Nevada Commerce Tax Due Date The Commerce Tax return can be filed between the end of the taxable year July 1st and the due date of the Commerce tax return August 14th If the due date falls on a

Each business entity whose Nevada gross revenue in a taxable year exceeds 4 000 000 is required to file the Commerce Tax return What entities are exempt from Commerce During certain months of the year the Department receives a particularly high volume of returns and payments This typically happens in April July October and especially

Nevada Commerce Tax Due Date

Nevada Commerce Tax Due Date

https://createyourownllc.com/wp-content/uploads/2022/08/i1mxzuhqd2k.jpg

Developments M P Fernley NV Official Website

https://www.cityoffernley.org/ImageRepository/Document?documentID=25685

AOPolaRtFtkYQ24U4DPgpM2PmOTaDb8 06UAFr7zvPms s900 c k c0x00ffffff no rj

https://yt3.googleusercontent.com/ytc/AOPolaRtFtkYQ24U4DPgpM2PmOTaDb8_06UAFr7zvPms=s900-c-k-c0x00ffffff-no-rj

The Nevada Commerce Tax return is due 45 days following the end of Nevada s fiscal year which ended on June 30 2021 That means that this year the return for all On June 10 2015 Governor Sandoval signed the bill 1 thus enacting a new commerce tax effective July 1 2015 applicable to each business entity engaged in business in Nevada with Nevada sitused gross revenue

The Nevada Commerce Tax return is due 45 days following the end of Nevada s fiscal year which ended on June 30 2020 This year the return is due August 14 2020 The If your company paid Nevada Commerce Tax and has its payroll concentrated outside Nevada it should consider filing a refund claim for the tax year

Download Nevada Commerce Tax Due Date

More picture related to Nevada Commerce Tax Due Date

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

Sales Use Taxes Deadline March 17th 2023

https://pasfirm.com/wp-content/uploads/2023/02/blog-calendar-sales-use-taxes-0317.jpg

What Is The Nevada Commerce Tax YouTube

https://i.ytimg.com/vi/RcXHQnFURAA/maxresdefault.jpg

SB 483 Commerce Tax Bill Department Revisions to LCB Draft of Revised Proposed Regulation R123 15 For Adoption Notice of Intent to Act Upon a Regulation Nevada Commerce Tax is a tax that is imposed on business owners that have the rights of a person to earn through a business that is registered in Nevada Only

The first payment is due August 15 2016 and covers the period of July 1 2015 June 30 2016 with payments due each August 15 thereafter In accounting for the The provisions of S B 483 go into effect on July 1 2015 This includes the new Commerce Tax which will be paid quarterly Business License Fee Increased

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

https://www.taxproadvice.com/wp-content/uploads/business-tax-return-due-date-by-company-structure.jpeg

Should You Be Concerned About The New Nevada Commerce Tax

https://media.licdn.com/dms/image/C4E12AQHep7x93aaq_g/article-cover_image-shrink_600_2000/0/1520125859523?e=2147483647&v=beta&t=W-dEfTCRYB2Um6CaZTFXCO6_ooTPeHiL1sk-L3wTLwg

https://tax.nv.gov/.../Commerce_Tax_Instructions.pdf

The Commerce Tax return can be filed between the end of the taxable year July 1st and the due date of the Commerce tax return August 14th If the due date falls on a

https://tax.nv.gov/Commerce/FilingRequirementFAQs

Each business entity whose Nevada gross revenue in a taxable year exceeds 4 000 000 is required to file the Commerce Tax return What entities are exempt from Commerce

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Nevada s New Commerce Tax Is A Throwback To The Days Of The Great

File Your Income Tax Return By 31st July Ebizfiling

Nevada Is No Longer A Tax free State

Nevada s New Commerce Tax

Nevada s New Commerce Tax

Are You Ready For The Nevada Commerce Tax

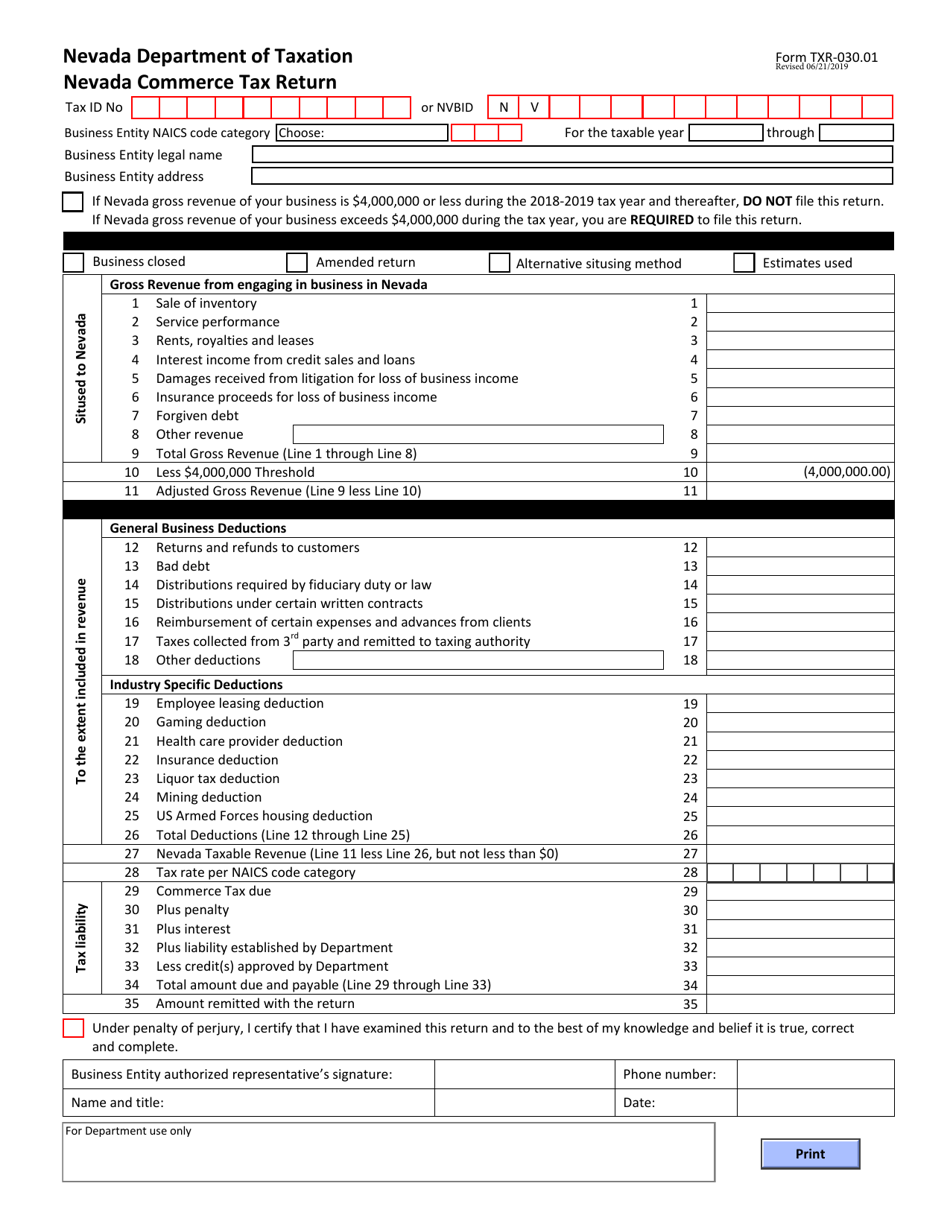

Form TXR 030 01 Download Fillable PDF Or Fill Online Nevada Commerce

Estate Tax Gift Tax Ken R Ashworth Associates

Nevada Commerce Tax Due Date - The Nevada Commerce Tax return is due 45 days following the end of Nevada s fiscal year which ended on June 30 2021 That means that this year the return for all