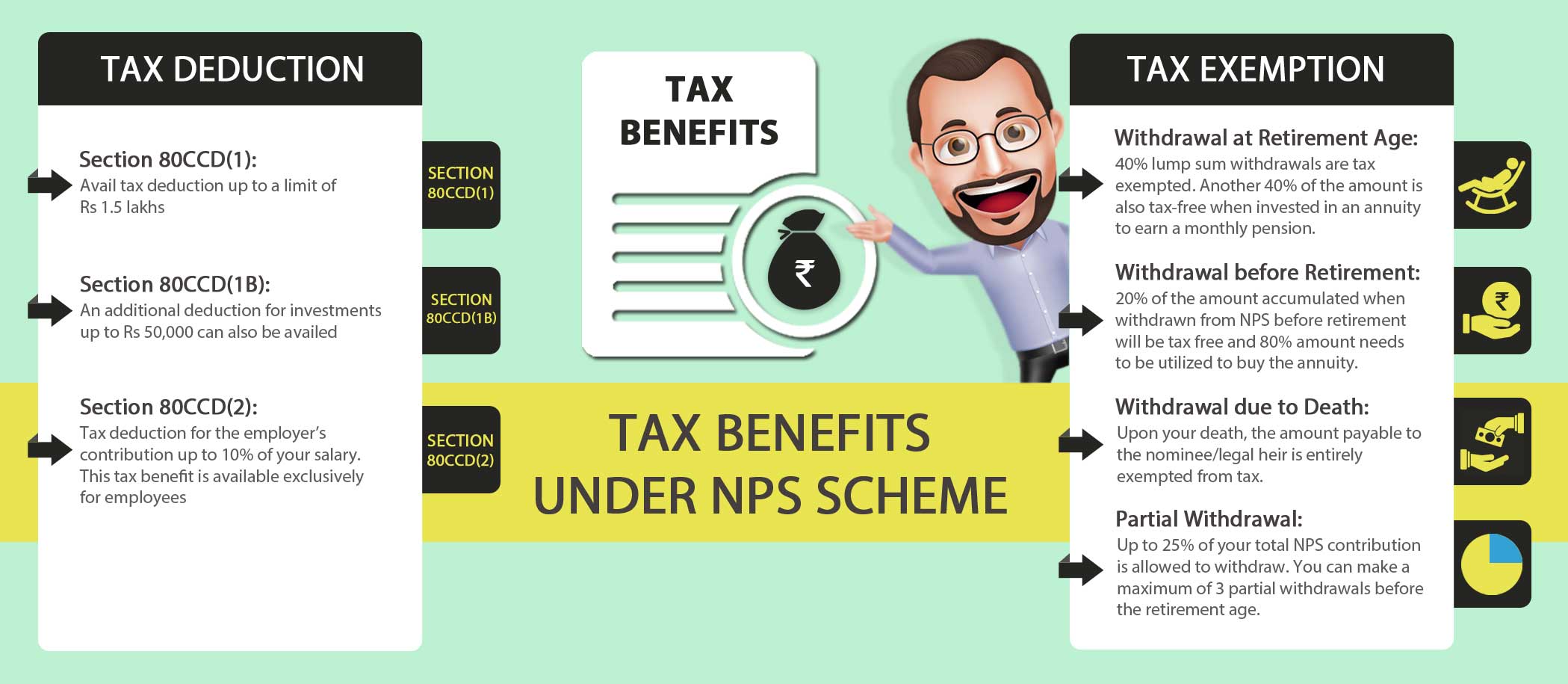

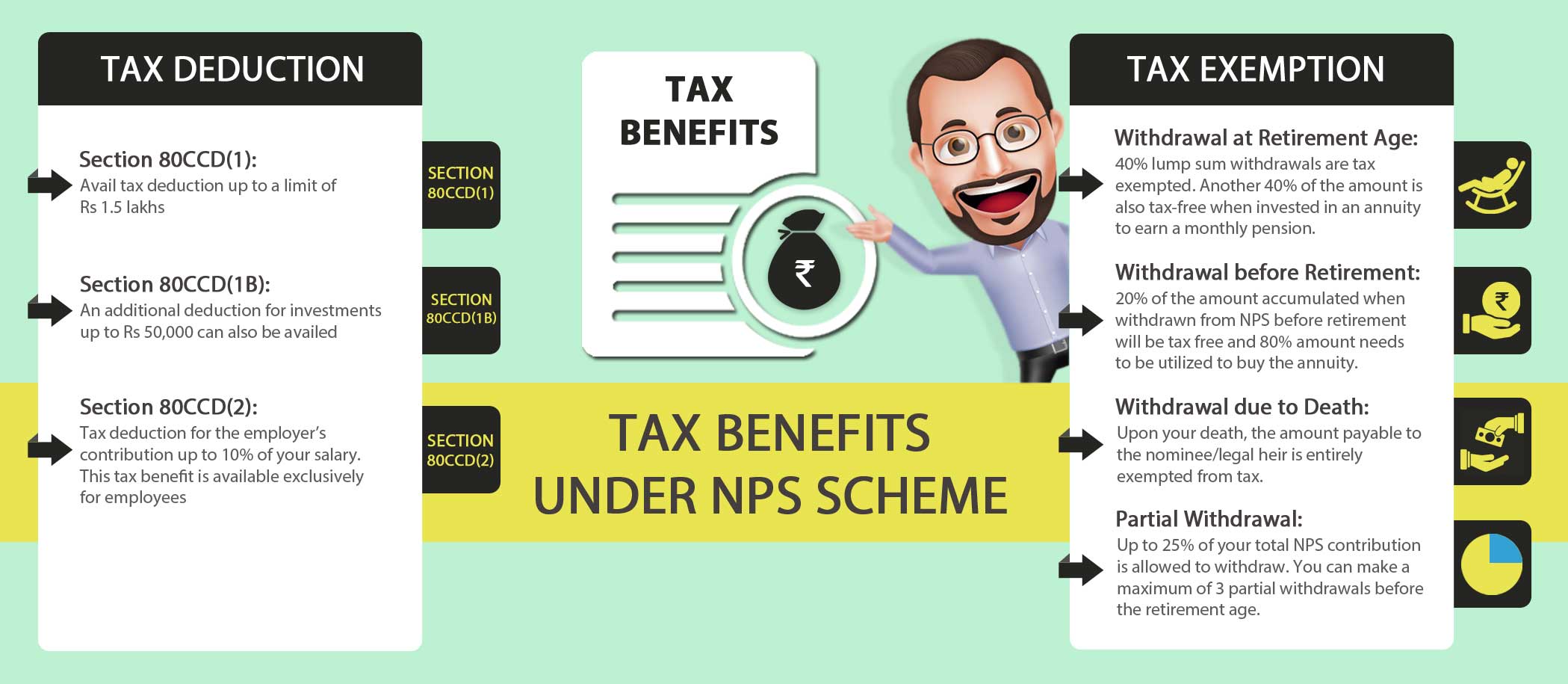

National Pension Scheme Tax Benefit In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals

National Pension Scheme Tax Benefit

National Pension Scheme Tax Benefit

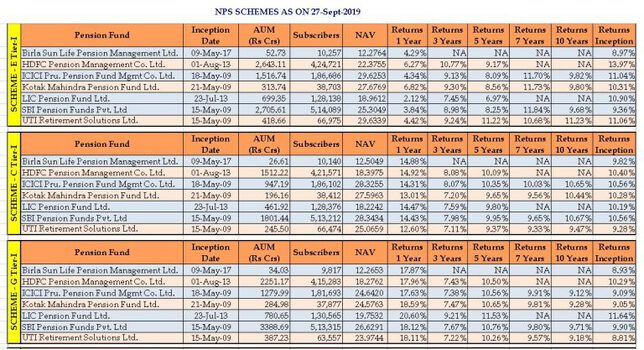

https://www.mintwise.com/blog/wp-content/uploads/2014/08/New-Pension-Scheme-NPS-Section-80CCD2-_1.png

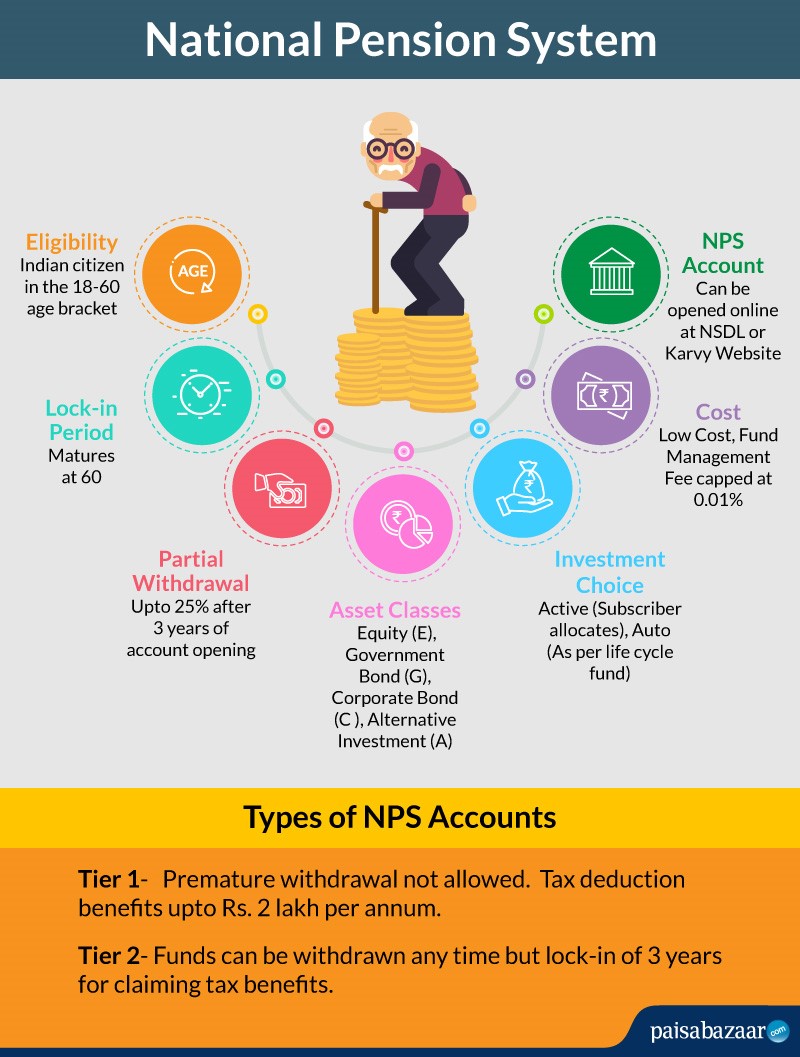

National Pension System NPS A Tax Saving Instrument ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/tax-benefits-under-national-pension-system.jpg

NPS National Pension Schemes Eligibility Types Calculator

https://www.paisabazaar.com/wp-content/uploads/2016/10/NPS-1.jpg

Understanding the importance of Section 80CCD for tax savings in India covering deductions of 2 lakh rupees for contributions to National Pension System and Atal Pension Yojana under the Income Tax Benefits Under NPS As Per October 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961 The tax

You can avail tax benefits for NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD 2 Now let s delve Contribution to employee s pension account referred to in Section 80CCD Therefore any payment made by your employer to your NPS account is a part of your taxable salary However for comparison

Download National Pension Scheme Tax Benefit

More picture related to National Pension Scheme Tax Benefit

NPS New Pension Scheme Tax Benefits Of Section 80CCD 2

https://www.mintwise.com/blog/wp-content/uploads/2014/08/New-Pension-Scheme-NPS-Section-80CCD2-_2.png

National Pension System NPS Is It A Good Tool For Retirement

https://getmoneyrich.com/wp-content/uploads/2009/12/National-Pension-System-NPS-Income-Tax-Benefits-Deductions.png

Nps Calendar 2022 23 January Calendar 2022

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80-ccd-1b.jpg

The National Pension Scheme provides tax benefits to investors According to Section 80C of the Income Tax Act individuals are entitled to a deduction that is up to 1 What are the tax benefits under NPS 2 What will be the investment proof to avail the tax benefit under NPS 3 What are other tax benefits under NPS apart from available

The National Pension System NPS is a government sponsored retirement savings scheme that provides tax benefits under both old and new tax regimes in India Annuity purchase from the National Pension Scheme corpus is tax exempt However income generated from such an annuity in the following years is taxable Lump sum

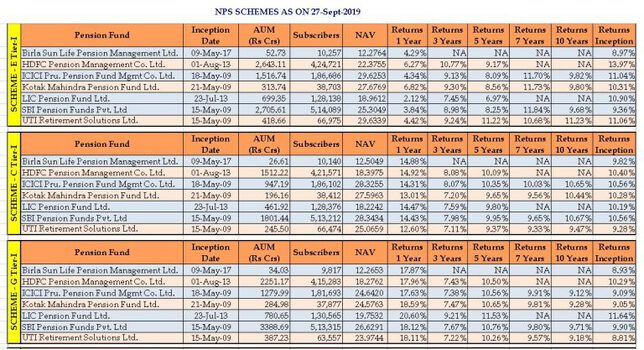

NPS Will Not Provide A Pension You Need To Buy One Yourself

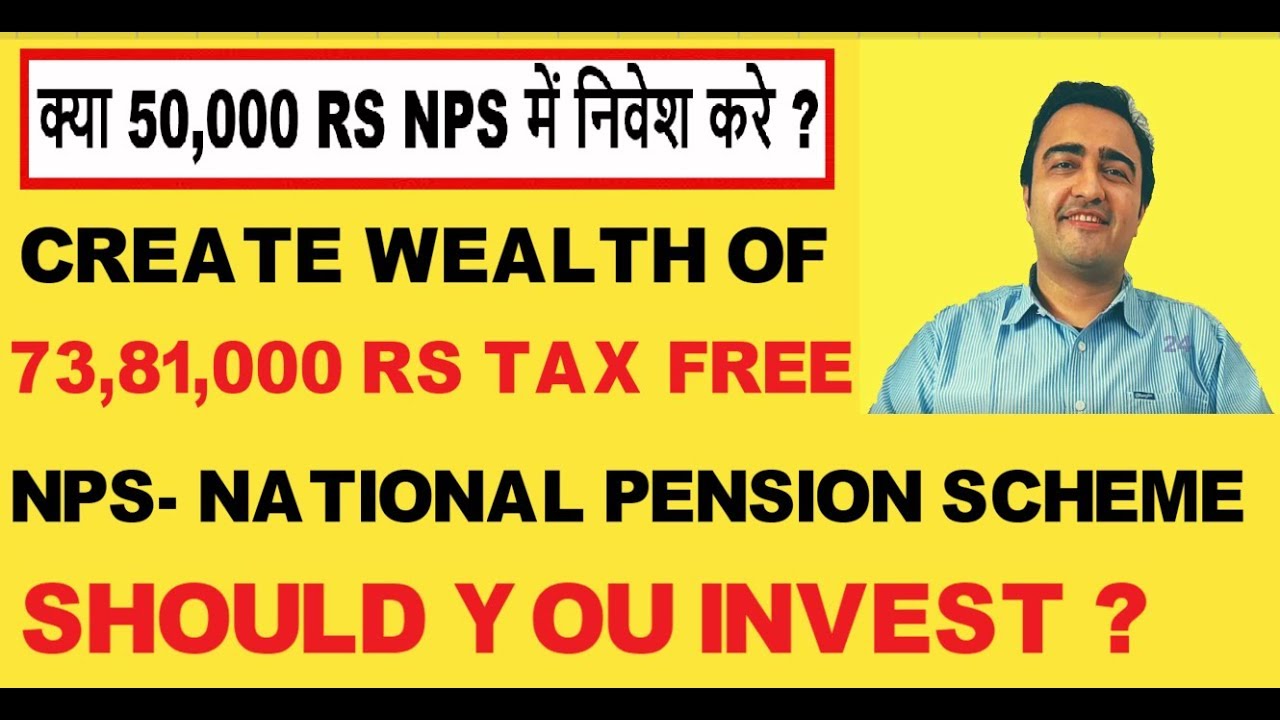

https://freefincal.com/wp-content/uploads/2016/01/NPS-Scheme-Returns-as-on-27-Sep-2019-768x417.jpg

National Pension Scheme NPS Tax Benefits For Nationa Pension Scheme

https://i.ytimg.com/vi/X5Ed5l0GClI/maxresdefault.jpg

https://www.etmoney.com/learn/nps/nps …

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

https://npstrust.org.in/benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1

Income Tax Benefits Under National Pension Scheme NPS

NPS Will Not Provide A Pension You Need To Buy One Yourself

How To Register Online Under National Pension Scheme And Save Tax

NPS National Pension Scheme All Know About Feature And Benefits

NPS Scheme

NPS Tax Benefits How To Avail NPS Income Tax Benefits

NPS Tax Benefits How To Avail NPS Income Tax Benefits

Are Employee Contributions To Health Insurance Taxable IRS Provides

NPS National Pension Scheme Tax Saving Benefit And Retirement Plan

Benefits Of National Pension Scheme How To Earn Money Through Small

National Pension Scheme Tax Benefit - Understanding the importance of Section 80CCD for tax savings in India covering deductions of 2 lakh rupees for contributions to National Pension System and Atal Pension Yojana under the Income