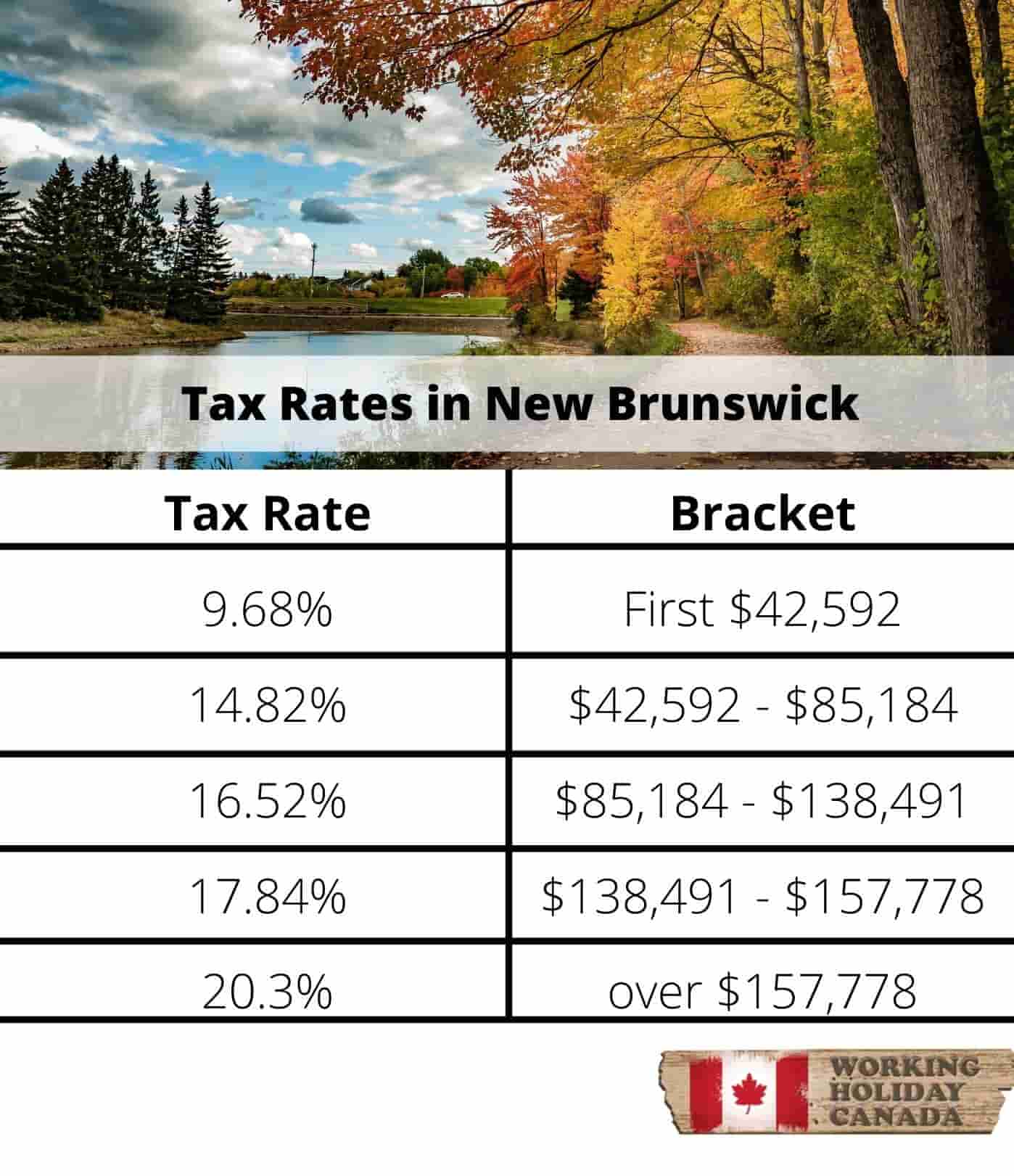

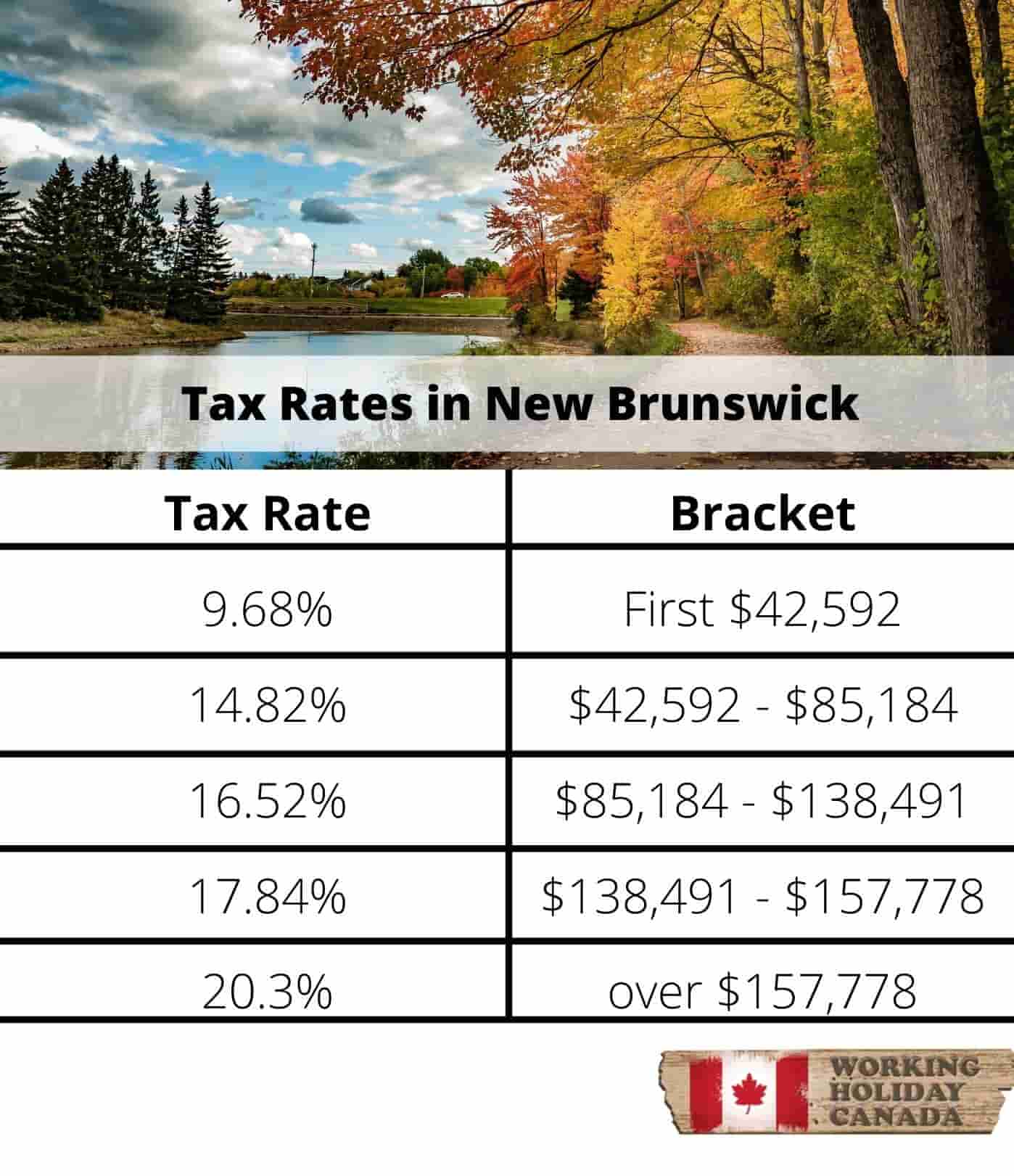

New Brunswick Income Tax Percentage The tax rates in New Brunswick range from 9 4 to 19 5 of income and the combined federal and provincial tax rate is between 24 4 and 52 5 New Brunswick s marginal tax rate

Estimate your provincial taxes with our free New Brunswick income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax New Brunswick personal income tax rates and bracket structure are applied to federally defined New Brunswick taxable income Tax credit amounts are multiplied by the lowest New

New Brunswick Income Tax Percentage

New Brunswick Income Tax Percentage

https://workingholidayincanada.com/wp-content/uploads/2020/02/New-Brunswick-min.jpg

The Correlation Between Median Income Earned In 2005 And Years Of

https://www.researchgate.net/profile/Mahmoud-Askari-5/publication/330998992/figure/fig19/AS:880924841480201@1587040257945/The-correlation-between-median-income-earned-in-2005-and-years-of-education-in-New.ppm

Poverty Data In Canada And New Brunswick Income Statistics Division

https://www.researchgate.net/publication/346630084/figure/tbl2/AS:965032078741505@1607092985420/Poverty-data-in-Canada-and-New-Brunswick-Income-Statistics-Division-2016.png

If you make 60 000 a year living in New Brunswick you will be taxed 14 390 Your average tax rate is 14 44 and your marginal tax rate is 20 5 The lowest tax rate in the province is 9 40 and the top rate is 20 30 When combined with federal taxes New Brunswickers pay a tax rate ranging from 15 to 53 30 on ordinary income Tax brackets in New

The tax rates in New Brunswick vary based on your income level The base rate of income tax is 9 40 However if your income exceeds 47 715 you will be taxed at a higher rate on the This is New Brunswick income tax calculator for NB province residents in 2012 2023 years Current tax rates in New Brunswick and federal tax rates are listed below IMPORTANT This tax calculator is used for income tax estimation

Download New Brunswick Income Tax Percentage

More picture related to New Brunswick Income Tax Percentage

New Brunswick Income Tax Brackets Rates Provincial Tax Credits

https://turbotax.intuit.ca/tips/images/cape-jourimain-lighthouse-in-new-brunswick-picture-id472684602-720x370.jpg

New Tax Rates For Richest New Brunswickers Introduced CBC News

https://i.cbc.ca/1.3053870.1430324236!/fileImage/httpImage/image.jpg_gen/derivatives/original_1180/roger-melanson.jpg

Top State Income Tax Rates For All 50 States Chris Banescu

http://www.newhallstudios.com/images-lib/CA-taxes/US_States_Income_Tax_Rates_01_2013_945px.gif

Find out about how much tax you should pay for your income in New Brunswick Learn about New Brunswick tax brackets in 2023 and 2024 Estimate your take home pay after income tax in New Brunswick Canada with our easy to use 2024 income tax calculator

Individuals resident in New Brunswick on December 31 2022 with taxable income up to 18 268 pay no provincial income tax as a result of a low income tax reduction Calculate you Annual salary after tax using the online New Brunswick Tax Calculator updated with the 2024 income tax rates in New Brunswick Calculate your income tax social security

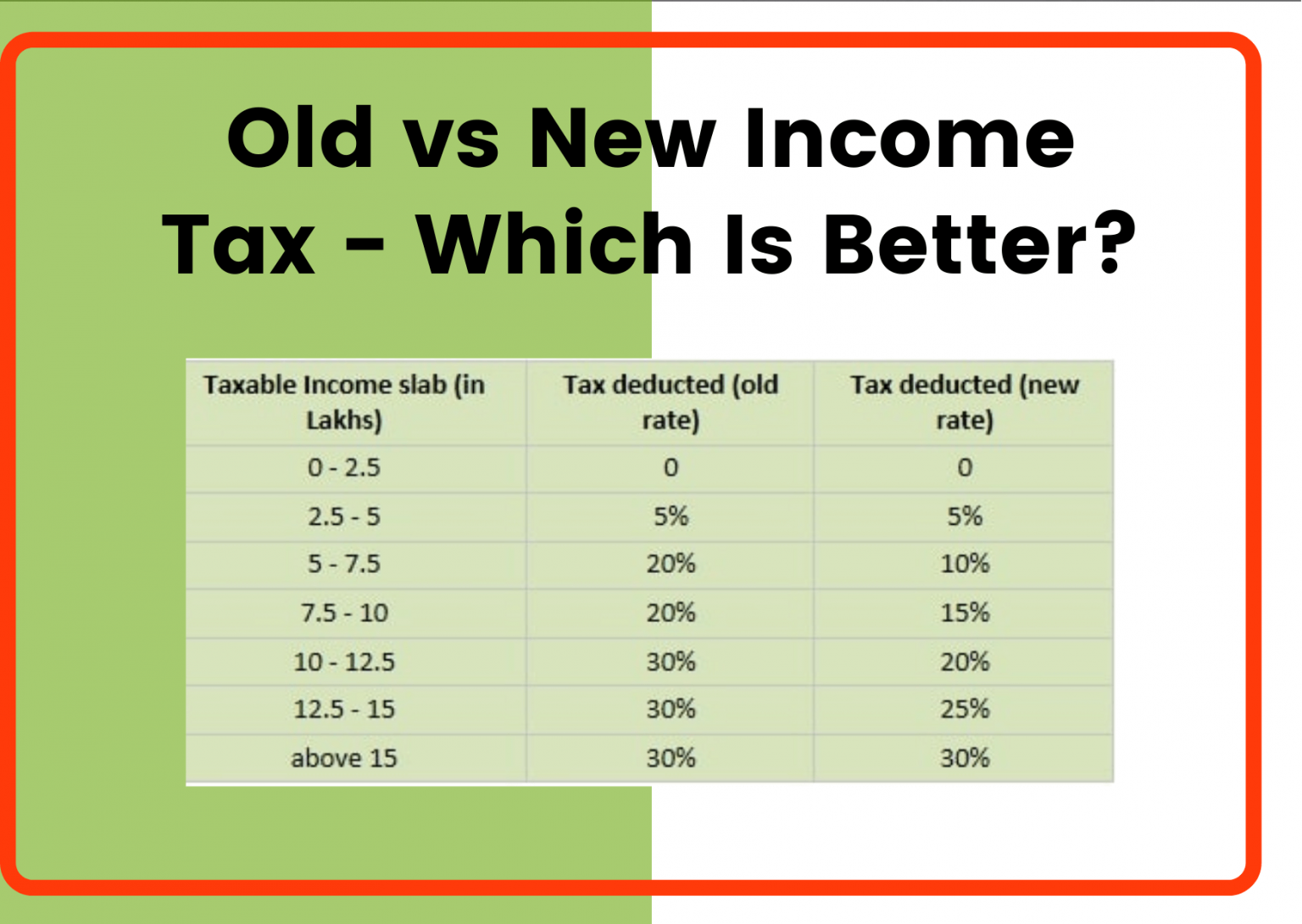

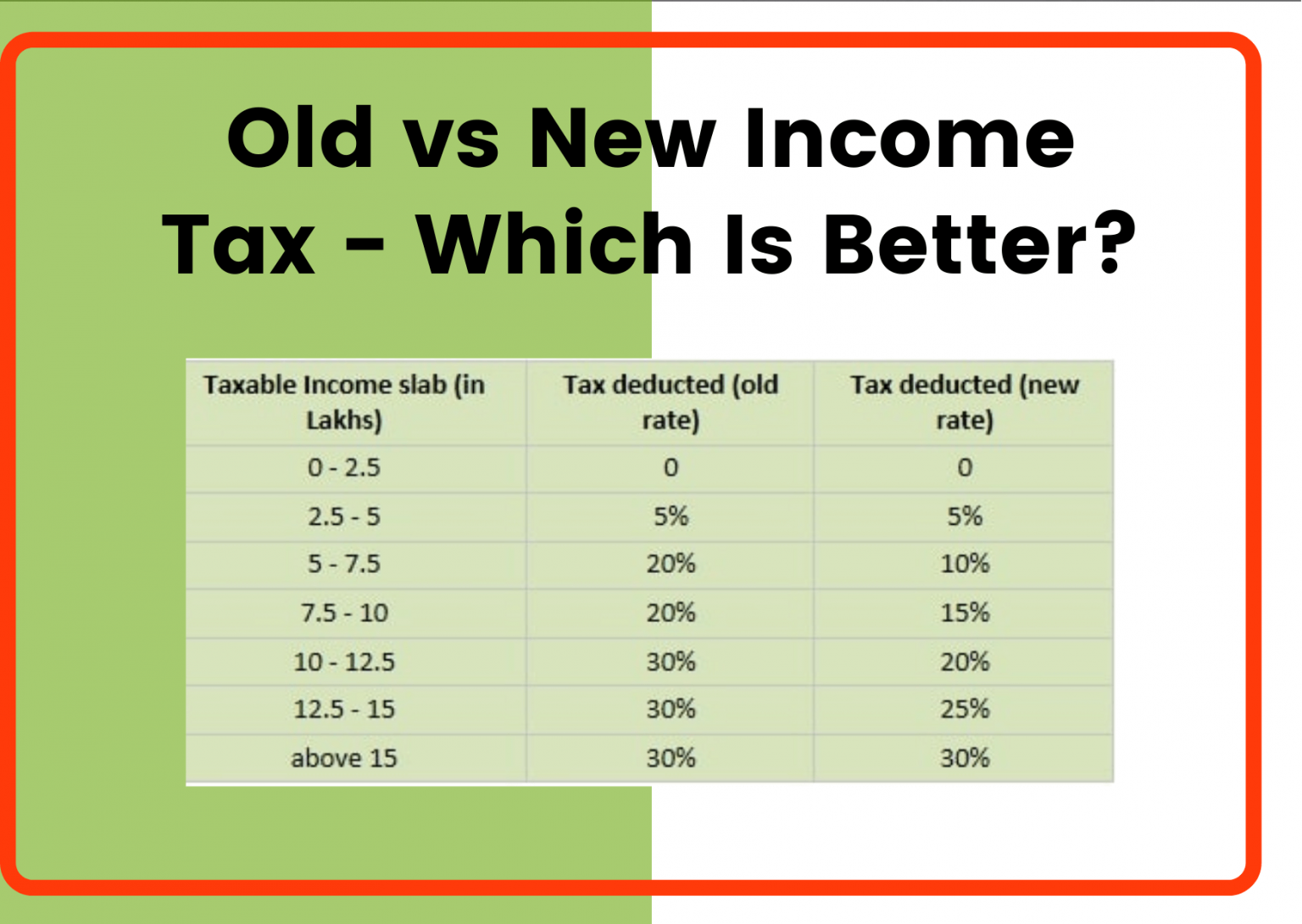

Old Vs New Income Tax Slabs Who Should Choose What Save More Money

https://savemoremoney.in/wp-content/uploads/2020/09/Old-vs-New-Income-Tax-1536x1090.png

Federal Income Tax Brackets 2021 Tyredmath

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

https://turbotax.intuit.ca › tax-resources › new...

The tax rates in New Brunswick range from 9 4 to 19 5 of income and the combined federal and provincial tax rate is between 24 4 and 52 5 New Brunswick s marginal tax rate

https://www.wealthsimple.com › ... › new-brunswick

Estimate your provincial taxes with our free New Brunswick income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax

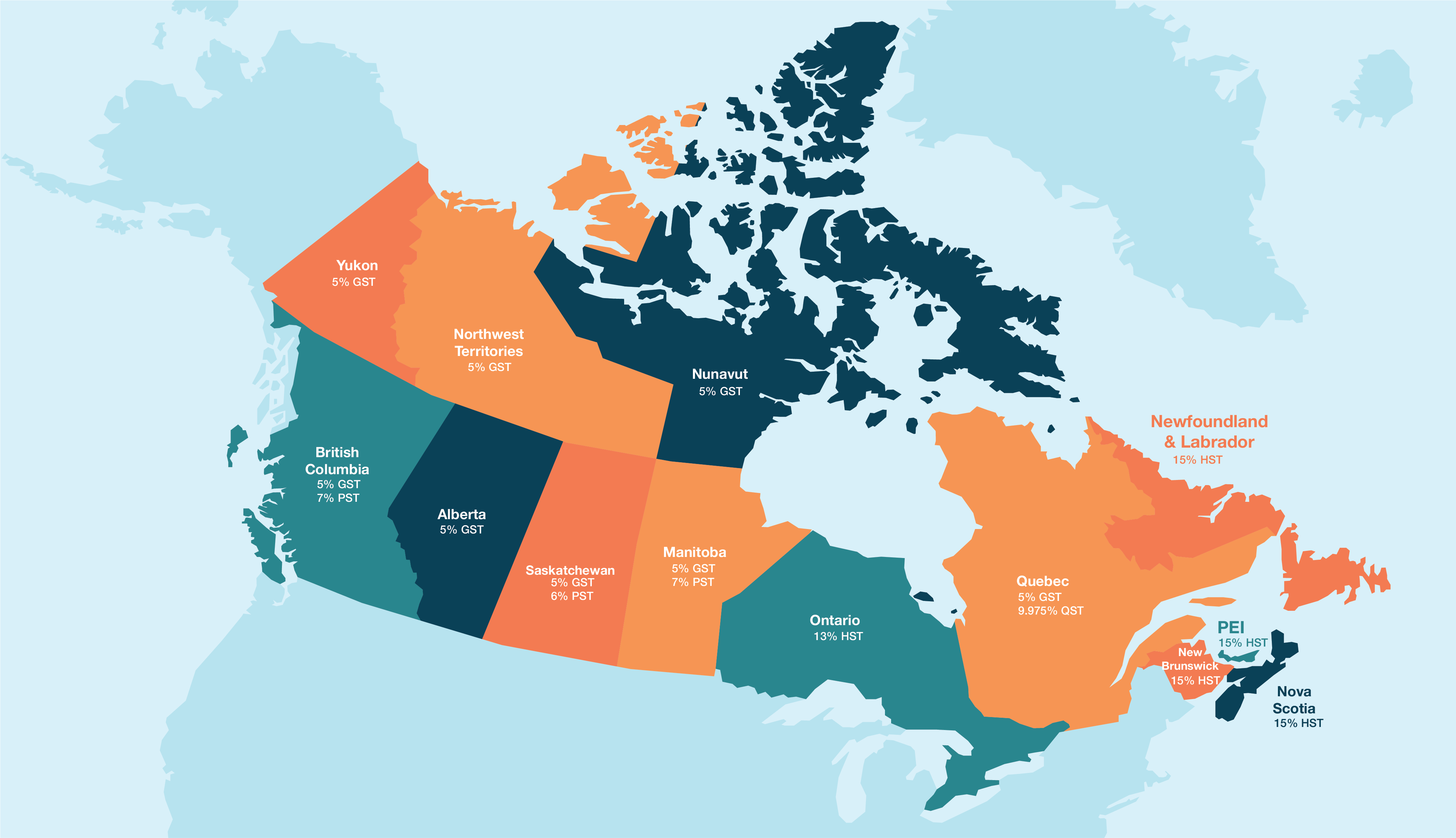

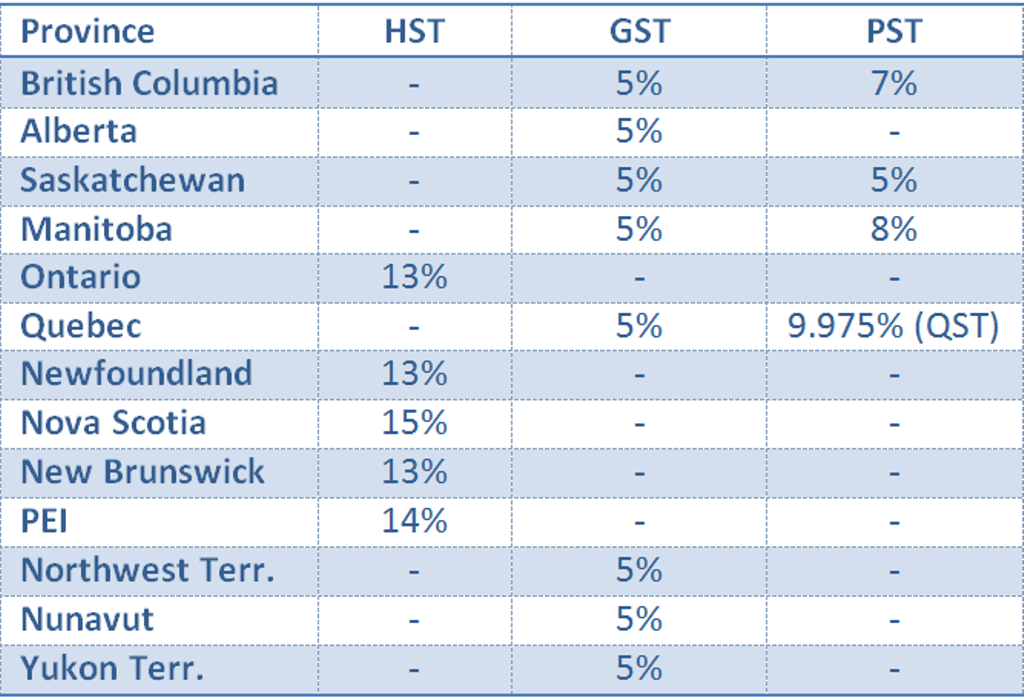

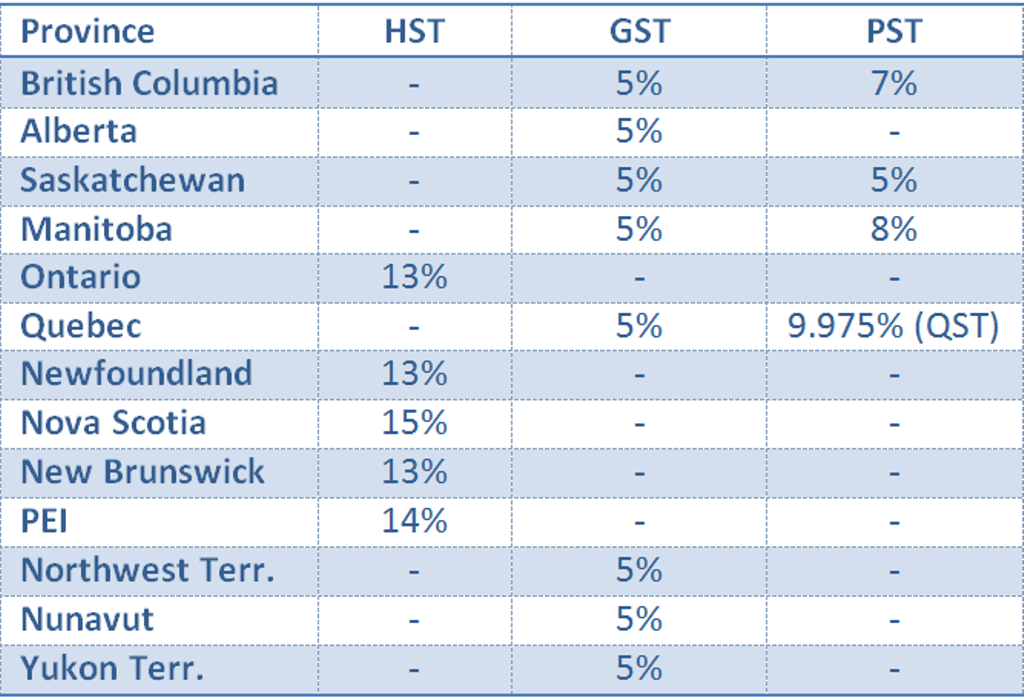

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

Old Vs New Income Tax Slabs Who Should Choose What Save More Money

2019 State Individual Income Tax Rates And Brackets Tax Foundation

New Brunswick Income Tax Brackets Rates Provincial Tax Credits

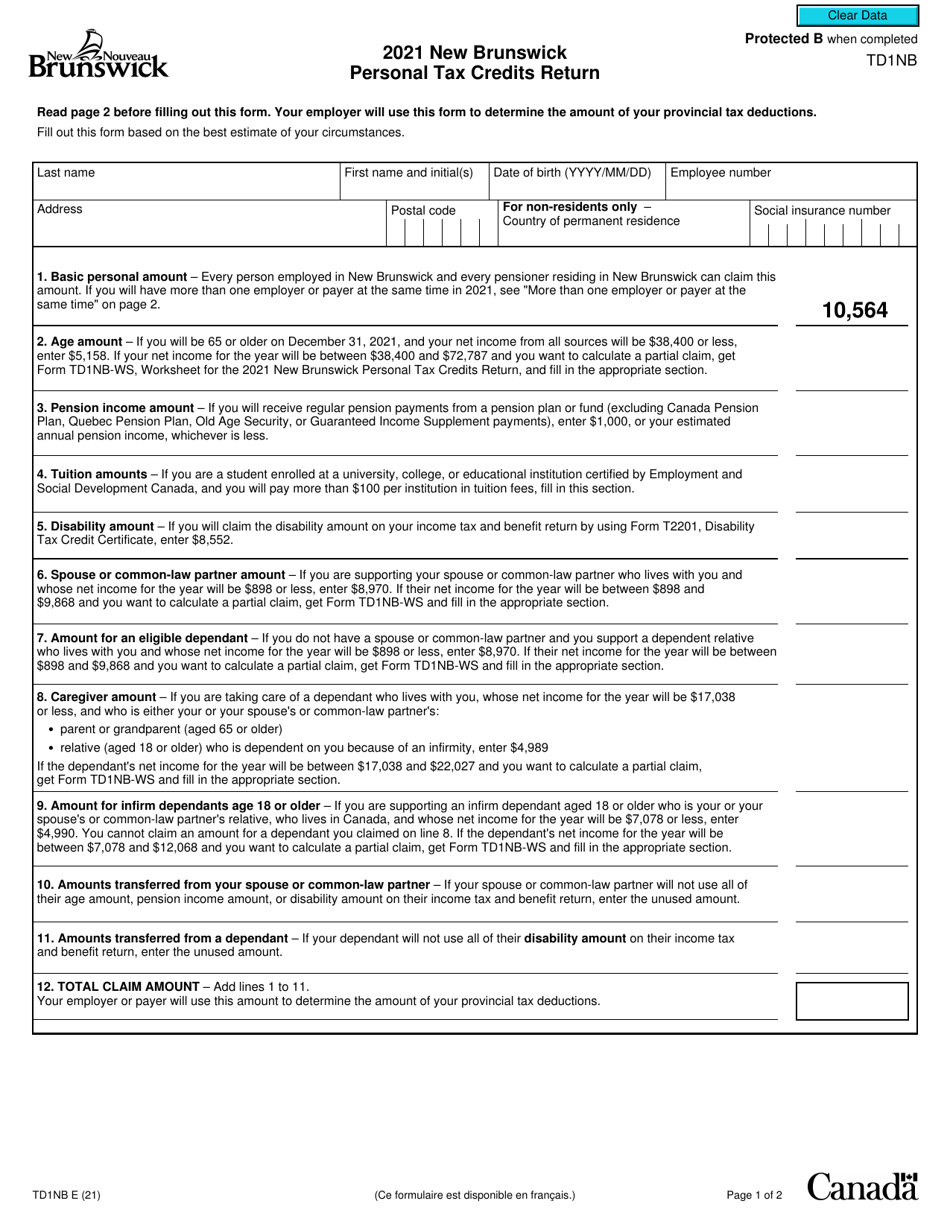

Form TD1NB Download Fillable PDF Or Fill Online New Brunswick Personal

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA ConnectCPA

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA ConnectCPA

Average Federal Income Tax Rates By Income Group Are Highly Progressive

How High Are Income Tax Rates In Your State Your Survival Guy

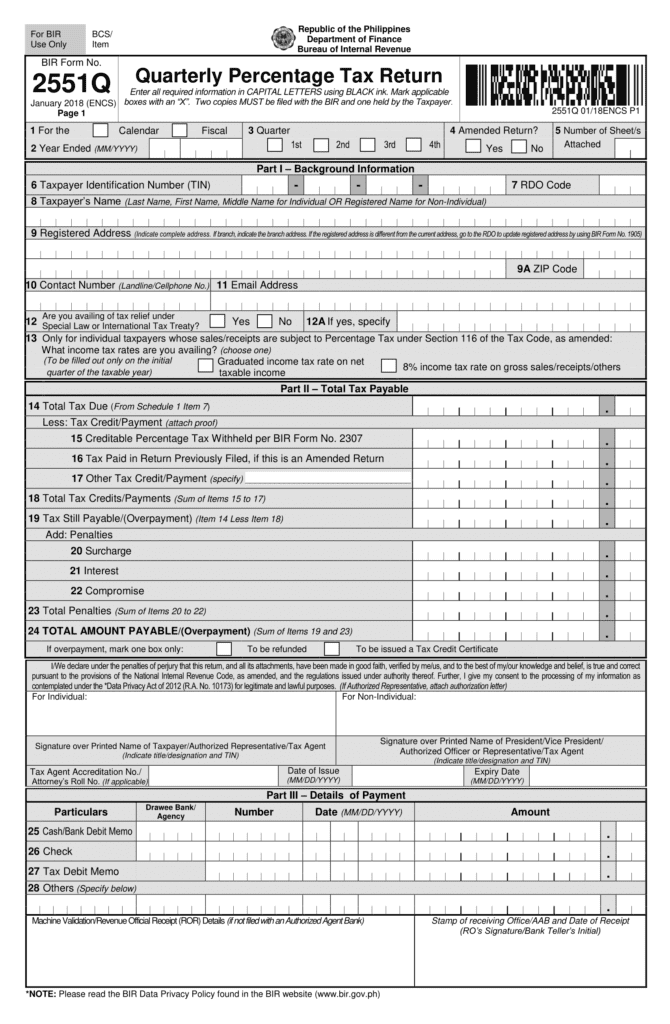

Complete Guide To Quarterly Percentage Tax BIR Form 2551Q

New Brunswick Income Tax Percentage - If you make 52 000 a year living in the region of New Brunswick Canada you will be taxed 15 697 That means that your net pay will be 36 303 per year or 3 025 per month Your