New Car Tax Deduction For Business If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later However if you use the car for both

If you use vehicles in your small business how and when you deduct for the business use of those vehicles can have significant tax implications It pays to learn the nuances of Under the actual expense rules for both leased and purchased vehicles you can deduct the business percentage of your gasoline oil insurance garage rent parking

New Car Tax Deduction For Business

New Car Tax Deduction For Business

http://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-for-free-tax-deduction-spreadsheet-along-with-57-beautiful-gallery-tax.jpg

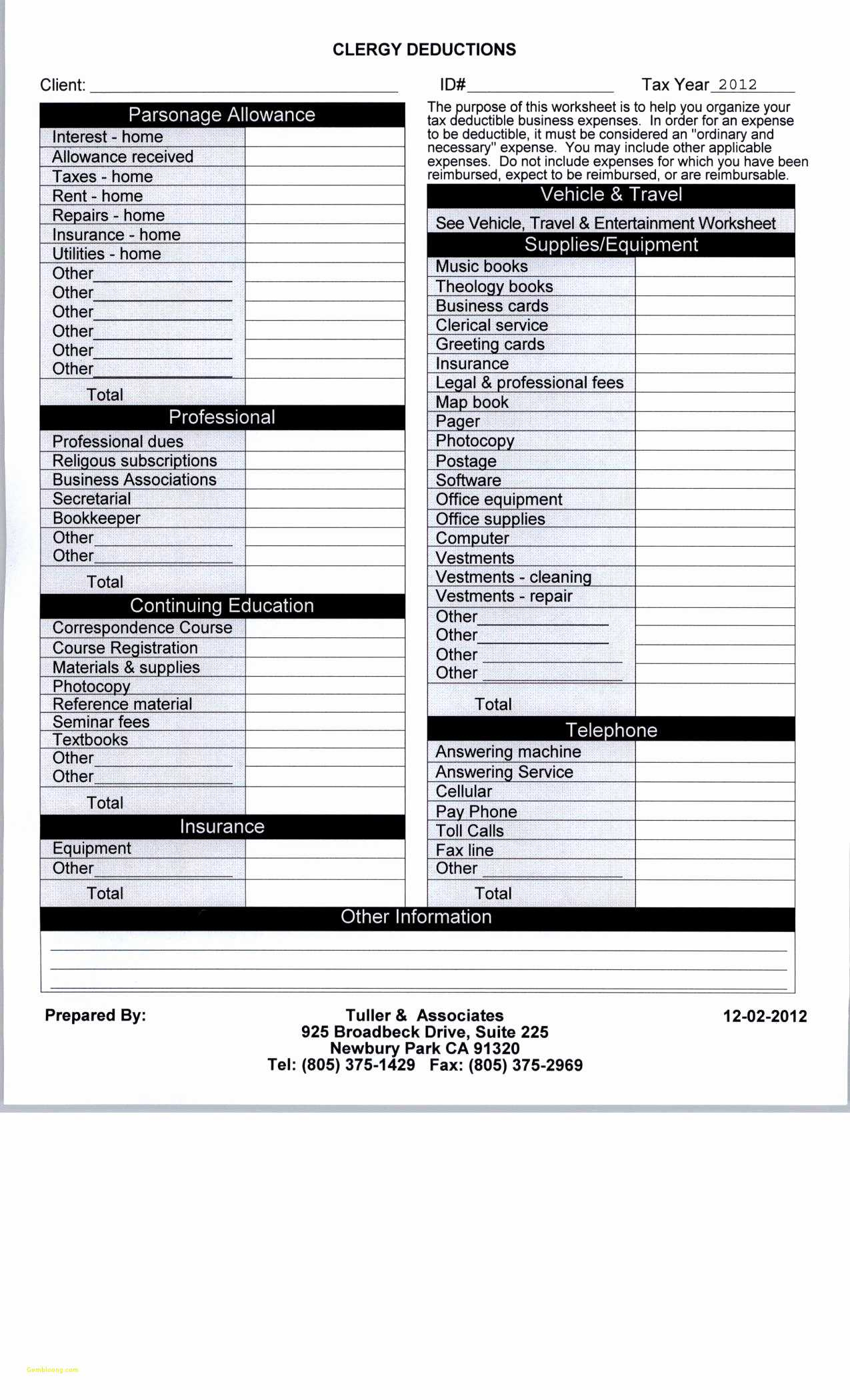

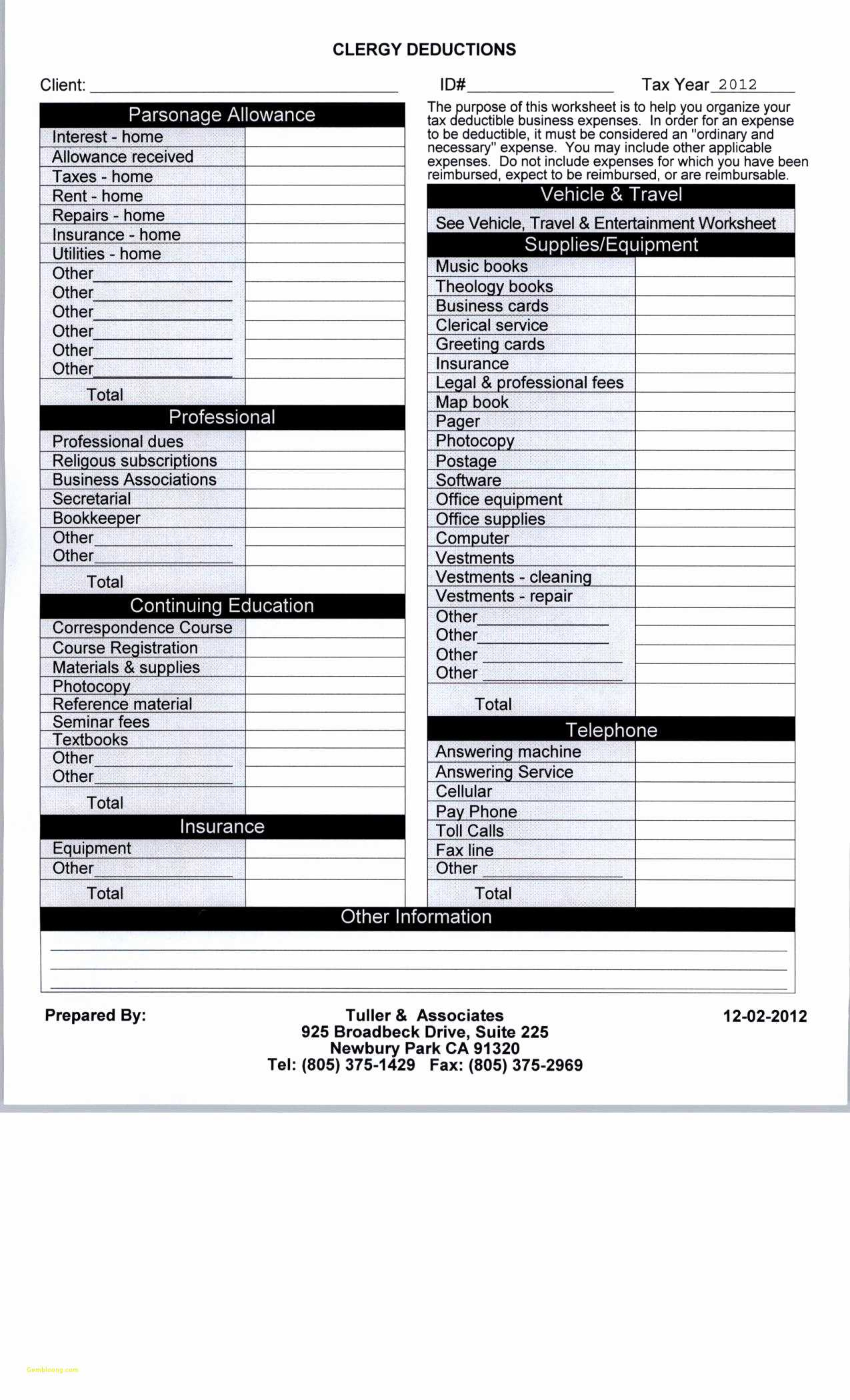

List Of Tax Deductions Examples And Forms

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

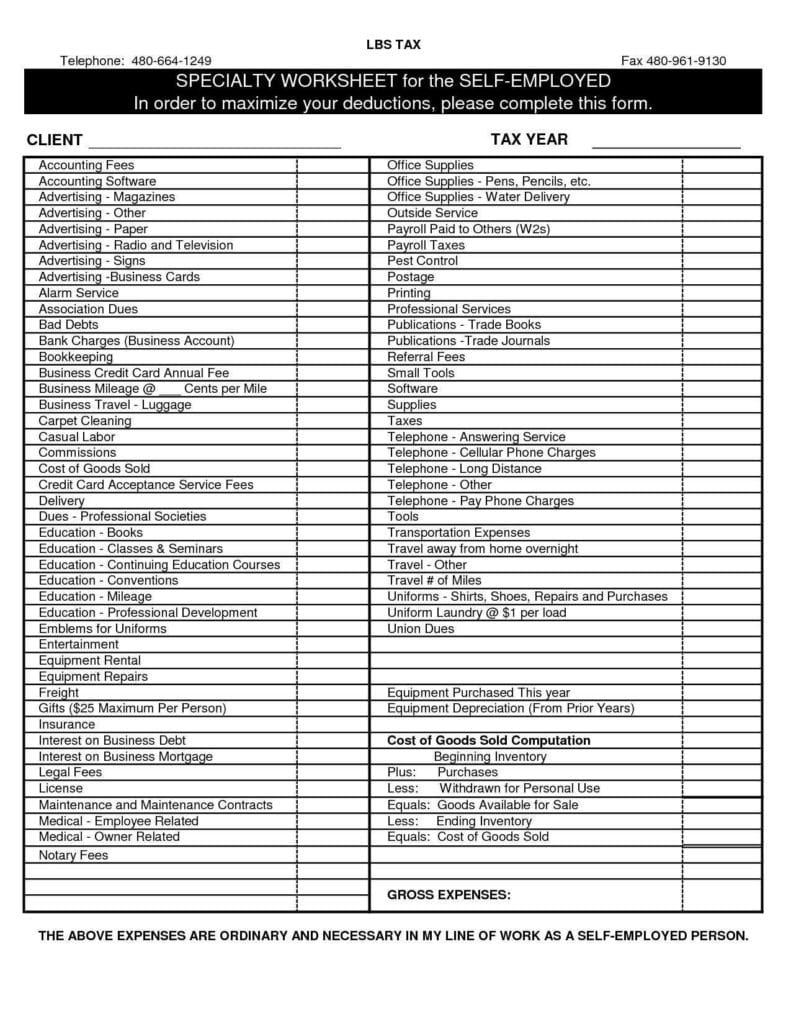

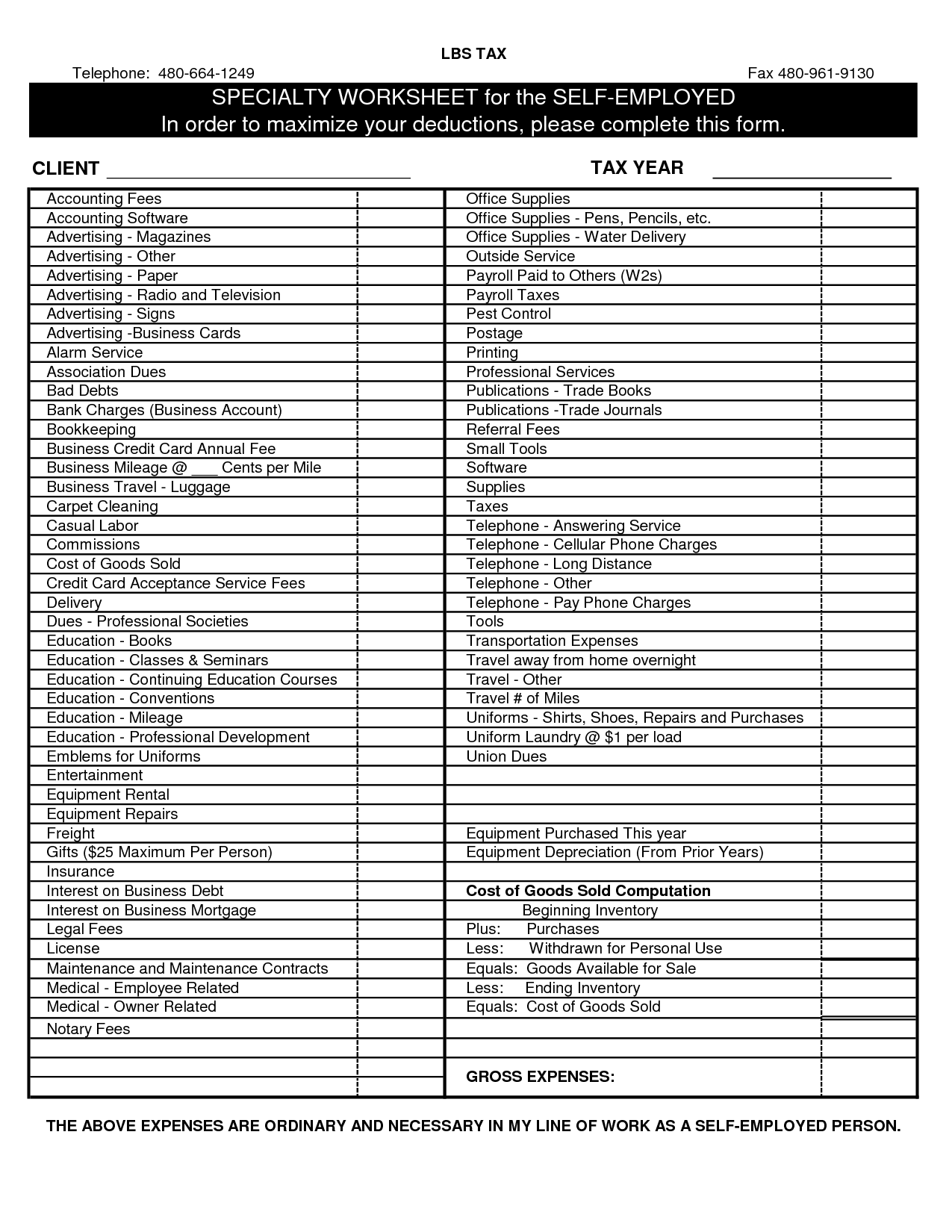

Self Employed Business Tax Deduction Sheet A Success Of Your Business

https://s-media-cache-ak0.pinimg.com/originals/0f/39/4f/0f394febb07050a111c4d2e0f3298c24.jpg

Two methods The Actual Expenses method Standard Mileage method Click to expand Key Takeaways Deducting the business use of your car can reduce both your personal There are two methods to calculate the car tax deduction the actual expense method and the standard mileage rate method How to qualify for business car tax

Taxes 101 Tax Breaks and Money What s New Tax Information Center Filing Adjustments and deductions Deducting Business Vehicle Expenses 3 min read Share You can In 2022 you bought a new car and used it for personal purposes In 2023 you began to use it for business Changing its use to business use doesn t qualify the cost of your car for a

Download New Car Tax Deduction For Business

More picture related to New Car Tax Deduction For Business

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

https://www.anchor-tax-service.com/s/cc_images/cache_2322148.jpg?t=1395580511

Itemized Deductions Worksheet 2018 Printable Worksheets And

https://i1.wp.com/www.worksheeto.com/postpic/2015/05/tax-deduction-worksheet_449270.png

Truck Driver Profit And Loss Statement And Truck Db excel

https://db-excel.com/wp-content/uploads/2019/09/truck-driver-profit-and-loss-statement-and-truck.jpg

1 Cars This is any four wheeled car truck or van made primarily for use on public streets roads and highways with an unloaded gross vehicle weight GVW of 6 000 pounds or Two options are available for the business vehicle tax deduction standard mileage rate and actual expense method To use the standard mileage rate you must use this

Updated on February 29 2024 Why use LendingTree Being your own boss may be the American dream but taking that leap can be costly To help offset your expenses you How to claim Business cars You can claim capital allowances on cars you buy and use in your business This means you can deduct part of the value from your profits before you

Pin By Tonya Spangler On Book Keeping Business Tax Deductions Small

https://i.pinimg.com/736x/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.jpg

Daily Life In Your Day Care Business Expense Business Tax Deductions

https://i.pinimg.com/originals/af/d6/0a/afd60a0032aadbb6ed0cb6e42271dd06.jpg

https://www.irs.gov/taxtopics/tc510

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later However if you use the car for both

https://turbotax.intuit.com/tax-tips/small...

If you use vehicles in your small business how and when you deduct for the business use of those vehicles can have significant tax implications It pays to learn the nuances of

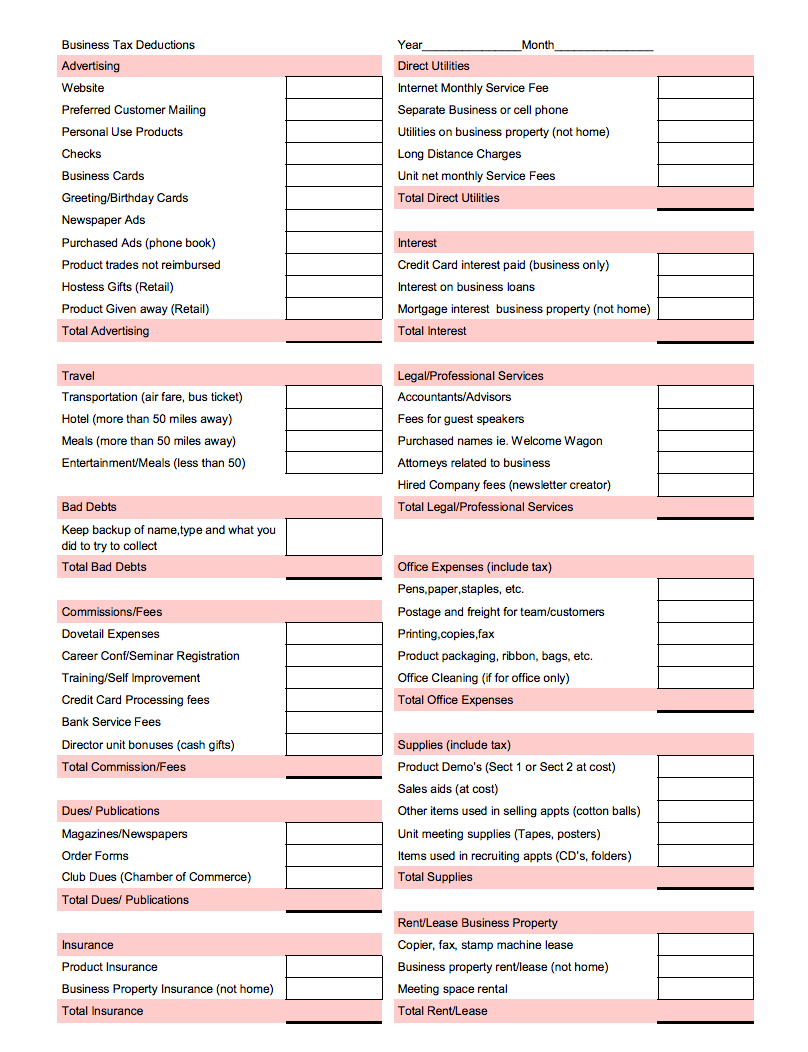

Business Tax Deductions Worksheet Business Expense Business Tax

Pin By Tonya Spangler On Book Keeping Business Tax Deductions Small

8 Best Images Of Tax Preparation Organizer Worksheet Individual

Tax Deduction Cheat Sheet For Real Estate Agents Independence Title

Farm Expenses Spreadsheet Charlotte Clergy Coalition

Tax Deduction Definition TaxEDU Tax Foundation

Tax Deduction Definition TaxEDU Tax Foundation

Tax Deduction Letter Sign Templates Jotform

Free Business Expense Spreadsheet And Self Employed Business Tax

Car Donation Tax Deduction Simplified Http www irstaxapp car

New Car Tax Deduction For Business - In 2022 you bought a new car and used it for personal purposes In 2023 you began to use it for business Changing its use to business use doesn t qualify the cost of your car for a