Nebraska State Income Tax Rate 2023 Web If Nebraska taxable income is over But not over The Nebraska income tax is 0 7 390 2 46 of Nebraska Taxable Income line 14 Form 1040N 7 390 44 350 181 79 3 51 of the excess over 7 390 44 350 71 460 1 479 09

Web The Nebraska income tax has four tax brackets with a maximum marginal income tax of 6 84 as of 2024 Detailed Nebraska state income tax rates and brackets are available on this page Web 2023 Individual Income Tax Booklet with forms tables instructions and additional information 2023 Nebraska Tax Table 2023 Nebraska Public High School District Codes 2023 Form 1040N Nebraska Individual Income Tax Return 2023 Form 1040N Schedules I II and III 2023 Form 1040N Conversion Chart for Schedule II

Nebraska State Income Tax Rate 2023

Nebraska State Income Tax Rate 2023

https://www.zrivo.com/wp-content/uploads/2024/01/Nebraska-State-Income-Tax-1024x576.jpg

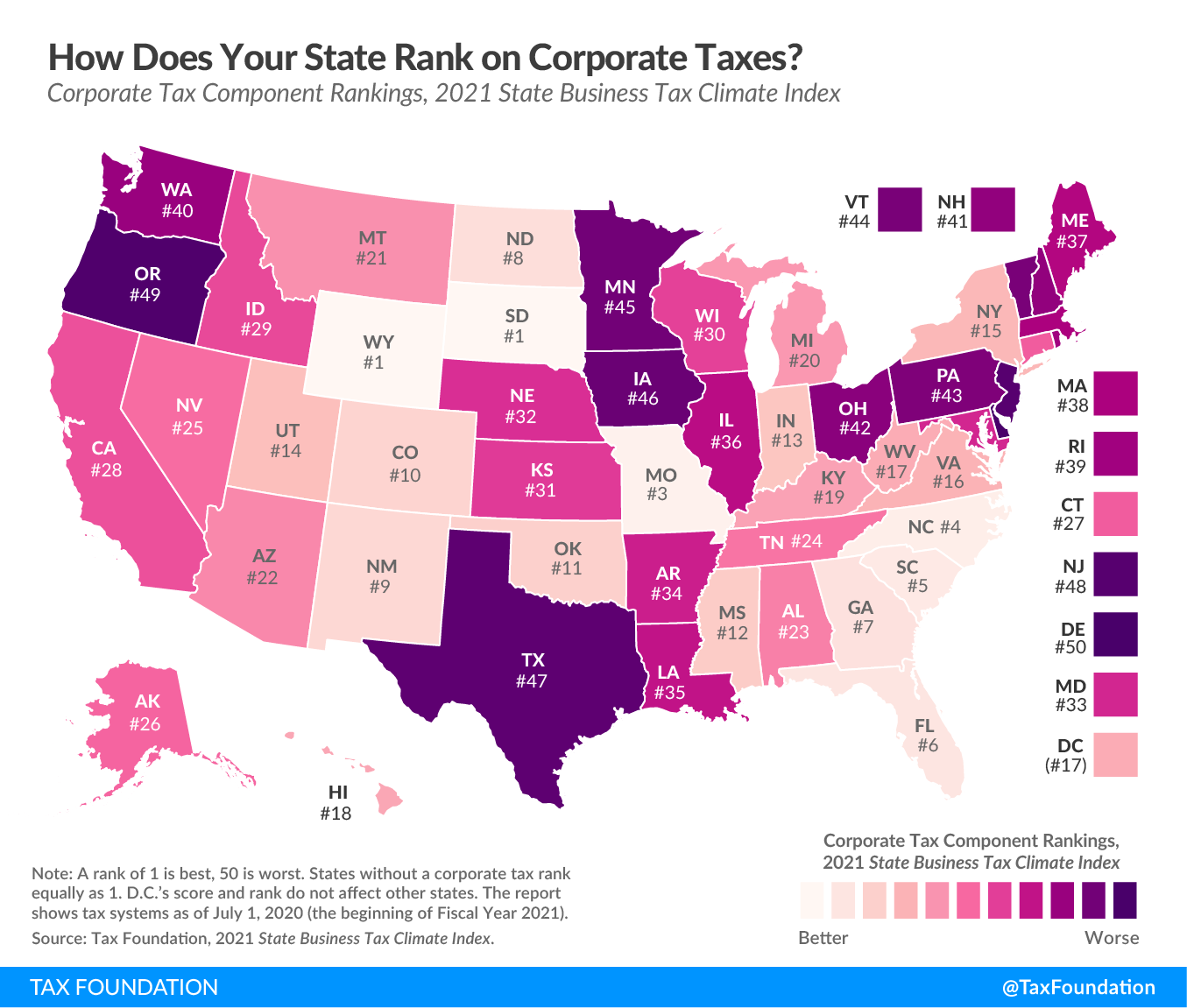

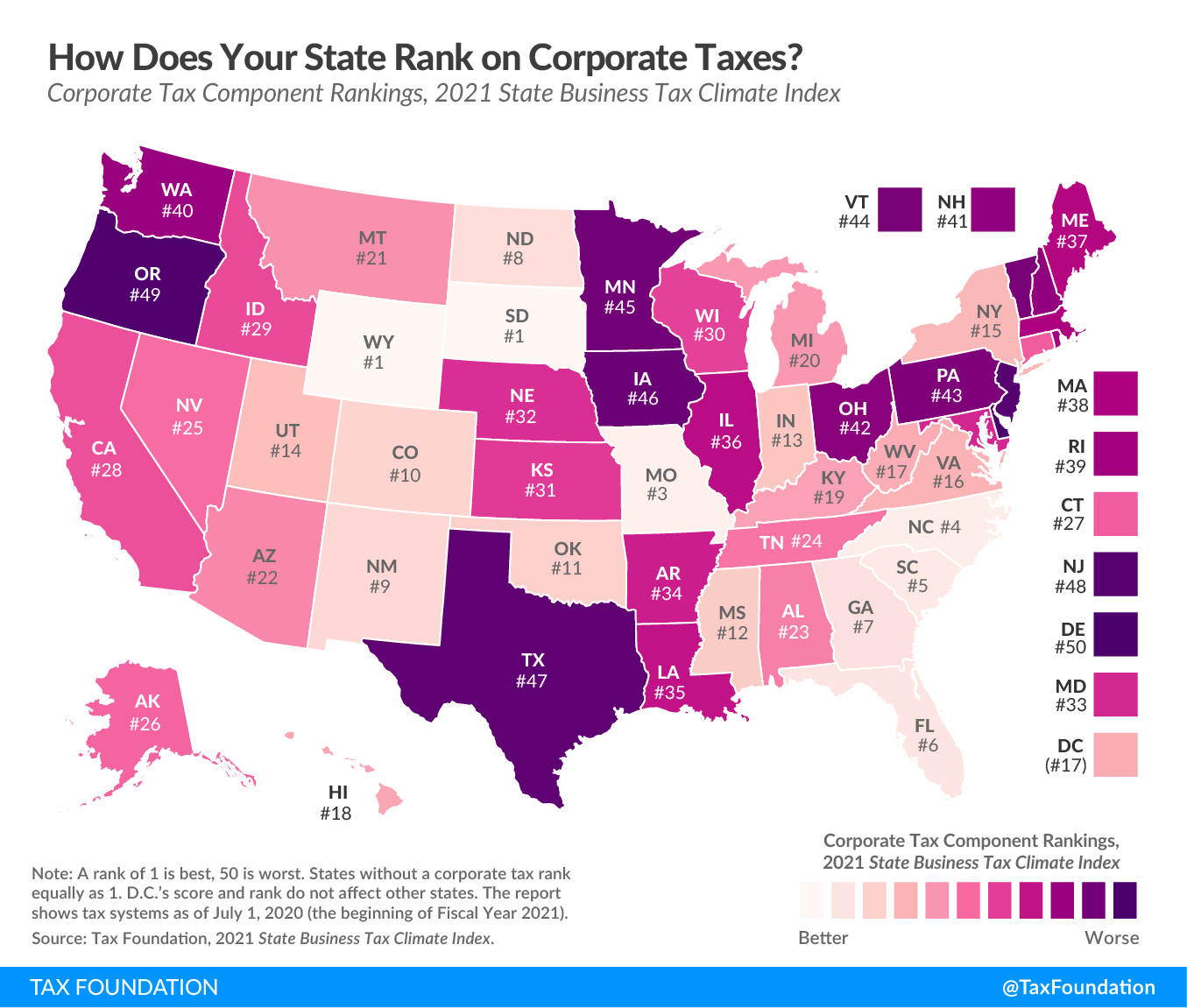

Nebraska State Income Tax Rate 2021 Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/ranking-corporate-income-taxes-on-the-2021-state-business.png

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/468/230/468230391/large.png

Web August 3 2023 2023 1362 Nebraska law gradually lowers personal income tax rates over four years starting in 2024 Nebraska Governor Jim Pillen signed into law LB 754 which gradually reduces the state s top personal income tax rates and collapses the tax brackets from four to three over four years starting in 2024 Web Nebraska State Single Filer Personal Income Tax Rates and Thresholds in 2024 Standard Deduction 6 900 00 Filer Allowance 137 00 Dependents Allowance 137 00 Are Federal Taxes Deductible n Local Taxes Apply n

Web 25 Mai 2023 nbsp 0183 32 For tax year 2023 Nebraska taxes income at and above 37 130 for individuals and at and above 74 260 for married couples at its top income tax rate of 6 64 LB 754 will cut the top rate to 3 99 by 2027 The bill eventually cuts the second tax bracket rate currently 5 01 to 3 99 by 2027 Web 58 499 After Tax Income Total Income Tax Federal taxes Marginal tax rate 22 Effective tax rate 11 67 Federal income tax 8 168 State taxes Marginal tax rate

Download Nebraska State Income Tax Rate 2023

More picture related to Nebraska State Income Tax Rate 2023

Live In A High Tax State Like Oregon Here Are 9 Ways To Lower Your Tax

https://uplevelwealth.com/wp-content/uploads/2023/02/17.jpg

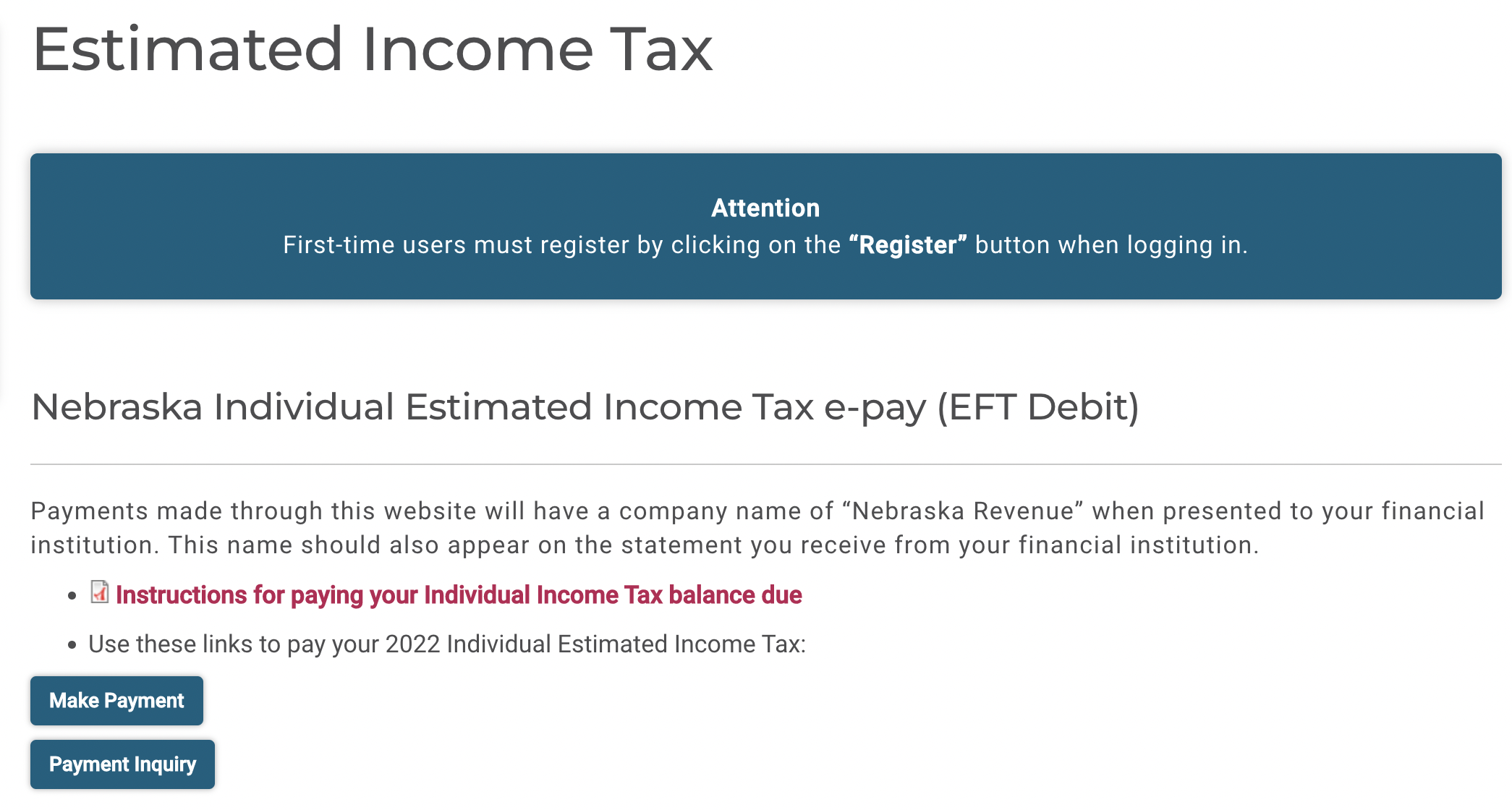

Paying State Income Tax In Nebraska Heard

https://support.joinheard.com/hc/article_attachments/5162117927831/Screen_Shot_2022-03-31_at_21.20.04.png

Nebraska Income Tax Rates Explained

https://www.mortgagerater.com/wp-content/uploads/2023/11/nebraska-state-income-tax.png

Web 13 Dez 2023 nbsp 0183 32 Nebraska state income tax rate table for the 2023 2024 filing season has four income tax brackets with NE tax rates of 2 46 3 51 5 01 and 6 64 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses The Nebraska tax rate decreased from 6 84 last year to 6 64 this year Web If you file your 2023 Nebraska Individual Income Tax Return Form 1040N on or before March 1 2024 and pay the total income tax due at that time you do not need to make any estimated income tax payments for 2023

Web Effective for tax years beginning on or after January 1 2023 the individual income tax brackets are as follows Bracket Married Filing Head of Single Individuals No Jointly Household Married Filing Separately 0 7 390 0 6 900 0 3 700 7 390 44 350 6 900 35 480 3 700 22 170 Web 21 Feb 2023 nbsp 0183 32 Table 2023 State Individual Income Tax Rates and Brackets Notable 2023 State Individual Income Tax Changes Historical State Individual Income Tax Rates and Brackets 2015 2023 Stay informed on the tax policies impacting you Subscribe to get insights from our trusted experts delivered straight to your inbox

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

https://www.incometaxpro.net/images/forms/2022/nebraska-tax-forms.png

Fillable Nebraska State Income Tax Forms Printable Forms Free Online

https://www.incometaxpro.net/images/forms/2021/nebraska-tax-forms.png

https://revenue.nebraska.gov/.../Tax_Calculation_Schedule_…

Web If Nebraska taxable income is over But not over The Nebraska income tax is 0 7 390 2 46 of Nebraska Taxable Income line 14 Form 1040N 7 390 44 350 181 79 3 51 of the excess over 7 390 44 350 71 460 1 479 09

https://www.tax-rates.org/nebraska/income-tax

Web The Nebraska income tax has four tax brackets with a maximum marginal income tax of 6 84 as of 2024 Detailed Nebraska state income tax rates and brackets are available on this page

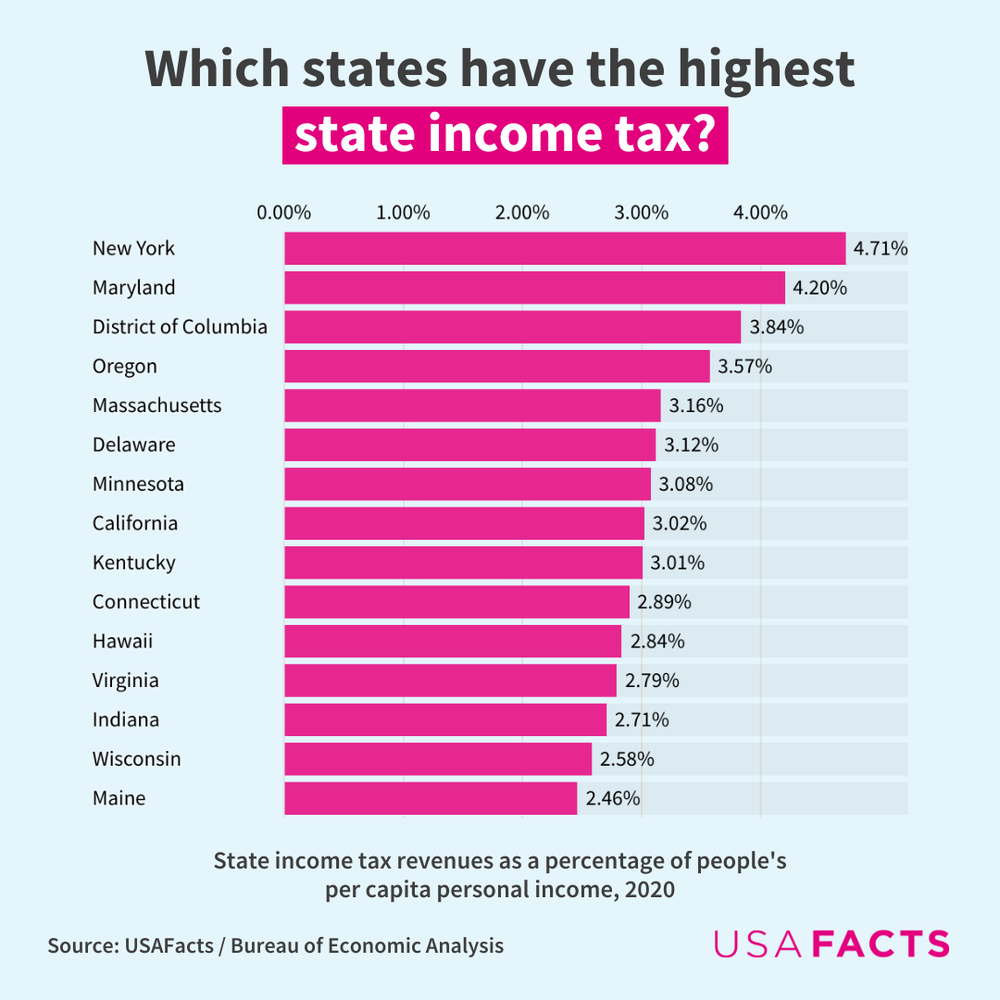

Which States Have The Highest And Lowest Income Tax USAFacts

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

Massachusetts Income Tax Calculator 2022 2023

What Is Nebraska State Income Tax Rate LiveWell

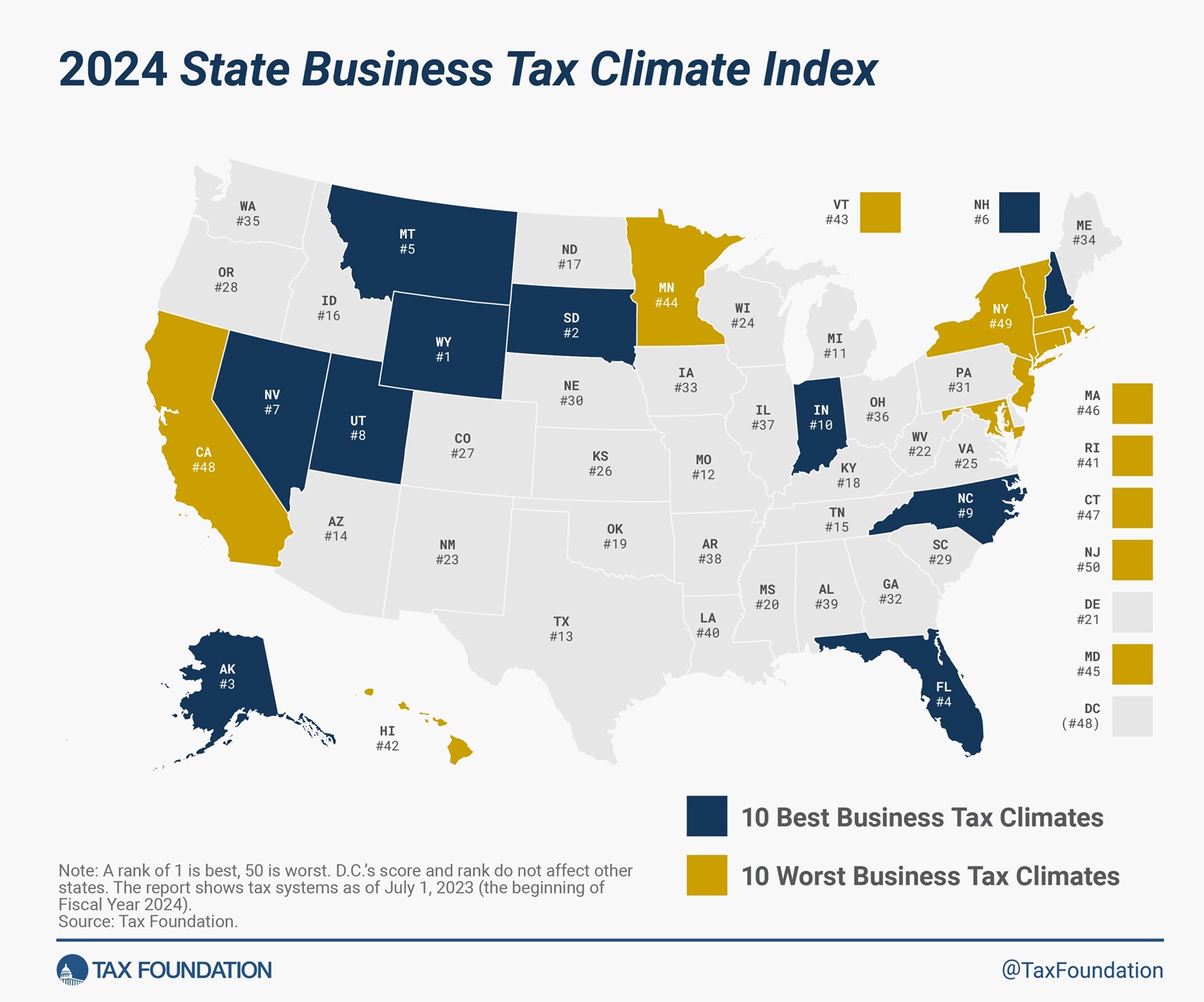

SBTCI 2023 Which States Are Best And Worst and Moving In The Right

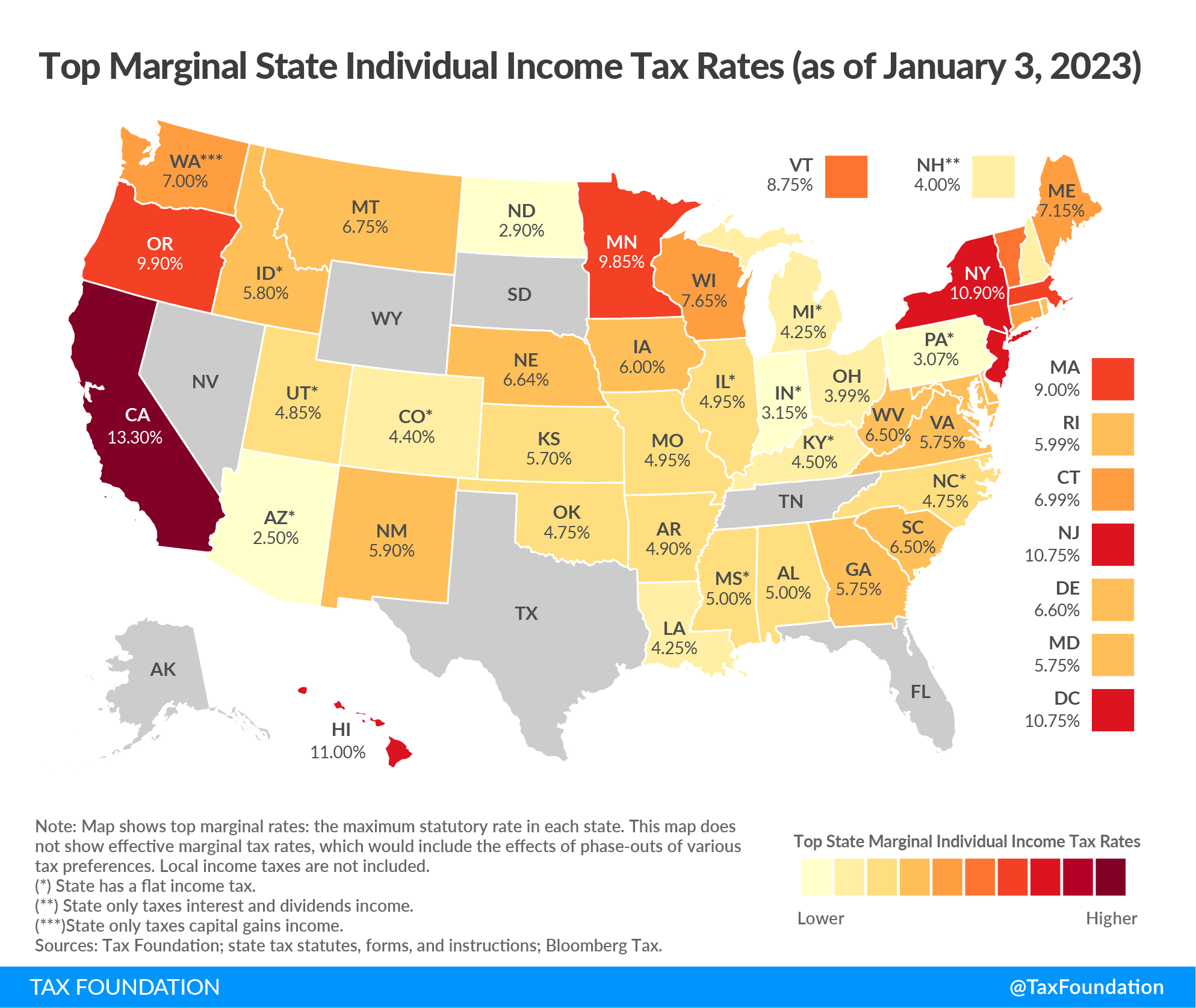

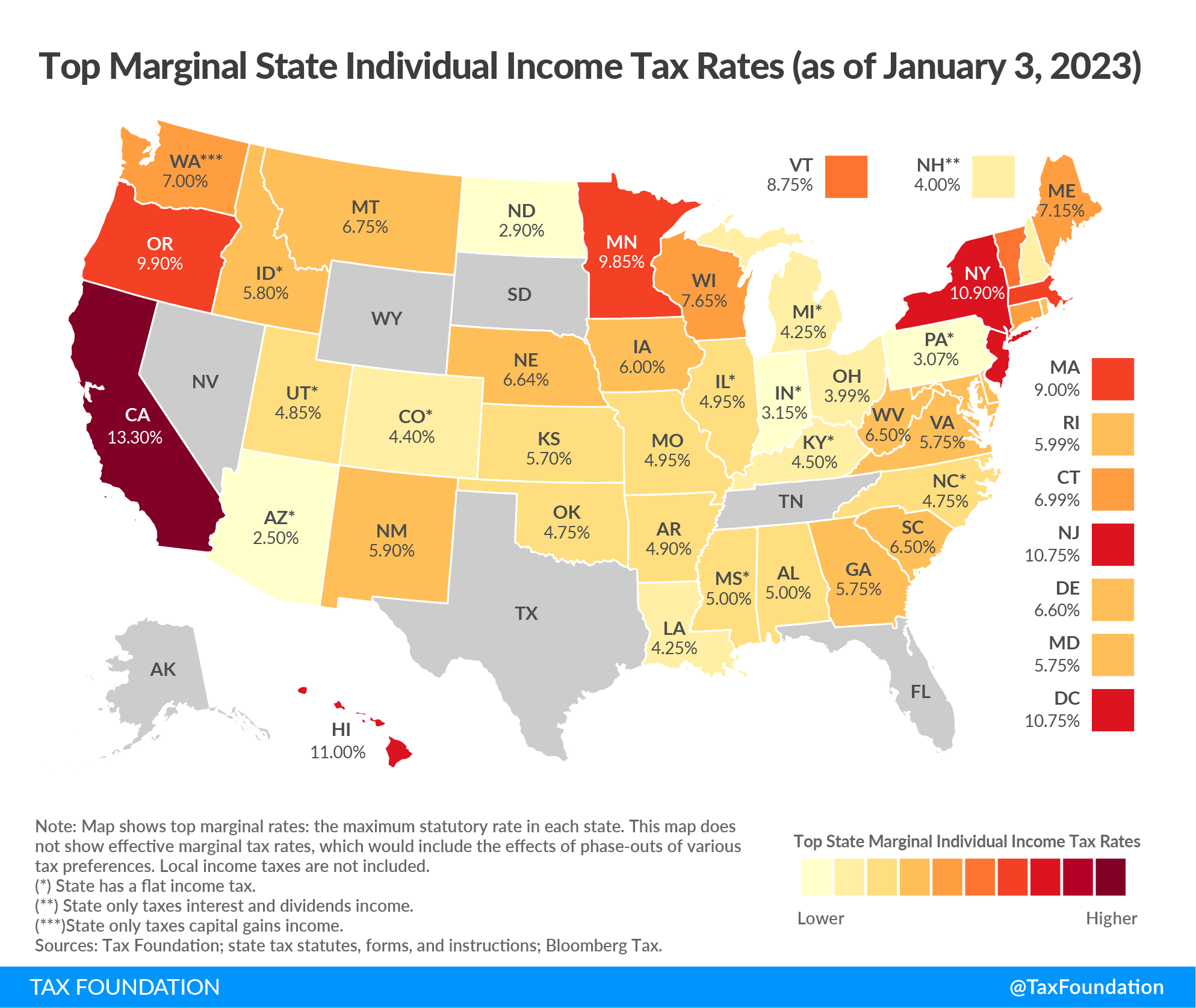

2023 State Income Tax Rates And Brackets Tax Foundation

2023 State Income Tax Rates And Brackets Tax Foundation

Average Income In California What Salary Puts You In The Top 50 Top

Tax Rates For The 2024 Year Of Assessment Just One Lap

2022 Tax Brackets Lashell Ahern

Nebraska State Income Tax Rate 2023 - Web Nebraska State Single Filer Personal Income Tax Rates and Thresholds in 2024 Standard Deduction 6 900 00 Filer Allowance 137 00 Dependents Allowance 137 00 Are Federal Taxes Deductible n Local Taxes Apply n