Netherlands Tax Free Income Web You pay tax in the Netherlands on your income on your financial interests in a company and on your savings and investments The Tax and Customs Administration collects income tax It uses the tax revenues to pay for roads benefits and the judiciary

Web As a result you pay less income tax on your monthly payslip You can see the modification in the table below Wealth tax Netherlands 2022 2023 Box 3 The biggest change in the Dutch tax system of 2022 amp 2023 is the modification in wealth tax Web The tax system in the Netherlands can be tricky to understand as an expat but this guide shows you what you need to know

Netherlands Tax Free Income

Netherlands Tax Free Income

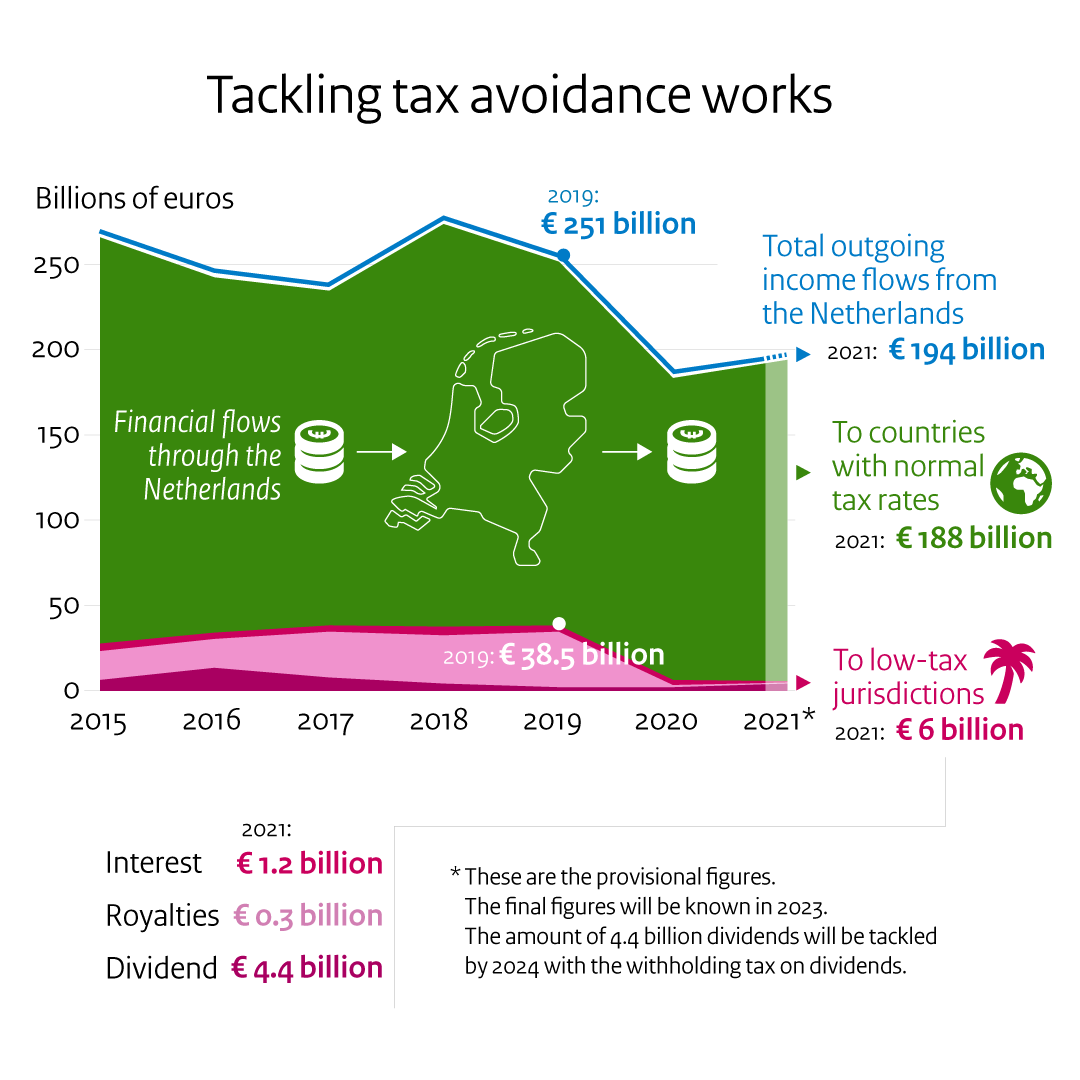

https://www.government.nl/binaries/large/content/gallery/rijksoverheid/content-afbeeldingen/ministeries/fin/belastingontwijking/geldstroom-laagbelastende-landen_def_en.png

File Tax Returns In The Netherlands Dyme

https://a.storyblok.com/f/56674/747x478/aa9b9e1641/file-your-taxes-in-the-netherlands.png

File Tax Returns In The Netherlands Dyme

https://a.storyblok.com/f/56674/747x382/14a2eaa706/tax-return.png

Web Income tax in the Netherlands personal rather than corporate is regulated by the Wet inkomstenbelasting 2001 Income Tax Law 2001 The fiscal year is the same as the calendar year Before May 1 citizens have to report their income from the previous year Web The Tax Administration is not responsible for the installation and use of the reader You can use this form to apply for our permission to make use of the 30 facility in 2024 Under this facility you are permitted under certain conditions to give an employee from abroad a tax free allowance for the extra costs involved in his temporary stay in the Netherlands

Web Log in on Mijn Belastingdienst Dutch Income statement for qualifying non resident taxpayers Select your income statement Deductions tax credits and living abroad Find out what applies to you Applying for the 30 facility You will then receive compensation for higher costs of living Read more about the 30 facility Quick link to Web Dutch taxes for individuals In the Netherlands we have different kinds of taxes for individuals 1 Income tax When you earn money while living in the Netherlands you are required to pay tax on your world income This can lead to double taxation when you have assets or income abroad however tax treaties often provide taxation relief

Download Netherlands Tax Free Income

More picture related to Netherlands Tax Free Income

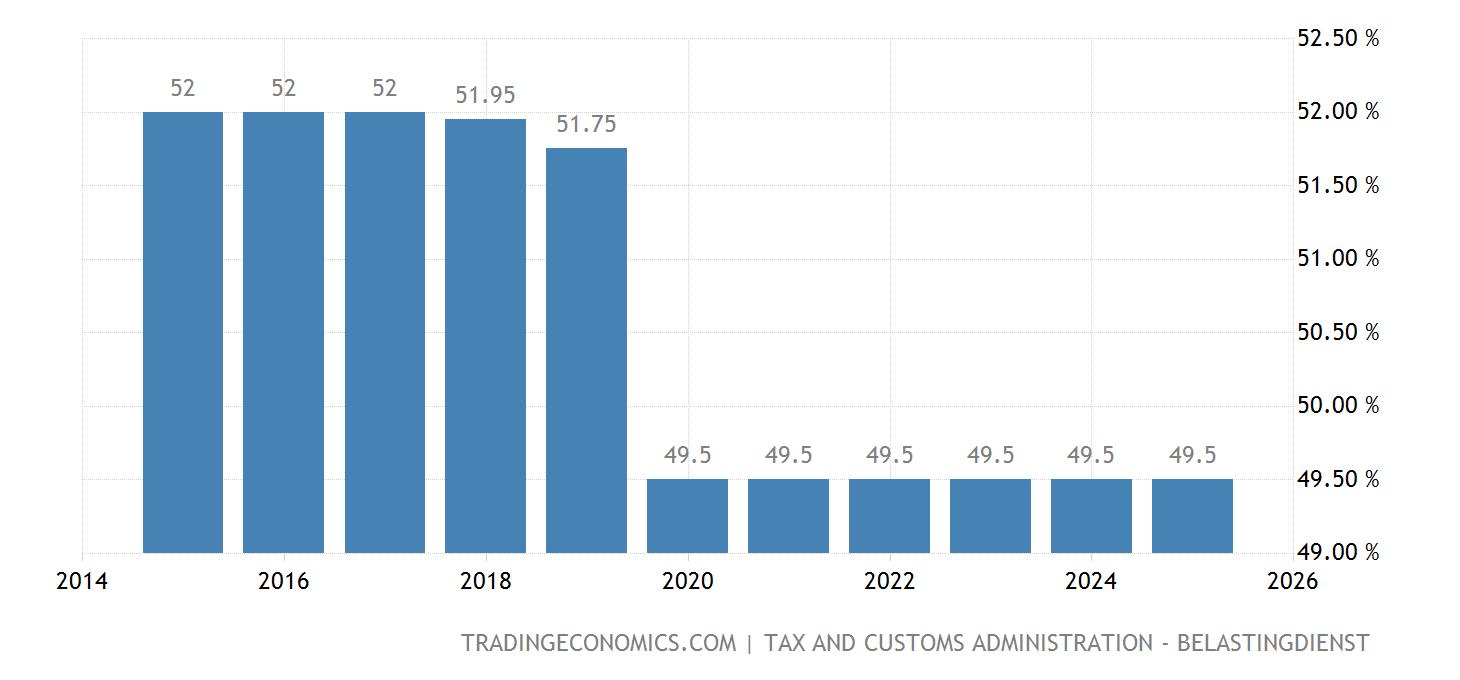

Netherlands Personal Income Tax Rate 2022 Data 2023 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=nldirstax&v=202210240929V20220312

Netherlands Taxing Wages 2020 OECD ILibrary

https://www.oecd-ilibrary.org/sites/a1ff9fb5-en/images/images/Netherlands19_final/media/image2.png

Freelance Taxes For The Self employed In The Netherlands Expatica

https://www.expatica.com/app/uploads/sites/3/2021/03/programmer-home-office-768x512.jpg

Web 19 Sept 2023 nbsp 0183 32 Purchasing power and fighting poverty The government wants to prevent people on low incomes from getting into difficulties It is therefore making 2 billion available on a structural basis to support them One way to achieve this through the tax system is by increasing the employment tax credit by 115 Web 1 Jan 2024 nbsp 0183 32 The Dutch Official Gazette Dec 27 published Law No 499 2023 Tax Plan 2024 The law includes measures 1 reducing the basic individual income tax rate in 2024 to 36 97 percent from 36 93 percent on income up to 75 518 euros US 75 518 euros 2 increasing the employment tax credit by 115 euros US 127 3 increasing the tax free

Web If you live in the Netherlands you are required to pay tax on your income Some of your expenditures may be tax deductible Web Who pays income tax in the Netherlands Who is exempt from income tax in the Netherlands Earnings subject to income tax in the Netherlands Taxes on income and salary in the Netherlands Taxes on employment benefits Taxes on savings and investments Taxes on rental income How to file your tax return in the Netherlands

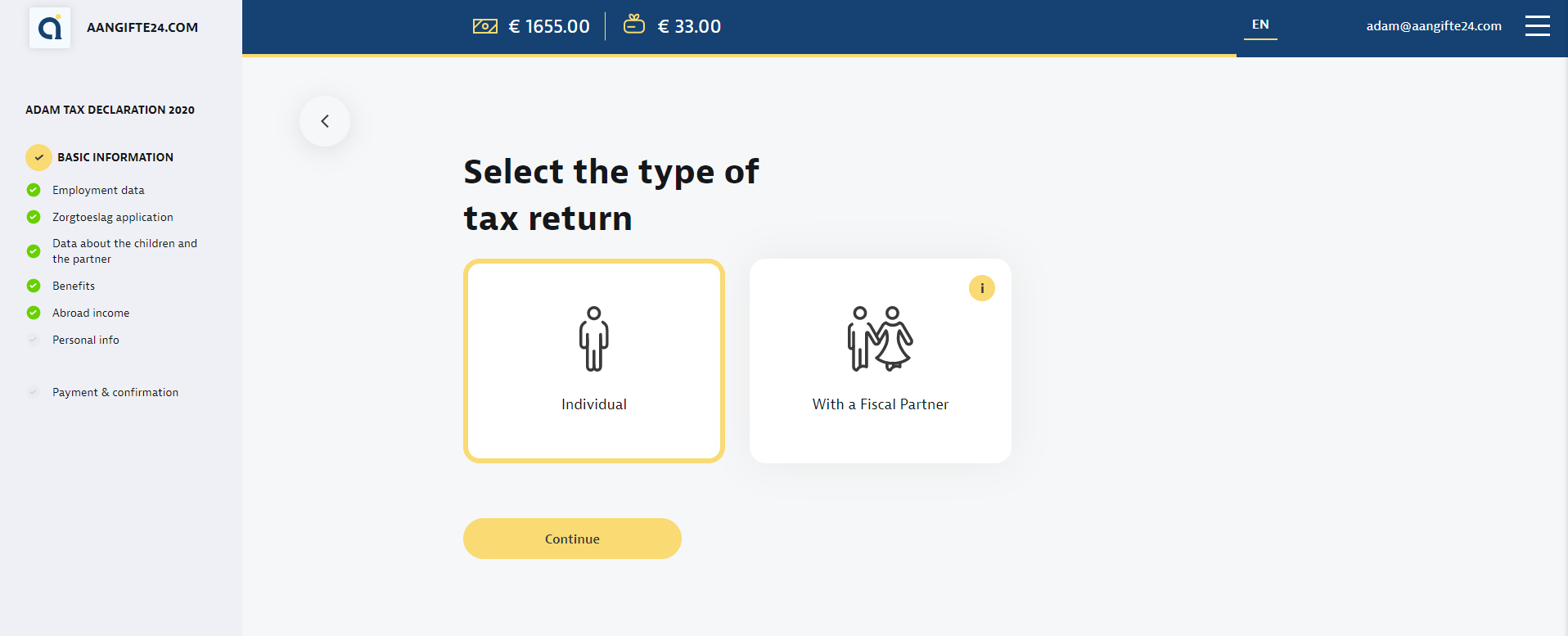

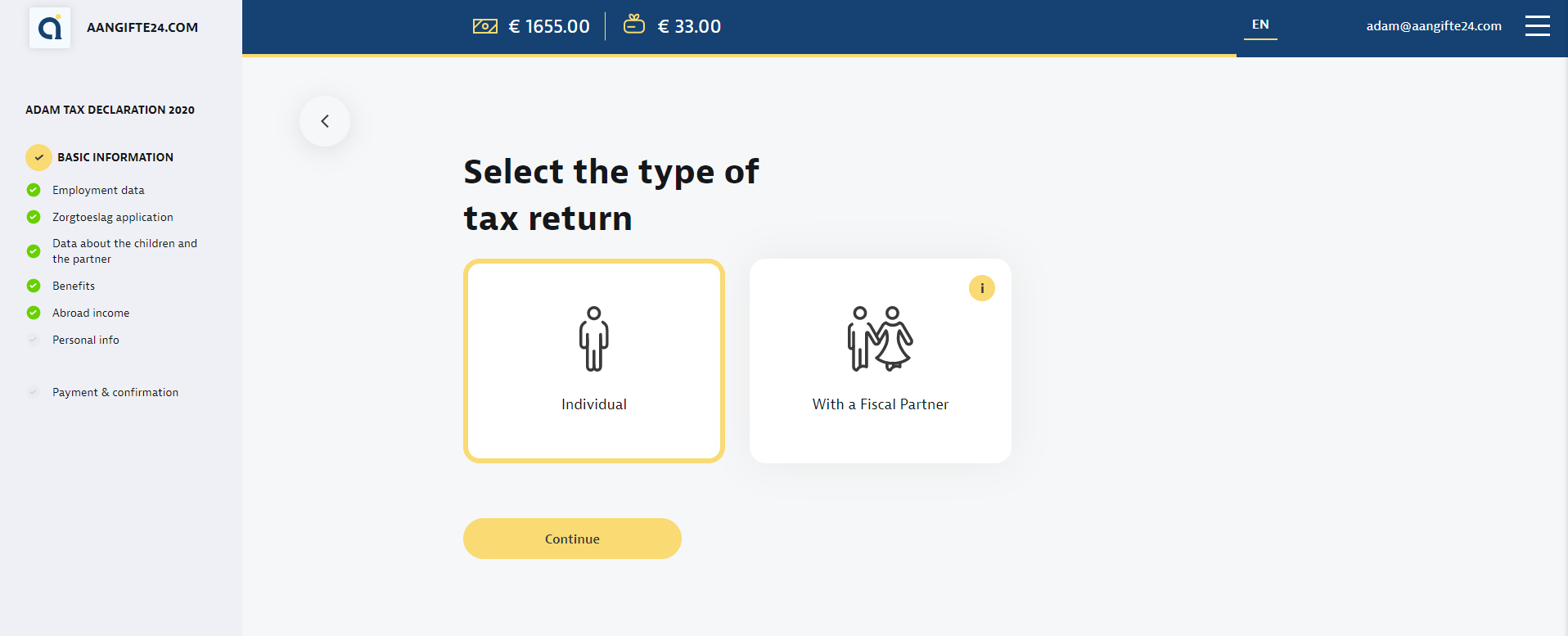

Netherlands Income Tax Calculator Online Aangifte24

https://aangifte24.com/wp-content/uploads/2021/05/Dutch-tax-calculator-2.png

Dutch Income Tax Returns ExpatINFO Holland

https://expatinfoholland.nl/wp-content/uploads/2018/09/blue-envelope-with-letter-from-Dutch-tax-bureau-Belastingdienst-768x312.jpg

https://www.government.nl/topics/income-tax

Web You pay tax in the Netherlands on your income on your financial interests in a company and on your savings and investments The Tax and Customs Administration collects income tax It uses the tax revenues to pay for roads benefits and the judiciary

https://taxsavers.nl/dutch-tax-system/2022-2023

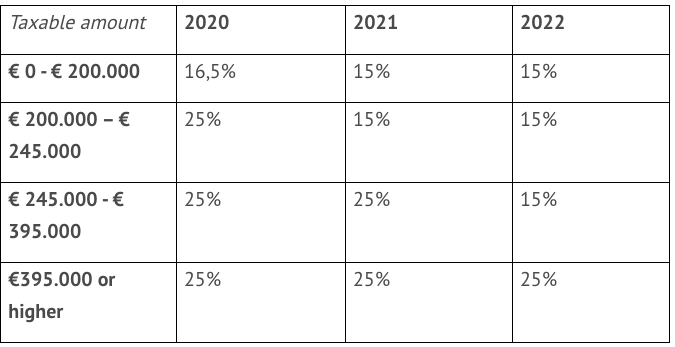

Web As a result you pay less income tax on your monthly payslip You can see the modification in the table below Wealth tax Netherlands 2022 2023 Box 3 The biggest change in the Dutch tax system of 2022 amp 2023 is the modification in wealth tax

File Your Dutch Tax Return Income Tax Return In The Netherlands

Netherlands Income Tax Calculator Online Aangifte24

The Netherlands Tax Haven Infographic Tax Justice Network

The Tax System In The Netherlands A Guide For Taxpayers Expatica

Average Income Netherlands 2021

How To Apply Tax Refund In Netherlands As Expats Dutch Tax

How To Apply Tax Refund In Netherlands As Expats Dutch Tax

Dutch Tax Brackets 2021 NEWREAY

Filing Your Income Tax Return In The Netherlands In 2022 Expatica

Netherlands Corporate Income Tax Calculator 2022 ODINT Consulting

Netherlands Tax Free Income - Web 30 Juni 2023 nbsp 0183 32 In the Taxes on personal income section we explained that in the Netherlands personal income is divided into three types of taxable income which are taxed separately under its own schedule referred to as box 1 box 2 and box 3